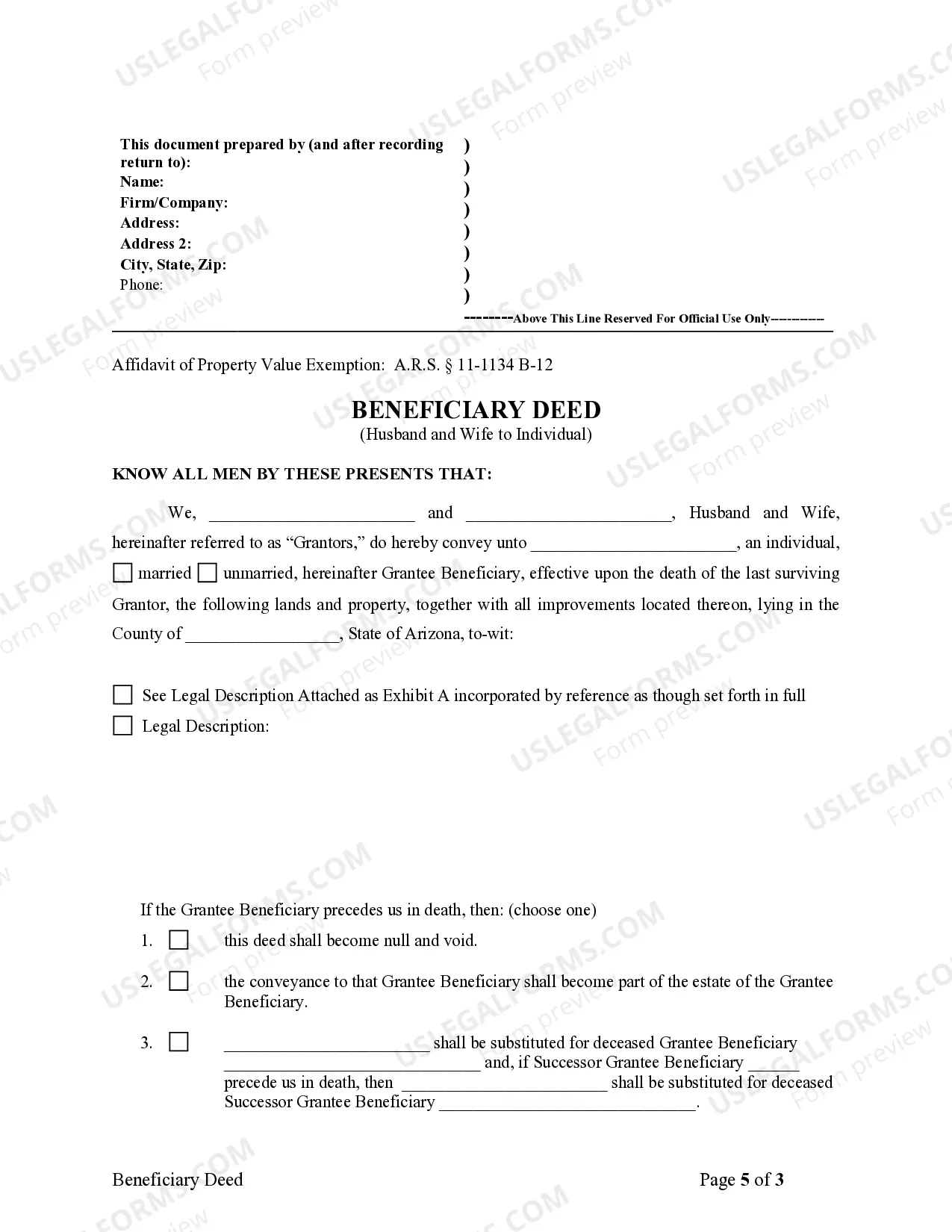

Transfer on Death Deed - Arizona - Husband and Wife to Individual: This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantors to the Grantee. It does not transfer any present ownership interest in the property and is revocable at any time. Therefore, it is commonly used to avoid probate upon death.

A Transfer on Death Deed (TOD) or Beneficiary Deed for Husband and Wife to Individual is a legal document used in Surprise, Arizona, that allows a property owner to transfer their property to a named beneficiary upon their death, without the need for probate. The primary purpose of a Surprise Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Individual is to simplify the transfer of property upon the owner's death. By designating a beneficiary, the owner ensures that the property will pass directly to the named individual, bypassing the probate process. This can save time, money, and reduce the chances of disputes among heirs. Several key features distinguish the various types within this category: 1. Basic Transfer on Death Deed: This is the standard format of the deed, in which the property owner names a specific individual or individuals as the beneficiary or beneficiaries. The transfer of property occurs only upon the owner's death, and until then, the owner retains full control and ownership rights. 2. Joint Tenancy with Right of Survivorship TOD Deed: In this type of Transfer on Death Deed, a husband and wife jointly own the property, and upon the death of one spouse, the surviving spouse automatically becomes the sole owner. However, if both spouses pass away simultaneously, the property transfers to the named beneficiary. 3. Tenancy in Common TOD Deed: This form of Transfer on Death Deed is suitable for unmarried couples or individuals with multiple beneficiaries. In this arrangement, each co-owner, whether husband and wife or unrelated individuals, has an equal or specified portion of ownership interest in the property, and upon their death, their respective share passes to the designated beneficiary or beneficiaries. 4. Secondary or Contingent Beneficiaries: To account for unforeseen circumstances, it is common for Transfer on Death Deeds to include secondary or contingent beneficiaries. These individuals are named as backup beneficiaries in case the primary beneficiary predeceases the property owner or is unable to accept the transfer for any reason. When drafting and executing a Surprise Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Individual, it is essential to consult with an experienced estate planning attorney to ensure compliance with state laws and to properly address any unique circumstances or preferences.A Transfer on Death Deed (TOD) or Beneficiary Deed for Husband and Wife to Individual is a legal document used in Surprise, Arizona, that allows a property owner to transfer their property to a named beneficiary upon their death, without the need for probate. The primary purpose of a Surprise Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Individual is to simplify the transfer of property upon the owner's death. By designating a beneficiary, the owner ensures that the property will pass directly to the named individual, bypassing the probate process. This can save time, money, and reduce the chances of disputes among heirs. Several key features distinguish the various types within this category: 1. Basic Transfer on Death Deed: This is the standard format of the deed, in which the property owner names a specific individual or individuals as the beneficiary or beneficiaries. The transfer of property occurs only upon the owner's death, and until then, the owner retains full control and ownership rights. 2. Joint Tenancy with Right of Survivorship TOD Deed: In this type of Transfer on Death Deed, a husband and wife jointly own the property, and upon the death of one spouse, the surviving spouse automatically becomes the sole owner. However, if both spouses pass away simultaneously, the property transfers to the named beneficiary. 3. Tenancy in Common TOD Deed: This form of Transfer on Death Deed is suitable for unmarried couples or individuals with multiple beneficiaries. In this arrangement, each co-owner, whether husband and wife or unrelated individuals, has an equal or specified portion of ownership interest in the property, and upon their death, their respective share passes to the designated beneficiary or beneficiaries. 4. Secondary or Contingent Beneficiaries: To account for unforeseen circumstances, it is common for Transfer on Death Deeds to include secondary or contingent beneficiaries. These individuals are named as backup beneficiaries in case the primary beneficiary predeceases the property owner or is unable to accept the transfer for any reason. When drafting and executing a Surprise Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Individual, it is essential to consult with an experienced estate planning attorney to ensure compliance with state laws and to properly address any unique circumstances or preferences.