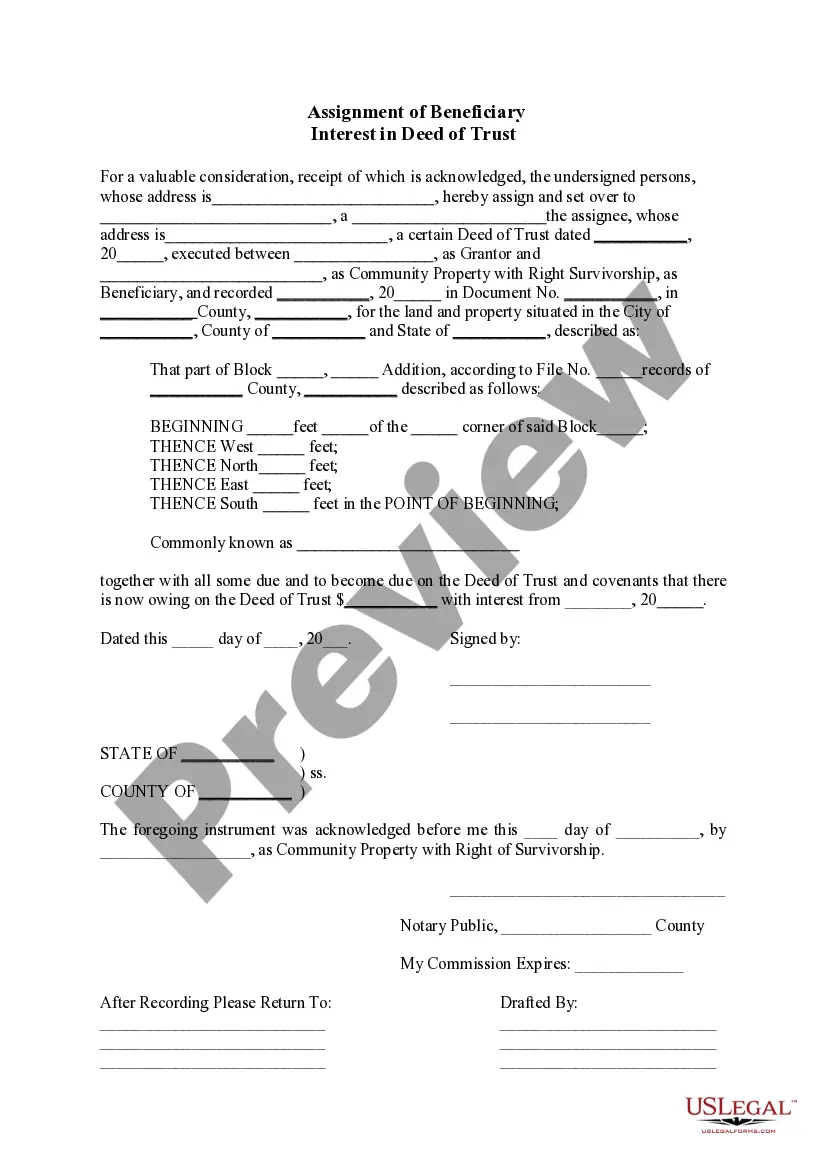

Scottsdale Arizona Assignment of Beneficiary Interest in Deed of Trust is a legal document that allows the transfer of the beneficiary interest in a deed of trust from one party to another in the context of a property located in Scottsdale, Arizona. This document plays a crucial role in property transactions and real estate financing. When an individual or entity obtains a loan to purchase a property, they typically sign a promissory note and a deed of trust. The deed of trust acts as security for the loan, granting the lender a security interest in the property to secure repayment. The beneficiary, usually the lender, holds the legal interest in the deed of trust until the loan is fully paid off. However, there might be instances where the original beneficiary wants to transfer or assign their interest to another party. This is where the Scottsdale Arizona Assignment of Beneficiary Interest in Deed of Trust comes into play. By completing this assignment, the original beneficiary assigns their rights, interests, and remedies associated with the deed of trust to the assignee. Assignments of beneficiary interest in deeds of trust can occur for various reasons, such as when a lender sells the loan to another financial institution, or when an individual wants to invest in trust deeds as a form of real estate investment. Regardless of the reason, this assignment allows for a seamless transfer of the beneficiary interest, ensuring that the assignee now has the right to enforce the terms of the deed of trust, including initiating foreclosure proceedings if necessary. Furthermore, there may be different types or variations of Scottsdale Arizona Assignment of Beneficiary Interest in Deed of Trust based on specific circumstances or preferences. Some common types include: 1. Partial Assignment: In some cases, the original beneficiary may only assign a portion of their interest to the assignee, keeping a partial interest for themselves. This arrangement often occurs when the original beneficiary wants to share the risks and rewards of the loan with another party. 2. Full Assignment: This is the most common type where the original beneficiary transfers their entire interest in the deed of trust to the assignee. Once the assignment is complete, the assignee assumes all the rights, responsibilities, and remedies associated with the deed of trust. 3. Assignment with Recourse: In certain situations, the original beneficiary may include a recourse provision in the assignment, which holds the assignor (original beneficiary) liable for any losses or liabilities arising from the deed of trust, even after the assignment is completed. This provision provides an extra layer of protection for the assignee. It is important to note that these variations may be subject to specific requirements and regulations governed by Scottsdale, Arizona law. It is advisable to consult with a qualified attorney to ensure compliance and accuracy when preparing and executing any Scottsdale Arizona Assignment of Beneficiary Interest in Deed of Trust.

