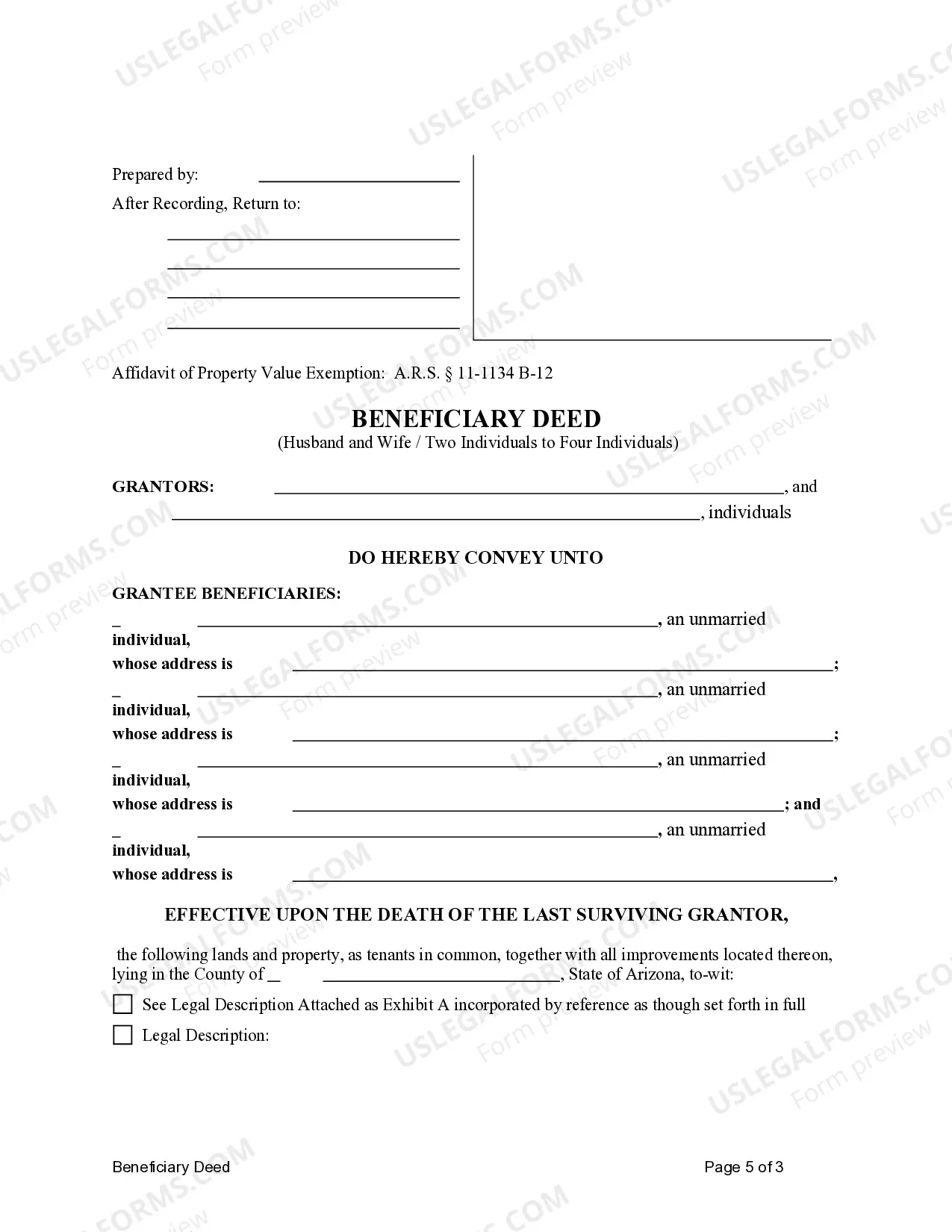

This form is a Transfer on Death Deed where the grantors are husband and wife and the grantees are four individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving grantor. The grantees take the property as tenants in common . This deed complies with all state statutory laws.

