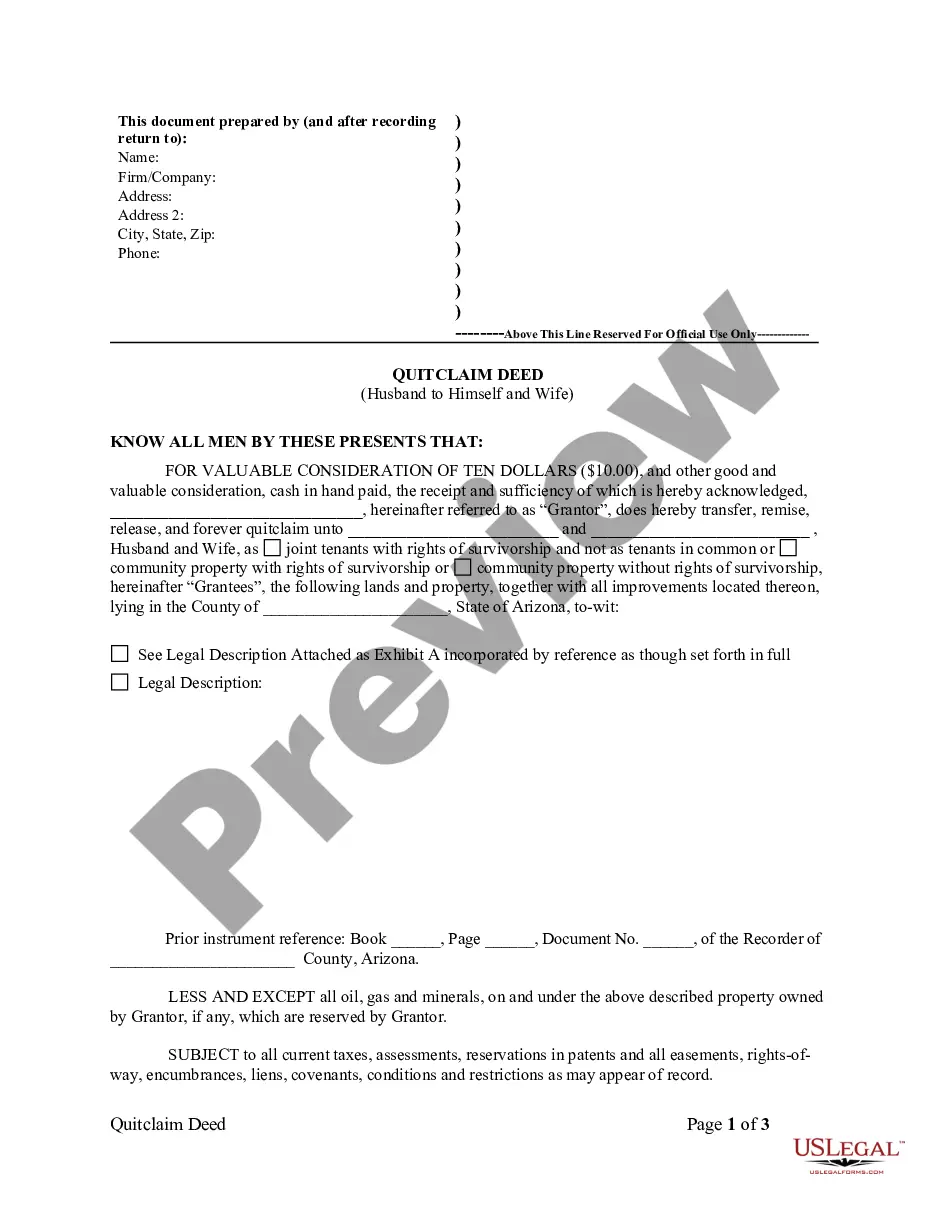

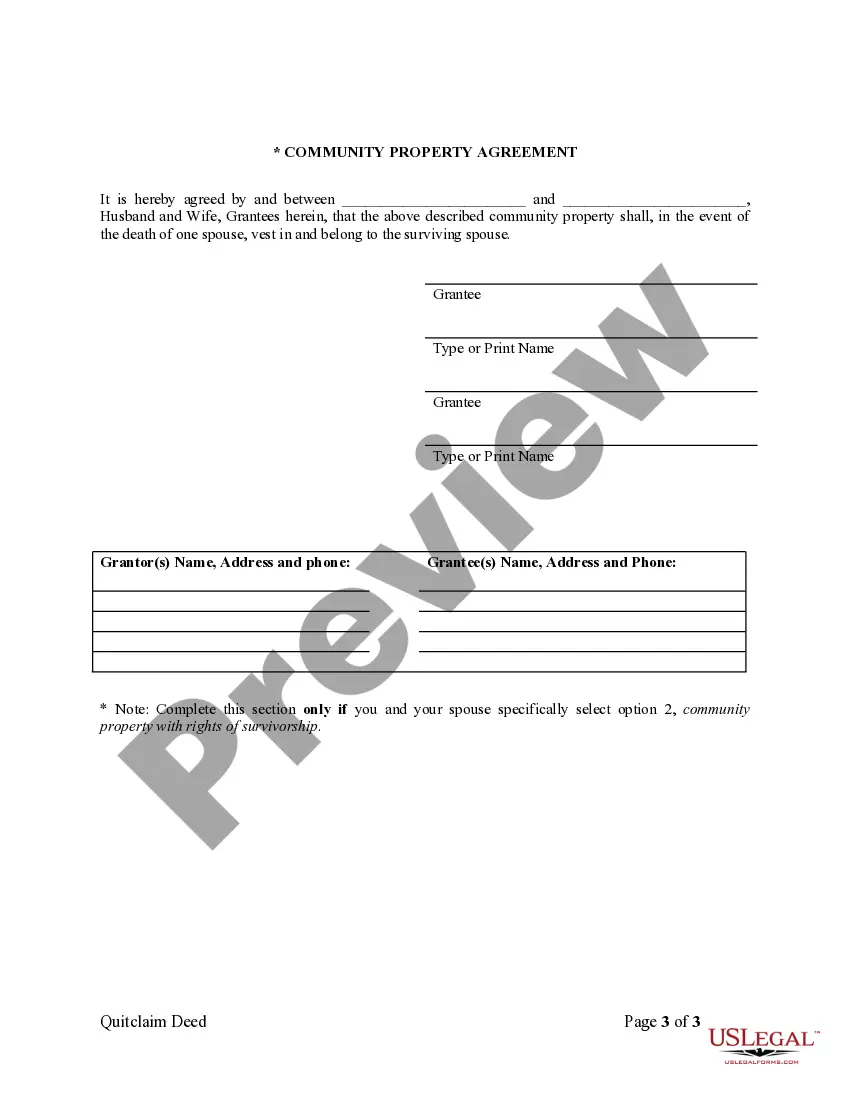

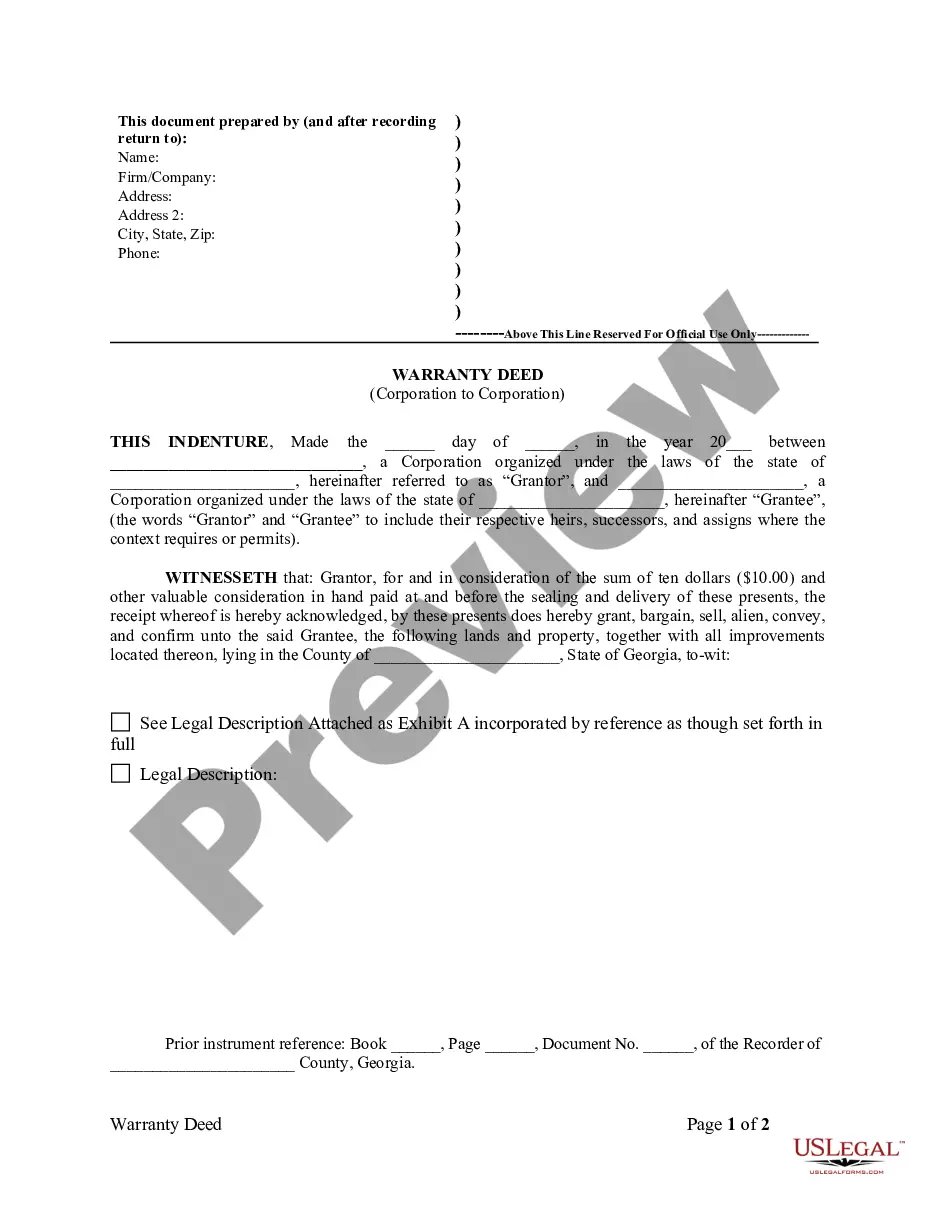

This Quitclaim Deed from Husband to Himself and Wife form is a Quitclaim Deed where the Grantor is the husband and the Grantees are the husband and his wife. Grantors convey and quitclaim the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

Gilbert Arizona Quitclaim Deed from Husband to Himself and Wife

Description

How to fill out Arizona Quitclaim Deed From Husband To Himself And Wife?

Are you searching for a trustworthy and cost-effective provider of legal forms to purchase the Gilbert Arizona Quitclaim Deed from Husband to Himself and Wife.

US Legal Forms is your best option.

