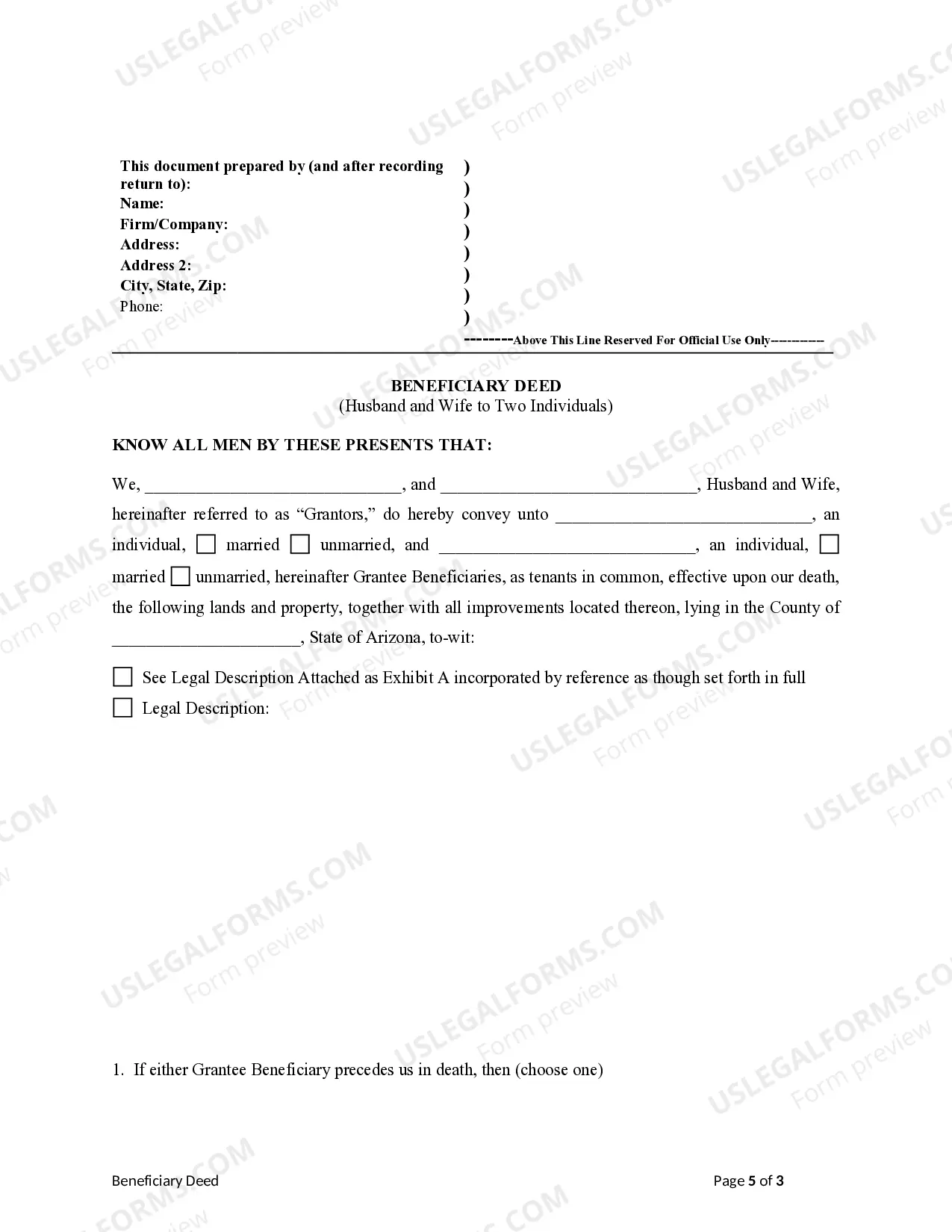

Transfer on Death Deed - Arizona - Husband and Wife to Two Individuals: This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantors to the Grantees. It does not transfer any present ownership interest in the property and is revocable at any time. Therefore, it is commonly used to avoid probate upon death.

