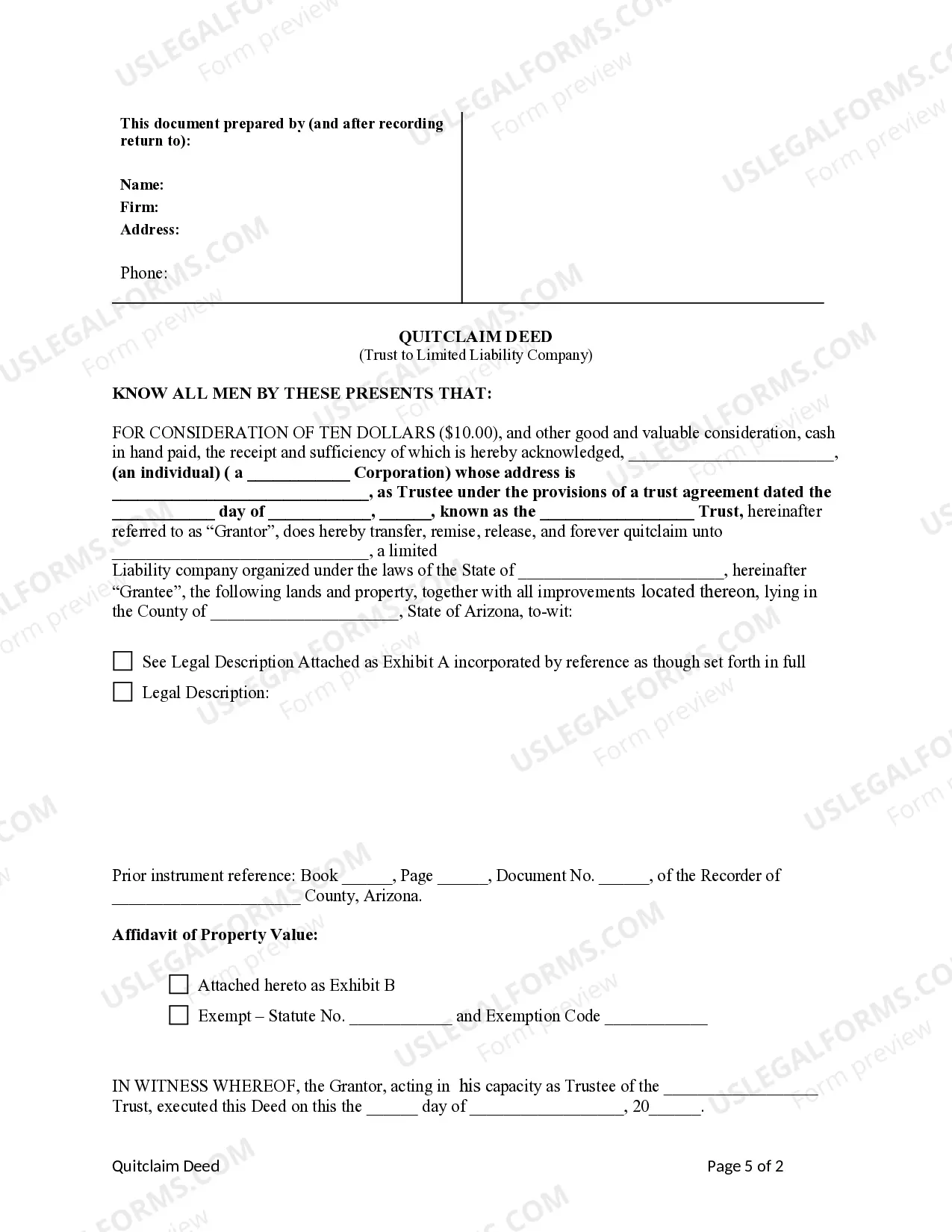

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantee is a Limited Liability Company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Lima Arizona Quitclaim Deed — Trust to Limited Liability Company is a legal document that transfers ownership of a property held in trust to a limited liability company (LLC) without any warranties or guarantees. This type of quitclaim deed is commonly used when a property that is owned by a trust needs to be transferred to an LLC for various purposes, such as asset protection or business planning. The Lima Arizona Quitclaim Deed — Trust to Limited Liability Company ensures a smooth and transparent transfer of ownership from the trust to the LLC, allowing the LLC to assume full control and responsibility for the property. It is important to note that a quitclaim deed does not guarantee clear title to the property, as it only transfers the interest that the trust holds in the property. Any existing liens or encumbrances will still remain on the property. There are different variations of the Lima Arizona Quitclaim Deed — Trust to Limited Liability Company, including: 1. Individual to LLC: This type of quitclaim deed is used when a property held in an individual's name is transferred to an LLC owned by that individual. It allows for personal liability protection and separates the individual's personal assets from the property. 2. Trustee to LLC: This variation involves transferring property from a trust, where an individual or entity acts as a trustee, to an LLC. It allows for flexibility in managing and protecting the property within the LLC structure. 3. Family Trust to LLC: In this scenario, a property held in a family trust can be transferred to an LLC owned by family members. It provides a formal structure for managing and distributing the property's assets within the family. 4. Living Trust to LLC: A living trust, also known as a revocable trust, can be used to transfer property to an LLC. This type of trust allows the settler to maintain control of the trust assets during their lifetime while simplifying the transfer of ownership to the LLC upon their death. The Lima Arizona Quitclaim Deed — Trust to Limited Liability Company is a versatile legal tool that allows for the seamless transition of property ownership from a trust to an LLC. It is crucial to consult with a qualified real estate attorney or legal professional to ensure compliance with local laws and regulations, as well as to address any specific circumstances or requirements associated with the transfer.A Lima Arizona Quitclaim Deed — Trust to Limited Liability Company is a legal document that transfers ownership of a property held in trust to a limited liability company (LLC) without any warranties or guarantees. This type of quitclaim deed is commonly used when a property that is owned by a trust needs to be transferred to an LLC for various purposes, such as asset protection or business planning. The Lima Arizona Quitclaim Deed — Trust to Limited Liability Company ensures a smooth and transparent transfer of ownership from the trust to the LLC, allowing the LLC to assume full control and responsibility for the property. It is important to note that a quitclaim deed does not guarantee clear title to the property, as it only transfers the interest that the trust holds in the property. Any existing liens or encumbrances will still remain on the property. There are different variations of the Lima Arizona Quitclaim Deed — Trust to Limited Liability Company, including: 1. Individual to LLC: This type of quitclaim deed is used when a property held in an individual's name is transferred to an LLC owned by that individual. It allows for personal liability protection and separates the individual's personal assets from the property. 2. Trustee to LLC: This variation involves transferring property from a trust, where an individual or entity acts as a trustee, to an LLC. It allows for flexibility in managing and protecting the property within the LLC structure. 3. Family Trust to LLC: In this scenario, a property held in a family trust can be transferred to an LLC owned by family members. It provides a formal structure for managing and distributing the property's assets within the family. 4. Living Trust to LLC: A living trust, also known as a revocable trust, can be used to transfer property to an LLC. This type of trust allows the settler to maintain control of the trust assets during their lifetime while simplifying the transfer of ownership to the LLC upon their death. The Lima Arizona Quitclaim Deed — Trust to Limited Liability Company is a versatile legal tool that allows for the seamless transition of property ownership from a trust to an LLC. It is crucial to consult with a qualified real estate attorney or legal professional to ensure compliance with local laws and regulations, as well as to address any specific circumstances or requirements associated with the transfer.