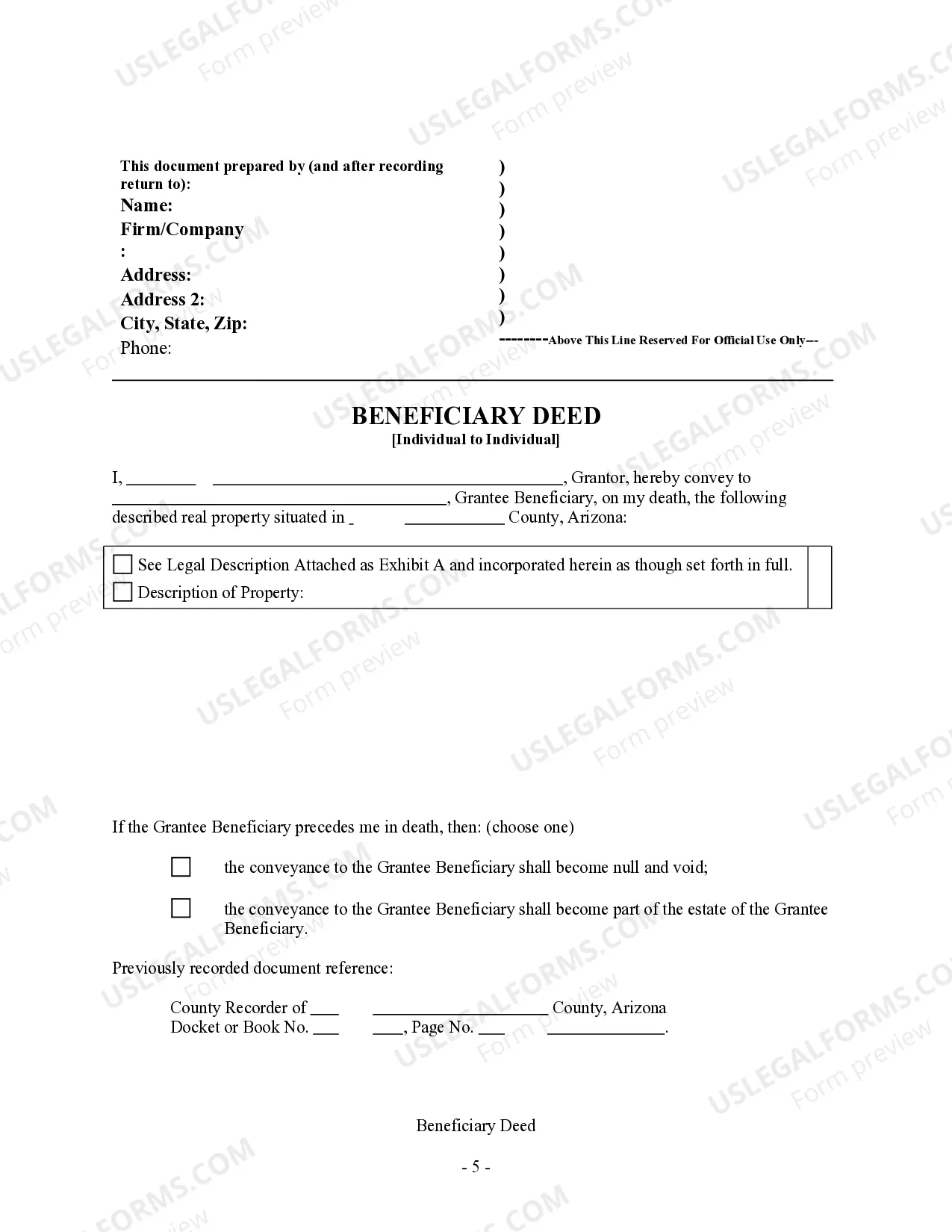

This form is a Beneficiary or Transfer on Death Deed where the grantor is an Individual and the Grantee is an Individual. This transfer is revocable by Grantor until his or her death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

A Transfer on Death Deed, also known as a TOD or Beneficiary Deed, is a legal document used in Tucson, Arizona, that allows an individual to designate a beneficiary or beneficiaries for their real estate property upon their passing. This type of deed helps to streamline the transfer of property to the designated beneficiary without the need for probate. Tucson offers different types of Transfer on Death Deeds or Beneficiary Deeds for individuals looking to plan for the future transfer of their property to loved ones. These include: 1. Tucson Revocable Transfer on Death Deed: This deed allows the property owner to name one or more beneficiaries who will inherit the property upon their death. The owner retains the right to change or revoke the designation at any time during their lifetime. 2. Tucson Irrevocable Transfer on Death Deed: With this type of deed, the property owner designates one or more beneficiaries to inherit the property upon their passing, and this designation cannot be changed or revoked without the consent of the beneficiaries. 3. Tucson Joint Tenancy with Right of Survivorship Transfer on Death Deed: This deed is specifically designed for joint property owners. It allows the surviving owner(s) to automatically inherit the property upon the death of the other joint owner(s) without the need for probate. 4. Tucson Community Property with Right of Survivorship Transfer on Death Deed: This deed is applicable to married couples who own property as community property. It ensures that the surviving spouse automatically becomes the sole owner of the property upon the death of their spouse, avoiding probate. 5. Tucson Tenants in Common Transfer on Death Deed: This deed allows multiple owners to individually designate their own beneficiaries for their respective share of the property. Upon the owner's death, their designated beneficiary inherits their portion of the property. By utilizing Tucson Transfer on Death Deeds or Beneficiary Deeds, individuals can have peace of mind knowing that their property will be efficiently transferred to their chosen beneficiaries without the hassle and expense of probate. It is advisable to consult with a qualified attorney familiar with Tucson real estate laws to ensure the proper preparation and execution of these deeds.