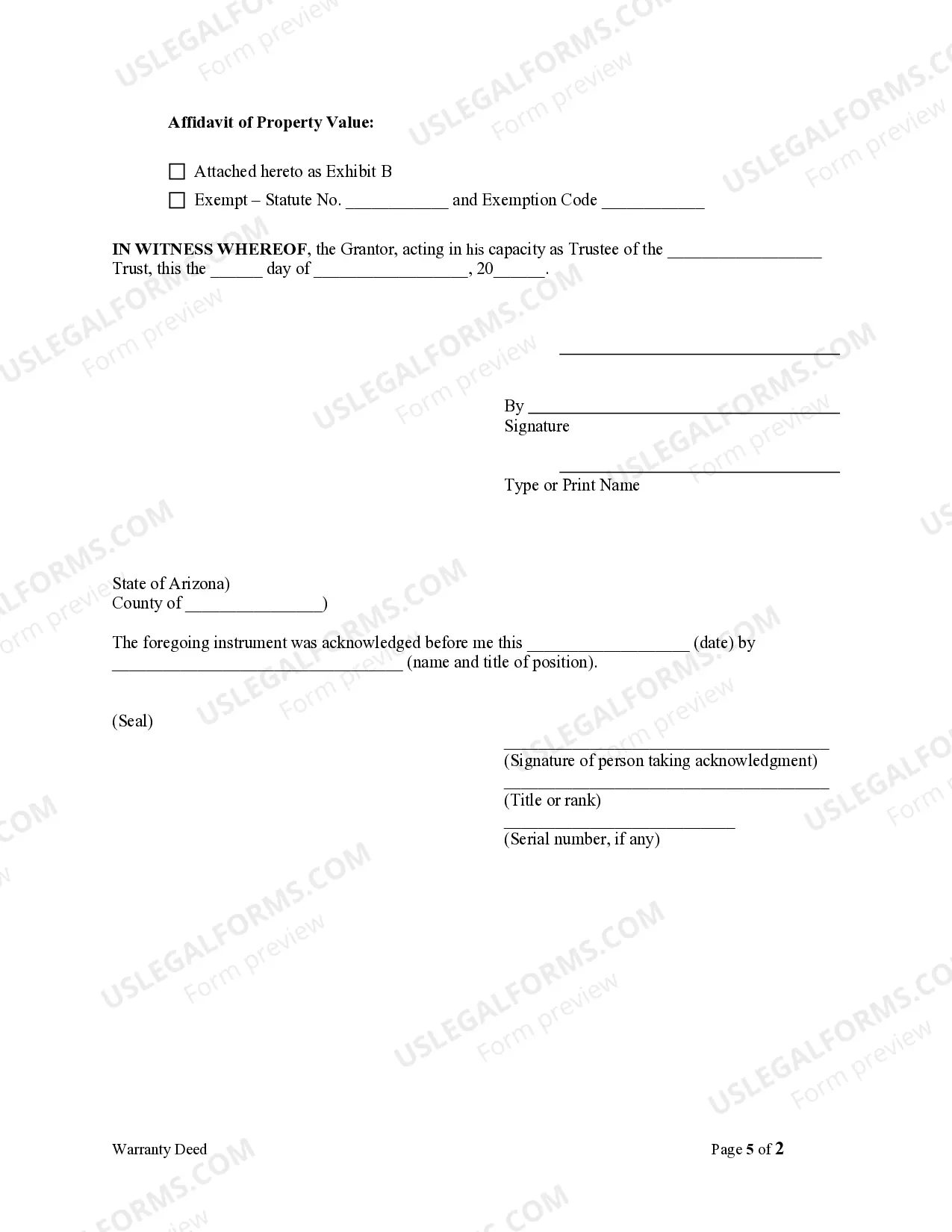

This form is a Warranty Deed where the grantor is a trust and the grantee is an individual. Grantor conveys the described property to the grantee. This deed complies with all state statutory laws.

A Surprise Arizona Warranty Deed — Trust to One Individual is a legal document that allows the transfer of property ownership from a trust to an individual. This type of deed is commonly used when a trust or wants to transfer their property to a specific person as a beneficiary. A Surprise Arizona Warranty Deed — Trust to One Individual provides protection to the beneficiary by guaranteeing that the property is free of any encumbrances or title defects. The trust or, who is the owner of the property, ensures that the property is transferred with a clean title. There are different types of Surprise Arizona Warranty Deed — Trust to One Individual: 1. Revocable Trust Deed: This type of deed allows the trust or to retain control over the property during their lifetime. They can change or revoke the trust at any time and have the ability to reclaim the property if needed. 2. Irrevocable Trust Deed: With an irrevocable trust deed, the trust or transfers ownership of the property to the beneficiary permanently. Once the transfer is complete, the trust or cannot change or reclaim the property, providing a more secure arrangement for the beneficiary. 3. Special Warranty Deed: This type of warranty deed guarantees that the trust or has not encumbered the property during their ownership, meaning there are no undisclosed claims or defects. However, it doesn't provide the same level of protection as a general warranty deed, which protects against all past claims on the property. 4. General Warranty Deed: This is the most comprehensive and protective type of warranty deed. It guarantees that the trust or has clear title and will defend the title against any claims made by others. This type of deed provides the highest level of protection to the beneficiary. When using a Surprise Arizona Warranty Deed — Trust to One Individual, it is important to consult with an experienced real estate attorney or professional to ensure that all legal requirements are met and the document accurately reflects the intentions of the trust or and beneficiary.A Surprise Arizona Warranty Deed — Trust to One Individual is a legal document that allows the transfer of property ownership from a trust to an individual. This type of deed is commonly used when a trust or wants to transfer their property to a specific person as a beneficiary. A Surprise Arizona Warranty Deed — Trust to One Individual provides protection to the beneficiary by guaranteeing that the property is free of any encumbrances or title defects. The trust or, who is the owner of the property, ensures that the property is transferred with a clean title. There are different types of Surprise Arizona Warranty Deed — Trust to One Individual: 1. Revocable Trust Deed: This type of deed allows the trust or to retain control over the property during their lifetime. They can change or revoke the trust at any time and have the ability to reclaim the property if needed. 2. Irrevocable Trust Deed: With an irrevocable trust deed, the trust or transfers ownership of the property to the beneficiary permanently. Once the transfer is complete, the trust or cannot change or reclaim the property, providing a more secure arrangement for the beneficiary. 3. Special Warranty Deed: This type of warranty deed guarantees that the trust or has not encumbered the property during their ownership, meaning there are no undisclosed claims or defects. However, it doesn't provide the same level of protection as a general warranty deed, which protects against all past claims on the property. 4. General Warranty Deed: This is the most comprehensive and protective type of warranty deed. It guarantees that the trust or has clear title and will defend the title against any claims made by others. This type of deed provides the highest level of protection to the beneficiary. When using a Surprise Arizona Warranty Deed — Trust to One Individual, it is important to consult with an experienced real estate attorney or professional to ensure that all legal requirements are met and the document accurately reflects the intentions of the trust or and beneficiary.