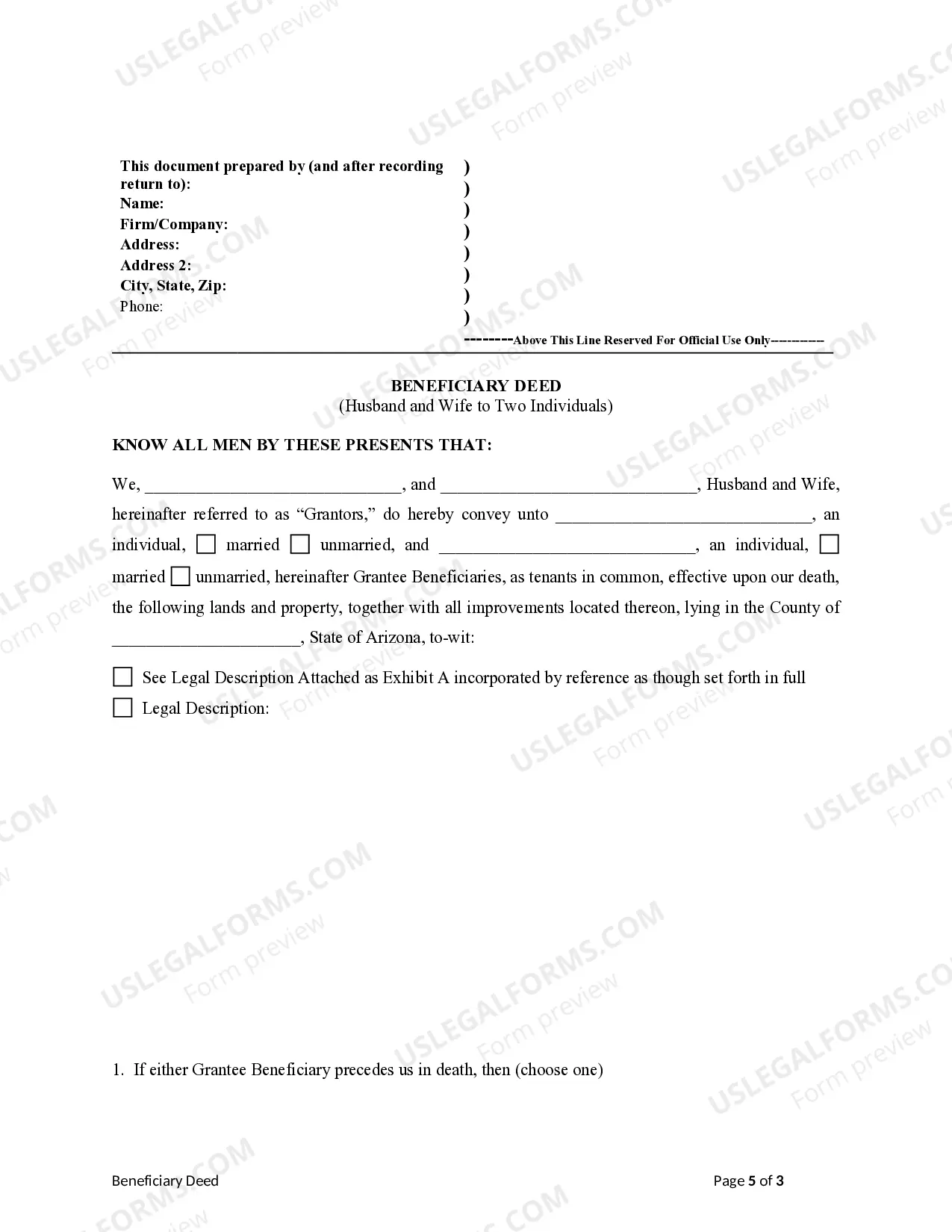

Transfer on Death Deed - Arizona - Husband and Wife to Two Individuals: This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantors to the Grantees. It does not transfer any present ownership interest in the property and is revocable at any time. Therefore, it is commonly used to avoid probate upon death.

