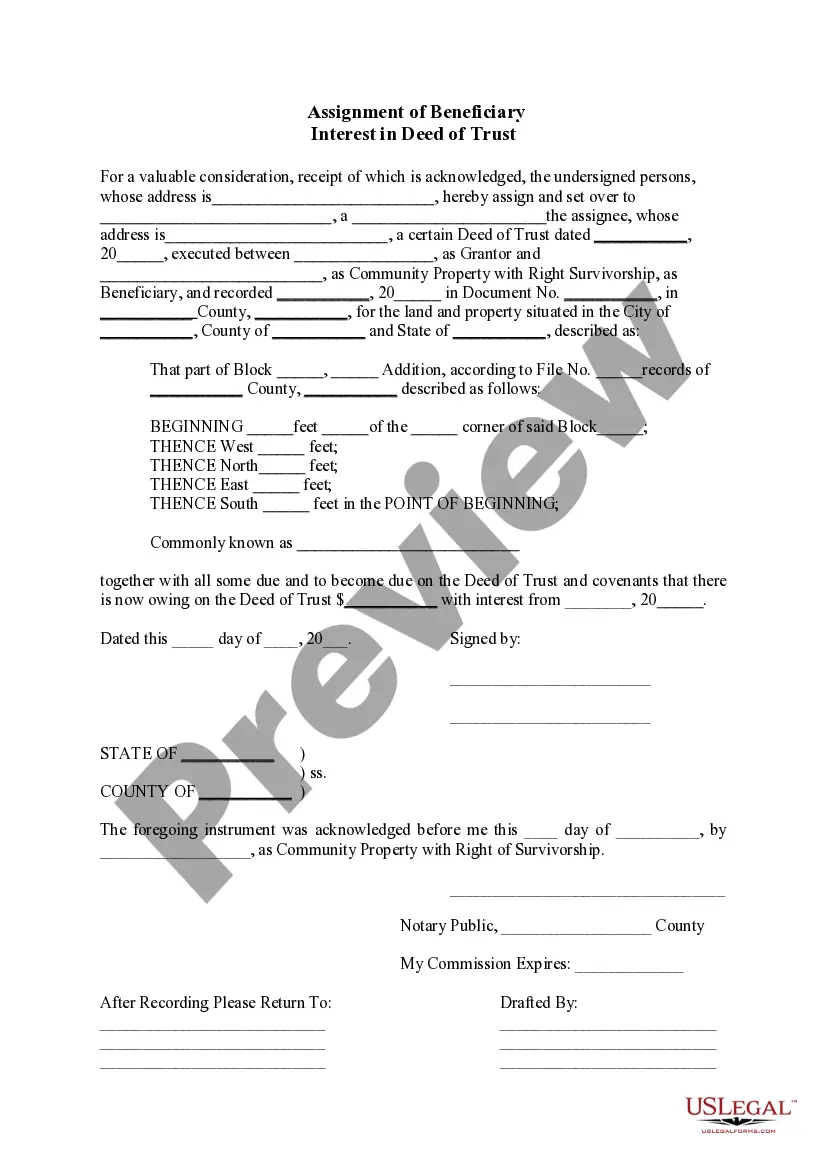

The Phoenix Arizona Assignment of Beneficiary Interest In Deed of Trust is a legal document that allows for the transfer of the beneficiary's interest in a deed of trust to another party. This document is commonly used in real estate transactions in Phoenix, Arizona. The assignment of beneficiary interest in a deed of trust occurs when the original beneficiary, who is typically the lender or mortgage holder, assigns their rights and interests to a different party. This can be done for various reasons, such as transferring ownership of the property or assigning the debt to another entity. By using this document, the original beneficiary is essentially transferring their rights to collect on the debt secured by the deed of trust to the assignee. The assignee then becomes the new beneficiary and assumes all the rights, responsibilities, and obligations of the original beneficiary. There are different types of Phoenix Arizona Assignment of Beneficiary Interest In Deed of Trust, depending on the specific circumstances of the transaction. Some common types include: 1. Full Assignment: This type of assignment transfers the entire interest of the original beneficiary to the assignee. The assignee becomes the new beneficiary and takes over all rights and obligations associated with the deed of trust. 2. Partial Assignment: In a partial assignment, only a portion of the beneficiary's interest is transferred to the assignee. This could be a specific dollar amount or a percentage of the debt. 3. Temporary Assignment: A temporary assignment is used when the original beneficiary wants to transfer their interest temporarily for a specific purpose. This could be done to facilitate a loan modification or to allow a different party to collect payments on their behalf. 4. Assignment with Assumption: In some cases, the assignment of beneficiary interest is coupled with an assumption of the debt by the assignee. This means that the assignee assumes responsibility for repaying the debt and becomes the new debtor. It is important to note that the Phoenix Arizona Assignment of Beneficiary Interest in Deed of Trust must be executed in writing and typically requires the consent of all parties involved, including the borrower. Additionally, the assignment must be recorded with the appropriate county recorder's office to be legally valid. Overall, the Phoenix Arizona Assignment of Beneficiary Interest In Deed of Trust is a crucial document in real estate transactions, allowing for the transfer of the beneficiary's rights and interests in a deed of trust to another party.

Phoenix Arizona Assignment of Beneficiary Interest In Deed of Trust

Description

How to fill out Phoenix Arizona Assignment Of Beneficiary Interest In Deed Of Trust?

If you are searching for a valid form, it’s impossible to choose a better platform than the US Legal Forms website – one of the most extensive libraries on the web. Here you can find a huge number of form samples for company and individual purposes by categories and regions, or key phrases. With the advanced search feature, discovering the most up-to-date Phoenix Arizona Assignment of Beneficiary Interest In Deed of Trust is as elementary as 1-2-3. Additionally, the relevance of every document is proved by a team of expert lawyers that regularly check the templates on our platform and revise them in accordance with the latest state and county demands.

If you already know about our platform and have a registered account, all you should do to receive the Phoenix Arizona Assignment of Beneficiary Interest In Deed of Trust is to log in to your profile and click the Download option.

If you make use of US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have chosen the sample you need. Check its information and use the Preview feature to check its content. If it doesn’t suit your needs, use the Search field at the top of the screen to get the appropriate record.

- Affirm your selection. Select the Buy now option. Following that, choose the preferred subscription plan and provide credentials to sign up for an account.

- Process the financial transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Receive the form. Choose the format and download it to your system.

- Make modifications. Fill out, edit, print, and sign the acquired Phoenix Arizona Assignment of Beneficiary Interest In Deed of Trust.

Each and every form you add to your profile does not have an expiration date and is yours forever. You can easily access them via the My Forms menu, so if you want to have an additional copy for modifying or creating a hard copy, feel free to come back and export it once again anytime.

Make use of the US Legal Forms extensive catalogue to gain access to the Phoenix Arizona Assignment of Beneficiary Interest In Deed of Trust you were seeking and a huge number of other professional and state-specific templates on one website!