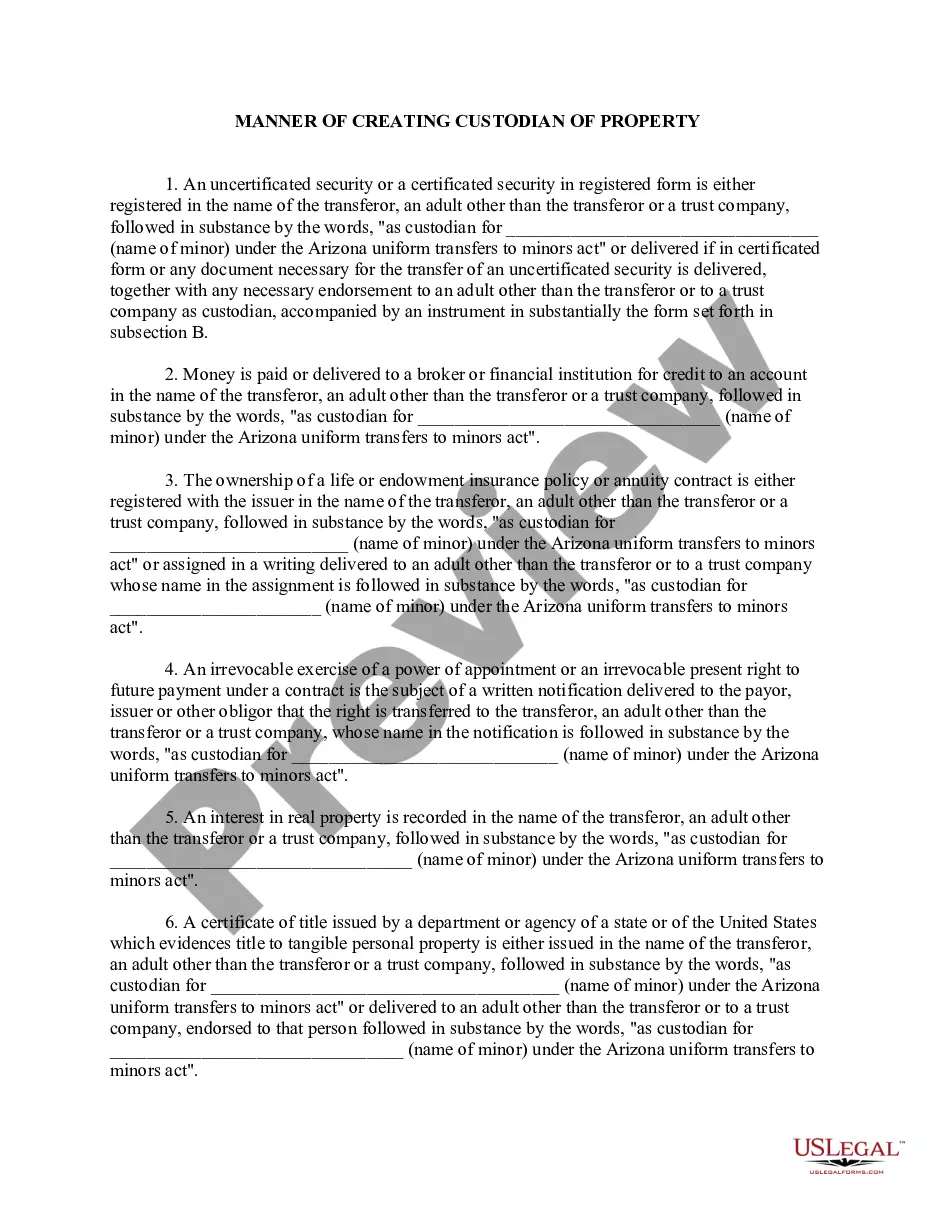

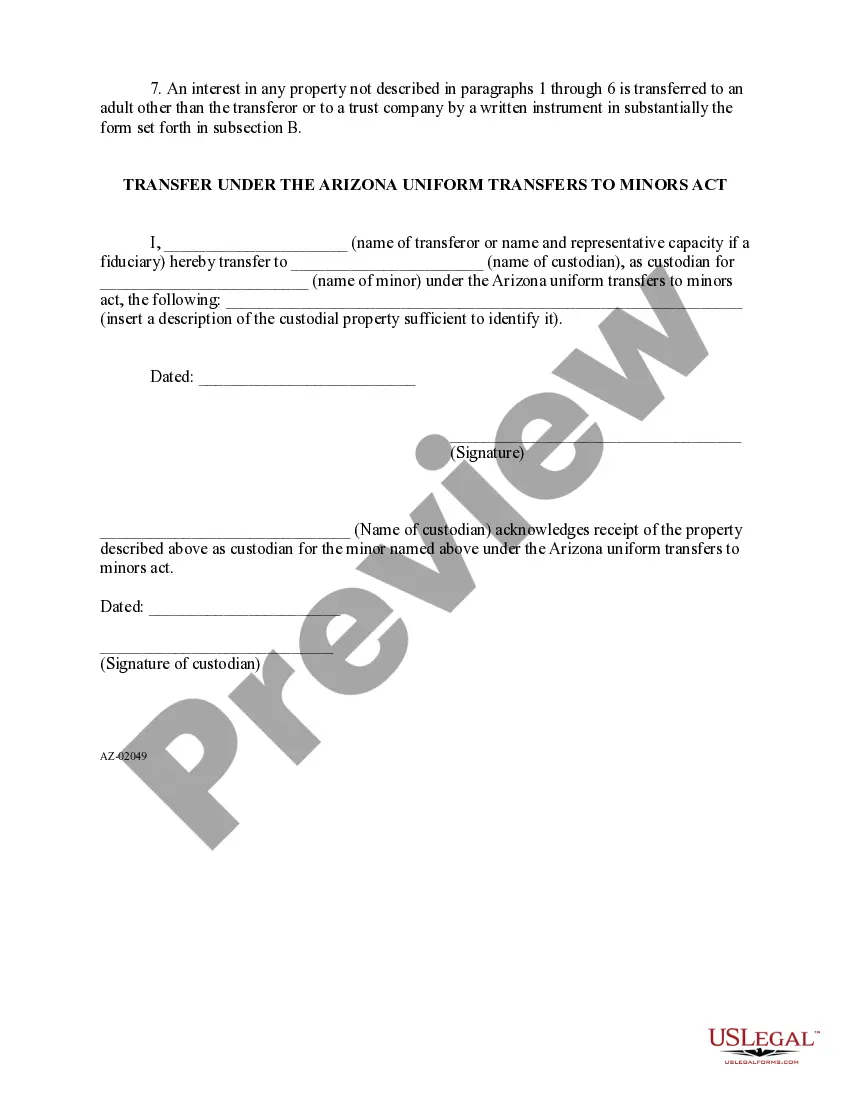

Manner of Creating Custodial Property: This form creates and/or assigns a particular custodian to a minor upon the death of the Grantor. The property granted to the minor, would be managed by the appointed custodian until the minor reaches the age of majority.

Surprise, Arizona is a city located in Maricopa County, known for its unique manner of creating custodial property. Custodial property refers to assets held in trust for the benefit of someone, typically a minor or a person with a disability. In Surprise, this process involves several key steps and legal requirements. One of the primary ways to create custodial property in Surprise, Arizona is through the establishment of a Uniform Transfers to Minors Act (TMA) account. Under this act, a custodian manages and controls the assets until the minor reaches the age of majority, typically 18 or 21 years old. The custodian has a fiduciary duty to act in the best interest of the minor and manage the assets prudently. Another method of creating custodial property in Surprise, Arizona is through the use of a trust. A trust allows the granter to transfer assets to a trustee, who holds and manages them for the benefit of the designated beneficiaries, including minors. There are various types of trusts available in Surprise, such as revocable trusts, irrevocable trusts, and special needs trusts, each serving different purposes and offering unique benefits. When creating custodial property in Surprise, it is essential to adhere to the legal requirements. The custodial property must be clearly identified and defined, ensuring that it is distinguishable from the custodian's personal assets. Additionally, proper documentation, such as a written agreement or a trust document, must be in place to establish the custodial relationship and outline the rights and responsibilities of all parties involved. Furthermore, Surprise residents should consult with an experienced attorney or estate planner to navigate the complexities of creating custodial property effectively. These professionals can provide valuable guidance on the selection of the most suitable type of custodial property, ensuring compliance with state laws, and addressing any tax implications or potential challenges that may arise. In summary, Surprise, Arizona offers various methods for creating custodial property, including TMA accounts and trusts. Establishing custodial property requires careful consideration of legal requirements and documents to protect the assets and manage them for the benefit of the designated