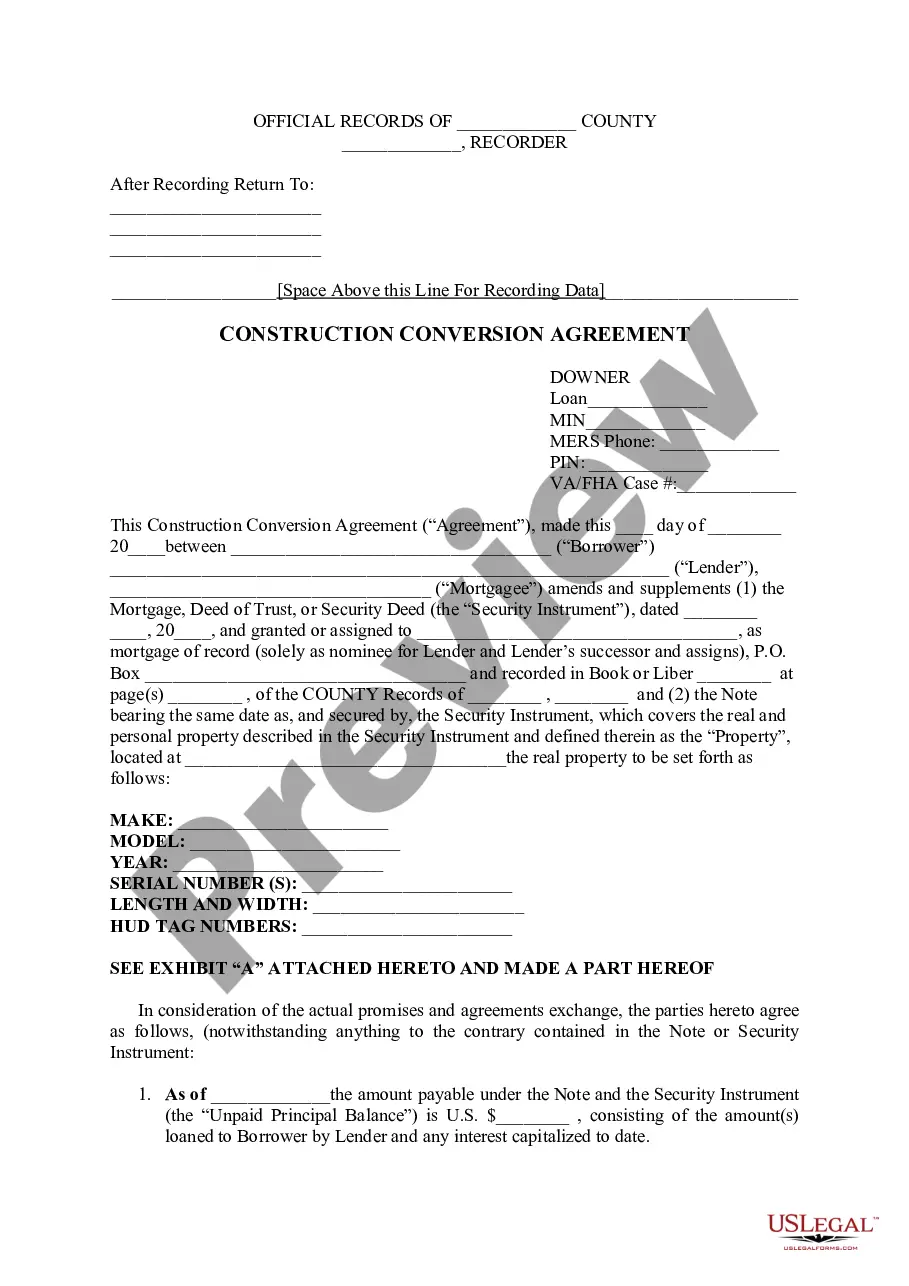

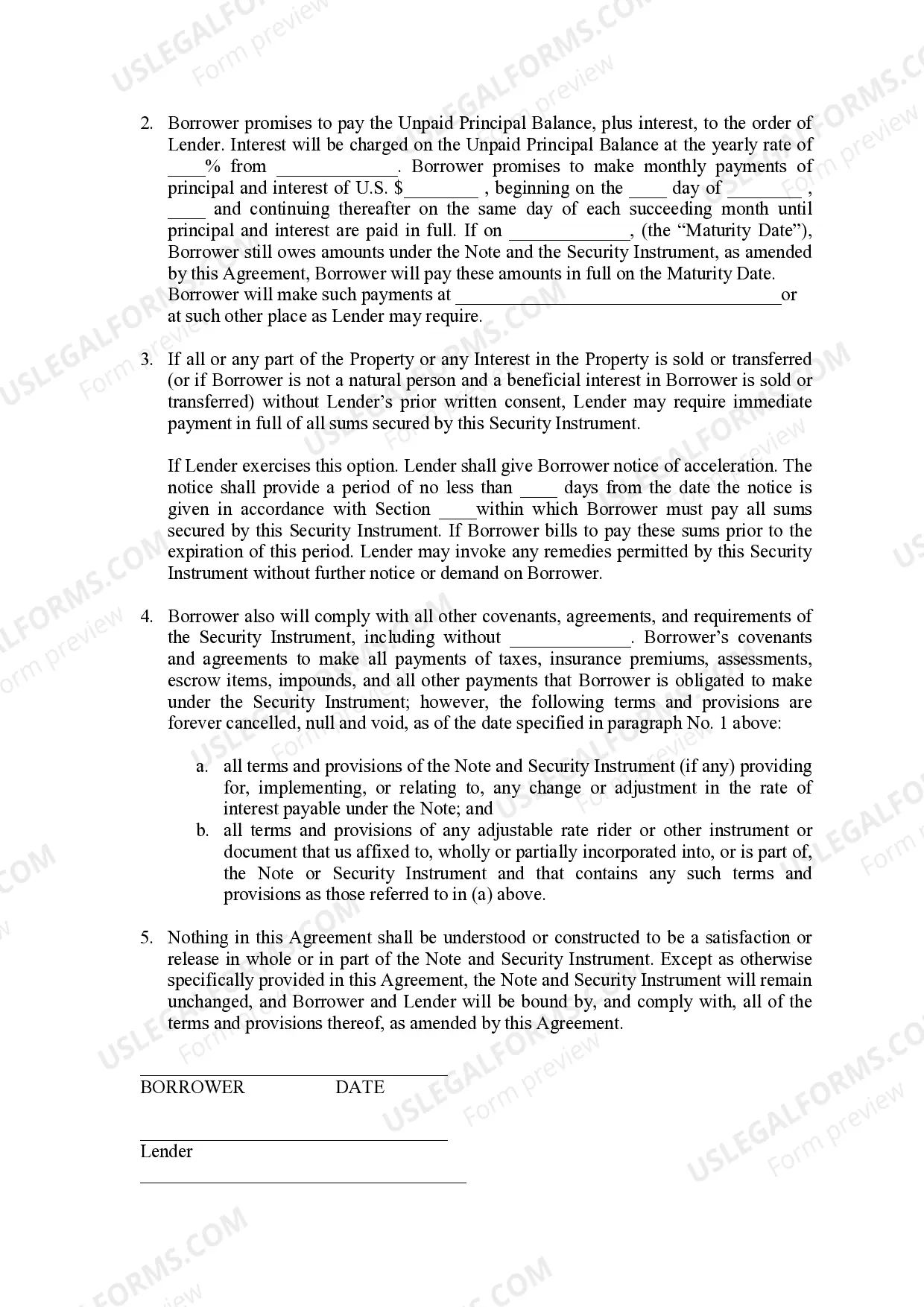

The Maricopa Arizona Construction Conversion Agreement is a legal document that outlines the terms and conditions for converting a construction loan into a permanent mortgage upon completion of a construction project in Maricopa, Arizona. This agreement serves as a crucial bridge between the construction phase and the long-term financing phase for residential and commercial properties. The agreement contains various key elements, including the borrower's name and contact details, the lender's information, and the property address. It stipulates the loan amount, interest rates, repayment terms, and any applicable fees or penalties. Additionally, it outlines the agreed-upon timeframe for the construction project and specifies the conditions that need to be met for the loan conversion to take place. One type of Maricopa Arizona Construction Conversion Agreement is the Single-Close Construction to Permanent Loan. This agreement combines the construction loan and permanent mortgage into a single process, reducing paperwork and streamlining the financing process for borrowers. This type of agreement is particularly beneficial for individuals looking to build their dream homes or for real estate developers undertaking large-scale construction projects in Maricopa, Arizona. Another type of agreement is the Two-Close Construction Conversion Agreement. This agreement involves two separate loans: the construction loan and the permanent mortgage. The construction loan covers the costs incurred during the construction phase, while the permanent mortgage is obtained once the project is completed. This type of agreement is commonly used when financing options may vary between the construction phase and the long-term loan. Irrespective of the type, the Maricopa Arizona Construction Conversion Agreement protects the interests of both the borrower and the lender. It ensures that all parties involved are clear on the terms and conditions, ultimately leading to a smooth transition from the construction phase to permanent financing. It is essential for borrowers to consult with legal professionals experienced in real estate and construction law to ensure the completion of a comprehensive and enforceable agreement.

