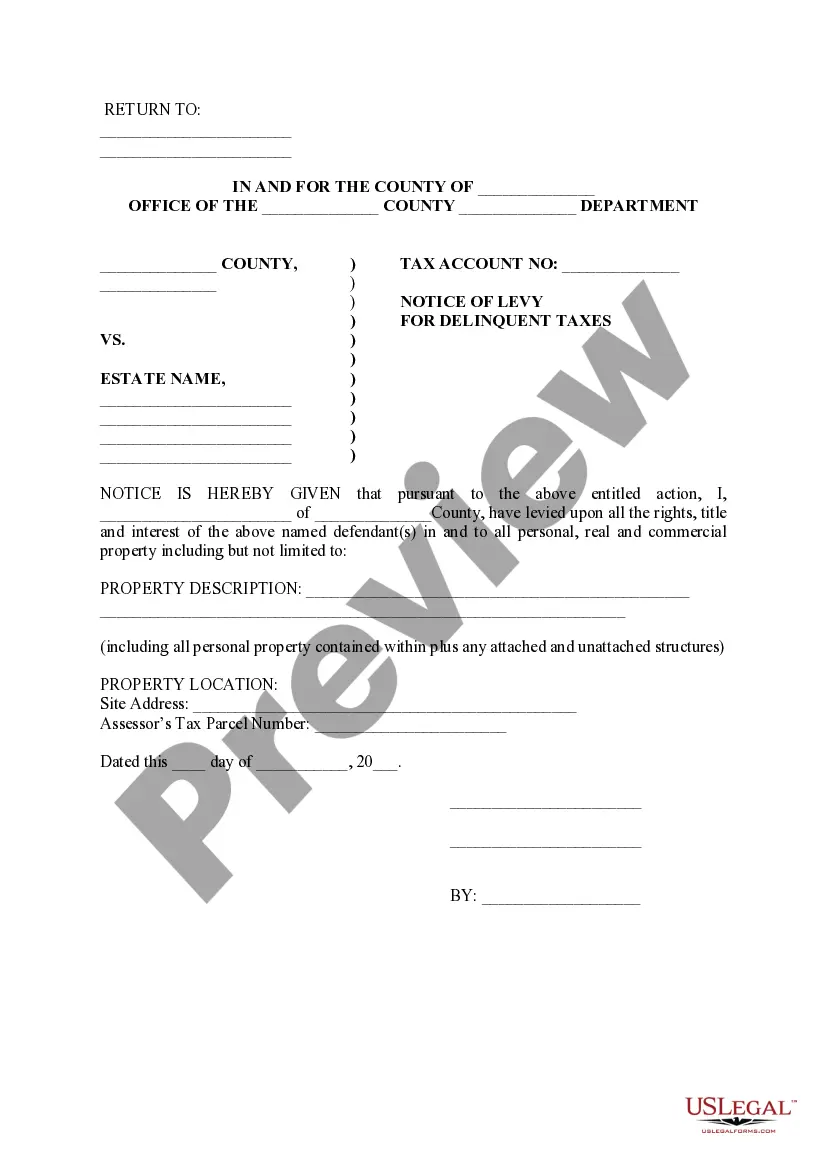

A Glendale Arizona Notice of Levy for Delinquent Taxes is a formal communication issued by the Glendale Arizona tax authorities to individuals or businesses who have failed to pay their taxes on time. This notice acts as a legal document indicating that the City of Glendale is going to take legal action to collect the outstanding tax debt. The Notice of Levy for Delinquent Taxes is typically sent after multiple attempts to collect the tax debt have been unsuccessful. It serves as a final warning to the taxpayer, informing them of the serious consequences they may face if they don't take immediate action to resolve their tax liabilities. The notice contains essential information such as the taxpayer's name, address, tax identification number, and the amount of outstanding taxes owed to the City of Glendale. It also specifies the deadline by which the taxpayer must either pay the full amount owed or contact the tax authorities to discuss potential repayment options. If the taxpayer fails to respond or settle the debt by the specified deadline, the city may proceed with various types of levies to collect the outstanding taxes. These may include: 1. Bank Levy: The tax authorities can legally freeze and seize funds from the taxpayer's bank account(s) to satisfy the delinquent tax debt. This action can be paralyzing for individuals or businesses as it limits access to their funds until the debt is fully paid. 2. Wage Garnishment: With wage garnishment, the city can legally instruct the taxpayer's employer to withhold a portion of their wages directly from their paycheck and remit it to the city until the tax debt is paid off. This type of levy can significantly impact a taxpayer's financial stability and ability to meet their daily expenses. 3. Property Levy: The tax authorities can place a lien on the taxpayer's property, including real estate, vehicles, or other assets. This means that if the taxpayer attempts to sell or transfer the property before satisfying the tax debt, the city has the right to claim the proceeds to cover the unpaid taxes. Receiving a Glendale Arizona Notice of Levy for Delinquent Taxes is a serious matter that should not be taken lightly. It is crucial for taxpayers to promptly address the notice to avoid further legal consequences, such as additional penalties, interests, or even asset seizures. Seeking professional tax assistance or contacting the Glendale Arizona tax authorities directly is highly recommended exploring potential solutions and negotiate a resolution to the tax debt issue.

