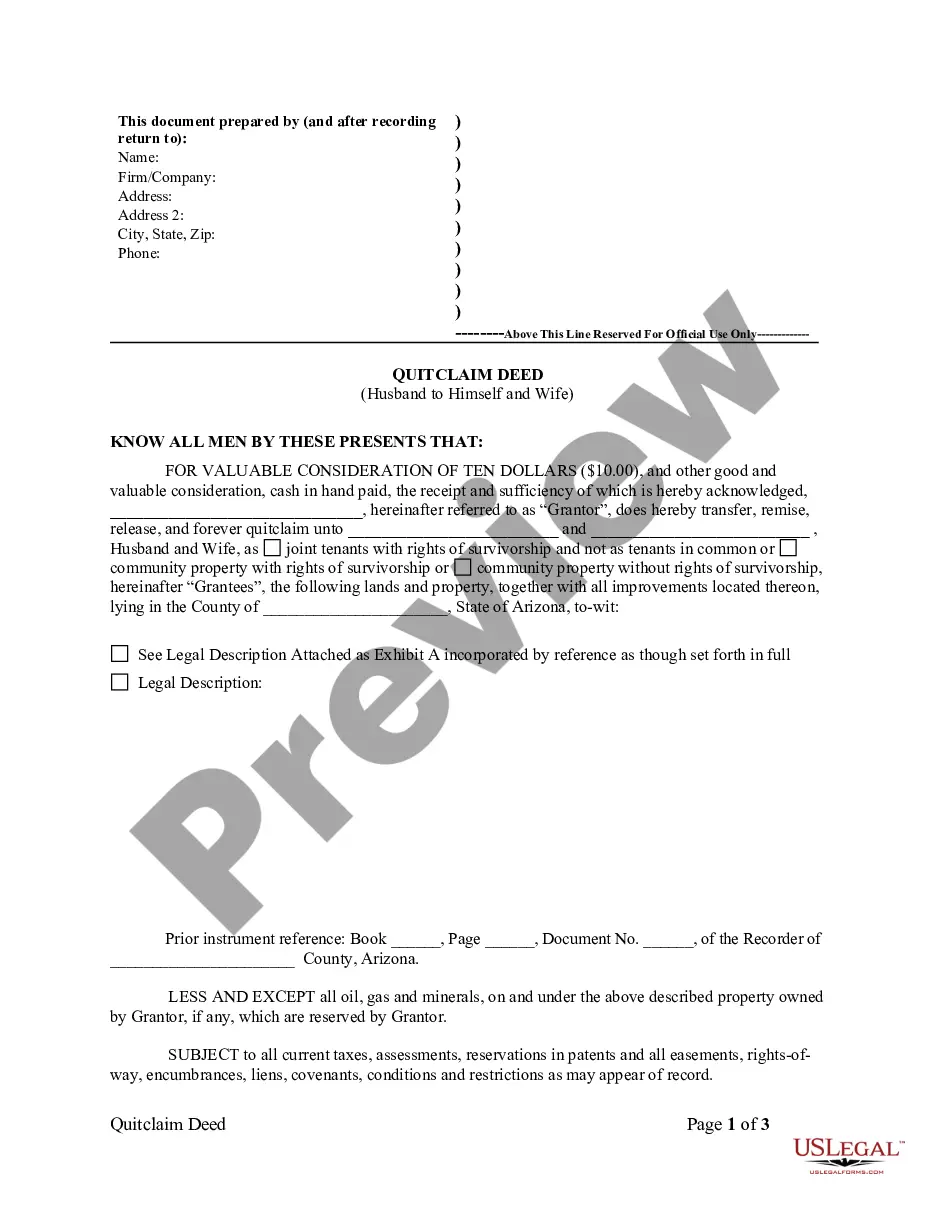

This Quitclaim Deed from Husband to Himself and Wife form is a Quitclaim Deed where the Grantor is the husband and the Grantees are the husband and his wife. Grantors convey and quitclaim the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

Surprise Arizona Quitclaim Deed from Husband to Himself and Wife

Description

How to fill out Arizona Quitclaim Deed From Husband To Himself And Wife?

Finding authenticated templates tailored to your local laws can be challenging unless you utilize the US Legal Forms library.

It’s a digital repository of over 85,000 legal documents for both personal and business purposes and various real-life situations.

All the papers are accurately sorted by usage area and jurisdiction sections, so retrieving the Surprise Arizona Quitclaim Deed from Husband to Himself and Wife becomes as simple as one, two, three.

Maintaining your documents organized and compliant with legal standards is of utmost importance. Make use of the US Legal Forms library to always have crucial document templates for any requirements right at your fingertips!

- Ensure you've checked the Preview mode and document description.

- Make sure you've chosen the correct one that fulfills your requirements and aligns completely with your local legal obligations.

- Look for another template, if necessary.

- If you encounter any discrepancies, employ the Search tab above to locate the accurate one. If it meets your needs, proceed to the next phase.

