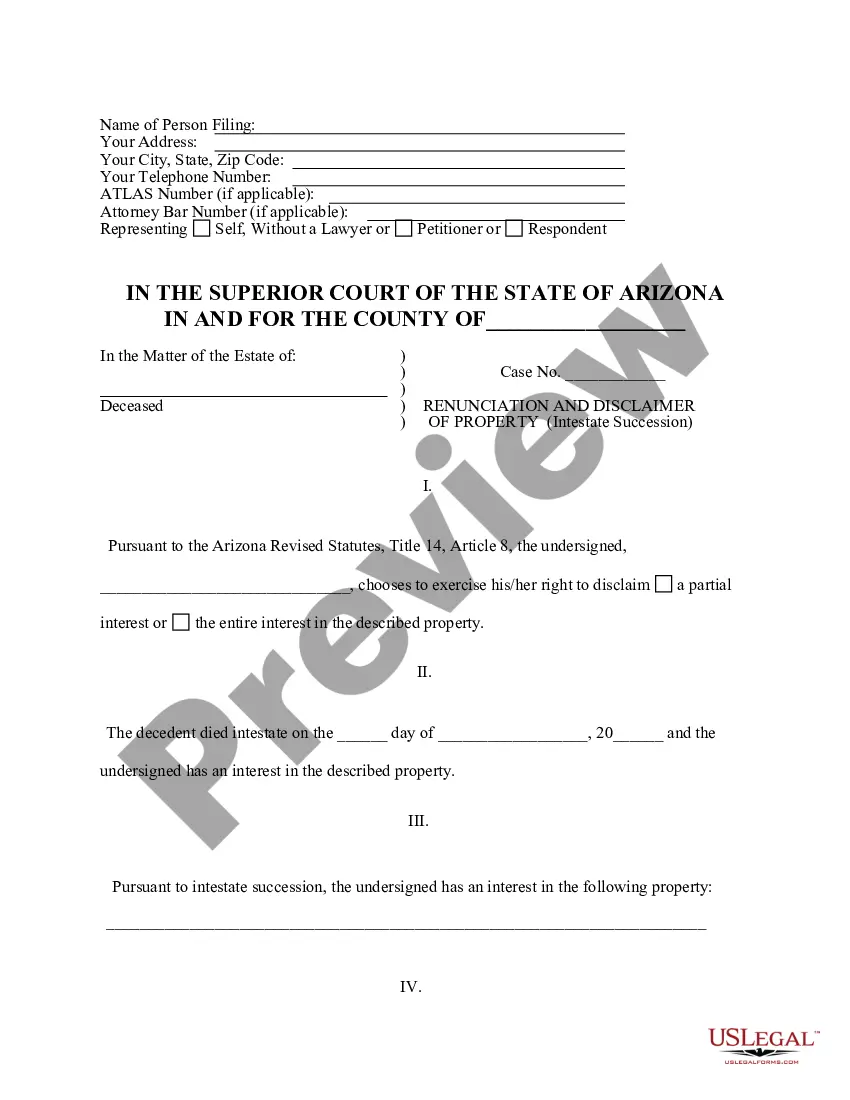

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. The beneficiary has chosen to disclaim a portion of his/her entire interest in the property. Pursuant to the Arizona Revised Statutes, Title 14, Article 8, the beneficiary is entitled to disclaim the interest if the disclaimer is filed within nine months of the death of the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Pima Arizona Renunciation and Disclaimer of Property received by Intestate Succession

Description

How to fill out Arizona Renunciation And Disclaimer Of Property Received By Intestate Succession?

Regardless of social or occupational standing, finalizing legal documents is a regrettable requisite in today’s society.

Frequently, it’s nearly unattainable for an individual lacking any legal education to generate such documents from scratch, primarily because of the intricate language and legal nuances they entail.

This is where US Legal Forms comes to the aid.

Ensure the template you have located is appropriate for your region, as the regulations of one state or area do not apply to another.

Preview the document and read a brief summary (if available) of situations the document can be utilized for.

- Our service boasts an extensive collection of over 85,000 ready-to-use state-specific documents suitable for nearly any legal circumstance.

- US Legal Forms also acts as a valuable resource for associates or legal advisors aiming to enhance their efficiency using our DIY forms.

- Irrespective of whether you need the Pima Arizona Renunciation and Disclaimer of Property received by Intestate Succession or any other document valid in your state or locality, with US Legal Forms, everything is readily accessible.

