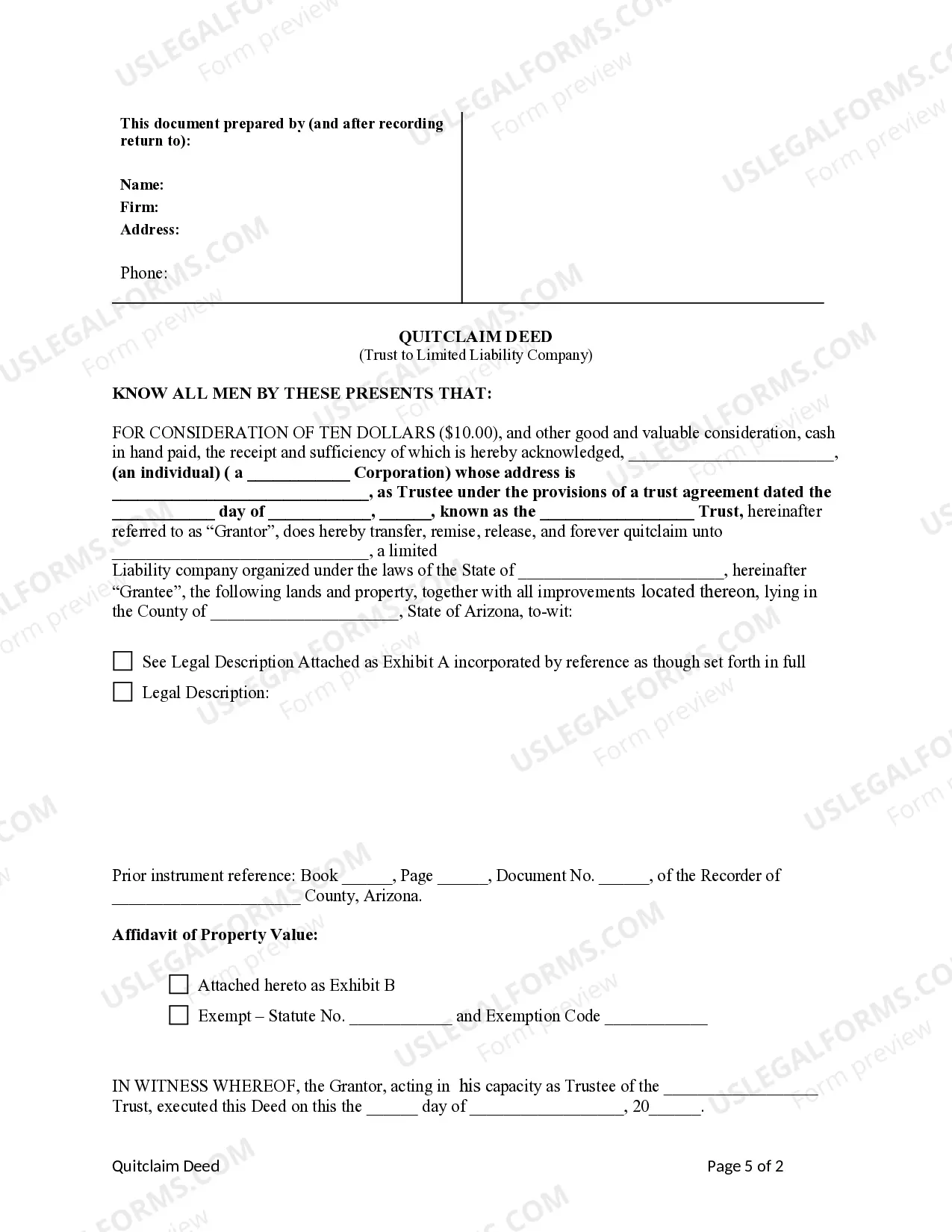

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantee is a Limited Liability Company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Surprise Arizona Quitclaim Deed — Trust to Limited Liability Company is a legal document that facilitates the transfer of property ownership from a trust to a limited liability company (LLC) in Surprise, Arizona. This type of deed is commonly used in real estate transactions where the property is held in a trust and the trustees wish to transfer it to an LLC for various reasons. The Surprise Arizona Quitclaim Deed — Trust to Limited Liability Company is a tool that provides a seamless transfer of property ownership without title insurance or warranties. It is important to note that a quitclaim deed transfers property ownership "as-is," meaning the granter does not guarantee that they own the property or that it is free from any encumbrances. There are different variations of the Surprise Arizona Quitclaim Deed — Trust to Limited Liability Company, including: 1. Individual Trust to LLC Quitclaim Deed: This type of deed is used when the trust holding the property is owned by an individual. The individual, as the trustee, transfers the property to an LLC they own or are a member of. 2. Joint Trust to LLC Quitclaim Deed: When the property is held in a joint trust, where multiple individuals are trustees, this type of deed is used to transfer the property to an LLC. The trustees as a whole sign the deed and transfer the property to the LLC. 3. Revocable Trust to LLC Quitclaim Deed: This deed is used when the property is held in a revocable trust, usually for estate planning purposes. The granter, who is also the trustee of the revocable trust, transfers the property to an LLC they control or partially own. 4. Irrevocable Trust to LLC Quitclaim Deed: When the property is held in an irrevocable trust, typically created for specific asset protection or tax planning purposes, this type of deed is utilized. The granter, who may not be the trustee, transfers the property to an LLC. It is crucial to consult with a qualified attorney or real estate professional well-versed in Arizona real estate laws and regulations before executing a Surprise Arizona Quitclaim Deed — Trust to Limited Liability Company. This will ensure a seamless and legally-binding transfer of property ownership from a trust to an LLC while protecting the rights and interests of all parties involved.Surprise Arizona Quitclaim Deed — Trust to Limited Liability Company is a legal document that facilitates the transfer of property ownership from a trust to a limited liability company (LLC) in Surprise, Arizona. This type of deed is commonly used in real estate transactions where the property is held in a trust and the trustees wish to transfer it to an LLC for various reasons. The Surprise Arizona Quitclaim Deed — Trust to Limited Liability Company is a tool that provides a seamless transfer of property ownership without title insurance or warranties. It is important to note that a quitclaim deed transfers property ownership "as-is," meaning the granter does not guarantee that they own the property or that it is free from any encumbrances. There are different variations of the Surprise Arizona Quitclaim Deed — Trust to Limited Liability Company, including: 1. Individual Trust to LLC Quitclaim Deed: This type of deed is used when the trust holding the property is owned by an individual. The individual, as the trustee, transfers the property to an LLC they own or are a member of. 2. Joint Trust to LLC Quitclaim Deed: When the property is held in a joint trust, where multiple individuals are trustees, this type of deed is used to transfer the property to an LLC. The trustees as a whole sign the deed and transfer the property to the LLC. 3. Revocable Trust to LLC Quitclaim Deed: This deed is used when the property is held in a revocable trust, usually for estate planning purposes. The granter, who is also the trustee of the revocable trust, transfers the property to an LLC they control or partially own. 4. Irrevocable Trust to LLC Quitclaim Deed: When the property is held in an irrevocable trust, typically created for specific asset protection or tax planning purposes, this type of deed is utilized. The granter, who may not be the trustee, transfers the property to an LLC. It is crucial to consult with a qualified attorney or real estate professional well-versed in Arizona real estate laws and regulations before executing a Surprise Arizona Quitclaim Deed — Trust to Limited Liability Company. This will ensure a seamless and legally-binding transfer of property ownership from a trust to an LLC while protecting the rights and interests of all parties involved.