- Click on the Buy Now button and select your preferred subscription plan. You need to sign up for an account to access the library’s offerings.

Form popularity

FAQ

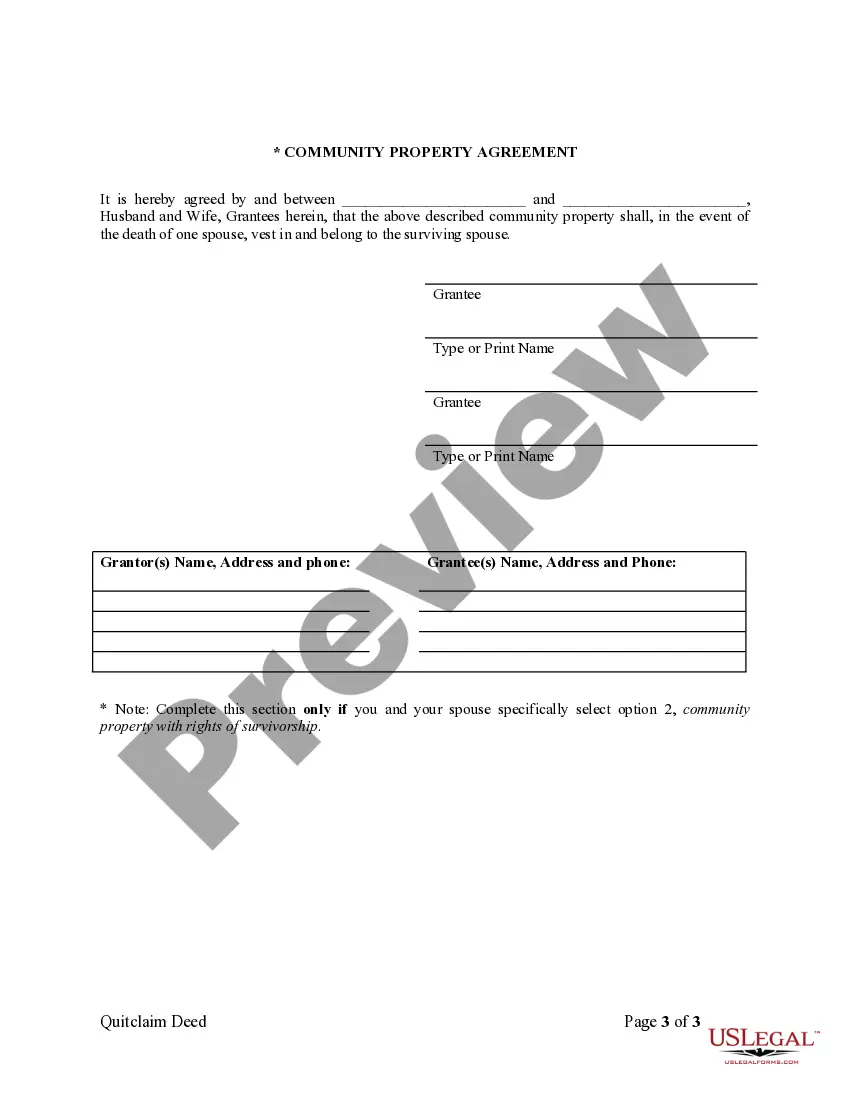

A spouse might choose to execute a Surprise Arizona Quitclaim Deed from Husband to Himself and Wife for various reasons, including consolidating property rights or simplifying ownership structures. This deed allows a partner to transfer their property interest effortlessly, which can be beneficial in situations such as marriage or estate planning. By doing this, both spouses can feel secure about their shared ownership. Platforms like uslegalforms can provide you with the resources needed to facilitate this transaction smoothly.

People often use a Surprise Arizona Quitclaim Deed from Husband to Himself and Wife to clarify ownership of property. This type of deed transfers interest without warranties, making it simpler and quicker than other options. It serves well in situations like marriage, where couples want to ensure both parties are recognized as co-owners. Utilizing platforms like uslegalforms can guide you through creating this deed accurately.

The best way to add your wife to your deed is by utilizing a quitclaim deed. Create a Surprise Arizona Quitclaim Deed from Husband to Himself and Wife, specifying both your names on the document. This method provides a clear legal record of ownership alongside your spouse. For a seamless experience, consider using tools from US Legal Forms to assist with the process.

Typically, property owners benefit the most from a quitclaim deed as it allows them to transfer property rights quickly and efficiently. For instance, a Surprise Arizona Quitclaim Deed from Husband to Himself and Wife can provide clarity about ownership, especially in shared properties. Additionally, it is often used in divorce settlements or estate planning, allowing for simple transitions that avoid tedious legal proceedings.

