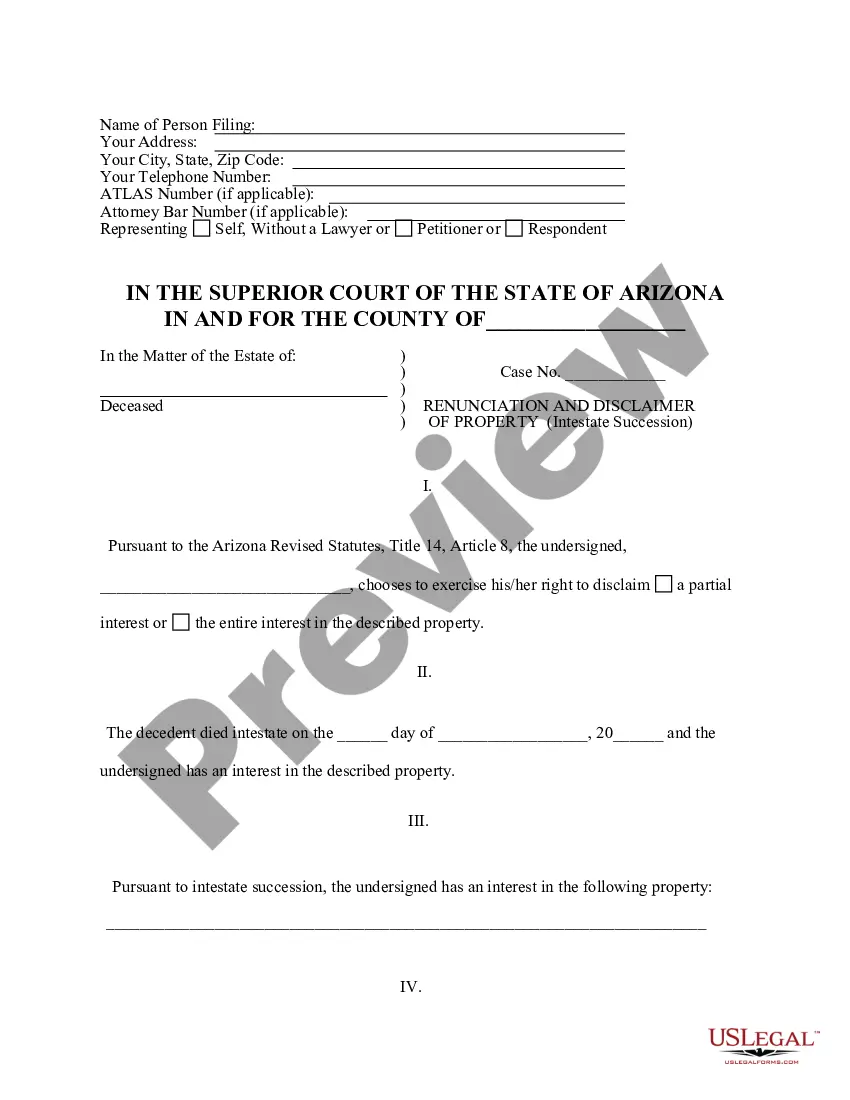

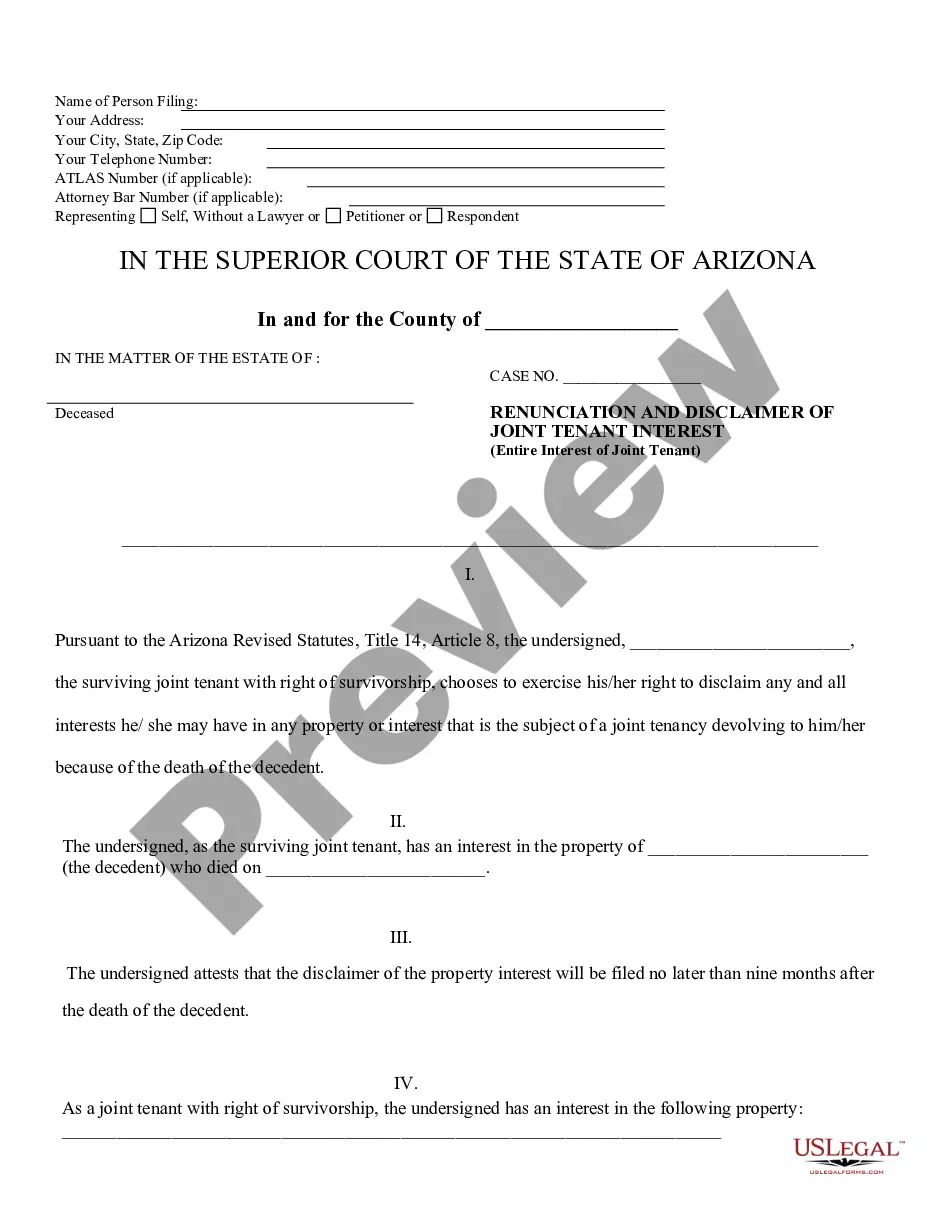

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. The beneficiary has chosen to disclaim a portion of his/her entire interest in the property. Pursuant to the Arizona Revised Statutes, Title 14, Article 8, the beneficiary is entitled to disclaim the interest if the disclaimer is filed within nine months of the death of the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Mesa Arizona Renunciation and Disclaimer of Property received by Intestate Succession

