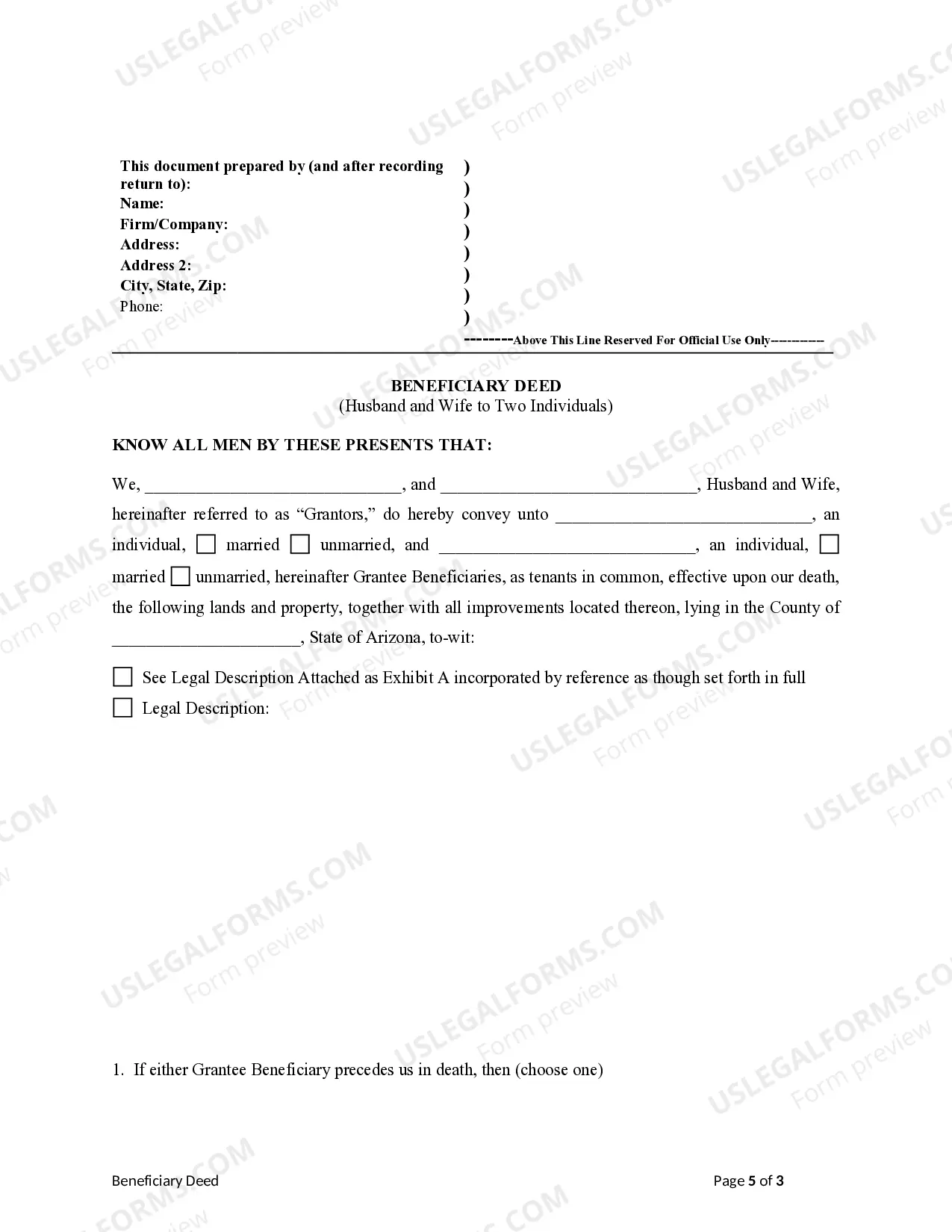

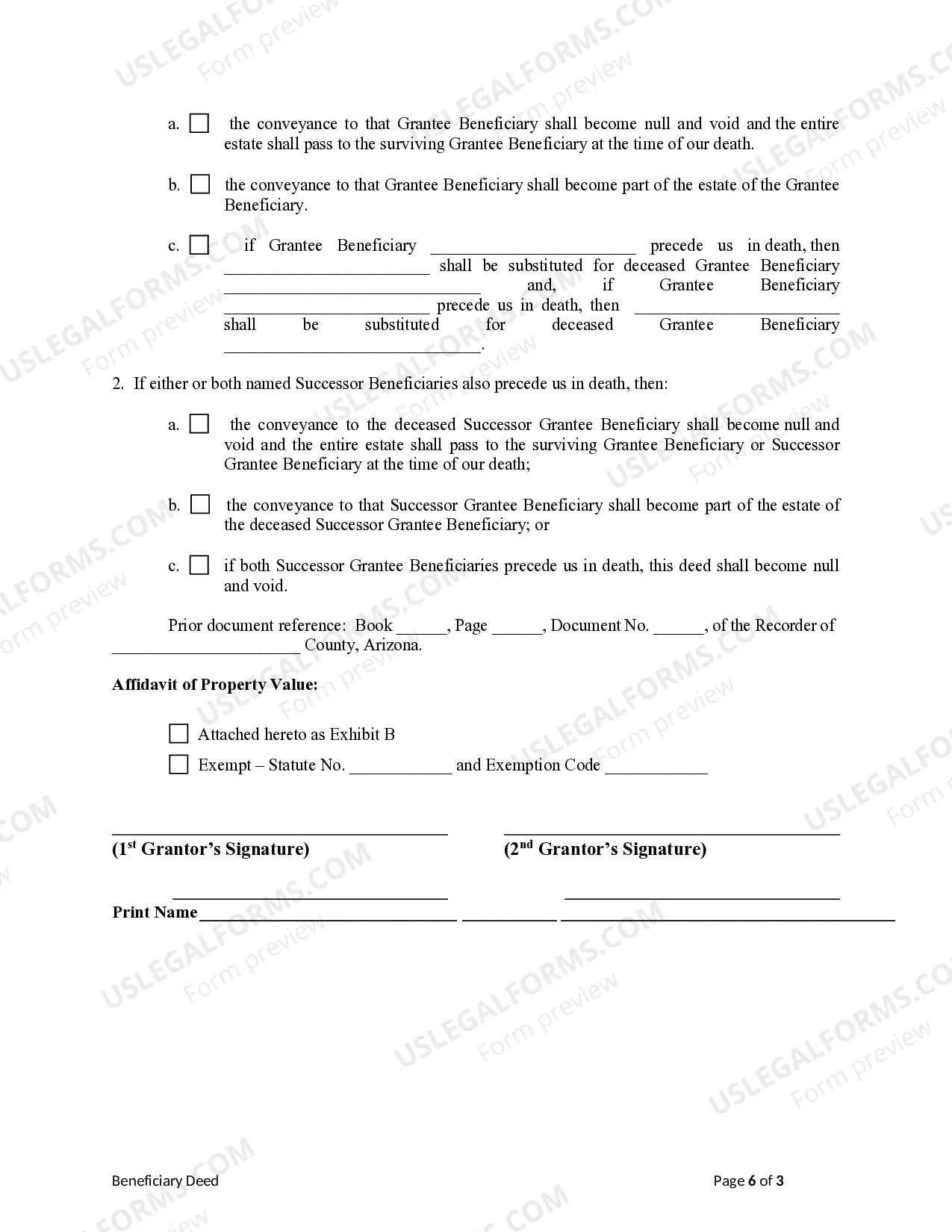

Transfer on Death Deed - Arizona - Husband and Wife to Two Individuals: This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantors to the Grantees. It does not transfer any present ownership interest in the property and is revocable at any time. Therefore, it is commonly used to avoid probate upon death.

Tempe Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries is a legal document that allows individuals to transfer their property to specific beneficiaries upon their death, without the need for probate. This type of deed is commonly used by married couples who wish to leave their property to two individuals, with additional beneficiaries named as successors. In Tempe, Arizona, there are different types of Transfer on Death Deeds or TOD — Beneficiary Deeds available for married couples to designate their beneficiaries. One type is the Joint Tenancy with Right of Survivorship, which allows both spouses to jointly own the property and automatically transfer ownership to the surviving spouse upon one's death. However, in this case, the property will not be transferred to the two individuals or successor beneficiaries. Alternatively, the specific type of Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries is typically a Tenancy in Common with Beneficiary Designations. With this type of deed, a married couple can designate two individuals as the initial beneficiaries, who will inherit the property upon the death of both spouses. Additionally, successor beneficiaries can be named to inherit the property if the initial beneficiaries pass away before the spouses. The Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries offers several advantages. Firstly, it allows the property to avoid probate, which is the court-supervised process of distributing assets after someone's death. This saves time and money for the beneficiaries as probate can be a lengthy and costly procedure. Secondly, it provides clear instructions on how the property should be transferred, ensuring that the intended beneficiaries receive their share without any disputes. To create a Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries in Tempe, Arizona, spouses need to follow specific legal requirements. They must complete a valid deed form, sign it in the presence of a notary public, and record the deed with the county recorder's office. It is essential to seek legal advice or consult an attorney experienced in estate planning to ensure the deed complies with all legal requirements. Overall, a Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries in Tempe, Arizona, provides a straightforward and efficient way for married couples to pass on their property to their chosen beneficiaries, while avoiding