Title: Understanding the Lima, Arizona Notice of Levy for Delinquent Taxes: Types and Implications Introduction: The Lima, Arizona Notice of Levy for Delinquent Taxes is a legal document that serves as a notification from the local tax authority to a taxpayer who has failed to pay their taxes on time. This notice highlights the consequences of non-payment and provides information on potential actions the authority may take to recoup the owed tax amount. This comprehensive guide aims to break down the intricacies of the Lima, Arizona Notice of Levy for Delinquent Taxes and shed light on the different types available. 1. Lima, Arizona Notice of Levy for Property Taxes: One type of Notice of Levy in Lima, Arizona relates to delinquent property taxes. When a property owner fails to pay their property taxes by the specified due date, the local tax authority may issue this notice, informing them about potential enforcement actions. The notice outlines the process of property seizure and sale, which is a possible outcome if the taxes remain unpaid. 2. Lima, Arizona Notice of Levy for Income Taxes: Another notable type of Notice of Levy concerns delinquent income taxes. If taxpayers fail to fulfill their income tax obligations by the established deadline, they risk receiving this notice. The document informs them about the intention of the tax authority to seize their income sources, such as wages or self-employment earnings, to satisfy the tax debt. 3. Lima, Arizona Notice of Levy for Business Taxes: Business owners who fall behind on their tax payments may encounter a specific type of Notice of Levy. This notice serves as a formal warning, notifying them of potential levies on their business assets or bank accounts. The local tax authority outlines the procedure for collecting the owed tax amount, which may include seizing business assets or freezing bank accounts. 4. Lima, Arizona Notice of Levy for Sales Taxes: Retailers or businesses collecting sales taxes on behalf of the state may receive a Notice of Levy when they fail to submit the collected sales taxes in a timely manner. This notice alerts the business owner about potential actions that may be taken to recover the unpaid sales taxes. The authority may resort to seizing business assets or applying a levy on the business's bank accounts. Conclusion: The Lima, Arizona Notice of Levy for Delinquent Taxes encompasses various types of notices related to different tax obligations, highlighting the potential consequences of non-payment. These types may include the Notice of Levy for Property Taxes, Income Taxes, Business Taxes, and Sales Taxes. It is crucial for taxpayers to be aware of these notices and their implications to address any outstanding tax debts promptly. Seeking professional assistance or contacting the local tax authority is advisable to explore potential options for resolution and avoid further complications.

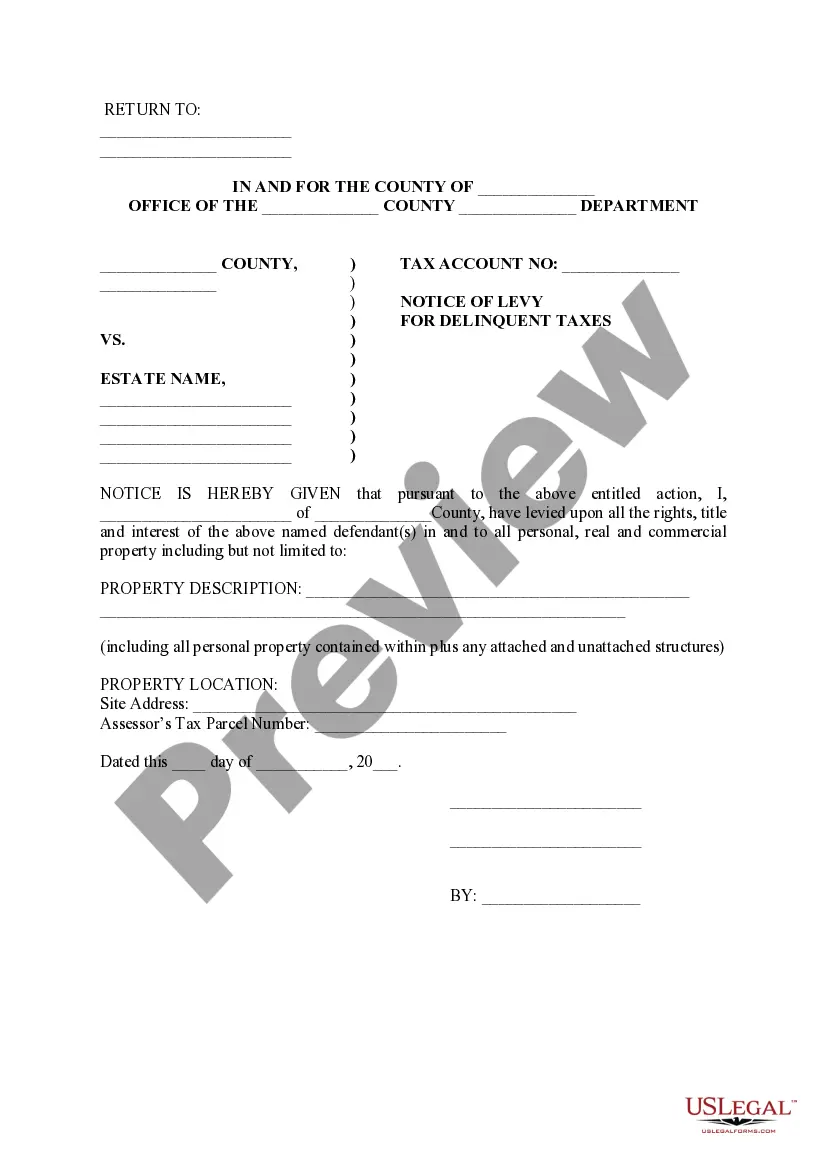

Pima Arizona Notice of Levy for Delinquent Taxes

Description

How to fill out Pima Arizona Notice Of Levy For Delinquent Taxes?

Are you looking for a reliable and inexpensive legal forms supplier to buy the Pima Arizona Notice of Levy for Delinquent Taxes? US Legal Forms is your go-to choice.

Whether you require a simple agreement to set rules for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed in accordance with the requirements of particular state and county.

To download the document, you need to log in account, find the required form, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time in the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Pima Arizona Notice of Levy for Delinquent Taxes conforms to the laws of your state and local area.

- Go through the form’s description (if available) to learn who and what the document is intended for.

- Start the search over if the form isn’t suitable for your specific situation.

Now you can register your account. Then pick the subscription plan and proceed to payment. Once the payment is completed, download the Pima Arizona Notice of Levy for Delinquent Taxes in any available file format. You can get back to the website when you need and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time learning about legal papers online once and for all.