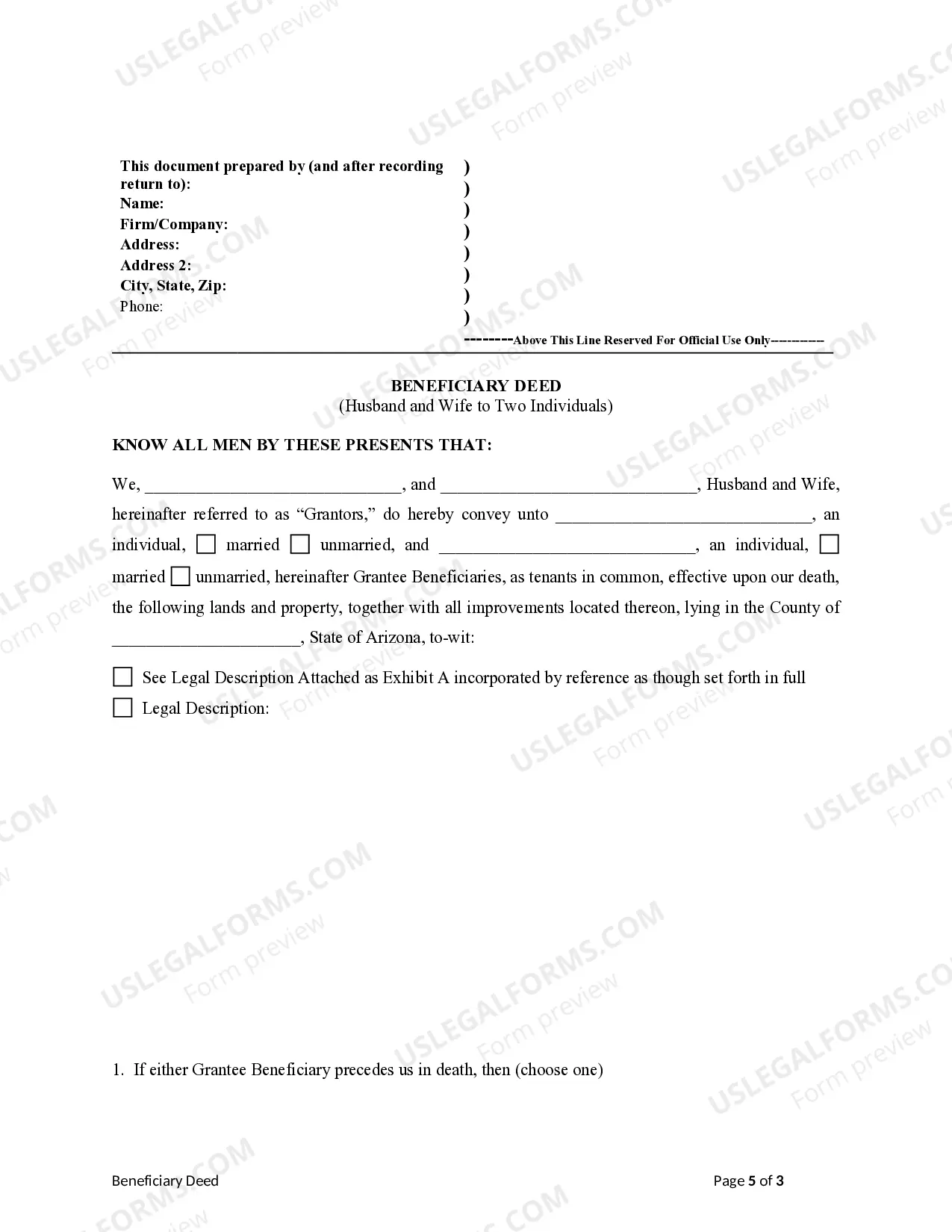

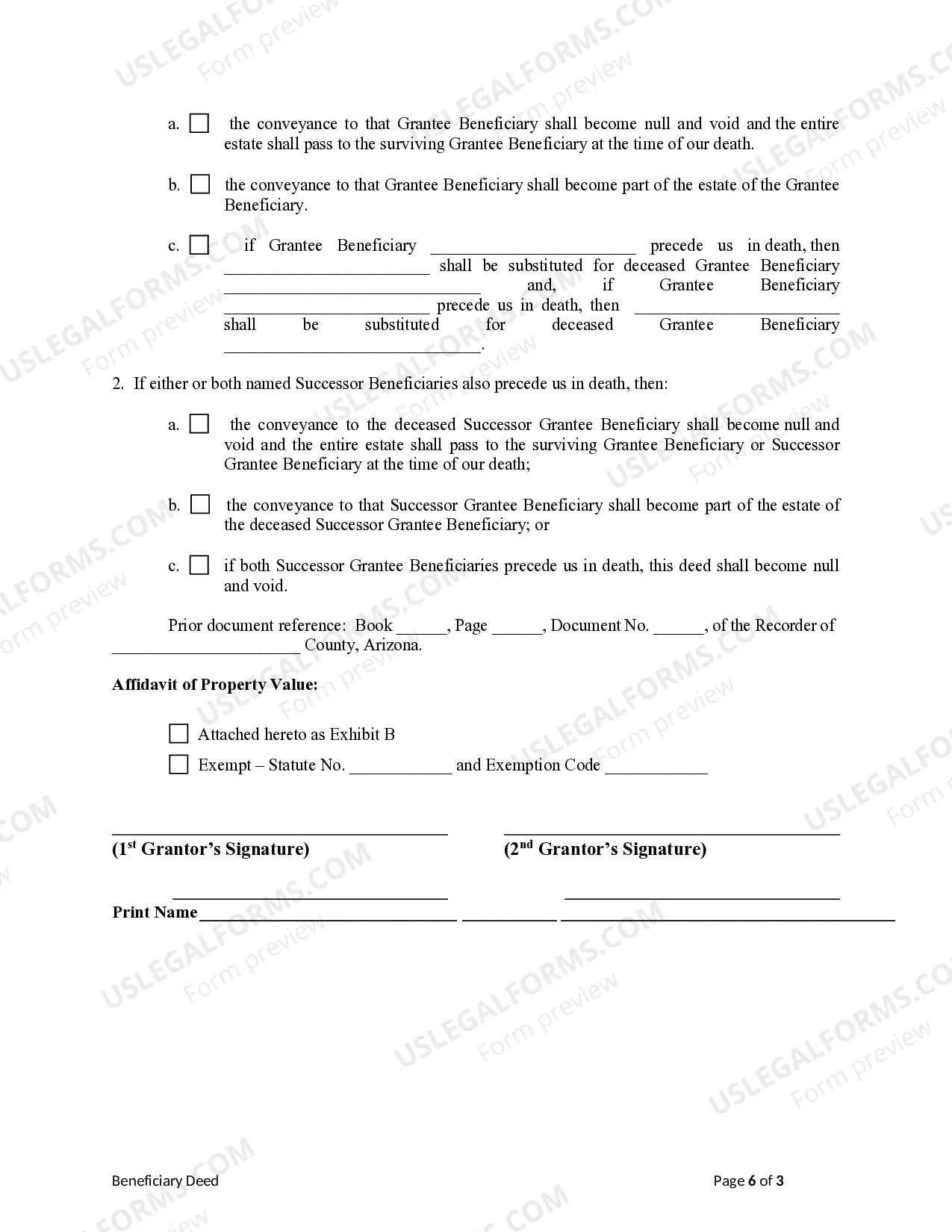

Transfer on Death Deed - Arizona - Husband and Wife to Two Individuals: This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantors to the Grantees. It does not transfer any present ownership interest in the property and is revocable at any time. Therefore, it is commonly used to avoid probate upon death.

