Title: Gilbert Arizona Notice of Levy for Delinquent Taxes: Understanding its Types and Relevant Information Introduction: A Gilbert Arizona Notice of Levy for Delinquent Taxes is an official document issued by the local tax authorities in Gilbert, Arizona, as a means to collect unpaid taxes. When a taxpayer fails to pay their outstanding tax liabilities, this notice serves as an enforcement tool that allows the government to levy a taxpayer's assets to fulfill their tax obligations. This detailed description will explore the types of Gilbert Arizona Notice of Levy for Delinquent Taxes and provide essential information regarding their implications. Types of Gilbert Arizona Notice of Levy for Delinquent Taxes: 1. Wage Levy: In the case of a delinquent taxpayer employed in Gilbert, Arizona, the tax authorities can issue a wage levy. This type of levy allows the government to instruct the employer to withhold a portion of the taxpayer's wages to satisfy the unpaid taxes. The employer is legally obligated to comply with the wage levy until the tax debt is paid off. 2. Bank Levy: A bank levy is another method employed by the Gilbert tax authorities to recover delinquent taxes. This levy allows the government to freeze the funds held by the taxpayer in their bank accounts. Once frozen, the funds are then seized to settle the outstanding tax obligation. This notice will be accompanied by instructions specifying the duration of the freeze and the procedure to resolve the delinquency. 3. Property Levy: For severe cases of tax delinquency, a Gilbert Arizona Notice of Levy for Delinquent Taxes may extend to the taxpayer's property, including real estate, vehicles, or other valuable assets. The tax authorities can seize and sell these properties to recover the unpaid taxes. This type of levy is usually considered when all other collection methods have been exhausted. Important Details and Implications: 1. Issuance and Delivery: The Gilbert Arizona Notice of Levy for Delinquent Taxes is typically issued by the Gilbert tax authorities after multiple unsuccessful attempts to collect taxes directly from the taxpayer. It will be delivered via certified mail, personally served by an authorized tax official, or left at the taxpayer's residence or place of business. 2. Response and Resolution: Upon receiving the notice, it is crucial for the delinquent taxpayer to promptly respond and take necessary action. Ignoring the notice can lead to further consequences, such as additional penalties and fees. Consulting a tax professional or contacting the tax authorities directly is advisable to explore payment plans, negotiate a settlement, or address any potential errors. 3. Financial Hardship Relief: In certain cases where the delinquent taxpayer is facing financial hardship, it is possible to request relief or a temporary hold on the levy. Providing relevant documentation and evidence of financial hardship, such as income statements, medical bills, or unemployment notices, can support such requests. Conclusion: The Gilbert Arizona Notice of Levy for Delinquent Taxes serves as a powerful tool for the tax authorities to ensure compliance with tax obligations. By understanding the different types of levy and their implications, taxpayers can make informed decisions to address their delinquent taxes and work towards resolving their outstanding liabilities in Gilbert, Arizona. Seeking professional guidance and engaging with the tax authorities are pivotal steps towards finding a suitable resolution.