Description

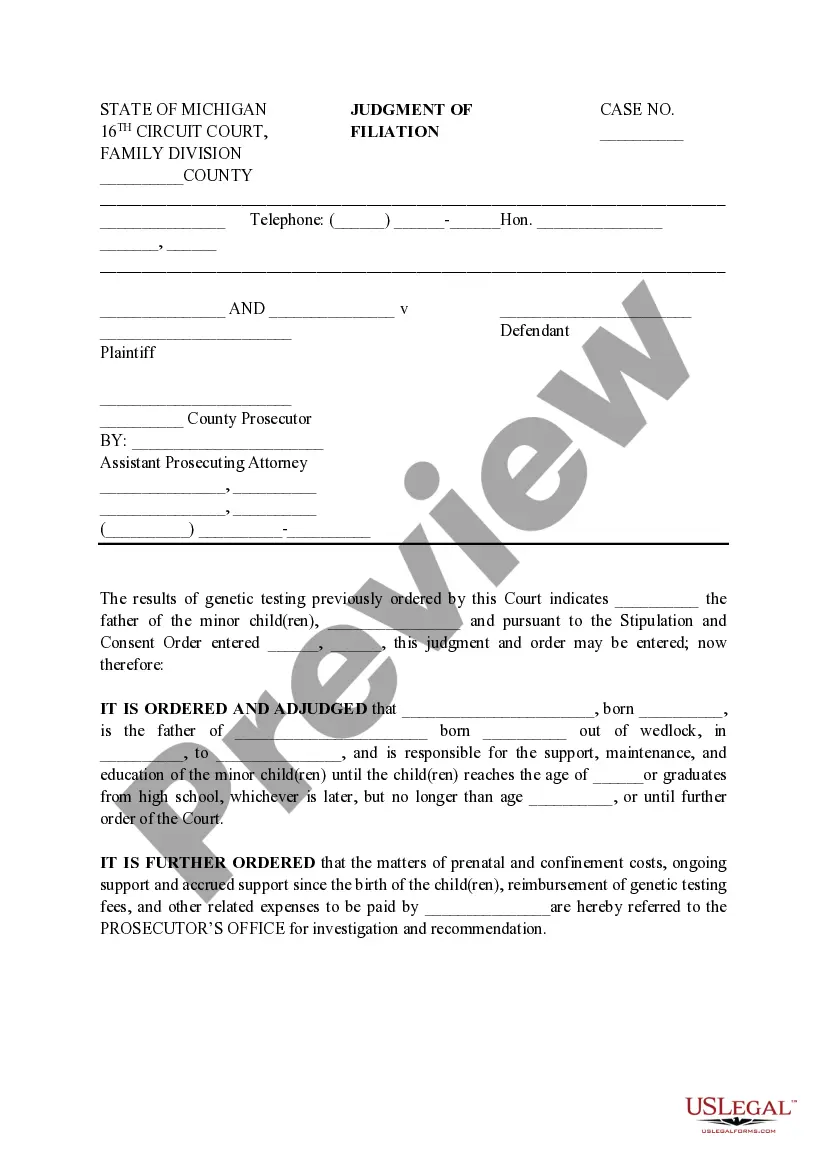

How to fill out Arizona Renunciation And Disclaimer Of Property Received By Intestate Succession?

Acquiring approved templates that cater to your local regulations can be difficult unless you utilize the US Legal Forms database.

It’s an online repository of over 85,000 legal documents for both personal and business requirements, as well as various real-life situations.

All documents are well-organized by field of application and jurisdiction, making it simple and straightforward to find the Mesa Arizona Renunciation and Disclaimer of Property acquired through Intestate Succession.

Completing all necessary steps will provide you with access to crucial document templates at your fingertips, ensuring your paperwork remains organized and compliant with legal standards.

- Examine the Preview mode and document details.

