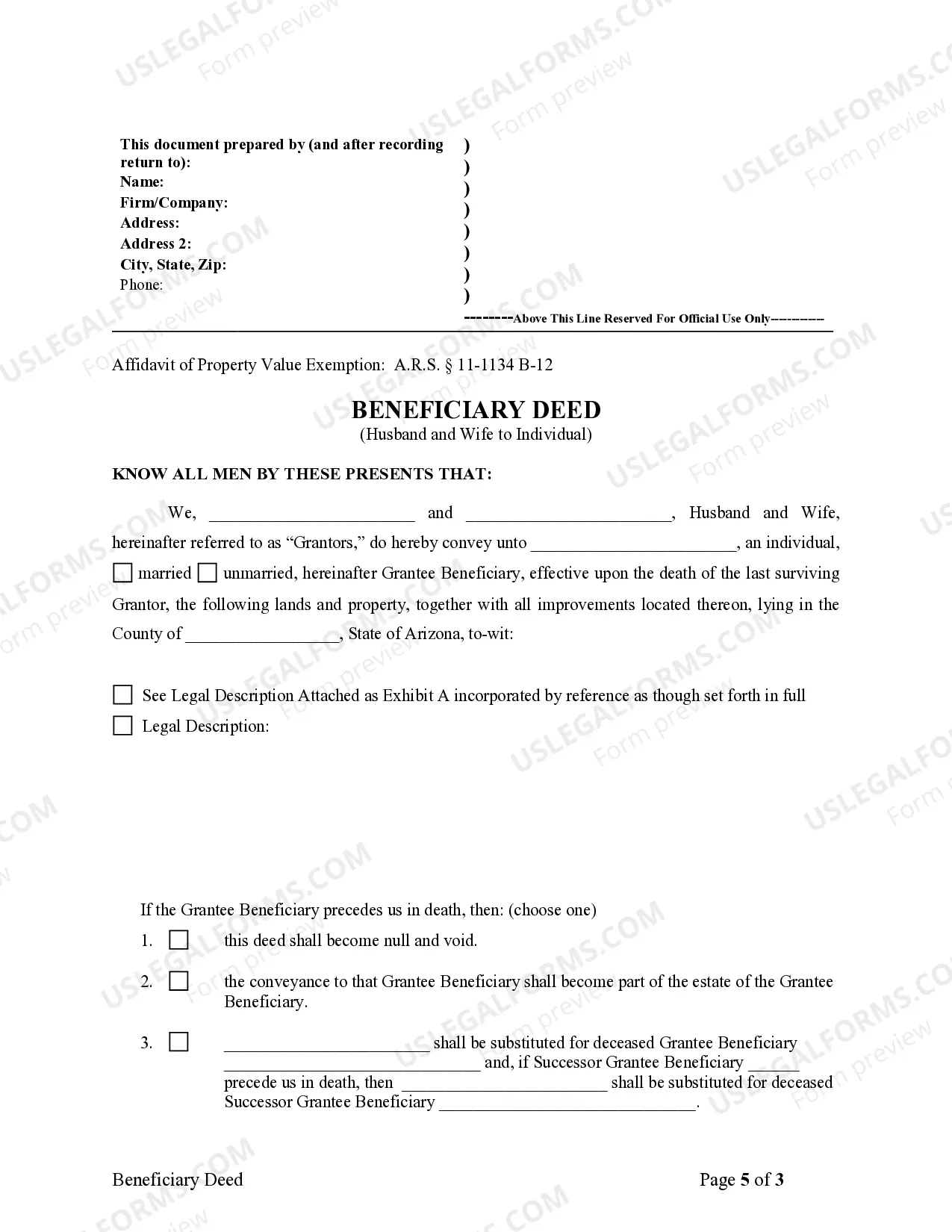

Transfer on Death Deed - Arizona - Husband and Wife to Individual: This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantors to the Grantee. It does not transfer any present ownership interest in the property and is revocable at any time. Therefore, it is commonly used to avoid probate upon death.

Phoenix Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual

Description

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife To Individual?

Do you require a reliable and affordable legal documents provider to obtain the Phoenix Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Couples? US Legal Forms is your preferred selection.

Whether you seek a straightforward agreement to establish rules for living with your partner or a collection of documents to facilitate your separation or divorce through the court system, we have you covered. Our website presents over 85,000 current legal document templates for personal and commercial use. All templates we provide are tailored and designed in alignment with the specifications of specific states and counties.

To retrieve the document, you must Log In to your account, locate the necessary template, and click the Download button adjacent to it. Please remember that you can download your previously acquired document templates at any moment from the My documents tab.

Are you unfamiliar with our platform? No problem. You can create an account in just a few minutes, but before that, ensure you do the following.

Now you can create your account. Then select a subscription plan and proceed to payment. Once the payment is successful, download the Phoenix Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Couples in any available format. You can revisit the website whenever necessary and redownload the document freely.

Acquiring up-to-date legal forms has never been simpler. Try US Legal Forms now, and stop wasting your valuable time searching for legal documents online forever.

- Confirm if the Phoenix Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Couples adheres to the laws of your state and locality.

- Review the form's information (if present) to determine who and what the document is designed for.

- Restart your search if the template is not suitable for your particular situation.

Form popularity

FAQ

Arizona inheritance laws specify that a decedent's property passes to their spouse and/or descendants. Qualifying descendants could include: Children, including adopted children or ones conceived before marriage. Grandchildren and great-grandchildren.