beneficiaries. Seeking professional advice is crucial to navigate this process effectively and ensure the long-term financial well-being of minors or individuals with disabilities.Surprise, Arizona is a city located in Maricopa County, known for its unique manner of creating custodial property. Custodial property refers to assets held in trust for the benefit of someone, typically a minor or a person with a disability. In Surprise, this process involves several key steps and legal requirements. One of the primary ways to create custodial property in Surprise, Arizona is through the establishment of a Uniform Transfers to Minors Act (TMA) account. Under this act, a custodian manages and controls the assets until the minor reaches the age of majority, typically 18 or 21 years old. The custodian has a fiduciary duty to act in the best interest of the minor and manage the assets prudently. Another method of creating custodial property in Surprise, Arizona is through the use of a trust. A trust allows the granter to transfer assets to a trustee, who holds and manages them for the benefit of the designated beneficiaries, including minors. There are various types of trusts available in Surprise, such as revocable trusts, irrevocable trusts, and special needs trusts, each serving different purposes and offering unique benefits. When creating custodial property in Surprise, it is essential to adhere to the legal requirements. The custodial property must be clearly identified and defined, ensuring that it is distinguishable from the custodian's personal assets. Additionally, proper documentation, such as a written agreement or a trust document, must be in place to establish the custodial relationship and outline the rights and responsibilities of all parties involved. Furthermore, Surprise residents should consult with an experienced attorney or estate planner to navigate the complexities of creating custodial property effectively. These professionals can provide valuable guidance on the selection of the most suitable type of custodial property, ensuring compliance with state laws, and addressing any tax implications or potential challenges that may arise. In summary, Surprise, Arizona offers various methods for creating custodial property, including TMA accounts and trusts. Establishing custodial property requires careful consideration of legal requirements and documents to protect the assets and manage them for the benefit of the designated beneficiaries. Seeking professional advice is crucial to navigate this process effectively and ensure the long-term financial well-being of minors or individuals with disabilities.