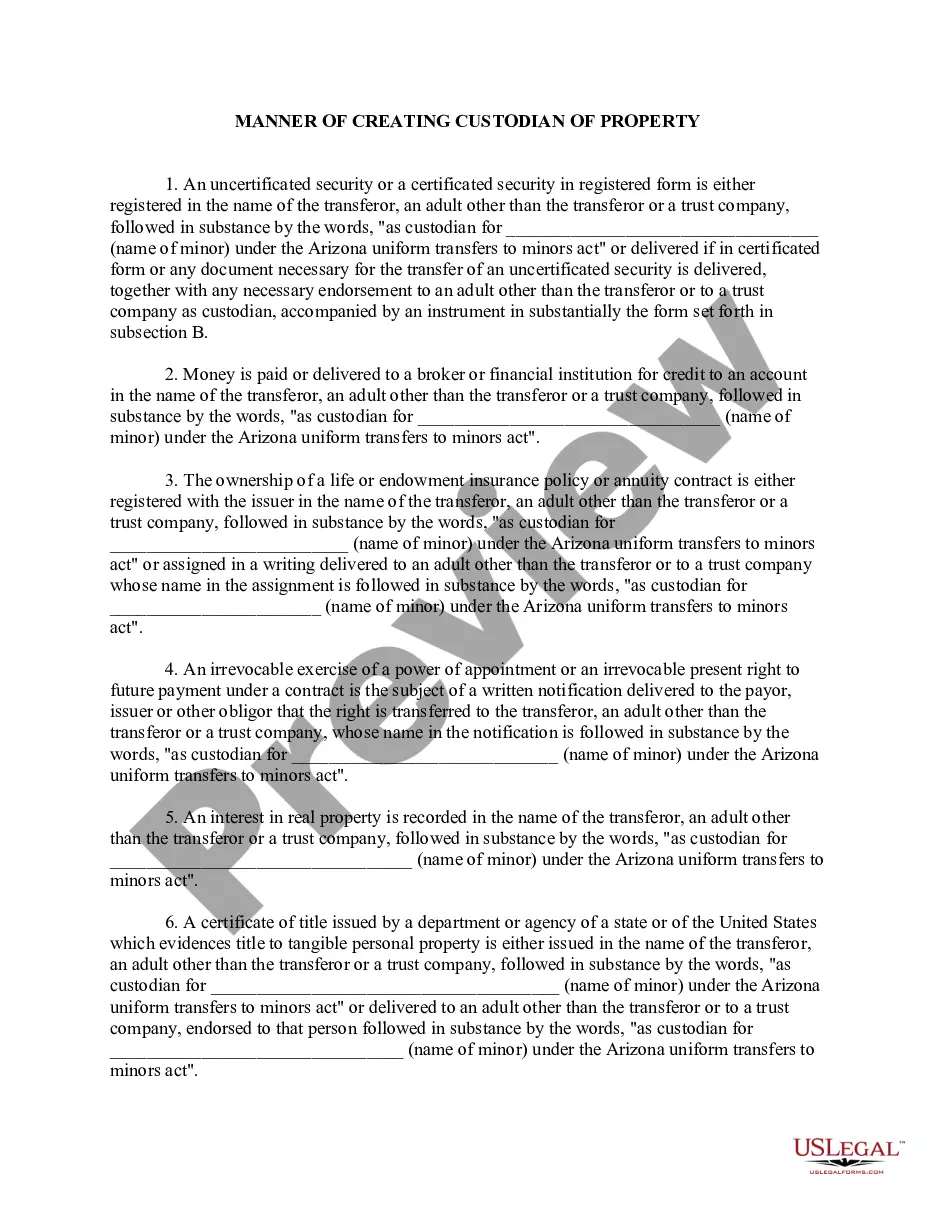

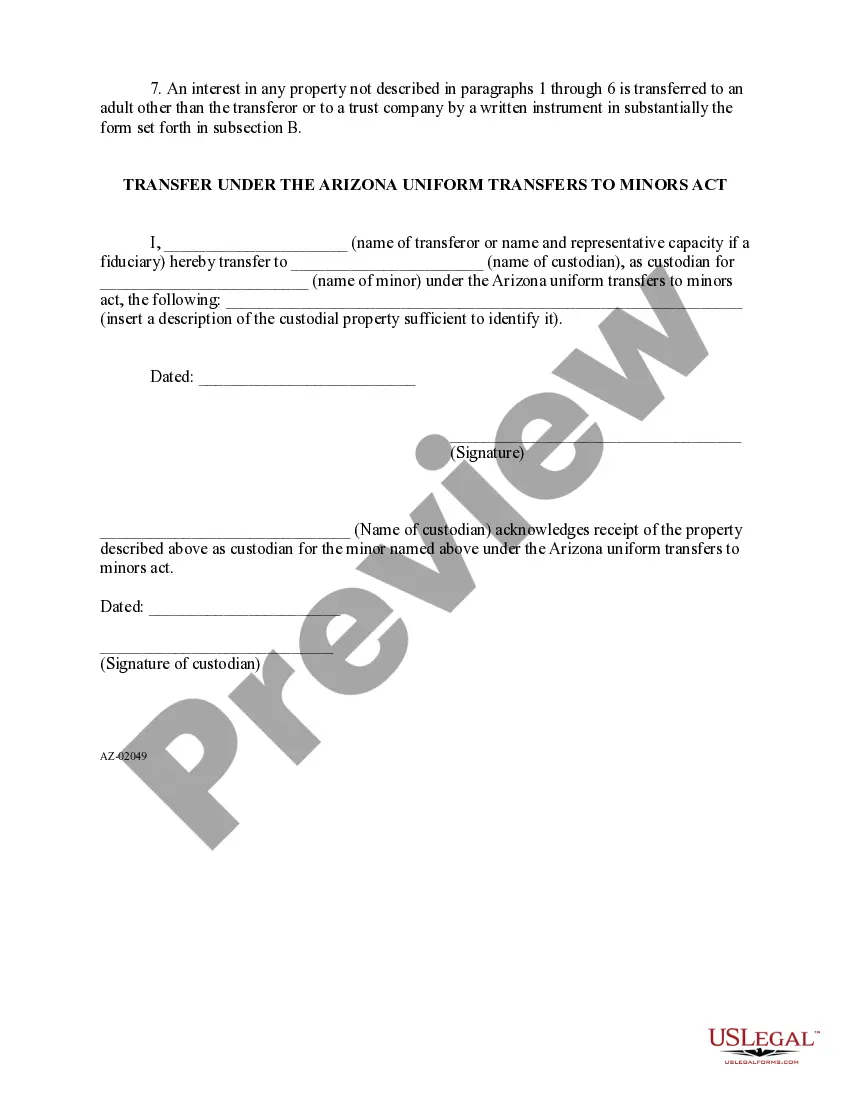

Manner of Creating Custodial Property: This form creates and/or assigns a particular custodian to a minor upon the death of the Grantor. The property granted to the minor, would be managed by the appointed custodian until the minor reaches the age of majority.

Lima Arizona Manner of Creating Custodial Property refers to the legal processes and methods used in Lima, Arizona to establish and manage custodial property. Custodial property, also known as trust property or custody property, typically involves assets and funds that are held and managed by a custodian on behalf of a beneficiary, often a minor or an individual who is unable to manage the assets on their own. In Lima, Arizona, there are various manners of creating custodial property, each designed to suit different circumstances and objectives. Here are some notable types of Lima Arizona Manner of Creating Custodial Property: 1. Uniform Transfers to Minors Act (TMA): Under the TMA, custodial property can be created by making an irrevocable gift to a minor. This act enables the transfer of a wide range of assets, including money, securities, real estate, and more, to a custodian who holds and manages them on behalf of a minor beneficiary until they reach a certain age (typically 18 or 21, depending on the state). 2. Uniform Gifts to Minors Act (UGA): Similar to the TMA, the UGA allows for the creation of custodial property by gifting assets to a minor. However, the UGA has some limitations compared to the TMA, as it only covers financial assets, such as cash, securities, and insurance policies. 3. Custodial Trust: This type of custodial property is created through a trust agreement, where a trust or (the granter) designates a trustee to hold and manage assets on behalf of a beneficiary. The terms of the trust, including the beneficiary's age or specific conditions, are often specified within the trust agreement. 4. Qualified Tuition Program (529 Plan): While not strictly a custodial property, a 529 Plan can be considered a form of custodial property as it involves the management of funds for educational purposes. This type of plan allows individuals to contribute money to an education savings account for a designated beneficiary, typically a child or grandchild, to cover qualified education expenses. In Lima, Arizona, the manner of creating custodial property is governed by specific state laws and regulations. It is always advisable to consult with an experienced attorney or financial advisor to ensure