Gilbert Arizona Notice of Levy for Delinquent Taxes

Description

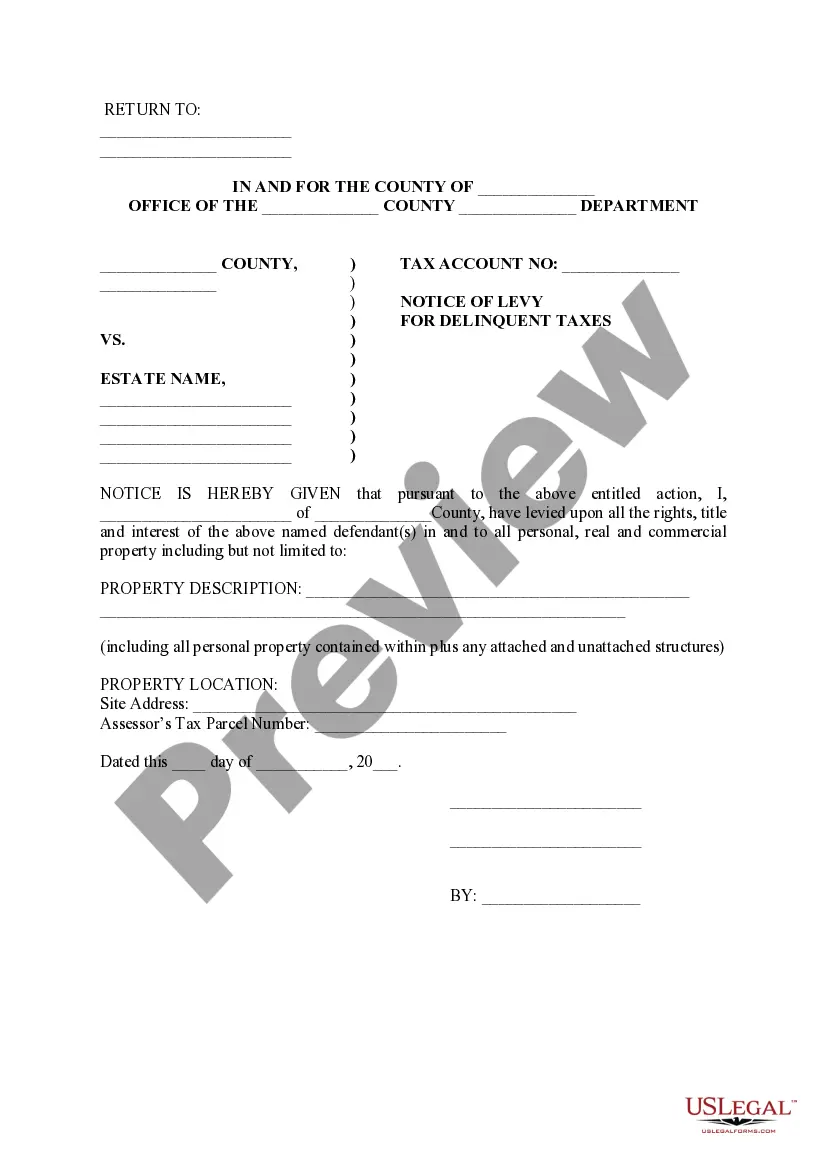

How to fill out Gilbert Arizona Notice Of Levy For Delinquent Taxes?

If you are looking for a relevant form, it’s extremely hard to find a more convenient service than the US Legal Forms website – probably the most considerable libraries on the internet. With this library, you can get a large number of document samples for business and individual purposes by types and states, or keywords. With the advanced search feature, getting the most up-to-date Gilbert Arizona Notice of Levy for Delinquent Taxes is as easy as 1-2-3. Additionally, the relevance of each file is proved by a team of professional lawyers that on a regular basis check the templates on our website and revise them according to the most recent state and county regulations.

If you already know about our system and have a registered account, all you need to get the Gilbert Arizona Notice of Levy for Delinquent Taxes is to log in to your account and click the Download button.

If you utilize US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have found the sample you need. Look at its information and utilize the Preview function to see its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to discover the appropriate document.

- Affirm your decision. Choose the Buy now button. Following that, pick the preferred pricing plan and provide credentials to register an account.

- Make the purchase. Use your bank card or PayPal account to finish the registration procedure.

- Obtain the form. Select the format and save it on your device.

- Make modifications. Fill out, edit, print, and sign the obtained Gilbert Arizona Notice of Levy for Delinquent Taxes.

Every single form you save in your account has no expiration date and is yours forever. It is possible to access them using the My Forms menu, so if you need to have an extra copy for editing or creating a hard copy, feel free to come back and save it once again at any time.

Take advantage of the US Legal Forms extensive collection to gain access to the Gilbert Arizona Notice of Levy for Delinquent Taxes you were seeking and a large number of other professional and state-specific templates on a single website!