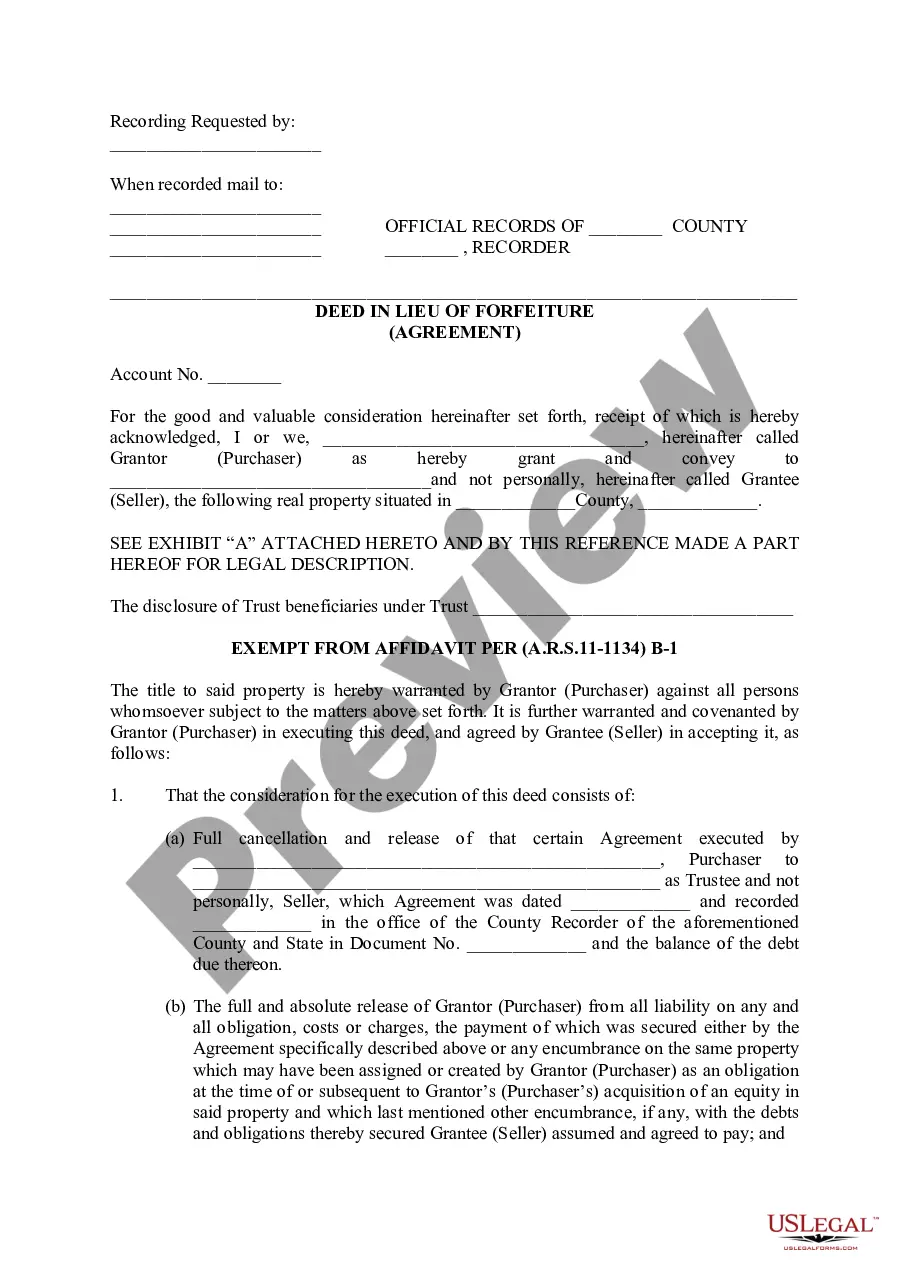

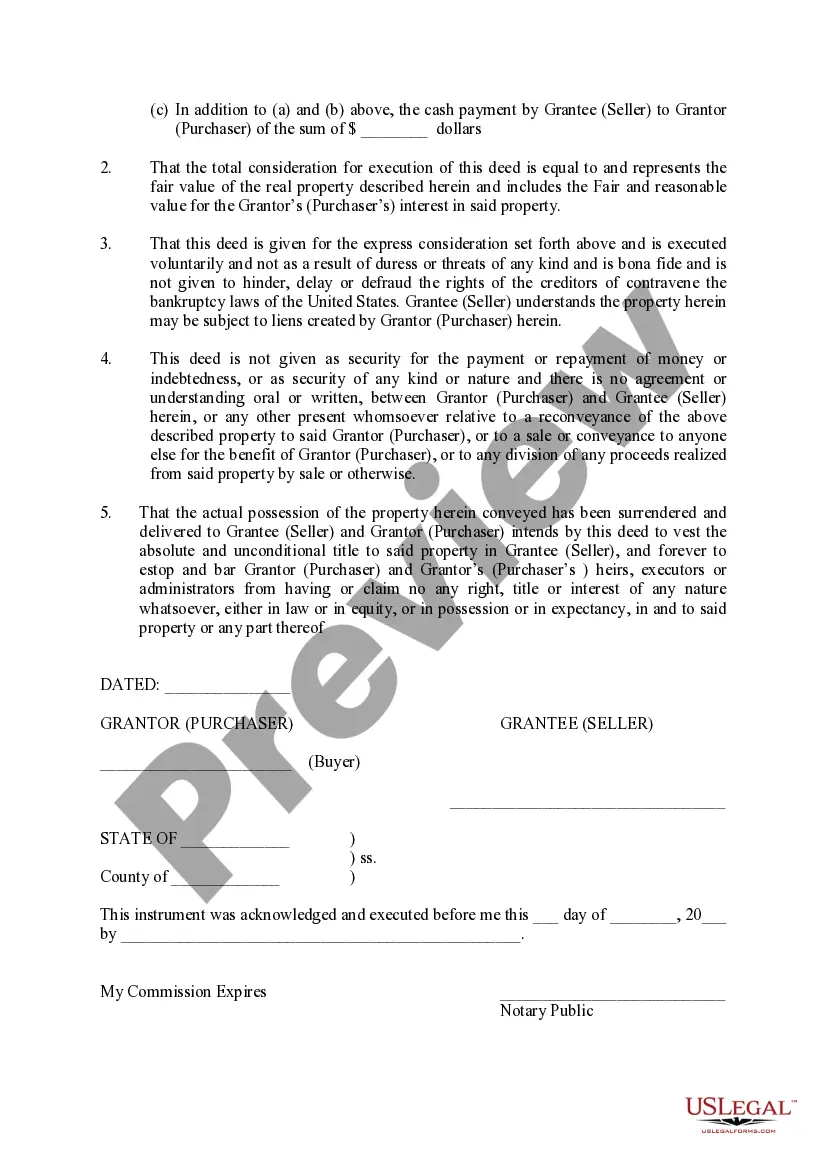

Tucson, Arizona Deed in Lieu of Forfeiture (Agreement) is a legal arrangement that allows a property owner facing potential foreclosure or asset forfeiture to voluntarily transfer their property's title to the lender or government agency in exchange for debt relief or release from potential criminal charges. This agreement is a viable option for individuals or businesses who find themselves unable to meet their financial obligations and wish to mitigate the potential consequences. In Tucson, there are various types of Deed in Lieu of Forfeiture (Agreement) depending on the circumstances and the entity involved. Let's explore a few common types: 1. Mortgage Deed in Lieu of Forfeiture: This type of agreement is typically used in residential or commercial real estate situations. When a homeowner or property owner is unable to make their mortgage payments and faces foreclosure, they may opt for a Mortgage Deed in Lieu of Forfeiture. By voluntarily transferring the property's title to the lender, the borrower can potentially avoid foreclosure proceedings, protect their credit score, and work towards resolving their debt. 2. Criminal Property Forfeiture Deed in Lieu: This agreement can arise in situations where the government seizes property due to its involvement in illegal activities. Instead of going through a formal forfeiture process, the individual or organization involved may choose to enter into a Deed in Lieu of Forfeiture with the law enforcement agency. This may allow them to transfer the property's title willingly, hence avoiding potential criminal charges or litigation. 3. Government Property Forfeiture Deed in Lieu: In cases where individuals or businesses owe substantial debts to the government, such as overdue taxes or unpaid fines, they may consider a Government Property Forfeiture Deed in Lieu. By surrendering the property voluntarily, the debtor may negotiate with the government agency to settle the debt, potentially reducing the amount owed or releasing any further liabilities. 4. Commercial Loan Deed in Lieu of Forfeiture: This type of agreement applies to commercial properties, such as retail spaces, offices, or industrial buildings. When a business owner faces financial distress or struggles to repay a commercial loan, they may engage with the lender to negotiate a Deed in Lieu of Forfeiture. By transferring the property's title back to the lender, the business owner can potentially avoid legal