Title: Understanding the Glendale Arizona Transfer on Death Deed (TOD) or Beneficiary Deed for Husband and Wife to Four Individuals Introduction: In Glendale, Arizona, property owners have the option to utilize a Transfer on Death Deed (TOD) or Beneficiary Deed to transfer their property to four individuals upon their passing. This legal instrument offers several advantages, including avoiding probate and ensuring a clear and efficient transfer of assets to designated beneficiaries. In this article, we will delve into the details of the Glendale Arizona TOD or Beneficiary Deed, highlighting its benefits and different types. 1. The Glendale Arizona Transfer on Death Deed (TOD): The Transfer on Death Deed (TOD) enables property owners to designate specific beneficiaries who will inherit their property upon the owner's death. The TOD deed does not require probate proceedings, simplifying the transfer process and saving time and costs for both the property owner and beneficiaries. 2. The Glendale Arizona Beneficiary Deed: Similar to the TOD, the Beneficiary Deed is a legal instrument that allows property owners to designate beneficiaries, ensuring a seamless transfer of property upon the owner's demise. The Beneficiary Deed operates similarly to a traditional deed but includes specific provisions that ensure a smoother transfer of property upon the owner's passing. Types of Glendale Arizona Transfer on Death Deed or Beneficiary Deed for Husband and Wife to Four Individuals: 1. Joint Tenancy TOD or Beneficiary Deed: Husband and wife jointly own the property and simultaneously designate four individuals as beneficiaries who will inherit the property once both spouses pass away. This type of TOD or Beneficiary Deed ensures that the property passes directly to the designated individuals without the need for probate or formal legal proceedings. 2. Tenancy in Common TOD or Beneficiary Deed: In this arrangement, four individuals jointly own the property and are named as beneficiaries in the TOD or Beneficiary Deed. Upon the passing of either spouse, their respective share in the property automatically transfers to the designated individuals, bypassing probate. 3. Community Property with Right of Survivorship TOD or Beneficiary Deed: When husband and wife own property as community property with the right of survivorship, they can execute a TOD or Beneficiary Deed designating four individuals to receive the property upon the death of both spouses. This type of deed ensures the property passes directly to the designated beneficiaries, avoiding probate. Conclusion: Utilizing a Glendale Arizona Transfer on Death Deed (TOD) or Beneficiary Deed for a husband and wife to four individuals offers numerous benefits, such as expediting the transfer process and avoiding probate. By choosing the appropriate type of deed, whether Joint Tenancy, Tenancy in Common, or Community Property with Right of Survivorship, property owners can ensure a smooth and efficient transfer of assets to their desired beneficiaries upon their demise.Title: Understanding the Glendale Arizona Transfer on Death Deed (TOD) or Beneficiary Deed for Husband and Wife to Four Individuals Introduction: In Glendale, Arizona, property owners have the option to utilize a Transfer on Death Deed (TOD) or Beneficiary Deed to transfer their property to four individuals upon their passing. This legal instrument offers several advantages, including avoiding probate and ensuring a clear and efficient transfer of assets to designated beneficiaries. In this article, we will delve into the details of the Glendale Arizona TOD or Beneficiary Deed, highlighting its benefits and different types. 1. The Glendale Arizona Transfer on Death Deed (TOD): The Transfer on Death Deed (TOD) enables property owners to designate specific beneficiaries who will inherit their property upon the owner's death. The TOD deed does not require probate proceedings, simplifying the transfer process and saving time and costs for both the property owner and beneficiaries. 2. The Glendale Arizona Beneficiary Deed: Similar to the TOD, the Beneficiary Deed is a legal instrument that allows property owners to designate beneficiaries, ensuring a seamless transfer of property upon the owner's demise. The Beneficiary Deed operates similarly to a traditional deed but includes specific provisions that ensure a smoother transfer of property upon the owner's passing. Types of Glendale Arizona Transfer on Death Deed or Beneficiary Deed for Husband and Wife to Four Individuals: 1. Joint Tenancy TOD or Beneficiary Deed: Husband and wife jointly own the property and simultaneously designate four individuals as beneficiaries who will inherit the property once both spouses pass away. This type of TOD or Beneficiary Deed ensures that the property passes directly to the designated individuals without the need for probate or formal legal proceedings. 2. Tenancy in Common TOD or Beneficiary Deed: In this arrangement, four individuals jointly own the property and are named as beneficiaries in the TOD or Beneficiary Deed. Upon the passing of either spouse, their respective share in the property automatically transfers to the designated individuals, bypassing probate. 3. Community Property with Right of Survivorship TOD or Beneficiary Deed: When husband and wife own property as community property with the right of survivorship, they can execute a TOD or Beneficiary Deed designating four individuals to receive the property upon the death of both spouses. This type of deed ensures the property passes directly to the designated beneficiaries, avoiding probate. Conclusion: Utilizing a Glendale Arizona Transfer on Death Deed (TOD) or Beneficiary Deed for a husband and wife to four individuals offers numerous benefits, such as expediting the transfer process and avoiding probate. By choosing the appropriate type of deed, whether Joint Tenancy, Tenancy in Common, or Community Property with Right of Survivorship, property owners can ensure a smooth and efficient transfer of assets to their desired beneficiaries upon their demise.