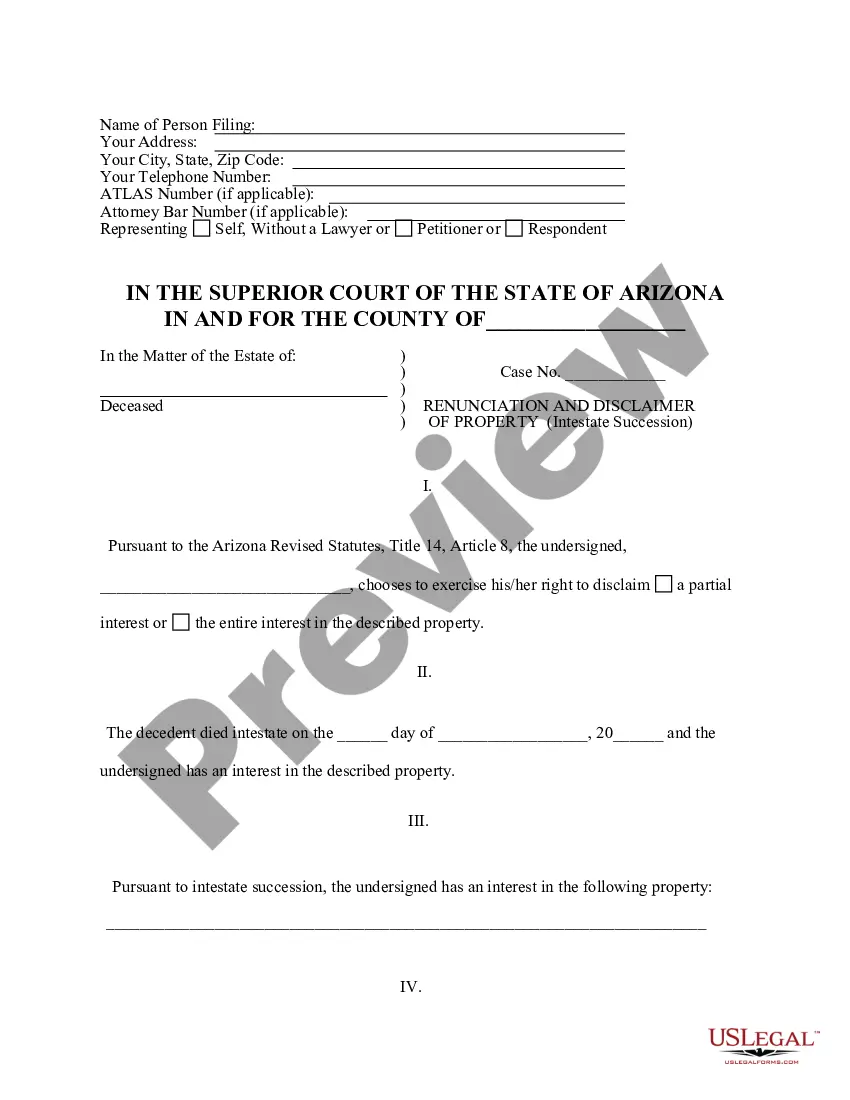

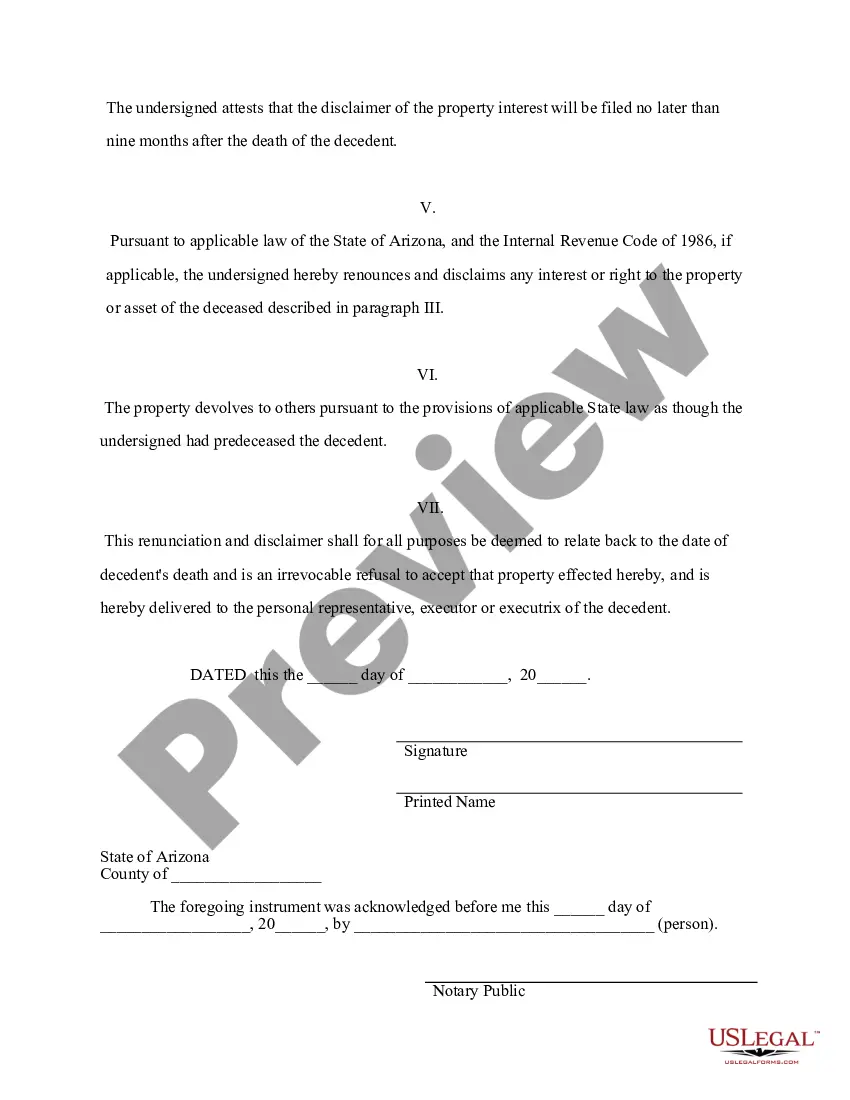

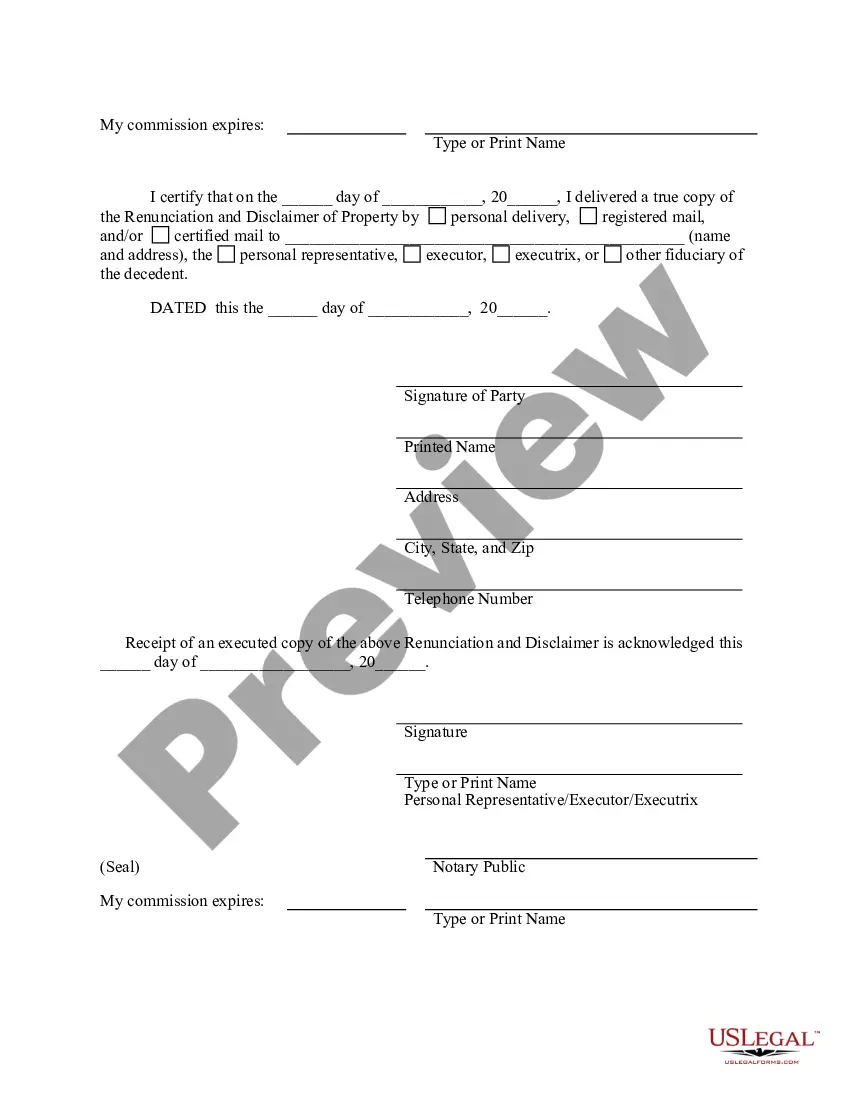

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. The beneficiary has chosen to disclaim a portion of his/her entire interest in the property. Pursuant to the Arizona Revised Statutes, Title 14, Article 8, the beneficiary is entitled to disclaim the interest if the disclaimer is filed within nine months of the death of the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Lima Arizona Renunciation and Disclaimer of Property received by Intestate Succession: Explained In Lima, Arizona, the process of renunciation and disclaimer of property received by intestate succession plays a significant role in estate planning and distribution. Intestate succession refers to the legal distribution of a deceased individual's assets and properties when they pass away without leaving a valid will. This precise renunciation and disclaimer process allows interested parties to refuse their right to inherit such assets and disclaim any associated responsibilities. 1. Types of Lima Arizona Renunciation and Disclaimer of Property received by Intestate Succession: a. Formal Renunciation: A formal renunciation involves a written document wherein an interested party willingly relinquishes their right to inherit assets received through intestate succession. This document must adhere to the stipulated legal requirements and should be filed with the appropriate court. b. Informal Renunciation: This type of renunciation occurs when an interested party verbally expresses their intention to refuse their right to inherit assets and does not submit a formal written document. However, it is important to note that an informal renunciation may not be legally enforceable in some cases. c. Partial Renunciation: In certain