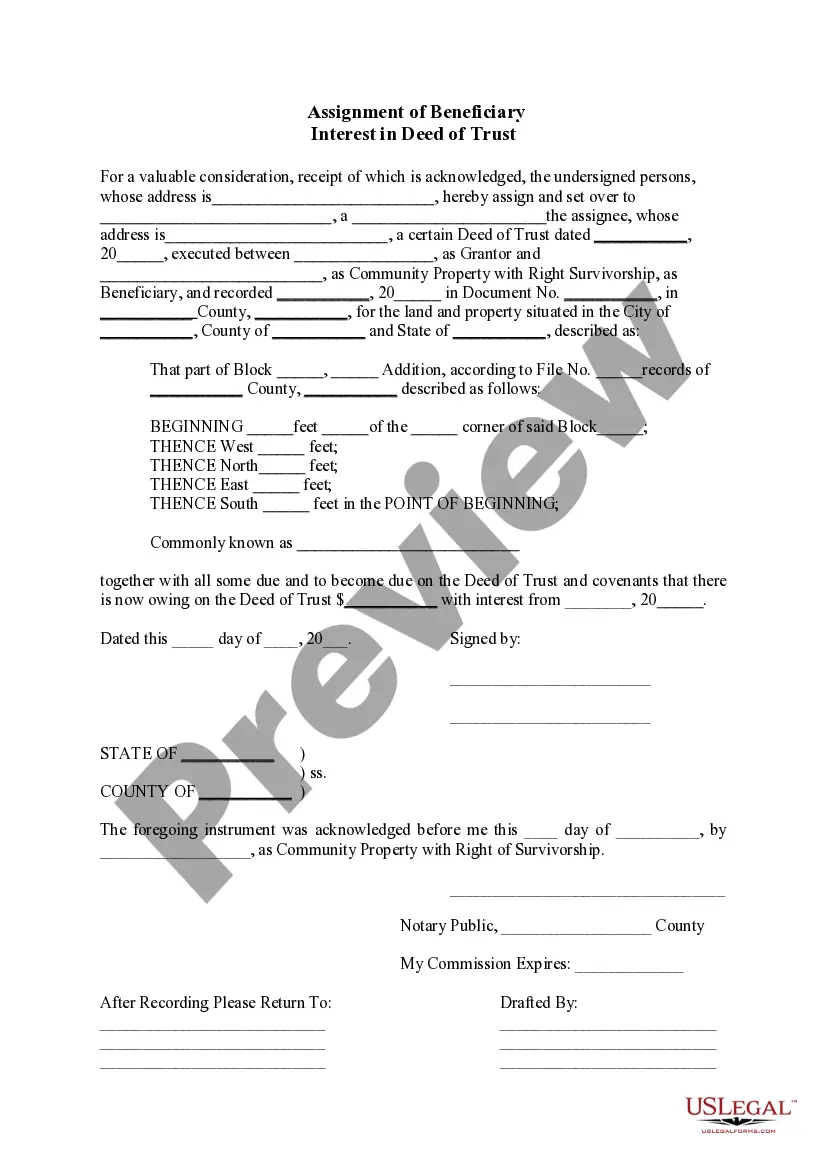

Title: Understanding the Surprise Arizona Assignment of Beneficiary Interest In Deed of Trust: A Comprehensive Overview Introduction: The Surprise Arizona Assignment of Beneficiary Interest In Deed of Trust is a crucial legal document that deals with the transfer of ownership of a beneficiary interest in a deed of trust. This assignment allows for the transfer of rights, interests, and obligations from one party to another, providing a framework for securing real estate loans. In this article, we will delve into the details of this assignment, its types, implications, and key considerations surrounding it. I. What is an Assignment of Beneficiary Interest In Deed of Trust? 1. Definition: The assignment of beneficiary interest in deed of trust involves the transfer of ownership and rights of a party (the beneficiary) holding a beneficiary interest in a deed of trust loan to another party. 2. Importance: This assignment facilitates the efficient transfer of loan servicing responsibilities, transfer of rights to foreclose, and ensures proper lien protections. II. Types of Surprise Arizona Assignment of Beneficiary Interest In Deed of Trust: 1. Standard Assignment: This type of assignment involves the transfer of beneficiary interest from one party to another, with the new party assuming each obligation and right held by the original beneficiary. 2. Partial Assignment: In cases where only a portion of the beneficiary interest needs to be transferred, a partial assignment allows for the specified fraction or amount to be reassigned to a new party. III. Key Considerations and Implications: 1. Legal Requirements: The assignment of beneficiary interest in deed of trust must comply with the relevant Arizona laws and be properly recorded to maintain its enforceability. 2. Notice to Borrower: It is crucial to provide timely notice to the borrower about the assignment, ensuring transparency and smooth continuation of loan servicing. 3. Lien Rights: The assignee becomes the new beneficiary and can exercise the rights to foreclose in case of borrower default, as stated in the original deed of trust. 4. Loan Servicing Rights and Obligations: With the assignment, the new beneficiary assumes all servicing rights and responsibilities, including receiving payments, managing escrow accounts, and handling loan modification requests. IV. Steps Involved in the Assignment Process: 1. Drafting the Assignment: A legally binding assignment document must be prepared, clearly specifying the assignor, assignee, beneficiary details, loan details, and any specific terms or conditions. 2. Execution: The assignment document must be signed, witnessed, and notarized by all parties involved. 