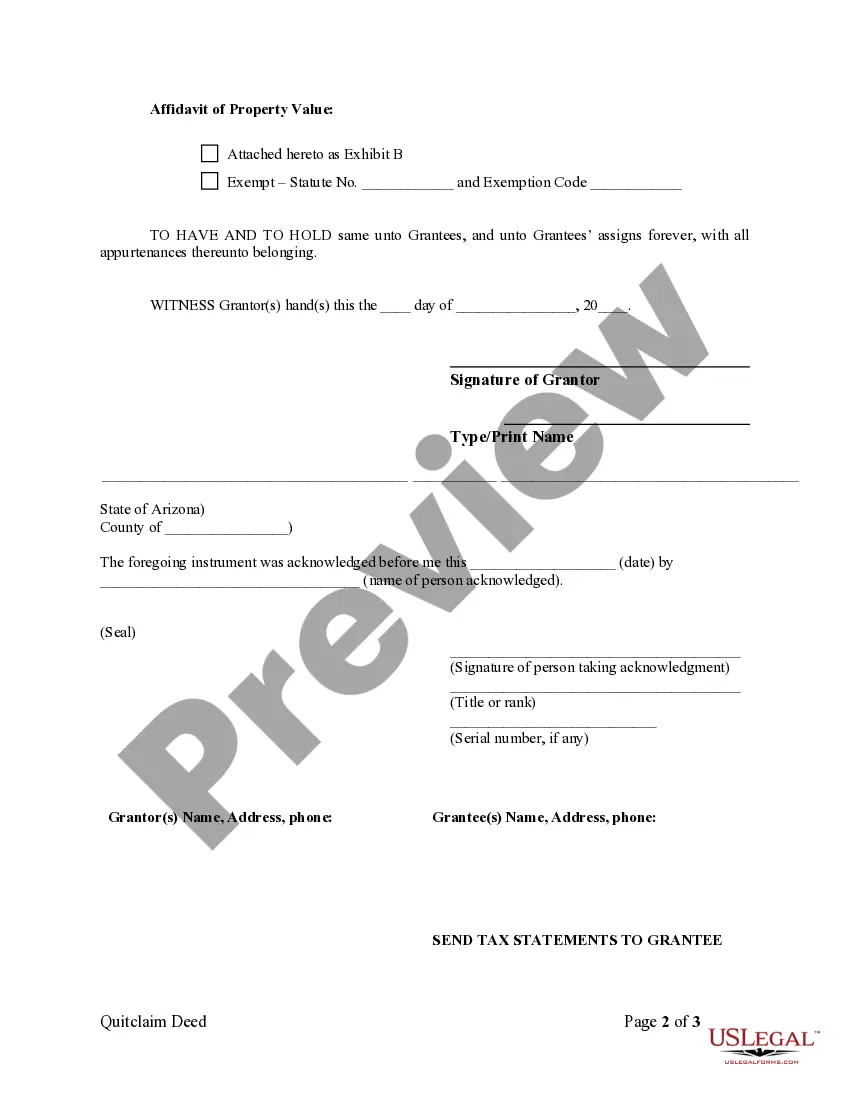

Filling out a quitclaim deed form involves a few straightforward steps. Begin with accurate property details, including the address and legal description. Next, enter the names of the grantor and grantee, making sure it reflects a Surprise Arizona Quitclaim Deed from Husband to Himself and Wife. After filling out the form, sign it in front of a notary and file it with your county's recorder's office.

To fill out a quitclaim deed adding your spouse, start by obtaining the appropriate form for a Surprise Arizona Quitclaim Deed from Husband to Himself and Wife. Clearly list both your name and your spouse's name, along with a full description of the property. Make sure to include the consideration amount, sign the document, and have it notarized. Finally, file the completed deed with the local recorder’s office for it to take effect.

You can add your spouse to your deed without refinancing by executing a quitclaim deed. In this case, you would create a Surprise Arizona Quitclaim Deed from Husband to Himself and Wife to transfer partial ownership to your spouse. This process typically involves filling out the appropriate form, signing it, and filing it with the county recorder's office. Using resources like US Legal Forms can make this process more straightforward.

To fill out a quitclaim deed in Arizona, you should start by identifying the property description clearly. Next, include the names of both parties involved in the deed: the grantor, who is transferring the title, and the grantee, who is receiving it. Make sure to specify that it is a Surprise Arizona Quitclaim Deed from Husband to Himself and Wife, as this clarifies the intent of the document. Finally, the form must be signed and notarized to be legally binding.

Yes, you can complete a quitclaim deed yourself in Arizona. If you choose to go this route, ensure that you understand the specific requirements for a Surprise Arizona Quitclaim Deed from Husband to Himself and Wife. Properly filling out the form is essential to avoid legal complications. Additionally, consider using platforms like US Legal Forms for guidance and convenience.

Yes, you can create a quitclaim deed yourself, as long as you follow the proper guidelines. Many people use templates or online resources, such as USLegalForms, to simplify the process. Utilizing a Surprise Arizona Quitclaim Deed from Husband to Himself and Wife ensures that you include all necessary information and comply with legal requirements. However, always consider consulting an attorney if you have questions or need guidance on the proper execution.