Maricopa Arizona Construction Conversion Agreement

Description

How to fill out Maricopa Arizona Construction Conversion Agreement?

Make use of the US Legal Forms and get immediate access to any form sample you require. Our beneficial website with a huge number of document templates simplifies the way to find and get almost any document sample you want. You are able to save, complete, and certify the Maricopa Arizona Construction Conversion Agreement in just a couple of minutes instead of surfing the Net for many hours trying to find an appropriate template.

Using our catalog is a great strategy to increase the safety of your record filing. Our experienced attorneys regularly check all the documents to make certain that the forms are appropriate for a particular region and compliant with new acts and regulations.

How do you get the Maricopa Arizona Construction Conversion Agreement? If you already have a profile, just log in to the account. The Download option will appear on all the documents you view. Additionally, you can get all the previously saved records in the My Forms menu.

If you haven’t registered a profile yet, follow the instructions listed below:

- Find the form you require. Make sure that it is the template you were seeking: check its name and description, and utilize the Preview option if it is available. Otherwise, use the Search field to look for the needed one.

- Start the saving process. Click Buy Now and choose the pricing plan that suits you best. Then, create an account and process your order utilizing a credit card or PayPal.

- Export the document. Indicate the format to get the Maricopa Arizona Construction Conversion Agreement and change and complete, or sign it according to your requirements.

US Legal Forms is one of the most extensive and trustworthy document libraries on the web. Our company is always ready to assist you in any legal procedure, even if it is just downloading the Maricopa Arizona Construction Conversion Agreement.

Feel free to make the most of our service and make your document experience as straightforward as possible!