- Ensure you’ve picked the correct one that fulfills your requirements and aligns with your local jurisdiction specifications.

- Look for another template if required.

- If you notice any discrepancies, use the Search tab above to locate the appropriate one. If it fits your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

The general rule is that if a beneficiary dies during probate but prior to the point at which assets earmarked for him/her have legally been transferred into his/her name, those assets become part of the deceased beneficiary's estate.

The Arizona beneficiary deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

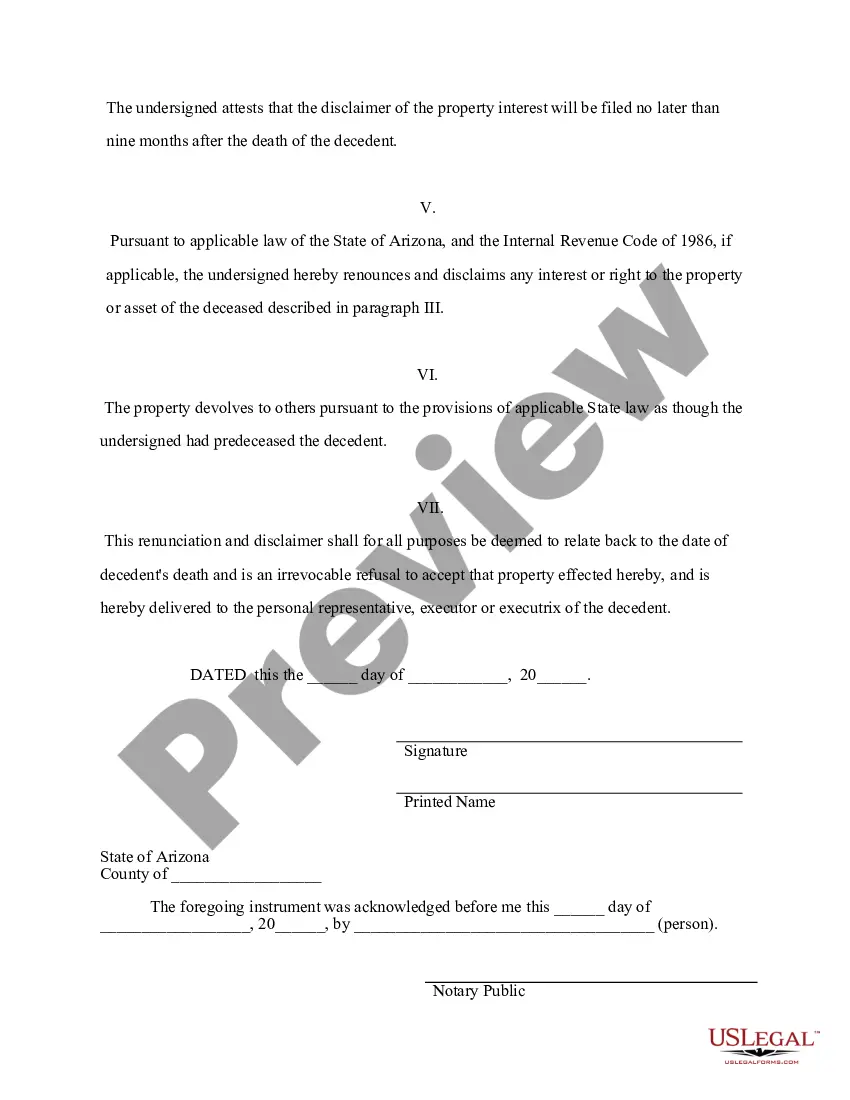

There is no prescribed form for drafting or implementing a disclaimer of inheritance. Generally, the waiver should be a written agreement, acknowledging the waiver of inheritance (preferably drafted by a lawyer). The disclaiming agreement should be signed by the beneficiary, and witnessed.