- Here’s how you can acquire the Pima Arizona Renunciation and Disclaimer of Property received by Intestate Succession in minutes using our reliable service.

- If you are currently an existing customer, you may proceed to Log In to your account to download the relevant form.

- However, if you are new to our platform, make sure to follow these steps before obtaining the Pima Arizona Renunciation and Disclaimer of Property received by Intestate Succession.

Form popularity

FAQ

When it comes to disallowing an inheritance with the IRS, you'll want to ensure you complete the necessary tax filings accurately. You should indicate your disclaimer on the appropriate tax return forms to clarify that you did not accept the property. Understanding how this impacts your taxes is crucial, especially in Pima Arizona, where specific regulations apply. Seeking assistance from uslegalforms can simplify this process by providing comprehensive resources for your Pima Arizona Renunciation and Disclaimer of Property received by Intestate Succession.

Writing a sample disclaimer of inheritance requires a straightforward format. Begin with your name, address, and date, followed by a clear statement expressing your intention to renounce the property. Include specifics about the inherited asset and reference the relevant laws in Pima Arizona. Utilizing platforms like uslegalforms can provide you with templates that adhere to the legal standards for a Pima Arizona Renunciation and Disclaimer of Property received by Intestate Succession.

To disclaim inherited property in Pima Arizona, you need to create a written renunciation that meets state requirements. This document should clearly indicate your intent to reject the inheritance, including details about the property. It's important to file it with the estate's executor or the probate court within the designated time frame. By taking these steps, you can successfully execute a Pima Arizona Renunciation and Disclaimer of Property received by Intestate Succession.

When a person dies without a will in Arizona, state laws dictate how their estate will be distributed among heirs. This might lead to complications, such as disputes among family members or unintended beneficiaries receiving assets. It's essential to understand that dying intestate does not negate the distribution of property; instead, it follows a legal framework. For comprehensive guidance, review resources related to Pima Arizona Renunciation and Disclaimer of Property received by Intestate Succession which can help clarify the process.

Compulsory heirs in Arizona intestate succession include spouses, children, parents, and sometimes siblings. These individuals automatically inherit a portion of the estate when a person dies without leaving a will. Each heir's share varies based on the family structure and state laws. For tailored assistance in understanding the implications of compulsory heirs, consider looking into Pima Arizona Renunciation and Disclaimer of Property received by Intestate Succession.

In Arizona, the order of intestate succession determines how a deceased person’s assets are distributed when they die without a will. Typically, the surviving spouse receives the first share, followed by children, parents, and siblings. This order ensures that close family members inherit, based on their relationship to the deceased. To navigate this process effectively, referring to guidelines on Pima Arizona Renunciation and Disclaimer of Property received by Intestate Succession can be beneficial.

Statute 14 3108 in Arizona addresses the renunciation and disclaimer of property received through intestate succession. This law allows individuals to refuse any inheritance they are entitled to and simplifies the process for those wanting to avoid potential tax liabilities or unwanted properties. Understanding this statute is crucial when considering the implications of your property rights. For more information, consider exploring resources related to Pima Arizona Renunciation and Disclaimer of Property received by Intestate Succession.

To disclaim an inherited property, you must file a formal disclaimer with the appropriate court in Arizona, ensuring it meets legal requirements. This process usually requires you to act quickly after the inheritance becomes available, often within a specific timeframe. For those looking to navigate the Pima Arizona Renunciation and Disclaimer of Property received by Intestate Succession, using platforms like US Legal Forms can simplify the paperwork and provide guidance throughout the process. Taking these steps can protect your interests and provide clarity for your family's future.

A disclaimer of property interest is a legal document that allows an individual to refuse an inheritance or gift. It serves as a formal declaration that you do not want to accept certain property rights. In the context of Pima Arizona Renunciation and Disclaimer of Property received by Intestate Succession, this document can streamline the process of passing property to your heirs without undue complications. This practice helps you protect your financial future and that of your loved ones.

The disclaimer statute in Arizona allows individuals to refuse an inheritance under specific circumstances. This statute can be particularly relevant in cases of the Pima Arizona Renunciation and Disclaimer of Property received by Intestate Succession, as it provides a legal way to avoid accepting property that may carry burdens or obligations. By formally disclaiming an inherited interest, you can effectively pass it on to the next eligible heir without legal complications. This statute ensures that you have control over what you choose to accept.