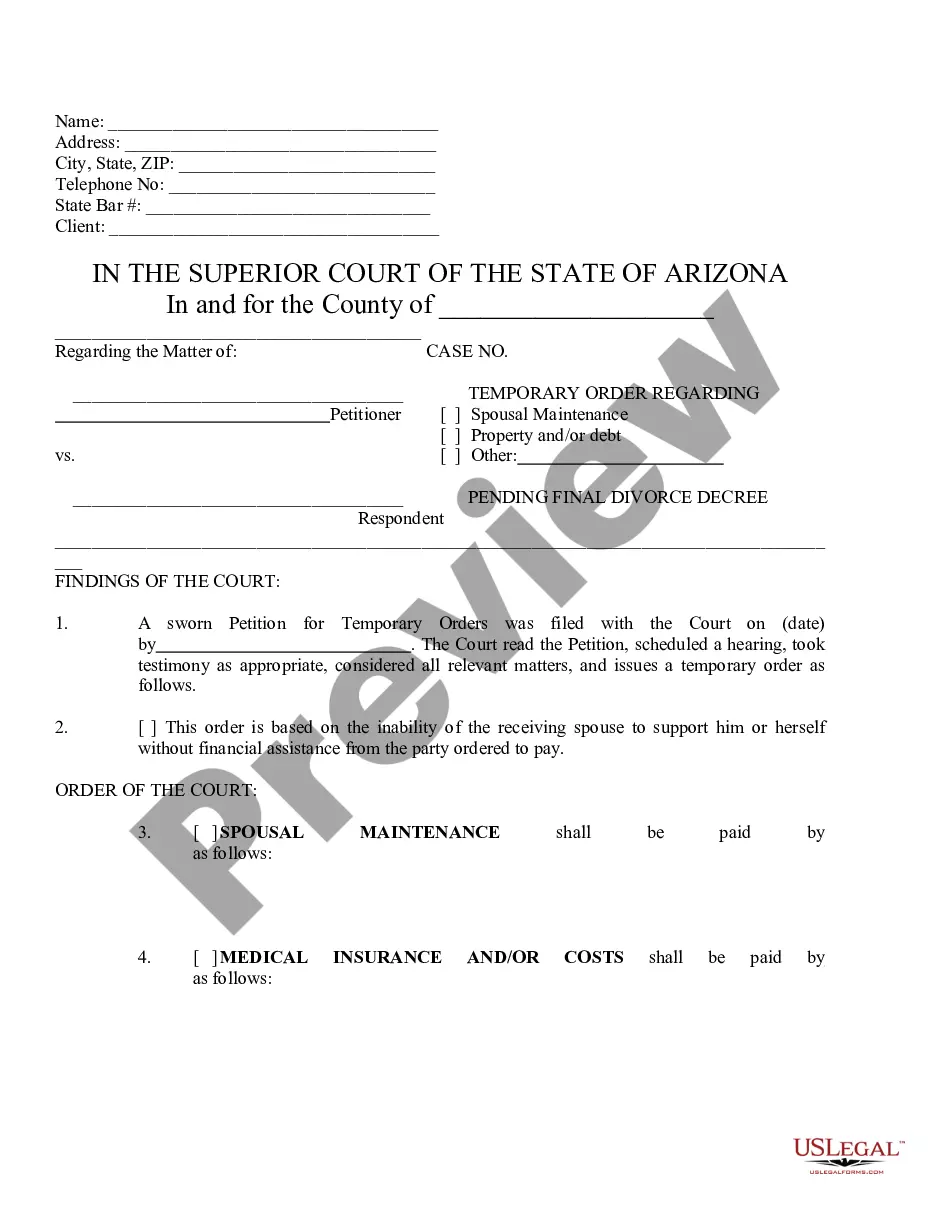

Whether you require a straightforward agreement to establish guidelines for living together with your partner or a bundle of documents to facilitate your separation or divorce through the legal system, we have got your needs covered.

Our website boasts over 85,000 current legal document templates for individual and business use.

Check if the Gilbert Arizona Quitclaim Deed from Husband to Himself and Wife complies with your state and local regulations.

Review the form's description (if available) to understand who and what the form is designed for.

- All templates we provide are not generic and tailored according to the demands of specific states and counties.

- To retrieve the form, you must Log In to your account, locate the necessary template, and click the Download button adjacent to it.

- Please remember that you can always download your previously acquired document templates from the My documents section.

- Is this your first visit to our site? No concerns.

- You can set up an account within minutes, but first, ensure you do the following.

Form popularity

FAQ

Yes, you can add a spouse to a deed without refinancing, particularly by utilizing a Gilbert Arizona Quitclaim Deed from Husband to Himself and Wife. This process allows you to transfer your ownership interest directly without affecting your current mortgage terms. Just make sure to follow the appropriate steps to complete and file the deed with your local county recorder's office.

Adding someone to a deed in Arizona may have tax implications, particularly when using a Gilbert Arizona Quitclaim Deed from Husband to Himself and Wife. Generally, this type of deed does not trigger a reassessment for property tax purposes. However, it is essential to consult a tax professional to understand any potential tax consequences that may arise depending on your specific situation.

To add a spouse to the house title in Arizona, you can use a Gilbert Arizona Quitclaim Deed from Husband to Himself and Wife. This deed allows you to transfer ownership interest without having to go through a lengthy legal process. First, gather the necessary information and complete the form. Once signed, you must file the deed with the county recorder's office.

To add your spouse to your deed in Arizona, you can utilize a Gilbert Arizona Quitclaim Deed from Husband to Himself and Wife. First, you need to prepare the quitclaim deed, which must clearly state both names and the legal description of the property. Next, sign the deed in front of a notary public to ensure its validity. Finally, file the completed deed with your county recorder’s office to officially update the property ownership.

