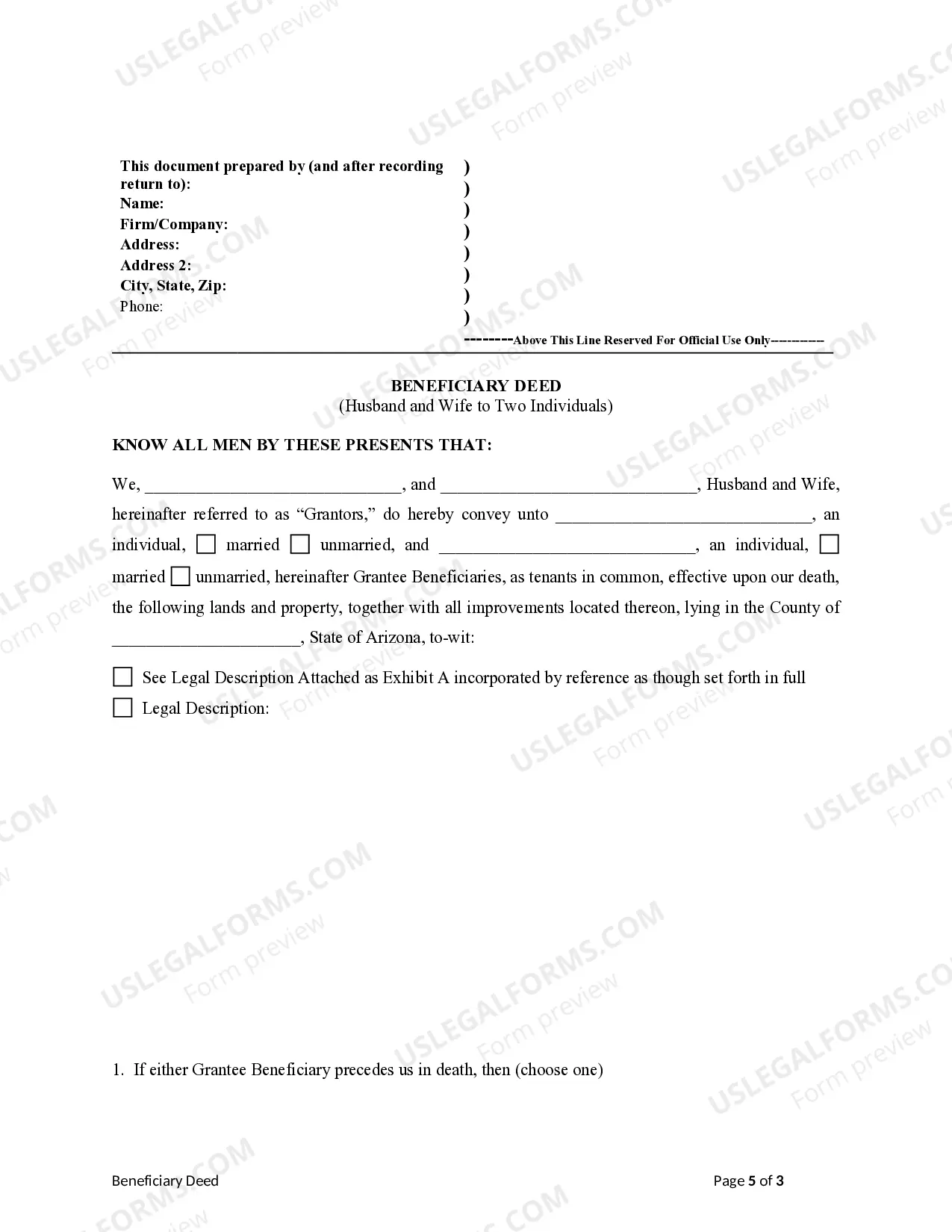

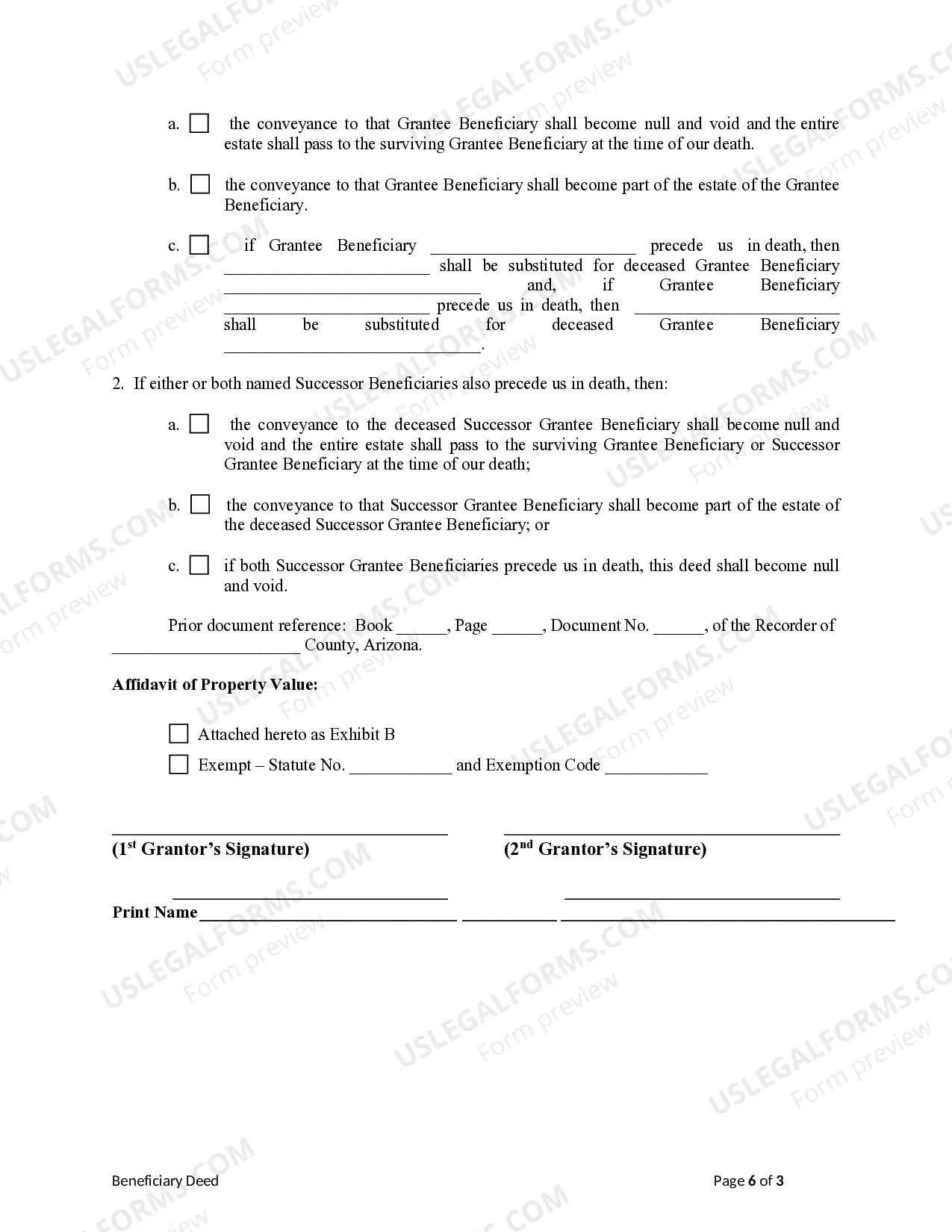

Transfer on Death Deed - Arizona - Husband and Wife to Two Individuals: This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantors to the Grantees. It does not transfer any present ownership interest in the property and is revocable at any time. Therefore, it is commonly used to avoid probate upon death.

The Surprise Arizona Transfer on Death Deed (TOD) or Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries is a legally binding document that allows married couples in Surprise, Arizona, to designate two individuals as beneficiaries of their property upon their death, with the provision of successor beneficiaries if the primary beneficiaries are unable to inherit the property. The TOD or Beneficiary Deed is a convenient estate planning tool that enables homeowners to bypass the lengthy and costly probate process. By using this deed, individuals can maintain control and ownership of their property during their lifetime while ensuring a smooth transfer of ownership to their chosen beneficiaries. There are multiple variations of the Surprise Arizona TOD or Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries, each tailored to specific needs and circumstances. Here are a few types: 1. Standard Surprise Arizona TOD or Beneficiary Deed: This type allows a married couple to designate two individuals as beneficiaries with equal rights to the property upon the death of both spouses. 2. Successor Beneficiary TOD or Beneficiary Deed: In addition to the primary beneficiaries, this variation includes the provision of successor beneficiaries. If the primary beneficiaries cannot inherit the property due to various reasons such as disqualification, death, or refusal, the successor beneficiaries will step into their place. 3. Unequal Distribution TOD or Beneficiary Deed: This type allows the married couple to distribute the property unequally between the two primary beneficiaries. It is particularly useful when a couple wishes to provide more substantial benefits to one beneficiary while still ensuring some inheritance for the other. 