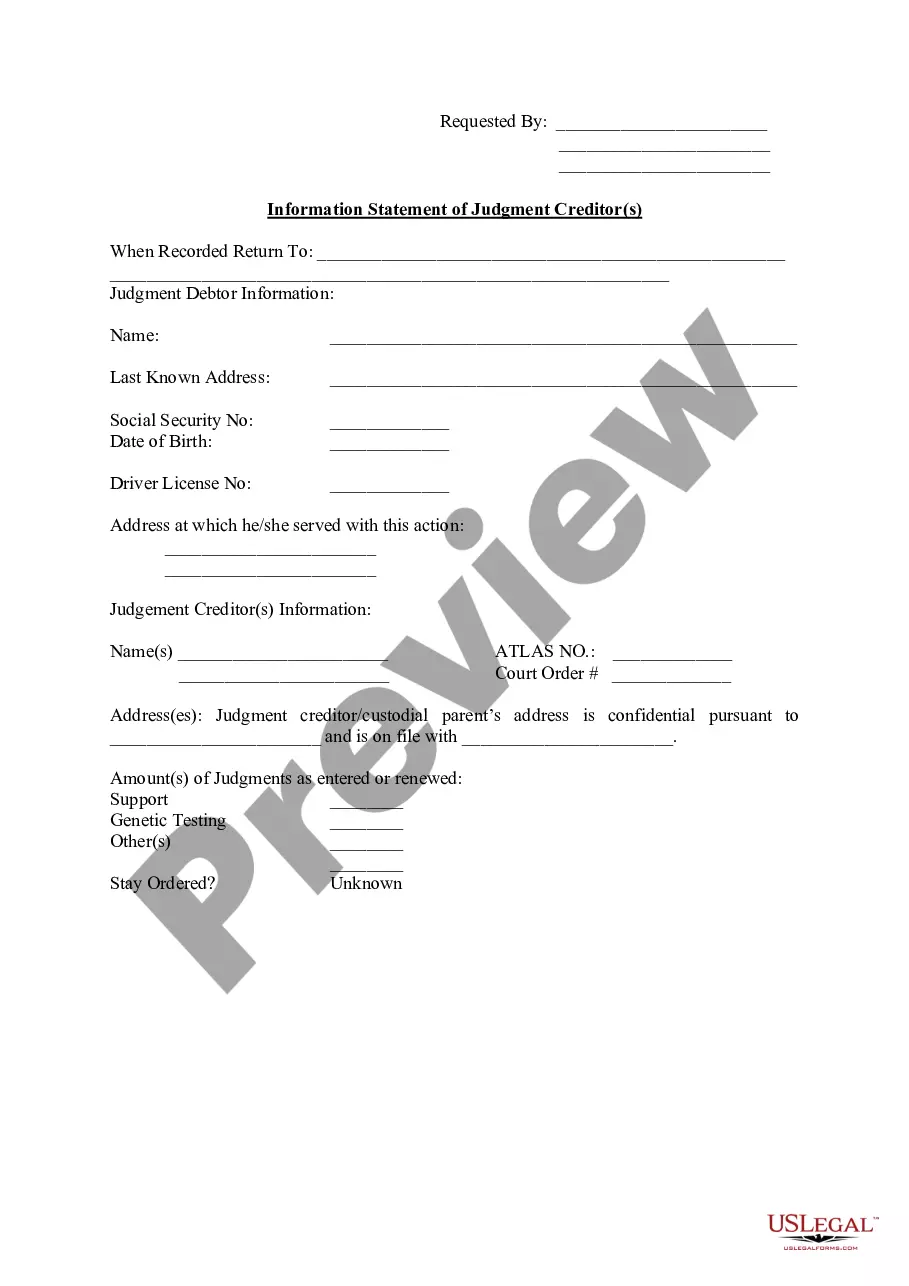

The Surprise Arizona Information Statement of Judgment Creditor(s) is a legal document that provides essential details about the creditors of a judgment in Surprise, Arizona. This statement is vital in keeping track of the creditors involved in a judgment case and the amounts owed to them. It assists individuals or entities in understanding and ensuring the proper distribution of any potential funds recovered from the judgment debtor. The Surprise Arizona Information Statement of Judgment Creditor(s) contains various relevant keywords that can aid in its understanding and processing. These keywords include "Surprise Arizona," "information statement," "judgment creditor(s)," "creditors," "judgment case," "amounts owed," "distribution of funds," and "judgment debtor." In Surprise, Arizona, there are two main types of Information Statements of Judgment Creditor(s) commonly encountered: 1. Individual Creditor Information Statement: This type of statement is used when there is only one individual creditor associated with a judgment case. It includes the creditor's personal details, such as name, contact information, social security number, and any other information required by the court to facilitate communication and payment. 2. Business Entity Creditor Information Statement: When a business entity is involved as a creditor in a judgment case, this form is utilized. It typically records the business's name, address, contact details, tax ID number, and any other relevant information needed for correspondence and disbursement of funds. Both types of Information Statements of Judgment Creditor(s) serve the same purpose but cater to the varying needs of individual or business creditors involved in a Surprise, Arizona judgment case. These statements ensure proper identification and communication between the court, judgment debtor, and respective creditors, thereby facilitating a transparent and fair distribution of any financial recovery associated with the judgment.