instances, an individual may not wish to disclaim their entire share of the intestate property but only a portion of it. In such cases, a partial renunciation is applicable, allowing them to disclaim specific assets or a percentage of the inherited property. d. Conditional Renunciation: A conditional renunciation arises when an interested party is willing to renounce their inheritance only under certain circumstances or conditions. These conditions must be specified clearly and agreed upon by all relevant parties involved to ensure their legal validity. e. Posthumous Renunciation: This renunciation occurs when an interested party, who is unaware of their potential right to inherit, is granted the opportunity to renounce their share even after the intestate succession process has begun. This type of renunciation is generally permitted within a specified period, allowing for fairness and equal distribution of assets. Keywords: Lima Arizona, renunciation, disclaimer, intestate succession, estate planning, distribution, assets, properties, formal, informal, partial, conditional, posthumous, inherit, renounce, legal, will, interested party, document, court, enforceable.Lima Arizona Renunciation and Disclaimer of Property received by Intestate Succession: Explained In Lima, Arizona, the process of renunciation and disclaimer of property received by intestate succession plays a significant role in estate planning and distribution. Intestate succession refers to the legal distribution of a deceased individual's assets and properties when they pass away without leaving a valid will. This precise renunciation and disclaimer process allows interested parties to refuse their right to inherit such assets and disclaim any associated responsibilities. 