You may create life estates or any other form of ownership recognized in Arizona. Beneficiary deeds work well when the title will pass to a single individual or to a few individuals all of whom share a common vision of what to do with the property.

A beneficiary deed allows for the avoidance of probate. Arizona allows for the transfer of real estate by affidavit if the equity of all the real property in the estate is not greater than $100,000.

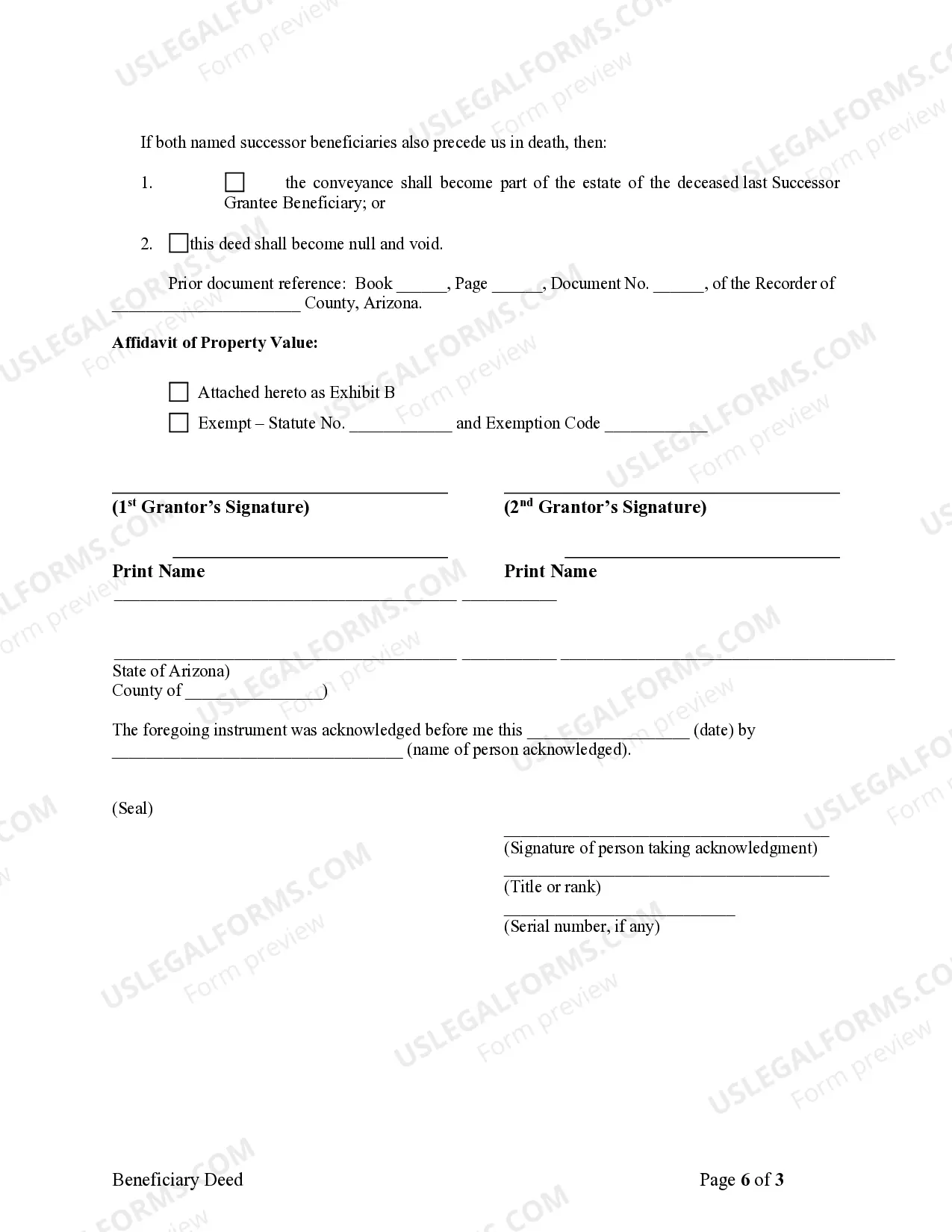

A Beneficiary Deed has to be signed by the property owner and notarized, recorded in the county where the property is located during the owner's lifetime, and must accurately state the property's legal description. While an Arizona Beneficiary Deed has many advantages, it is not for everyone.

The second important point is that a beneficiary deed supersedes a will, so if the documents contradict one another, the beneficiary deed takes precedence.

What is an Arizona Beneficiary Deed? An Arizona beneficiary deed form?also known as an Arizona transfer-on-death deed form or Arizona TOD deed form?is a type of deed authorized by statute to pass Arizona real estate to designated beneficiaries on the death of an owner.

To establish a beneficiary deed in Arizona, the deed must: Grant the real estate property to a beneficiary designated by the owner of said property. Be recorded in the office of the county where the property is located. Be recorded in the county office before the property owner's death.

A Beneficiary Deed has to be signed by the property owner and notarized, recorded in the county where the property is located during the owner's lifetime, and must accurately state the property's legal description. While an Arizona Beneficiary Deed has many advantages, it is not for everyone.

In Maricopa County, Arizona, you can do this at either the main office in Phoenix, at 111 S. Third Avenue, or in Mesa at 222 E. Javelina Avenue. The recorder will need your original deed or a legible copy with original signatures.