3. Recording: The assignment should be recorded in the official county records where the original deed of trust was recorded, ensuring proper notice to all concerned parties. Conclusion: The Surprise Arizona Assignment of Beneficiary Interest In Deed of Trust plays a crucial role in the transfer of ownership and rights associated with a beneficiary interest in a deed of trust. Whether it be a standard or partial assignment, understanding the legal requirements, implications, and steps involved is essential to ensure smooth transitions and secure real estate loan transactions. Keywords: Surprise Arizona, Assignment of Beneficiary Interest, Deed of Trust, transfer of ownership, real estate loans, loan servicing, lien protections, legal requirements, notice to borrower, partial assignment, standard assignment, foreclosure rights, loan modification, loan servicing rights, loan servicing obligations, drafting assignment, recording assignment, enforceability, Arizona laws.

Surprise Arizona Assignment of Beneficiary Interest In Deed of Trust

Description

How to fill out Surprise Arizona Assignment Of Beneficiary Interest In Deed Of Trust?

If you are searching for a relevant form, it’s difficult to find a more convenient place than the US Legal Forms site – probably the most comprehensive libraries on the web. With this library, you can find a large number of templates for company and individual purposes by types and regions, or keywords. With our high-quality search feature, getting the most recent Surprise Arizona Assignment of Beneficiary Interest In Deed of Trust is as easy as 1-2-3. Moreover, the relevance of every document is confirmed by a team of professional lawyers that on a regular basis check the templates on our platform and update them in accordance with the newest state and county requirements.

If you already know about our system and have a registered account, all you need to get the Surprise Arizona Assignment of Beneficiary Interest In Deed of Trust is to log in to your account and click the Download button.

If you make use of US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have chosen the sample you require. Check its description and make use of the Preview function to check its content. If it doesn’t suit your needs, use the Search option at the top of the screen to get the appropriate document.

- Confirm your decision. Select the Buy now button. After that, select the preferred pricing plan and provide credentials to register an account.

- Make the financial transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Obtain the form. Choose the format and download it on your device.

- Make changes. Fill out, revise, print, and sign the received Surprise Arizona Assignment of Beneficiary Interest In Deed of Trust.

Every form you save in your account does not have an expiry date and is yours forever. You can easily gain access to them via the My Forms menu, so if you want to receive an extra version for enhancing or creating a hard copy, feel free to come back and save it again anytime.

Make use of the US Legal Forms professional library to get access to the Surprise Arizona Assignment of Beneficiary Interest In Deed of Trust you were looking for and a large number of other professional and state-specific samples in one place!