compliance with applicable laws and to determine the most suitable approach for creating and managing custodial property based on individual circumstances and objectives.Lima Arizona Manner of Creating Custodial Property refers to the legal processes and methods used in Lima, Arizona to establish and manage custodial property. Custodial property, also known as trust property or custody property, typically involves assets and funds that are held and managed by a custodian on behalf of a beneficiary, often a minor or an individual who is unable to manage the assets on their own. In Lima, Arizona, there are various manners of creating custodial property, each designed to suit different circumstances and objectives. Here are some notable types of Lima Arizona Manner of Creating Custodial Property: 1. Uniform Transfers to Minors Act (TMA): Under the TMA, custodial property can be created by making an irrevocable gift to a minor. This act enables the transfer of a wide range of assets, including money, securities, real estate, and more, to a custodian who holds and manages them on behalf of a minor beneficiary until they reach a certain age (typically 18 or 21, depending on the state). 2. Uniform Gifts to Minors Act (UGA): Similar to the TMA, the UGA allows for the creation of custodial property by gifting assets to a minor. However, the UGA has some limitations compared to the TMA, as it only covers financial assets, such as cash, securities, and insurance policies. 3. Custodial Trust: This type of custodial property is created through a trust agreement, where a trust or (the granter) designates a trustee to hold and manage assets on behalf of a beneficiary. The terms of the trust, including the beneficiary's age or specific conditions, are often specified within the trust agreement. 4. Qualified Tuition Program (529 Plan): While not strictly a custodial property, a 529 Plan can be considered a form of custodial property as it involves the management of funds for educational purposes. This type of plan allows individuals to contribute money to an education savings account for a designated beneficiary, typically a child or grandchild, to cover qualified education expenses. In Lima, Arizona, the manner of creating custodial property is governed by specific state laws and regulations. It is always advisable to consult with an experienced attorney or financial advisor to ensure compliance with applicable laws and to determine the most suitable approach for creating and managing custodial property based on individual circumstances and objectives.