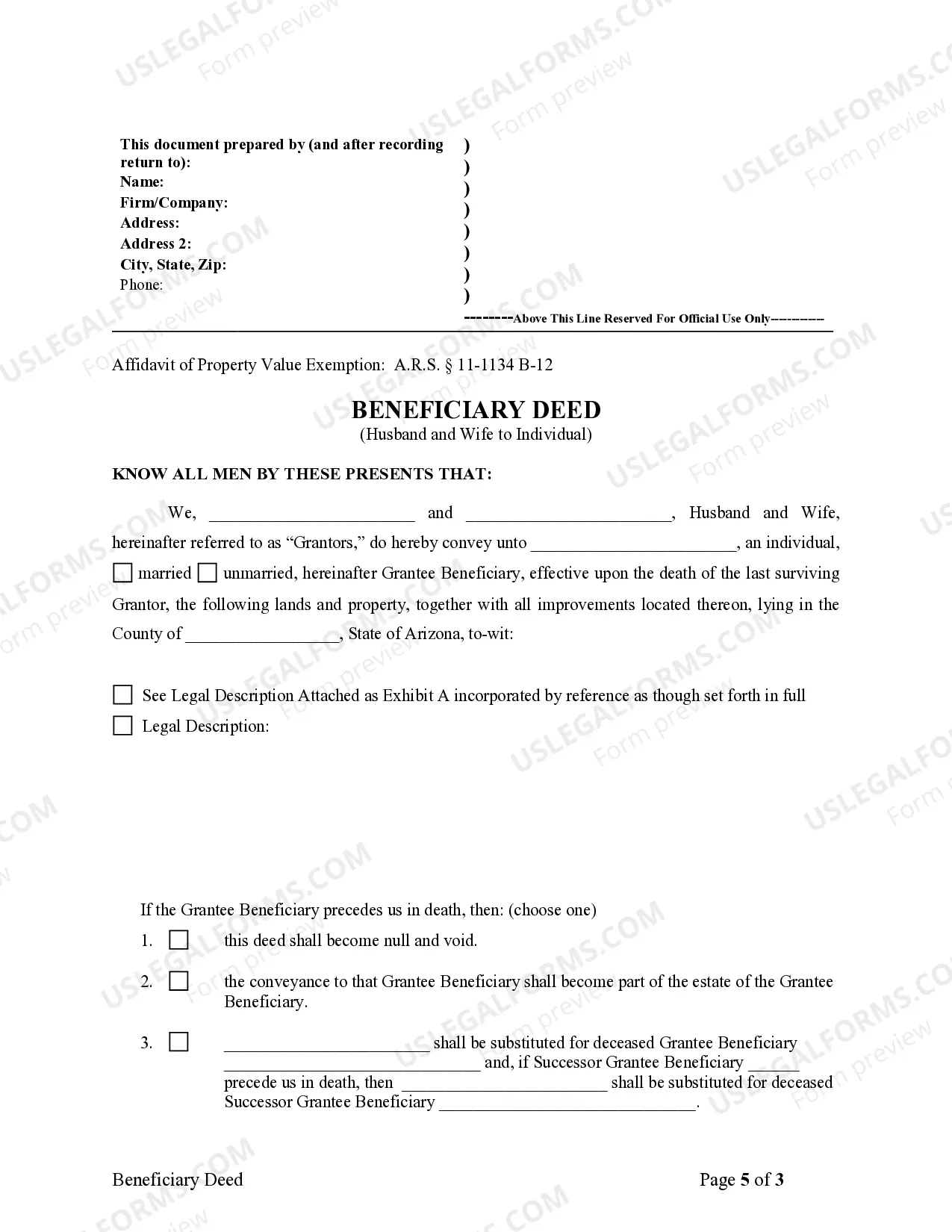

Transfer on Death Deed - Arizona - Husband and Wife to Individual: This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantors to the Grantee. It does not transfer any present ownership interest in the property and is revocable at any time. Therefore, it is commonly used to avoid probate upon death.

Gilbert Arizona Transfer on Death Deed, also known as TOD — Beneficiary Deed for Husband and Wife to Individual, is a legal document that allows married couples to transfer their real property to an individual beneficiary upon their death. This type of deed is commonly used as part of estate planning, ensuring a smooth and efficient transfer of property without the need for probate. Keywords: Gilbert Arizona, Transfer on Death Deed, TOD, Beneficiary Deed, Husband and Wife, Individual, estate planning, real property, probate. There are several types of Gilbert Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Individual, including: 1. Joint Tenancy with Right of Survivorship TOD Deed: This type of deed allows the property to be jointly owned by both spouses, with the understanding that upon the death of one spouse, the property automatically passes to the surviving spouse without the need for probate. 2. Tenancy in Common TOD Deed: With this type of deed, the property is owned by both spouses as tenants in common, meaning they each have a defined share of ownership. Upon the death of one spouse, their share of the property passes to the designated individual beneficiary. 3. Community Property with Right of Survivorship TOD Deed: This type of TOD deed is applicable in community property states like Arizona. It allows the property to be owned jointly by both spouses, with the understanding that upon the death of one spouse, the property automatically passes to the surviving spouse as their community property share. 4. Solely Owned Property TOD Deed: In cases where only one spouse owns the property, this TOD deed allows for the transfer of the property directly to the named individual beneficiary upon the owner's death. Gilbert Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Individual offers flexibility and control in determining how property should be distributed after the husband and wife pass away. It eliminates the need for probate, which can be costly and time-consuming. It is essential to consult with an attorney or estate planning professional to ensure that all legal requirements are met when creating and executing this type of deed.Gilbert Arizona Transfer on Death Deed, also known as TOD — Beneficiary Deed for Husband and Wife to Individual, is a legal document that allows married couples to transfer their real property to an individual beneficiary upon their death. This type of deed is commonly used as part of estate planning, ensuring a smooth and efficient transfer of property without the need for probate. Keywords: Gilbert Arizona, Transfer on Death Deed, TOD, Beneficiary Deed, Husband and Wife, Individual, estate planning, real property, probate. There are several types of Gilbert Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Individual, including: 1. Joint Tenancy with Right of Survivorship TOD Deed: This type of deed allows the property to be jointly owned by both spouses, with the understanding that upon the death of one spouse, the property automatically passes to the surviving spouse without the need for probate. 2. Tenancy in Common TOD Deed: With this type of deed, the property is owned by both spouses as tenants in common, meaning they each have a defined share of ownership. Upon the death of one spouse, their share of the property passes to the designated individual beneficiary. 3. Community Property with Right of Survivorship TOD Deed: This type of TOD deed is applicable in community property states like Arizona. It allows the property to be owned jointly by both spouses, with the understanding that upon the death of one spouse, the property automatically passes to the surviving spouse as their community property share. 4. Solely Owned Property TOD Deed: In cases where only one spouse owns the property, this TOD deed allows for the transfer of the property directly to the named individual beneficiary upon the owner's death. Gilbert Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Individual offers flexibility and control in determining how property should be distributed after the husband and wife pass away. It eliminates the need for probate, which can be costly and time-consuming. It is essential to consult with an attorney or estate planning professional to ensure that all legal requirements are met when creating and executing this type of deed.