In the context of a contract, a renunciation occurs when one party, by words or conduct, evinces an intention not to perform, or expressly declares that they will be unable to perform their obligations under the contract in some essential respect. The renunciation may occur before or at the time of performance.

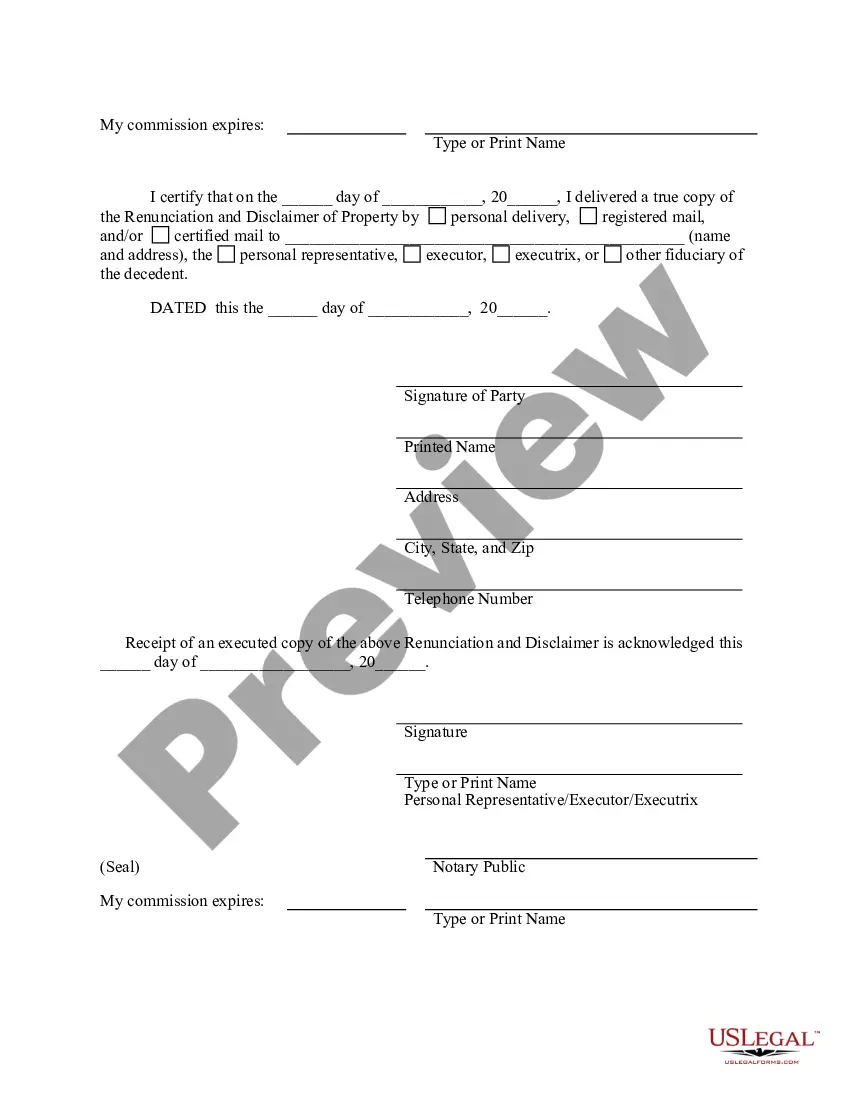

Often, the disclaimer must be delivered to the executor or other appropriate persons within 9 months of the date of transfer of the property. No disclaimer can be made if the heir has accepted an interest in the transfer of the estate assets.

How to Make a Disclaimer Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate?usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.Do not accept any benefit from the property you're disclaiming.

To be valid under Arizona law, a disclaimer of a bequest or inheritance must be in writing, signed by the person disclaiming, and delivered (or recorded) according to the statute.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.

If the decedent left a will and named you as a beneficiary and you decline the bequest, most states treat the event the same as if you had predeceased him. The executor must probate the will as if you had died and were no longer available to accept your inheritance. Your bequest will then revert back to the estate.

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.