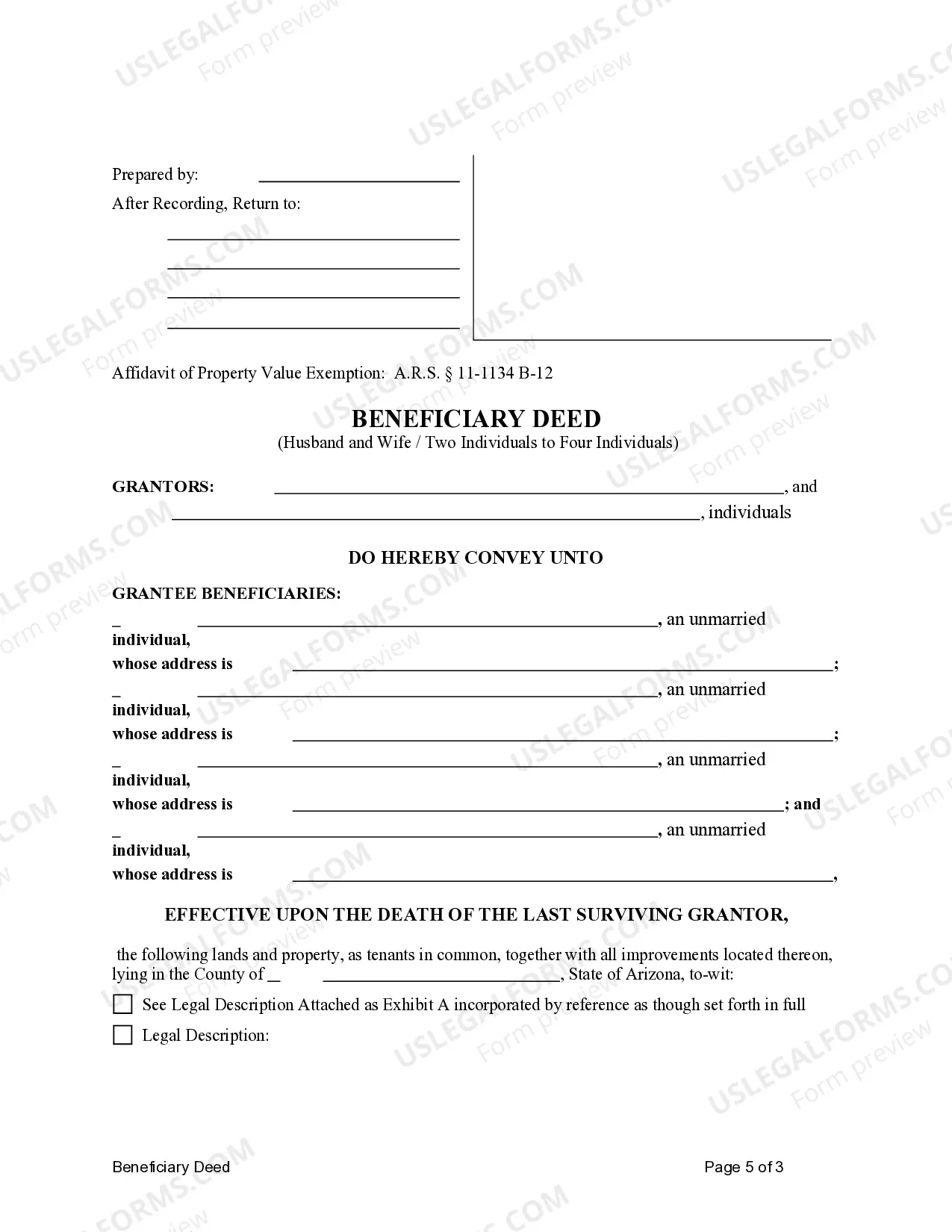

This form is a Transfer on Death Deed where the grantors are husband and wife and the grantees are four individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving grantor. The grantees take the property as tenants in common . This deed complies with all state statutory laws.

