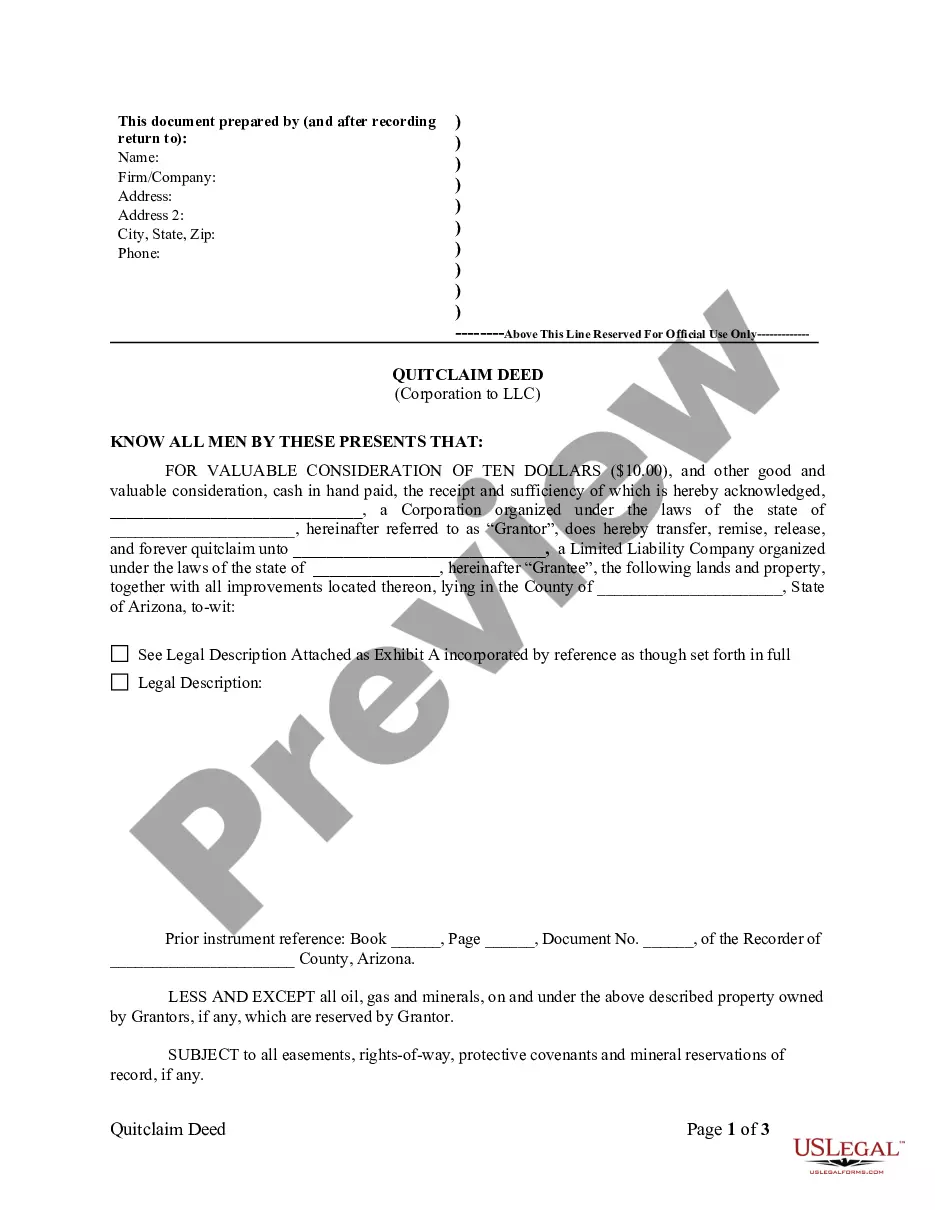

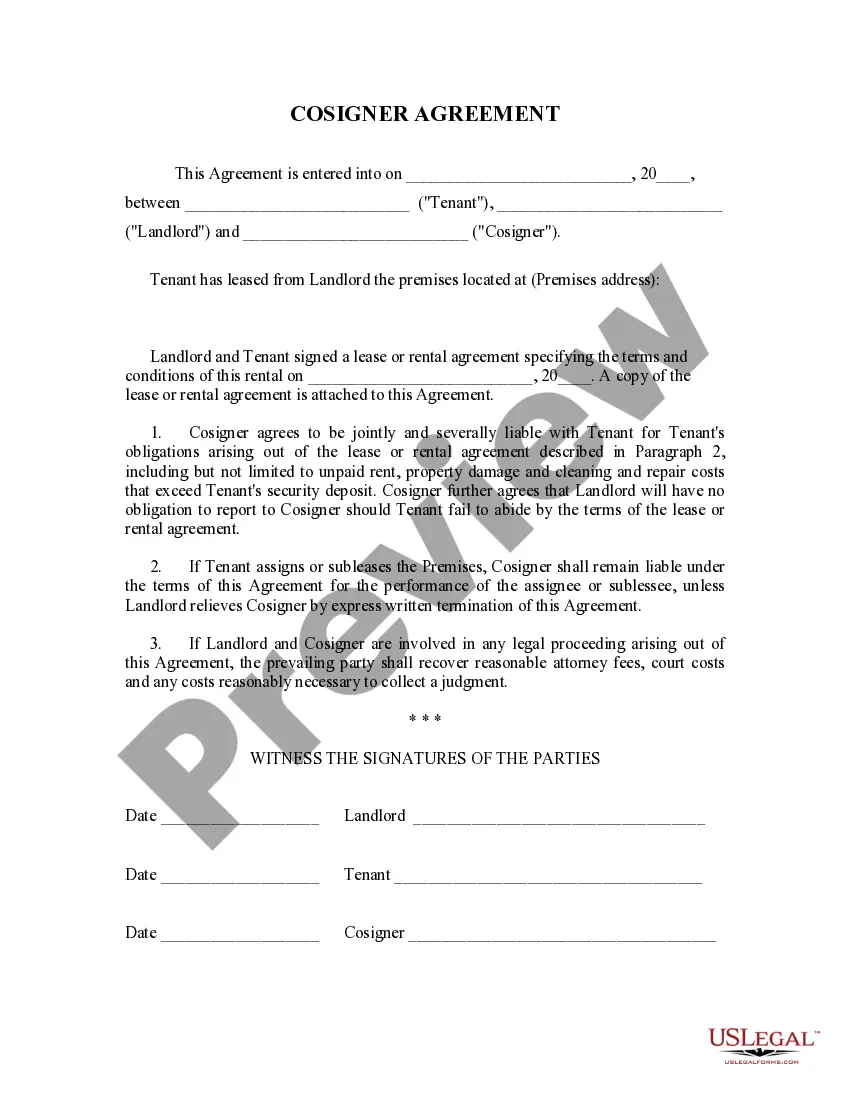

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Maricopa Arizona Quitclaim Deed from Corporation to LLC

Description

How to fill out Arizona Quitclaim Deed From Corporation To LLC?

We consistently aim to reduce or avert legal repercussions when managing intricate legal or financial issues.

To achieve this, we seek out legal aid that is generally quite costly.

However, not every legal concern is as complicated.

Many of them can be resolved independently.

Take advantage of US Legal Forms whenever you need to obtain and download the Maricopa Arizona Quitclaim Deed from Corporation to LLC or any other form effortlessly and securely. Just Log In to your account and click the Get button next to it. If you misplace the form, you can always re-download it from the My documents tab. The procedure is just as simple if you’re unfamiliar with the website! You can set up your account in just a few minutes. Ensure that the Maricopa Arizona Quitclaim Deed from Corporation to LLC complies with the laws and regulations of your state and locality. Additionally, it’s critical to review the form’s description (if available), and if you find any inconsistencies with what you were originally looking for, search for an alternative form. Once you've confirmed that the Maricopa Arizona Quitclaim Deed from Corporation to LLC fits your needs, you can select a subscription plan and process your payment. Then you can download the form in any of the available file formats. With over 24 years of experience in the market, we’ve assisted millions by providing ready-to-customize and up-to-date legal forms. Make the most of US Legal Forms today to conserve time and resources!

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to take charge of your affairs without the need for legal representation.

- We offer access to legal form templates that aren’t always publicly available.

- Our templates are tailored to be state- and region-specific, making the search process much easier.

Form popularity

FAQ

People often place their property in an LLC for various reasons, primarily to protect personal assets from any legal liabilities associated with the property. An LLC can also provide tax benefits and simplify transactions when transferring ownership. By utilizing a Maricopa Arizona Quitclaim Deed from Corporation to LLC, individuals ensure a smooth transition that enhances privacy and facilitates property management.