Glendale Arizona Notice of Levy for Delinquent Taxes

Description

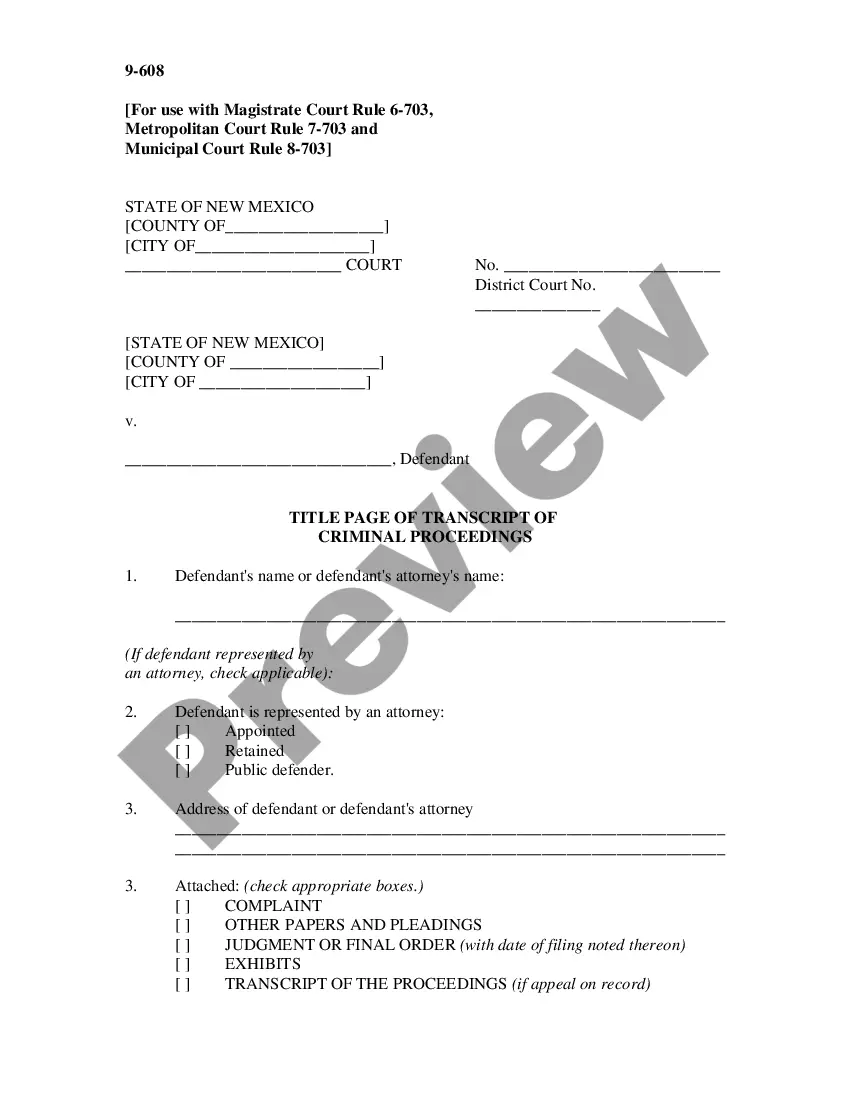

How to fill out Glendale Arizona Notice Of Levy For Delinquent Taxes?

No matter the social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Too often, it’s practically impossible for a person without any law education to draft such paperwork from scratch, mainly due to the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our service provides a massive collection with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal case. US Legal Forms also is an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you require the Glendale Arizona Notice of Levy for Delinquent Taxes or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Glendale Arizona Notice of Levy for Delinquent Taxes in minutes employing our reliable service. In case you are already an existing customer, you can proceed to log in to your account to download the needed form.

However, in case you are unfamiliar with our platform, make sure to follow these steps prior to downloading the Glendale Arizona Notice of Levy for Delinquent Taxes:

- Ensure the form you have chosen is good for your area considering that the regulations of one state or county do not work for another state or county.

- Review the form and read a short outline (if provided) of scenarios the document can be used for.

- If the form you selected doesn’t meet your requirements, you can start over and search for the suitable document.

- Click Buy now and pick the subscription plan you prefer the best.

- utilizing your credentials or register for one from scratch.

- Choose the payment method and proceed to download the Glendale Arizona Notice of Levy for Delinquent Taxes once the payment is done.

You’re all set! Now you can proceed to print out the form or complete it online. Should you have any issues getting your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.