A Transfer on Death Deed (TOD), commonly known as a Beneficiary Deed in Scottsdale, Arizona, is a legal document that allows an individual to transfer their property to named beneficiaries upon their death, without the need for probate. This type of deed is particularly beneficial for married couples who wish to leave their property to multiple individuals, as it ensures a smooth and efficient transfer of ownership. In Scottsdale, there are various types of Transfer on Death Deeds or TOD — Beneficiary Deeds available for husband and wife to four individuals: 1. Joint Tenancy with Right of Survivorship: This type of TOD deed allows a husband and wife to transfer their property to four individuals while maintaining joint ownership and the right of survivorship. In the event of the death of one spouse, the surviving spouse automatically becomes the sole owner of the property, and upon the death of both spouses, the property transfers to the named beneficiaries. 2. Tenancy in Common: A TOD deed can also be structured as a tenancy in common. In this arrangement, each spouse owns an undivided interest in the property, and upon their death, their respective share is transferred to the named beneficiaries. Unlike joint tenancy, the right of survivorship does not apply, and each spouse can designate specific shares for each beneficiary. 3. Community Property with Right of Survivorship: This TOD deed is available for married couples and is specifically applicable in community property states, including Arizona. Community property acquired during marriage is considered equally owned by both spouses. With this deed, the property is automatically transferred to the surviving spouse upon the death of one spouse, and upon the death of both spouses, it passes to the four named beneficiaries. 4. Life Estate with Remainder Interest: Another option is to set up a TOD deed with a life estate, where the husband and wife retain ownership and the right to live in the property until their death. After the death of both spouses, the property automatically transfers to the four individuals named as beneficiaries, who hold the remainder interest. This arrangement allows the spouses to live in the property while ensuring its transfer to the beneficiaries without probate. By utilizing Scottsdale Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Four Individuals, individuals can ensure the seamless transfer of their property to their chosen beneficiaries, while avoiding the complexities and delays associated with probate. Consulting with a legal professional experienced in estate planning and real estate law is highly recommended ensuring the proper execution of these deeds and to comply with legal requirements in Arizona.A Transfer on Death Deed (TOD), commonly known as a Beneficiary Deed in Scottsdale, Arizona, is a legal document that allows an individual to transfer their property to named beneficiaries upon their death, without the need for probate. This type of deed is particularly beneficial for married couples who wish to leave their property to multiple individuals, as it ensures a smooth and efficient transfer of ownership. In Scottsdale, there are various types of Transfer on Death Deeds or TOD — Beneficiary Deeds available for husband and wife to four individuals: 1. Joint Tenancy with Right of Survivorship: This type of TOD deed allows a husband and wife to transfer their property to four individuals while maintaining joint ownership and the right of survivorship. In the event of the death of one spouse, the surviving spouse automatically becomes the sole owner of the property, and upon the death of both spouses, the property transfers to the named beneficiaries. 2. Tenancy in Common: A TOD deed can also be structured as a tenancy in common. In this arrangement, each spouse owns an undivided interest in the property, and upon their death, their respective share is transferred to the named beneficiaries. Unlike joint tenancy, the right of survivorship does not apply, and each spouse can designate specific shares for each beneficiary. 3. Community Property with Right of Survivorship: This TOD deed is available for married couples and is specifically applicable in community property states, including Arizona. Community property acquired during marriage is considered equally owned by both spouses. With this deed, the property is automatically transferred to the surviving spouse upon the death of one spouse, and upon the death of both spouses, it passes to the four named beneficiaries. 4. Life Estate with Remainder Interest: Another option is to set up a TOD deed with a life estate, where the husband and wife retain ownership and the right to live in the property until their death. After the death of both spouses, the property automatically transfers to the four individuals named as beneficiaries, who hold the remainder interest. This arrangement allows the spouses to live in the property while ensuring its transfer to the beneficiaries without probate. By utilizing Scottsdale Arizona Transfer on Death Deed or TOD — Beneficiary Deed for Husband and Wife to Four Individuals, individuals can ensure the seamless transfer of their property to their chosen beneficiaries, while avoiding the complexities and delays associated with probate. Consulting with a legal professional experienced in estate planning and real estate law is highly recommended ensuring the proper execution of these deeds and to comply with legal requirements in Arizona.