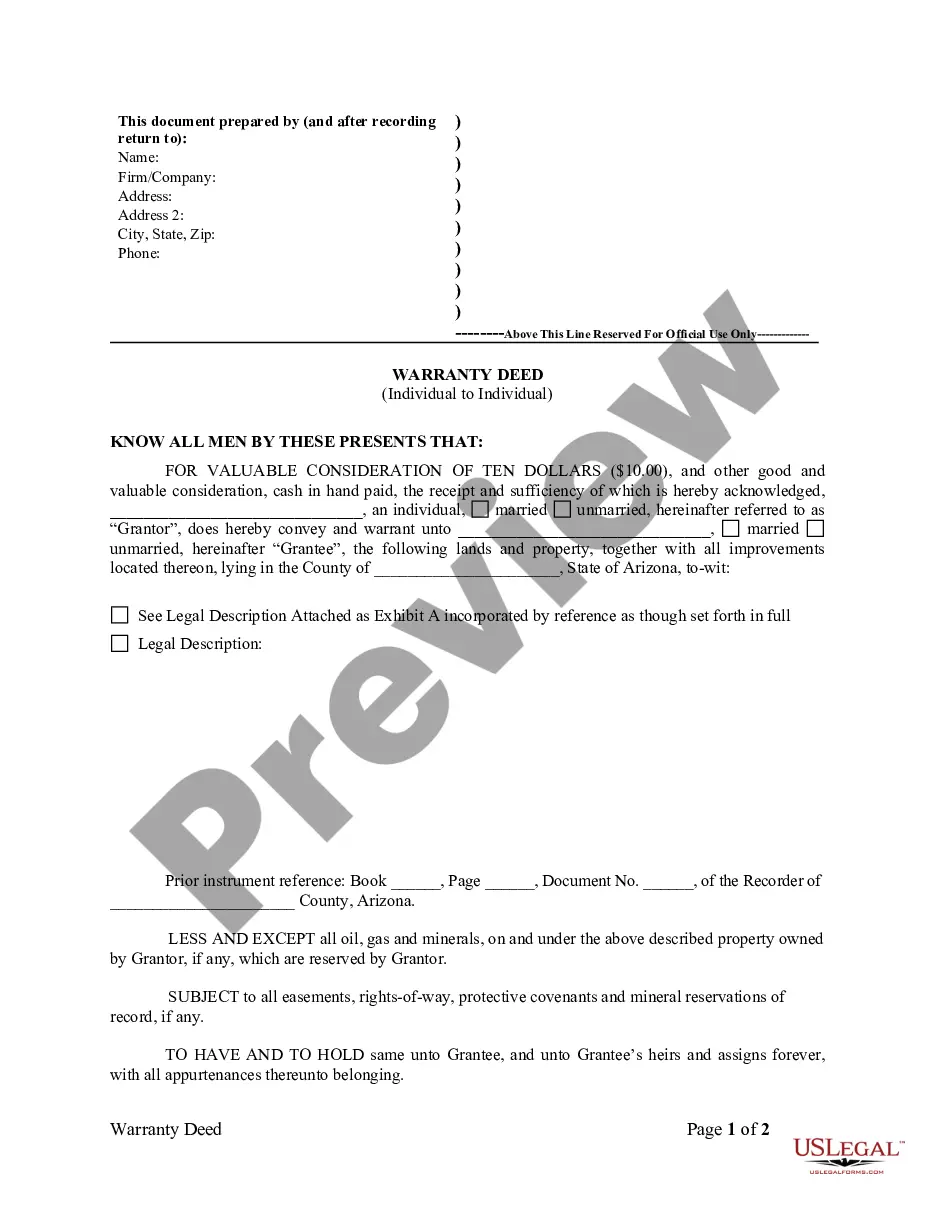

This Warranty Deed from Individual to Individual form is a Warranty Deed where the Grantor is an individual and the Grantee is an individual. Grantor conveys and warrants the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Mesa Arizona Warranty Deed from Individual to Individual