proceedings and minimize the negative impact on their credit history. In summary, Tucson, Arizona Deed in Lieu of Forfeiture (Agreement) is an option for property owners facing financial challenges or potential property seizures. Whether it involves mortgage debts, criminal property seizures, governmental debts, or commercial loans, the Deed in Lieu agreement provides a voluntary transfer of property's title to mitigate the consequences and seek economic relief.

Tucson Arizona Deed in Lieu of Forfeiture (Agreement)

Description

How to fill out Tucson Arizona Deed In Lieu Of Forfeiture (Agreement)?

Take advantage of the US Legal Forms and obtain instant access to any form sample you need. Our useful website with thousands of document templates simplifies the way to find and get almost any document sample you want. You can export, complete, and sign the Tucson Arizona Deed in Lieu of Forfeiture (Agreement) in a few minutes instead of browsing the web for several hours seeking the right template.

Utilizing our catalog is an excellent way to raise the safety of your document filing. Our experienced lawyers regularly check all the records to make sure that the forms are relevant for a particular region and compliant with new acts and regulations.

How can you get the Tucson Arizona Deed in Lieu of Forfeiture (Agreement)? If you already have a subscription, just log in to the account. The Download option will be enabled on all the samples you view. Additionally, you can find all the earlier saved files in the My Forms menu.

If you don’t have an account yet, stick to the instructions below:

- Find the template you need. Make certain that it is the form you were looking for: check its headline and description, and make use of the Preview function when it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Start the downloading procedure. Select Buy Now and select the pricing plan that suits you best. Then, create an account and process your order with a credit card or PayPal.

- Export the file. Select the format to get the Tucson Arizona Deed in Lieu of Forfeiture (Agreement) and modify and complete, or sign it according to your requirements.

US Legal Forms is one of the most considerable and reliable template libraries on the internet. Our company is always happy to help you in virtually any legal case, even if it is just downloading the Tucson Arizona Deed in Lieu of Forfeiture (Agreement).

Feel free to take full advantage of our form catalog and make your document experience as convenient as possible!