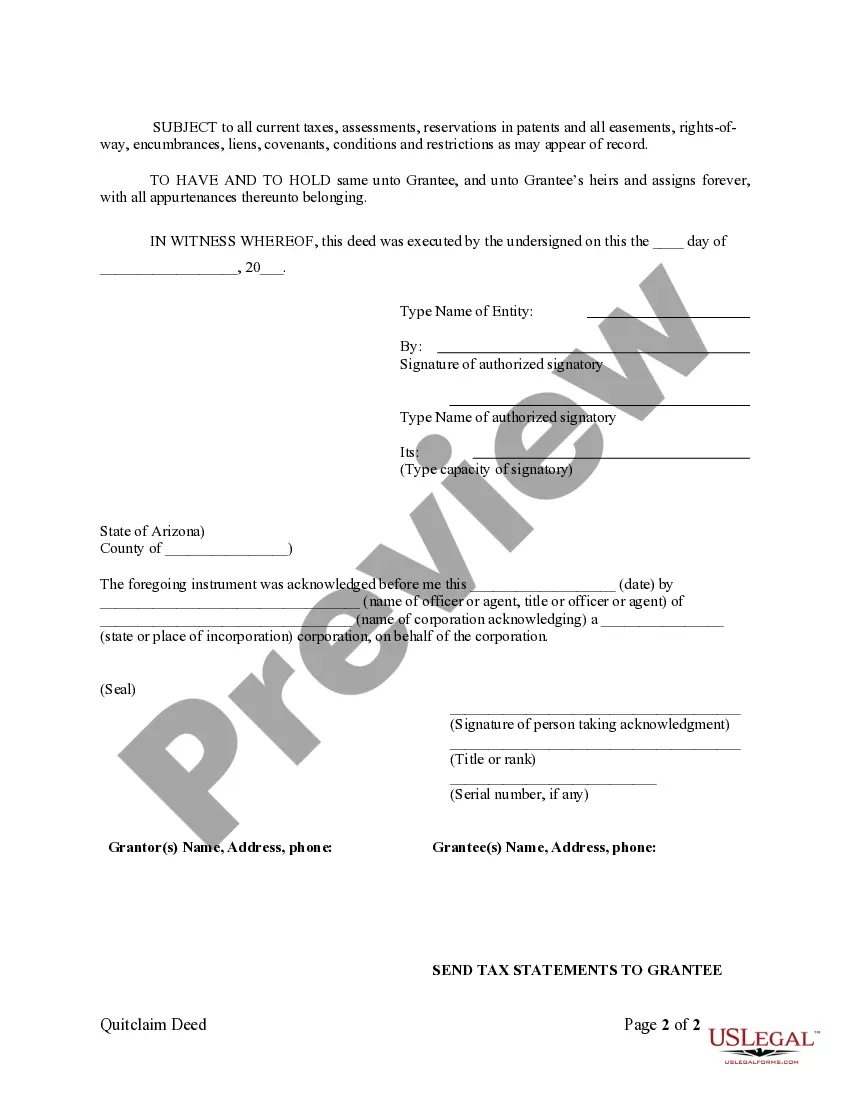

This Quitclaim Deed from Corporation to Corporation form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Surprise Arizona quitclaim deed from corporation to corporation is a legal document that transfers ownership of property from one corporation to another without making any guarantees about the property's title. This type of deed is often used in corporate transactions, such as mergers, acquisitions, or internal restructuring. In a Surprise Arizona quitclaim deed from corporation to corporation, the transferring corporation, also known as the granter, relinquishes any claims, interest, or rights it may have on the property to the receiving corporation, called the grantee. This transfer can involve a single property or multiple properties, depending on the transaction's scope. Unlike warranty deeds, which provide guarantees about the property's legal and marketable title, a quitclaim deed only transfers whatever interest the granter has at the time of the transfer. This means that if there are any undisclosed liens, encumbrances, or other issues with the title, the grantee does not have any legal recourse against the granter. It is important to mention that a quitclaim deed is not a method of proving ownership, but rather a mechanism to transfer existing ownership rights. Before executing a Surprise Arizona quitclaim deed from corporation to corporation, it is crucial for both parties to conduct a thorough due diligence process to ensure there are no outstanding liens, disputes, or other title issues that may affect the property's value or future use. Different types of Surprise Arizona quitclaim deeds from corporation to corporation may include: 1. General quitclaim deed: This is the most common type of quitclaim deed used in corporate transactions. It transfers the granter's interest in the property to the grantee without any warranties or guarantees. 2. Special quitclaim deed: In some cases, parties may choose to use a special quitclaim deed that includes specific conditions or limitations on the transfer. For instance, the deed may state that the transfer is subject to certain existing leases, easements, or other contractual obligations. 3. Aggregate quitclaim deed: When multiple properties or parcels are being transferred from one corporation to another, an aggregate quitclaim deed can be used. This type of deed consolidates the transfer of all properties into a single document. 4. Partial quitclaim deed: In situations where only a portion of a corporate property is being transferred, a partial quitclaim deed can be used to transfer the specific portion of interest to the grantee corporation. In summary, a Surprise Arizona quitclaim deed from corporation to corporation is a legal instrument used to transfer ownership of property between two corporations without any guarantees about the property's title. It is essential for both parties involved to conduct due diligence before executing the deed. Different types of quitclaim deeds, such as general, special, aggregate, or partial, may be used depending on the specific circumstances of the transfer.A Surprise Arizona quitclaim deed from corporation to corporation is a legal document that transfers ownership of property from one corporation to another without making any guarantees about the property's title. This type of deed is often used in corporate transactions, such as mergers, acquisitions, or internal restructuring. In a Surprise Arizona quitclaim deed from corporation to corporation, the transferring corporation, also known as the granter, relinquishes any claims, interest, or rights it may have on the property to the receiving corporation, called the grantee. This transfer can involve a single property or multiple properties, depending on the transaction's scope. Unlike warranty deeds, which provide guarantees about the property's legal and marketable title, a quitclaim deed only transfers whatever interest the granter has at the time of the transfer. This means that if there are any undisclosed liens, encumbrances, or other issues with the title, the grantee does not have any legal recourse against the granter. It is important to mention that a quitclaim deed is not a method of proving ownership, but rather a mechanism to transfer existing ownership rights. Before executing a Surprise Arizona quitclaim deed from corporation to corporation, it is crucial for both parties to conduct a thorough due diligence process to ensure there are no outstanding liens, disputes, or other title issues that may affect the property's value or future use. Different types of Surprise Arizona quitclaim deeds from corporation to corporation may include: 1. General quitclaim deed: This is the most common type of quitclaim deed used in corporate transactions. It transfers the granter's interest in the property to the grantee without any warranties or guarantees. 2. Special quitclaim deed: In some cases, parties may choose to use a special quitclaim deed that includes specific conditions or limitations on the transfer. For instance, the deed may state that the transfer is subject to certain existing leases, easements, or other contractual obligations. 3. Aggregate quitclaim deed: When multiple properties or parcels are being transferred from one corporation to another, an aggregate quitclaim deed can be used. This type of deed consolidates the transfer of all properties into a single document. 4. Partial quitclaim deed: In situations where only a portion of a corporate property is being transferred, a partial quitclaim deed can be used to transfer the specific portion of interest to the grantee corporation. In summary, a Surprise Arizona quitclaim deed from corporation to corporation is a legal instrument used to transfer ownership of property between two corporations without any guarantees about the property's title. It is essential for both parties involved to conduct due diligence before executing the deed. Different types of quitclaim deeds, such as general, special, aggregate, or partial, may be used depending on the specific circumstances of the transfer.