To transfer a property title to a family member in Arizona, you can utilize a Gilbert Arizona Quitclaim Deed from Husband to Himself and Wife. Start by completing the deed with all required information, including the names of both parties and a description of the property. After signing in front of a notary, make sure to file the deed with the county recorder. This method streamlines the process and helps avoid potential disputes in the future.

The primary beneficiaries of a Gilbert Arizona Quitclaim Deed from Husband to Himself and Wife are individuals looking to simplify property transfers, such as married couples or family members. This type of deed allows for quick transfers without extensive legal formalities. Therefore, it is particularly advantageous for those wanting to add or clarify ownership among family members, ensuring easy management of the property.

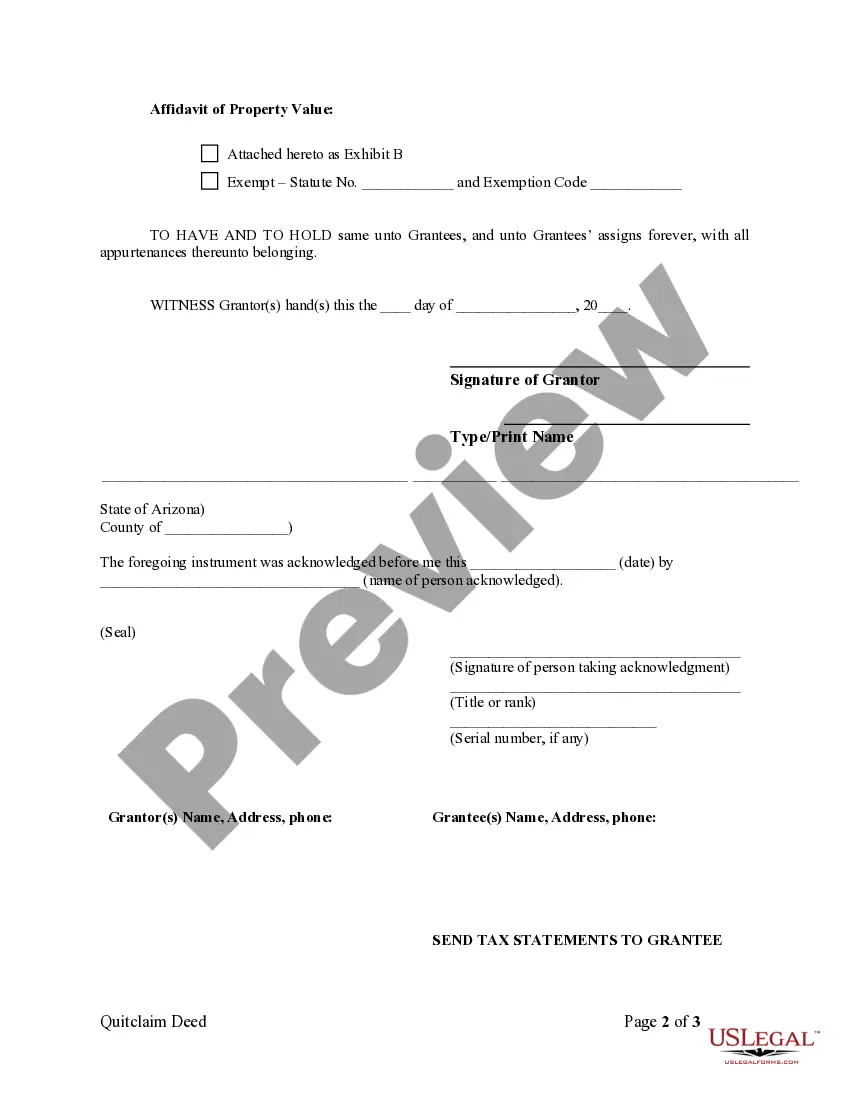

A quitclaim deed in Arizona requires specific elements to be valid. It must contain the full names of both the person giving the property and the person receiving it. Furthermore, a detailed description of the property being transferred is essential. Lastly, the signatures of both parties, along with notarization, complete the requirements for a Gilbert Arizona Quitclaim Deed from Husband to Himself and Wife.

To create a valid Gilbert Arizona Quitclaim Deed from Husband to Himself and Wife, you must meet certain requirements. First, the deed should be in writing and clearly state the intent to transfer property. Additionally, it must include the names of the granter and grantee, along with a description of the property. Finally, both parties should sign the deed in front of a notary public to ensure its legality.