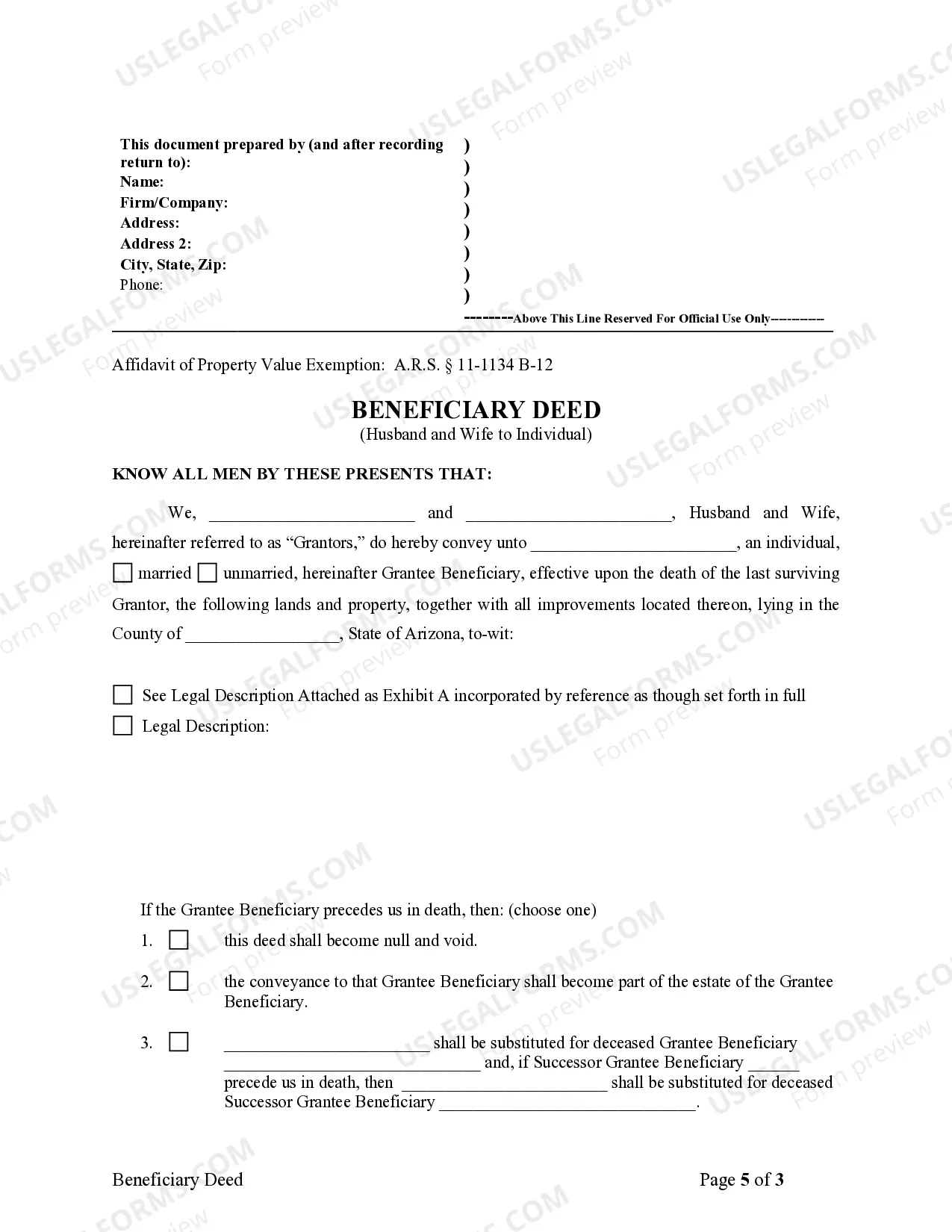

Transfer on Death Deed - Arizona - Husband and Wife to Individual: This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantors to the Grantee. It does not transfer any present ownership interest in the property and is revocable at any time. Therefore, it is commonly used to avoid probate upon death.

Glendale Arizona Transfer on Death Deed (TOD) and Beneficiary Deed are legal instruments that allow individuals to transfer their real property upon their death, without the need for probate. In the case of a married couple, these deeds can be utilized to transfer property to an individual beneficiary. The primary difference between a TOD and a Beneficiary Deed lies in the timing of the property transfer. A Glendale Arizona Transfer on Death Deed (TOD) for Husband and Wife allows joint owners of real property to designate a specific beneficiary or beneficiaries who will receive the property upon their death. This deed can be executed by both spouses and ensures that the property avoids probate and transfers directly to the named individual beneficiary after the death of the surviving spouse. On the other hand, a Glendale Arizona Beneficiary Deed for Husband and Wife to Individual is a similar instrument that allows joint owners to designate a specific beneficiary who will receive the property upon the death of both spouses. However, unlike a TOD, the property is transferred to the named beneficiary only after the death of both spouses, rather than the surviving spouse. These types of deeds provide various advantages, including the avoidance of probate, which can be time-consuming, costly, and often stressful for the beneficiaries. By utilizing either a Glendale Arizona TOD or Beneficiary Deed, individuals can ensure a smoother transfer of property and provide greater financial security for their loved ones. In summary, Glendale Arizona offers two types of transfer on death deeds or beneficiary deeds for husband and wife to an individual: the Transfer on Death Deed (TOD) and the Beneficiary Deed. Both these deeds enable joint owners to designate a specific beneficiary to receive the property after their death. However, TOD allows the property transfer after the death of the surviving spouse, while the Beneficiary Deed transfers the property after the death of both spouses. These instruments offer a convenient way to bypass probate, ensuring a seamless transition of property ownership.