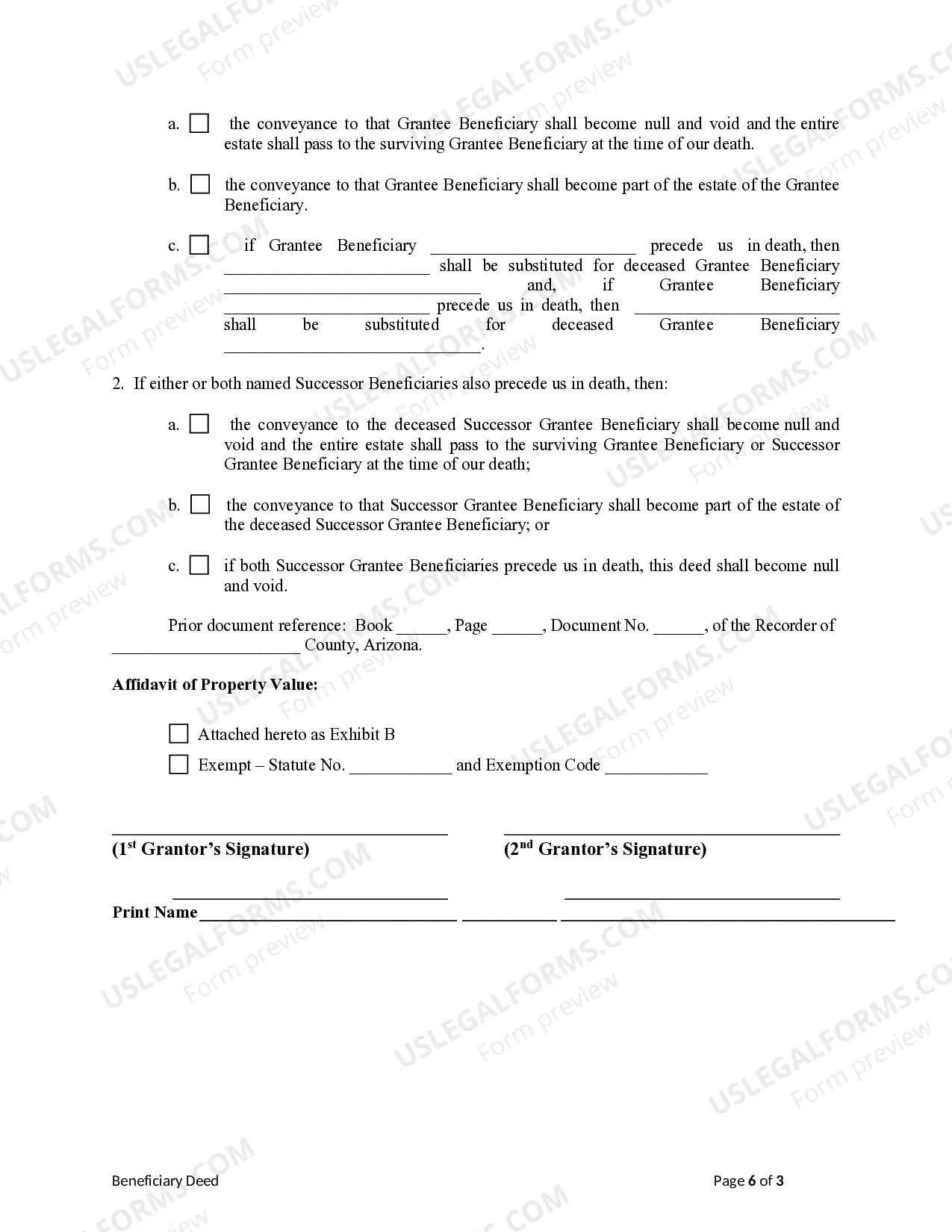

The Transfer on Death Deed (TOD) or Beneficiary Deed is a legal instrument recognized in Phoenix, Arizona, that allows homeowners to transfer their property to designated beneficiaries upon their death, without the need for probate. This option is particularly beneficial for married couples who jointly own property and wish to ensure a smooth transfer of assets to their chosen individuals or entities. In the case of a husband and wife jointly owning property in Phoenix, they have the option to execute a TOD or Beneficiary Deed to two individuals, typically their children or trusted relatives or friends. This type of deed ensures that the property automatically passes to the designated beneficiaries upon the death of both the husband and wife, without requiring court involvement or an additional legal process. There are various types of TOD or Beneficiary Deeds available, depending on the specific requirements and circumstances. Some common variations include: 1. Joint Tenancy with Right of Survivorship: This type of TOD or Beneficiary Deed allows the property to be owned jointly by the husband and wife, with the right of survivorship. Upon the death of one spouse, the property automatically passes to the surviving spouse. After the death of both spouses, the property then transfers to the designated beneficiaries. 2. Tenancy in Common: In this type of TOD or Beneficiary Deed, the property is owned by the husband and wife as tenants in common. Each spouse has a share or interest in the property, which they can designate to be transferred to their chosen beneficiaries upon their death. This allows for more flexibility in distributing the property, as each spouse can specify different beneficiaries for their share. It's important to note that while TOD or Beneficiary Deeds allow for a streamlined transfer of property upon death, they do not avoid estate taxes. Additionally, it's crucial to consult with a qualified attorney in Phoenix who specializes in estate planning and real estate law to ensure that the deed is properly executed and meets all legal requirements. By utilizing the Phoenix Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries, individuals can have peace of mind knowing that their property will be transferred to their chosen beneficiaries swiftly and efficiently, without the need for probate.The Transfer on Death Deed (TOD) or Beneficiary Deed is a legal instrument recognized in Phoenix, Arizona, that allows homeowners to transfer their property to designated beneficiaries upon their death, without the need for probate. This option is particularly beneficial for married couples who jointly own property and wish to ensure a smooth transfer of assets to their chosen individuals or entities. In the case of a husband and wife jointly owning property in Phoenix, they have the option to execute a TOD or Beneficiary Deed to two individuals, typically their children or trusted relatives or friends. This type of deed ensures that the property automatically passes to the designated beneficiaries upon the death of both the husband and wife, without requiring court involvement or an additional legal process. There are various types of TOD or Beneficiary Deeds available, depending on the specific requirements and circumstances. Some common variations include: 1. Joint Tenancy with Right of Survivorship: This type of TOD or Beneficiary Deed allows the property to be owned jointly by the husband and wife, with the right of survivorship. Upon the death of one spouse, the property automatically passes to the surviving spouse. After the death of both spouses, the property then transfers to the designated beneficiaries. 2. Tenancy in Common: In this type of TOD or Beneficiary Deed, the property is owned by the husband and wife as tenants in common. Each spouse has a share or interest in the property, which they can designate to be transferred to their chosen beneficiaries upon their death. This allows for more flexibility in distributing the property, as each spouse can specify different beneficiaries for their share. It's important to note that while TOD or Beneficiary Deeds allow for a streamlined transfer of property upon death, they do not avoid estate taxes. Additionally, it's crucial to consult with a qualified attorney in Phoenix who specializes in estate planning and real estate law to ensure that the deed is properly executed and meets all legal requirements. By utilizing the Phoenix Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries, individuals can have peace of mind knowing that their property will be transferred to their chosen beneficiaries swiftly and efficiently, without the need for probate.