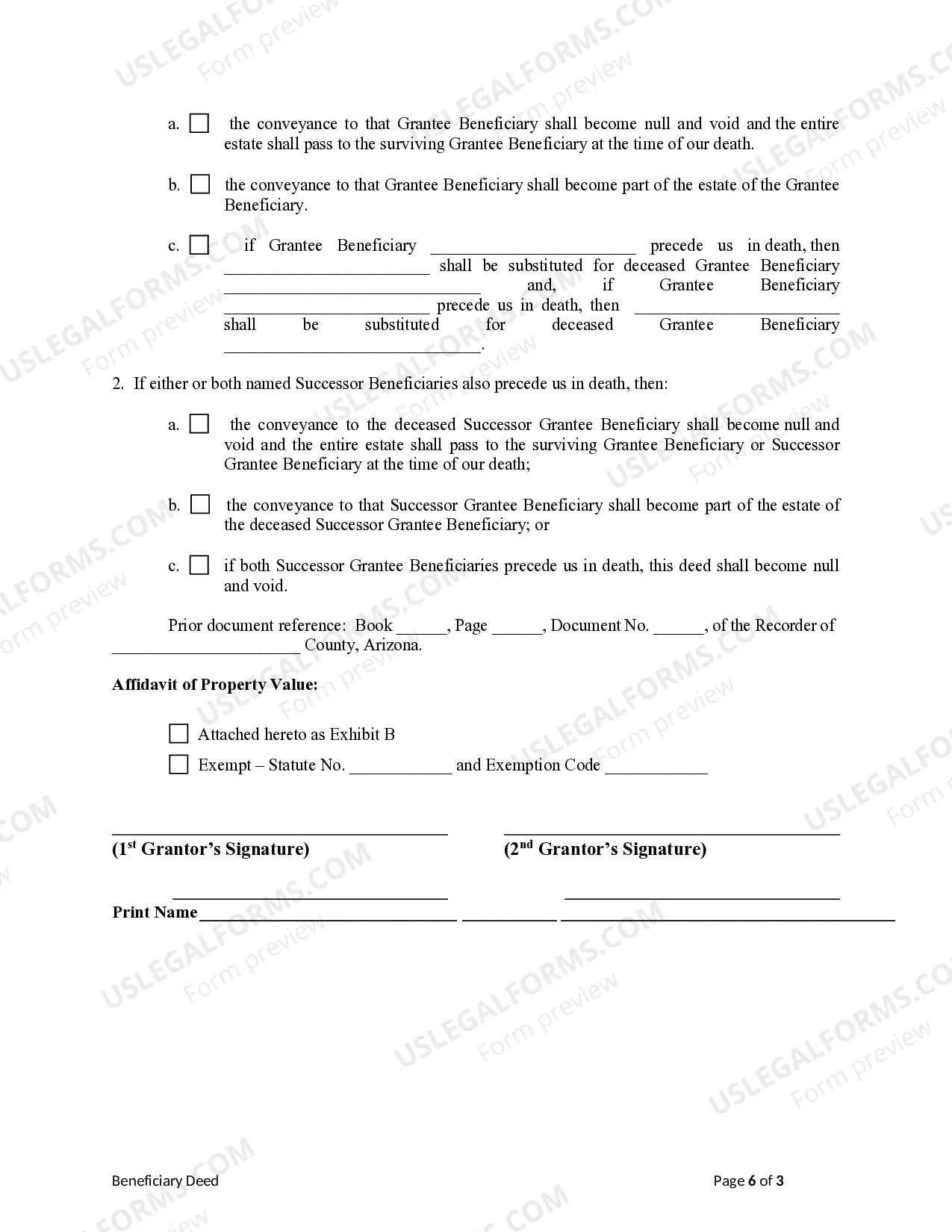

The Gilbert, Arizona Transfer on Death Deed (TOD) or Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries is a legal document that allows couples to transfer property to two specific individuals upon their death, with provisions for successor beneficiaries. This type of deed is a popular estate planning tool in Arizona and offers several variations to suit individual needs. The primary purpose of the Transfer on Death Deed in Gilbert, Arizona is to ensure a seamless transfer of property ownership upon the death of the granter(s), without the need for probate. This means that the property bypasses the lengthy and costly probate process, allowing for a quicker transfer to the named beneficiaries. The TOD Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries can be tailored to the specific needs of the couple. Some different types or variations of this deed include: 1. Simple TOD Beneficiary Deed: This type of deed allows a husband and wife to transfer their property to two individuals as primary beneficiaries. Upon the death of both spouses, the property will be transferred to the named beneficiaries without the need for probate. 2. Successor Beneficiaries TOD Beneficiary Deed: In addition to the primary beneficiaries, this type of deed also includes provisions for successor beneficiaries. This means that if the primary beneficiaries are unable or unwilling to accept the property, it would then be transferred to the successor beneficiaries. 3. Divided Interests TOD Beneficiary Deed: With this variation, the property can be divided into equal or specified shares, each going to different primary or successor beneficiaries. This option is useful when the granter(s) wish to allocate specific portions of the property to different beneficiaries. 4. Contingent Beneficiaries TOD Beneficiary Deed: This type of deed allows the granter(s) to name contingent beneficiaries who will receive the property if the primary beneficiaries predecease the granter(s). It ensures that the property is well-distributed in any unforeseen circumstances. By utilizing a Gilbert, Arizona Transfer on Death Deed or TOD Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries, couples can ensure their property is efficiently transferred to their intended beneficiaries upon their passing. It is advisable to consult with a qualified estate planning attorney to determine the best type of deed for individual circumstances and to ensure compliance with all legal requirements.The Gilbert, Arizona Transfer on Death Deed (TOD) or Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries is a legal document that allows couples to transfer property to two specific individuals upon their death, with provisions for successor beneficiaries. This type of deed is a popular estate planning tool in Arizona and offers several variations to suit individual needs. The primary purpose of the Transfer on Death Deed in Gilbert, Arizona is to ensure a seamless transfer of property ownership upon the death of the granter(s), without the need for probate. This means that the property bypasses the lengthy and costly probate process, allowing for a quicker transfer to the named beneficiaries. The TOD Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries can be tailored to the specific needs of the couple. Some different types or variations of this deed include: 1. Simple TOD Beneficiary Deed: This type of deed allows a husband and wife to transfer their property to two individuals as primary beneficiaries. Upon the death of both spouses, the property will be transferred to the named beneficiaries without the need for probate. 2. Successor Beneficiaries TOD Beneficiary Deed: In addition to the primary beneficiaries, this type of deed also includes provisions for successor beneficiaries. This means that if the primary beneficiaries are unable or unwilling to accept the property, it would then be transferred to the successor beneficiaries. 3. Divided Interests TOD Beneficiary Deed: With this variation, the property can be divided into equal or specified shares, each going to different primary or successor beneficiaries. This option is useful when the granter(s) wish to allocate specific portions of the property to different beneficiaries. 4. Contingent Beneficiaries TOD Beneficiary Deed: This type of deed allows the granter(s) to name contingent beneficiaries who will receive the property if the primary beneficiaries predecease the granter(s). It ensures that the property is well-distributed in any unforeseen circumstances. By utilizing a Gilbert, Arizona Transfer on Death Deed or TOD Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries, couples can ensure their property is efficiently transferred to their intended beneficiaries upon their passing. It is advisable to consult with a qualified estate planning attorney to determine the best type of deed for individual circumstances and to ensure compliance with all legal requirements.