Creditor Statement

Category:

State:

Arizona

City:

Surprise

Control #:

AZ-019LRS

Format:

Word;

Rich Text

Instant download

Description

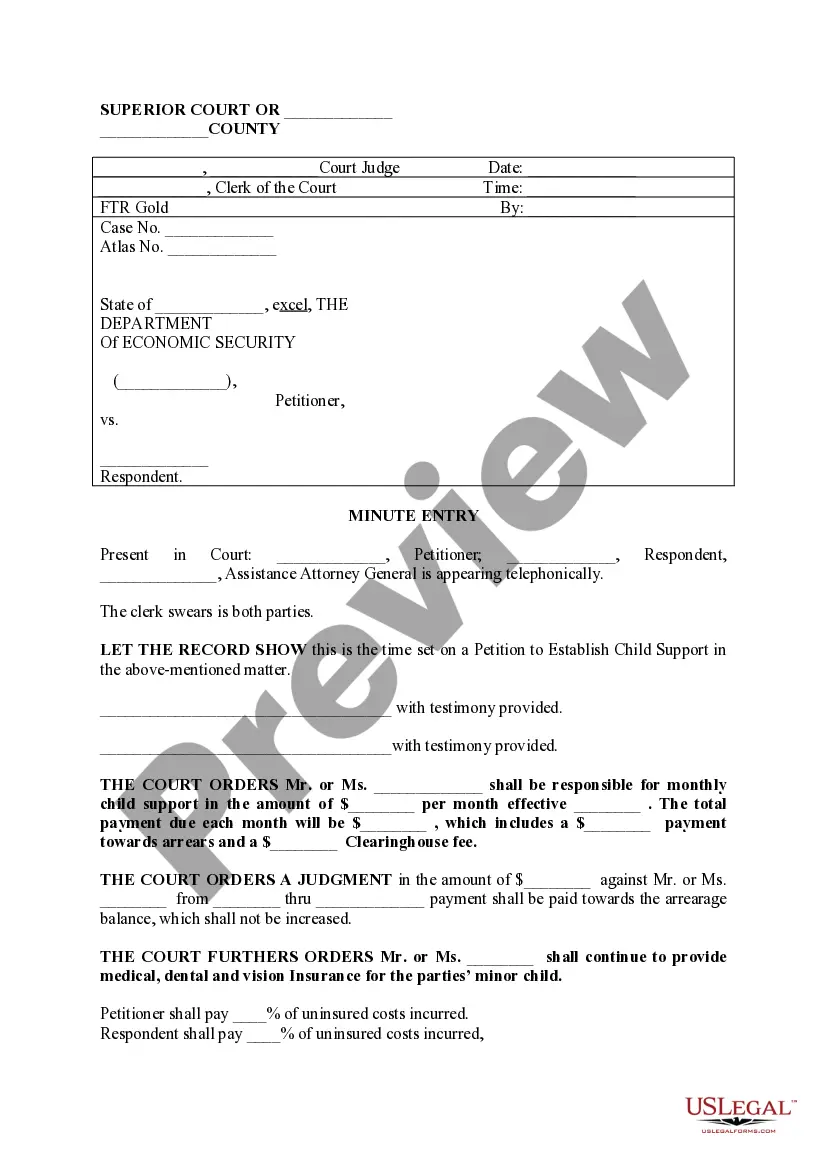

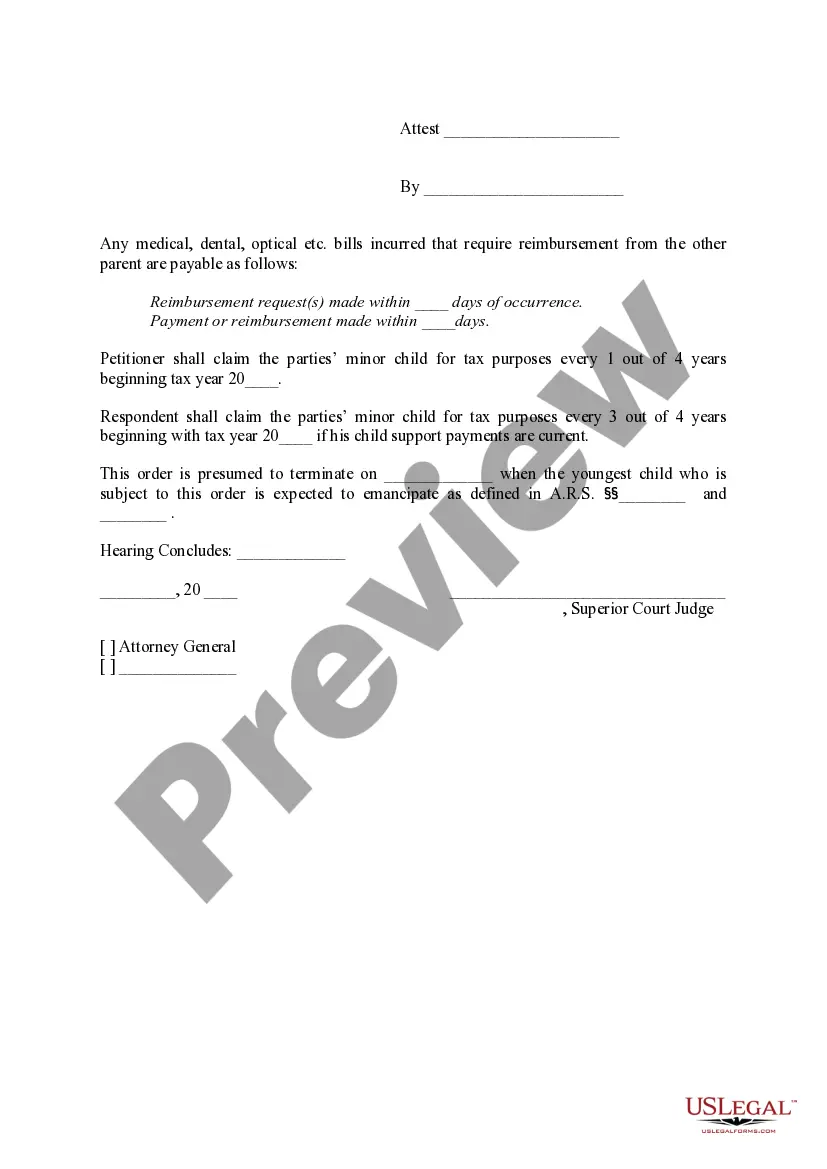

This is an example of a judgment on rule in a child support case, with the court finding in favor of the plaintiff and against the defendant.

child support payments

The Surprise Arizona Information Statement of Judgment Creditor(s) is a legal document that provides essential details about the creditors of a judgment in Surprise, Arizona. This statement is vital in keeping track of the creditors involved in a judgment case and the amounts owed to them. It assists individuals or entities in understanding and ensuring the proper distribution of any potential funds recovered from the judgment debtor. The Surprise Arizona Information Statement of Judgment Creditor(s) contains various relevant keywords that can aid in its understanding and processing. These keywords include "Surprise Arizona," "information statement," "judgment creditor(s)," "creditors," "judgment case," "amounts owed," "distribution of funds," and "judgment debtor." In Surprise, Arizona, there are two main types of Information Statements of Judgment Creditor(s) commonly encountered: 1. Individual Creditor Information Statement: This type of statement is used when there is only one individual creditor associated with a judgment case. It includes the creditor's personal details, such as name, contact information, social security number, and any other information required by the court to facilitate communication and payment. 2. Business Entity Creditor Information Statement: When a business entity is involved as a creditor in a judgment case, this form is utilized. It typically records the business's name, address, contact details, tax ID number, and any other relevant information needed for correspondence and disbursement of funds. Both types of Information Statements of Judgment Creditor(s) serve the same purpose but cater to the varying needs of individual or business creditors involved in a Surprise, Arizona judgment case. These statements ensure proper identification and communication between the court, judgment debtor, and respective creditors, thereby facilitating a transparent and fair distribution of any financial recovery associated with the judgment.

Free preview

How to fill out Surprise Arizona Information Statement Of Judgment Creditor(s)?

If you’ve already utilized our service before, log in to your account and download the Surprise Arizona Information Statement of Judgment Creditor(s) on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make sure you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Surprise Arizona Information Statement of Judgment Creditor(s). Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!