Scottsdale Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries is a legal tool that allows married couples to transfer their real estate property to two individuals of their choice, with the provision of successor beneficiaries in case the primary beneficiaries are unable to inherit the property. This type of deed offers flexibility and control over the distribution of the property after the death of the homeowners. Here are a few different types of Scottsdale Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries: 1. Traditional Joint Tenancy with Rights of Survivorship: This type of TOD — Beneficiary Deed allows the husband and wife to transfer their property to two individuals as joint tenants. In the event of the death of one spouse, the surviving spouse becomes the sole owner of the property. However, if both spouses pass away, the property is transferred to the primary beneficiaries named in the deed. 2. Community Property with Right of Survivorship: This variant of the TOD — Beneficiary Deed is specific to community property states, like Arizona. It allows the husband and wife to convey their property to two individuals as community property, with the right of survivorship. If one spouse dies, the surviving spouse automatically becomes the sole owner of the property. Ultimately, the primary beneficiaries inherit the property upon the death of both spouses. 3. Tenancy in Common with Successor Beneficiaries: This version of the TOD — Beneficiary Deed enables the husband and wife to transfer their property to two individuals as tenants in common. Each individual has their share of ownership and can pass it on to their chosen successors or beneficiaries, ensuring the property stays within the family bloodline. This provides flexibility in distributing the property among multiple heirs. 4. Additional Successor Beneficiaries: In addition to the primary beneficiaries, the TOD — Beneficiary Deed allows the homeowners to name successor beneficiaries. These individuals would inherit the property if the primary beneficiaries pass away before the homeowners. Successor beneficiaries provide a backup plan for the seamless transfer of the property, ensuring the intentions of the homeowners are upheld. Overall, Scottsdale Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries offers homeowners a convenient way to plan the distribution of their property upon their passing, while maintaining control and flexibility over their assets. It is essential to consult with a qualified estate planning attorney to understand the specific requirements and implications of these deeds based on individual circumstances.Scottsdale Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries is a legal tool that allows married couples to transfer their real estate property to two individuals of their choice, with the provision of successor beneficiaries in case the primary beneficiaries are unable to inherit the property. This type of deed offers flexibility and control over the distribution of the property after the death of the homeowners. Here are a few different types of Scottsdale Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries: 1. Traditional Joint Tenancy with Rights of Survivorship: This type of TOD — Beneficiary Deed allows the husband and wife to transfer their property to two individuals as joint tenants. In the event of the death of one spouse, the surviving spouse becomes the sole owner of the property. However, if both spouses pass away, the property is transferred to the primary beneficiaries named in the deed. 2. Community Property with Right of Survivorship: This variant of the TOD — Beneficiary Deed is specific to community property states, like Arizona. It allows the husband and wife to convey their property to two individuals as community property, with the right of survivorship. If one spouse dies, the surviving spouse automatically becomes the sole owner of the property. Ultimately, the primary beneficiaries inherit the property upon the death of both spouses. 3. Tenancy in Common with Successor Beneficiaries: This version of the TOD — Beneficiary Deed enables the husband and wife to transfer their property to two individuals as tenants in common. Each individual has their share of ownership and can pass it on to their chosen successors or beneficiaries, ensuring the property stays within the family bloodline. This provides flexibility in distributing the property among multiple heirs. 4. Additional Successor Beneficiaries: In addition to the primary beneficiaries, the TOD — Beneficiary Deed allows the homeowners to name successor beneficiaries. These individuals would inherit the property if the primary beneficiaries pass away before the homeowners. Successor beneficiaries provide a backup plan for the seamless transfer of the property, ensuring the intentions of the homeowners are upheld. Overall, Scottsdale Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries offers homeowners a convenient way to plan the distribution of their property upon their passing, while maintaining control and flexibility over their assets. It is essential to consult with a qualified estate planning attorney to understand the specific requirements and implications of these deeds based on individual circumstances.