Scottsdale Arizona Assignment of Beneficiary Interest In Deed of Trust

Description

How to fill out Scottsdale Arizona Assignment Of Beneficiary Interest In Deed Of Trust?

Irrespective of social or professional standing, filling out law-related documents is a regrettable necessity in today’s business landscape.

Frequently, it’s nearly impossible for someone without a legal background to create such paperwork from the ground up, largely due to the intricate terminology and legal subtleties they include.

This is where US Legal Forms proves to be beneficial.

Ensure that the form you’ve selected is suitable for your location, as the regulations of one state or area may not apply to another.

Investigate the document and review a brief description (if available) of the situations for which the document can be utilized.

- Our service provides an extensive collection with over 85,000 ready-to-use state-specific forms suitable for nearly any legal situation.

- US Legal Forms is also an excellent tool for associates or legal advisors who wish to enhance their efficiency with our DYI templates.

- Whether you need the Scottsdale Arizona Assignment of Beneficiary Interest In Deed of Trust or another document relevant to your state or region, US Legal Forms has everything you need at your fingertips.

- Here’s how to quickly obtain the Scottsdale Arizona Assignment of Beneficiary Interest In Deed of Trust using our reliable service.

- If you are already a subscriber, feel free to Log In to your account to download the required form.

- However, if you’re new to our platform, follow these steps before downloading the Scottsdale Arizona Assignment of Beneficiary Interest In Deed of Trust.

Form popularity

FAQ

A right of survivorship deed in Arizona allows co-owners to automatically transfer their interest in the property to the surviving owner upon death. This type of deed prevents the property from going through probate, which can save time and expenses. When considering ownership options, understanding this concept is important alongside the Scottsdale Arizona Assignment of Beneficiary Interest In Deed of Trust.

Yes, Arizona recognizes beneficiary deeds. A beneficiary deed allows property owners to designate a beneficiary who will receive the property upon the owner's death, avoiding probate. This deed plays a vital role in the Scottsdale Arizona Assignment of Beneficiary Interest In Deed of Trust, simplifying the transfer of ownership and protecting your loved ones.

To record a beneficiary deed in Arizona, complete the necessary form and submit it to the county recorder's office. You need to provide accurate details about the property and named beneficiaries. Following this process ensures the effective transfer of property interests without probate, particularly when considering the Scottsdale Arizona Assignment of Beneficiary Interest In Deed of Trust.

Beneficiary laws in Arizona define the rights and responsibilities of beneficiaries named in a deed of trust. These laws ensure that beneficiaries have the authority to receive payments and rights to property upon certain conditions, such as the death of the trustor. When dealing with the Scottsdale Arizona Assignment of Beneficiary Interest In Deed of Trust, it is crucial to follow these regulations to protect your interests.

Yes, Arizona is a deed of trust state. This means that lenders use a deed of trust instead of a mortgage to secure property loans. In the case of default, the lender can initiate a non-judicial foreclosure process. Understanding the Scottsdale Arizona Assignment of Beneficiary Interest In Deed of Trust is essential for both borrowers and lenders.

Yes, a beneficiary deed must be recorded in Arizona to be effective. By recording it with the county recorder’s office where the property is located, you establish a public record of your intentions as stated in the Scottsdale Arizona Assignment of Beneficiary Interest In Deed of Trust. This step is crucial for confirming the beneficiary's rights to the property and avoiding potential legal disputes.

To obtain a beneficiary deed in Arizona, you typically need to draft the deed, ensuring it includes the necessary legal language. The Scottsdale Arizona Assignment of Beneficiary Interest In Deed of Trust serves as a useful framework to guide you through this process. You can either consult a legal professional or access online resources like US Legal Forms to download templates and ensure the deed meets state requirements.

Yes, a beneficiary deed does avoid probate in Arizona. By designating a beneficiary through the Scottsdale Arizona Assignment of Beneficiary Interest In Deed of Trust, the property transfers directly to the beneficiary upon the owner’s death. This process helps streamline the transfer of assets without the delays and costs typically associated with probate proceedings.

To transfer a deed after death in Arizona, you need to provide a copy of the death certificate and complete the necessary paperwork for the Scottsdale Arizona Assignment of Beneficiary Interest In Deed of Trust. This process often involves filing a beneficiary deed, which clearly outlines who inherits the property. You may want to consult with a real estate attorney or use online legal platforms like US Legal Forms to ensure all forms are completed accurately.

To file a beneficiary deed in Arizona, you need to prepare the deed with accurate property details and designate your beneficiaries. Once completed, the document must be signed, notarized, and recorded with the county recorder's office where the property is located. Using uslegalforms can streamline this process, especially when dealing with the Scottsdale Arizona Assignment of Beneficiary Interest In Deed of Trust to ensure your intentions are legally recognized.