1. Types of Lima Arizona Renunciation and Disclaimer of Property received by Intestate Succession: a. Formal Renunciation: A formal renunciation involves a written document wherein an interested party willingly relinquishes their right to inherit assets received through intestate succession. This document must adhere to the stipulated legal requirements and should be filed with the appropriate court. b. Informal Renunciation: This type of renunciation occurs when an interested party verbally expresses their intention to refuse their right to inherit assets and does not submit a formal written document. However, it is important to note that an informal renunciation may not be legally enforceable in some cases. c. Partial Renunciation: In certain instances, an individual may not wish to disclaim their entire share of the intestate property but only a portion of it. In such cases, a partial renunciation is applicable, allowing them to disclaim specific assets or a percentage of the inherited property. d. Conditional Renunciation: A conditional renunciation arises when an interested party is willing to renounce their inheritance only under certain circumstances or conditions. These conditions must be specified clearly and agreed upon by all relevant parties involved to ensure their legal validity. e. Posthumous Renunciation: This renunciation occurs when an interested party, who is unaware of their potential right to inherit, is granted the opportunity to renounce their share even after the intestate succession process has begun. This type of renunciation is generally permitted within a specified period, allowing for fairness and equal distribution of assets. Keywords: Lima Arizona, renunciation, disclaimer, intestate succession, estate planning, distribution, assets, properties, formal, informal, partial, conditional, posthumous, inherit, renounce, legal, will, interested party, document, court, enforceable.