Description

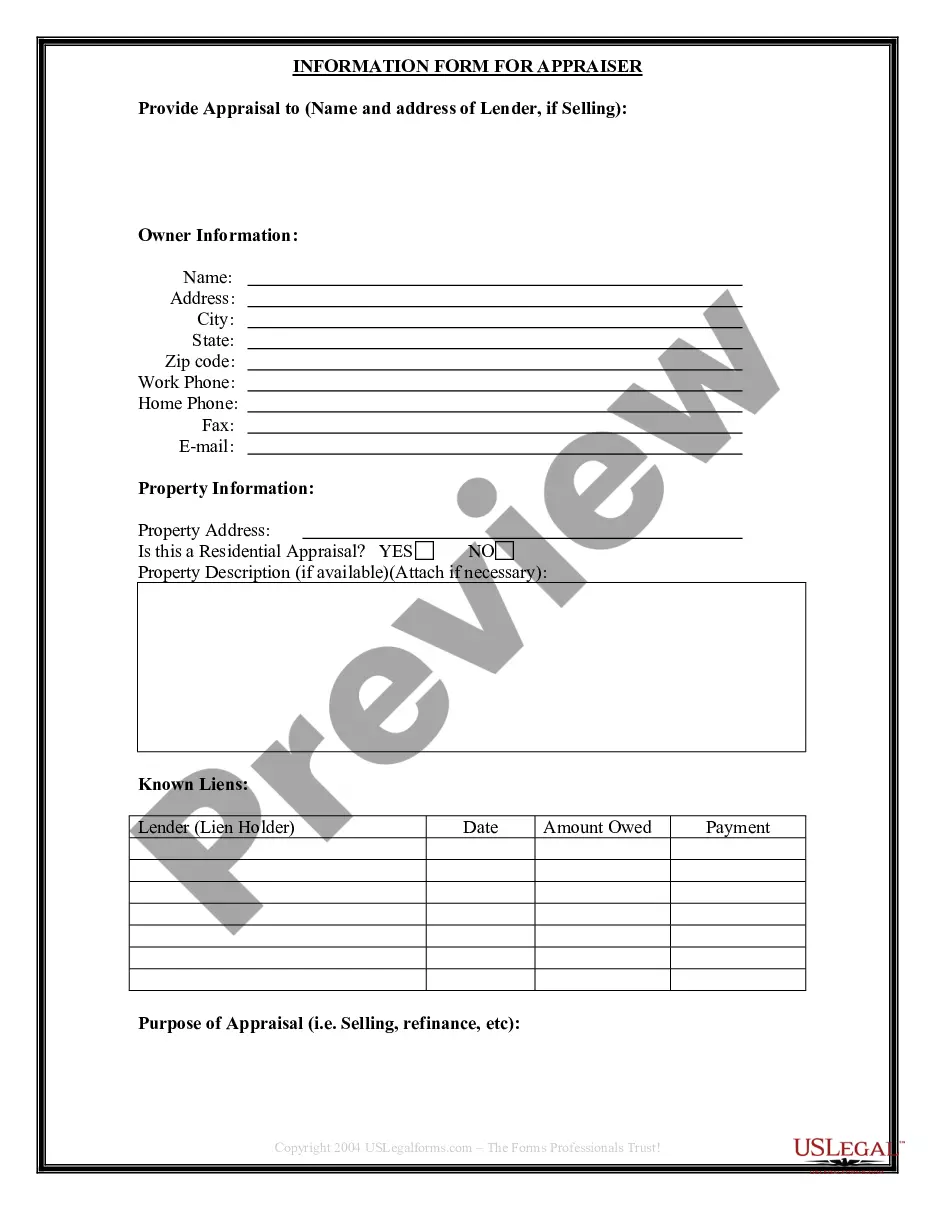

How to fill out Arizona Warranty Deed From Individual To Individual?

Gain from the US Legal Forms and gain immediate access to any form example you require.

Our helpful website with a vast array of templates facilitates the process of locating and obtaining nearly any document example you desire.

You can download, fill out, and verify the Mesa Arizona Warranty Deed from Individual to Individual in just a few minutes instead of spending hours on the internet searching for the correct template.

Using our catalog is an excellent way to enhance the security of your document filing.

If you haven’t created an account yet, follow the instructions outlined below.

Access the page with the template you require. Ensure it is the correct form you sought: check the title and description, and use the Preview option when it is available. If not, use the Search field to find the suitable one.

- Our skilled attorneys routinely review all documents to confirm that the templates are applicable for a specific state and comply with current laws and regulations.

- How can you secure the Mesa Arizona Warranty Deed from Individual to Individual.

- If you already have an account, simply Log In to your profile.

- The Download button will display on every document you examine.

- Additionally, you can access all previously saved files in the My documents section.

Form popularity

FAQ

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.

Arizona real estate is transferred using a legal document called a deed....The process involves four general steps: Locate the Prior Deed to the Property.Get a New Deed to the Property.Sign and Notarize the New Deed.Record the New Deed in the Land Records.

In order to transfer property to a family member as a gift, you'll need to execute a ?Deed of Gift?. This is also known as a ?Transfer of Gift?. This legal process ends with the family member(s) classified as the property's legal proprietors. The new owners' names will then appear on the Land Registry.

The recording charge is set by the county and we charge a administative fee. For counties from Erie, Elk, Franklin and Centre to Bucks, Berks, and Butler, the charge for a deed transfer across Pennsylvania is $700, with the sole exception of Philadelphia, which is $800. How long does it take?

Obtain the Correct Deed Transfer Document. Obtain the correct deed transfer document.Enter Full Legal Names of All Parties.Fill Out the Costs.Enter the Legal Description.Sign in Front of Appropriate Witnesses.Obtain an Affidavit of Property Value.Record the Document at the Recorder's Office.

Using a gift deed, you can transfer your home to a new owner. The transfer of a gift deed occurs among friends and relatives, or between donors and charities. The giver of the gift deed, formally known as a grantor or donor, conveys the home to the recipient or donee while the donor is alive.

Arizona Law on Real Property Deed Conveyance All transfers of property in Arizona must be in writing. The deed must be signed by the grantor and notarized by an authority granted those duties in the state.

Filing a Deed in Florida The comptroller's office charges a small fee for the deed's filing in the form of a documentary stamp tax, levied at 70 cents per $100 of the sale or transfer amount. There will also be a $10 fee for the first page of the document and $8.50 for each additional page.

Despite the amounts involved, it is possible to transfer ownership of your property without money changing hands. This process can either be called a deed of gift or transfer of gift, both definitions mean the same thing.

The Deed Transfer Department transfers the owner's name and address on the real estate tax list and duplicate. The department also collects the transfer tax/ conveyance fee ($4.00 per $1,000 of sale price) and the transfer fee ($. 50 per parcel).