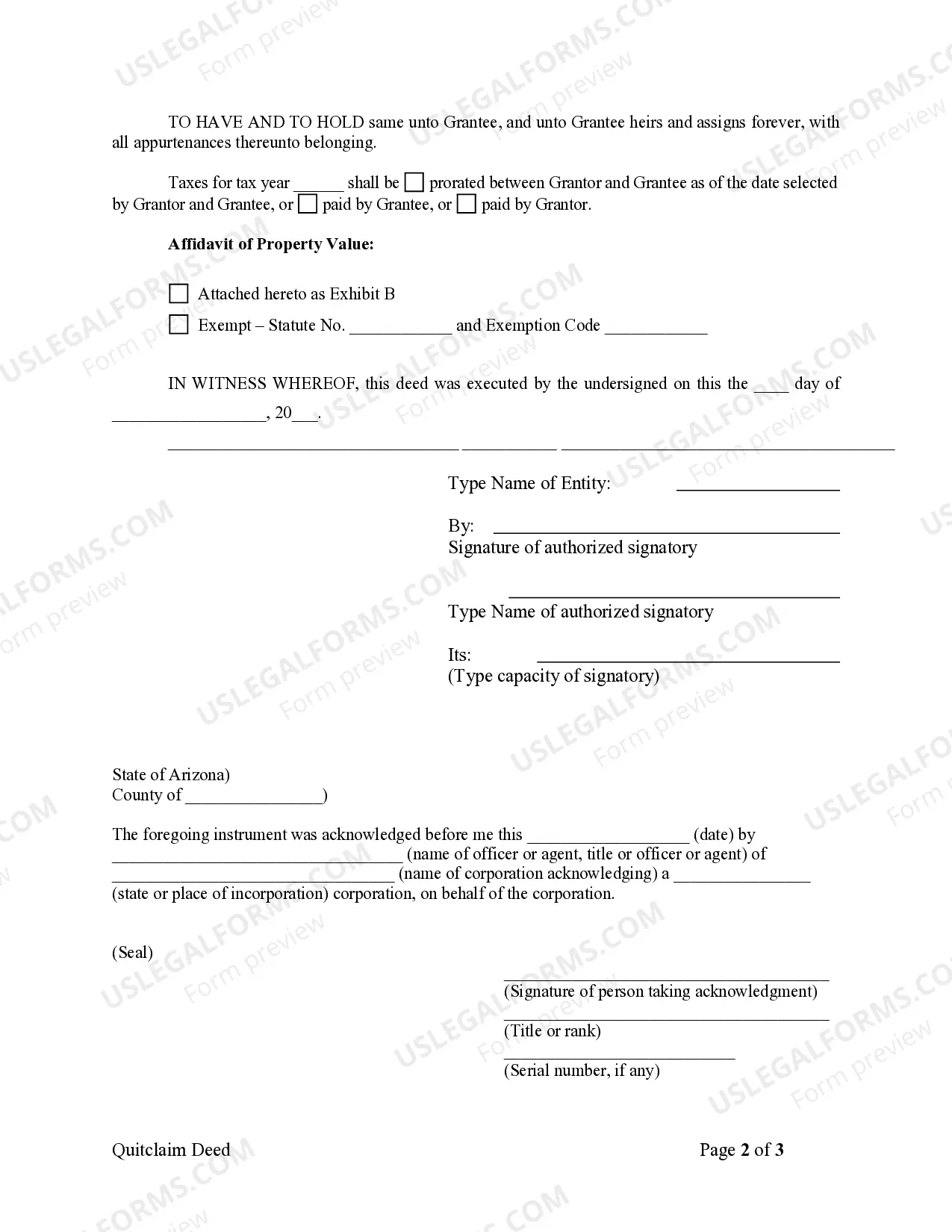

To file a quitclaim deed in Arizona, you must first complete the deed form with all required details about the property and the parties involved. After signing the form, you need to have it notarized. Next, file the Maricopa Arizona Quitclaim Deed from Corporation to LLC with the County Recorder's Office in your area. Remember to keep a copy for your records.

One key disadvantage of putting a property in an LLC is the potential for increased costs. You may face higher fees for starting and maintaining the LLC, including annual filing fees and possible tax implications. Additionally, transferring your property using a Maricopa Arizona Quitclaim Deed from Corporation to LLC might complicate your ownership and limit future financing options. Always consider these factors before proceeding.

To fill out an Arizona quitclaim deed, start by entering the names of the grantor and grantee, as well as the property description. Include the date of the transfer and make sure to sign the document in front of a notary. Following these steps helps ensure your Maricopa Arizona Quitclaim Deed from Corporation to LLC effectively transfers ownership and is legally binding.

Yes, you can prepare a quitclaim deed yourself, especially if you follow standardized templates. However, ensuring that your Maricopa Arizona Quitclaim Deed from Corporation to LLC meets all legal requirements is vital. Utilizing online resources or platforms like UsLegalForms can simplify this process by providing templates and guidance.

To write up a quitclaim deed, start by clearly stating the parties involved, the effective date, and a full property description. Use clear language, specifying that it is a quitclaim deed and including the necessary signatures and notary acknowledgment. A structured approach ensures your Maricopa Arizona Quitclaim Deed from Corporation to LLC is valid and enforceable.

After a quitclaim deed is recorded, it becomes part of the public record, affirming the new ownership of the property. You will receive a stamped copy of the deed, which serves as proof of the transfer. This step is crucial in a Maricopa Arizona Quitclaim Deed from Corporation to LLC because it solidifies your legal claim and prevents future issues.

Yes, a quitclaim deed should be recorded in Arizona to ensure the transfer of title is legally recognized. Recording your Maricopa Arizona Quitclaim Deed from Corporation to LLC protects your claim to the property and provides public notice of the transaction. Without recording, potential disputes about ownership could arise.

In Maricopa County, the Recorder of Deeds is responsible for managing all property records, including quitclaim deeds. You can reach out to the Maricopa County Recorder's Office for assistance in filing a Maricopa Arizona Quitclaim Deed from Corporation to LLC. They have resources to guide you through the process and ensure your deed is recorded correctly.

To transfer property from personal ownership to an LLC, you'll need to execute a Maricopa Arizona Quitclaim Deed from Corporation to LLC. Fill out the deed with your name as the current owner and the LLC’s name as the new owner. After preparation, record the deed with the county recorder’s office to effectuate the transfer legally.