4. Joint Tenancy with Right of Survivorship TOD or Beneficiary Deed: This variant is suitable for couples who wish to create joint ownership with their chosen beneficiaries, allowing them to automatically inherit the property upon the death of either spouse, without going through probate. Regardless of the specific type of TOD or Beneficiary Deed chosen, it is essential to consult with an experienced estate planning attorney to ensure compliance with all legal requirements and to address any unique aspects of the individual's circumstances.The Surprise Arizona Transfer on Death Deed (TOD) or Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries is a legally binding document that allows married couples in Surprise, Arizona, to designate two individuals as beneficiaries of their property upon their death, with the provision of successor beneficiaries if the primary beneficiaries are unable to inherit the property. The TOD or Beneficiary Deed is a convenient estate planning tool that enables homeowners to bypass the lengthy and costly probate process. By using this deed, individuals can maintain control and ownership of their property during their lifetime while ensuring a smooth transfer of ownership to their chosen beneficiaries. There are multiple variations of the Surprise Arizona TOD or Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries, each tailored to specific needs and circumstances. Here are a few types: 1. Standard Surprise Arizona TOD or Beneficiary Deed: This type allows a married couple to designate two individuals as beneficiaries with equal rights to the property upon the death of both spouses. 2. Successor Beneficiary TOD or Beneficiary Deed: In addition to the primary beneficiaries, this variation includes the provision of successor beneficiaries. If the primary beneficiaries cannot inherit the property due to various reasons such as disqualification, death, or refusal, the successor beneficiaries will step into their place. 3. Unequal Distribution TOD or Beneficiary Deed: This type allows the married couple to distribute the property unequally between the two primary beneficiaries. It is particularly useful when a couple wishes to provide more substantial benefits to one beneficiary while still ensuring some inheritance for the other. 4. Joint Tenancy with Right of Survivorship TOD or Beneficiary Deed: This variant is suitable for couples who wish to create joint ownership with their chosen beneficiaries, allowing them to automatically inherit the property upon the death of either spouse, without going through probate. Regardless of the specific type of TOD or Beneficiary Deed chosen, it is essential to consult with an experienced estate planning attorney to ensure compliance with all legal requirements and to address any unique aspects of the individual's circumstances.