probate. It offers peace of mind knowing that their assets will be distributed according to their wishes and helps streamline the process for their loved ones during a difficult time.Tempe Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries is a legal document that allows individuals to transfer their property to specific beneficiaries upon their death, without the need for probate. This type of deed is commonly used by married couples who wish to leave their property to two individuals, with additional beneficiaries named as successors. In Tempe, Arizona, there are different types of Transfer on Death Deeds or TOD — Beneficiary Deeds available for married couples to designate their beneficiaries. One type is the Joint Tenancy with Right of Survivorship, which allows both spouses to jointly own the property and automatically transfer ownership to the surviving spouse upon one's death. However, in this case, the property will not be transferred to the two individuals or successor beneficiaries. Alternatively, the specific type of Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries is typically a Tenancy in Common with Beneficiary Designations. With this type of deed, a married couple can designate two individuals as the initial beneficiaries, who will inherit the property upon the death of both spouses. Additionally, successor beneficiaries can be named to inherit the property if the initial beneficiaries pass away before the spouses. The Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries offers several advantages. Firstly, it allows the property to avoid probate, which is the court-supervised process of distributing assets after someone's death. This saves time and money for the beneficiaries as probate can be a lengthy and costly procedure. Secondly, it provides clear instructions on how the property should be transferred, ensuring that the intended beneficiaries receive their share without any disputes. To create a Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries in Tempe, Arizona, spouses need to follow specific legal requirements. They must complete a valid deed form, sign it in the presence of a notary public, and record the deed with the county recorder's office. It is essential to seek legal advice or consult an attorney experienced in estate planning to ensure the deed complies with all legal requirements. Overall, a Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Two Individuals with Successor Beneficiaries in Tempe, Arizona, provides a straightforward and efficient way for married couples to pass on their property to their chosen beneficiaries, while avoiding probate. It offers peace of mind knowing that their assets will be distributed according to their wishes and helps streamline the process for their loved ones during a difficult time.