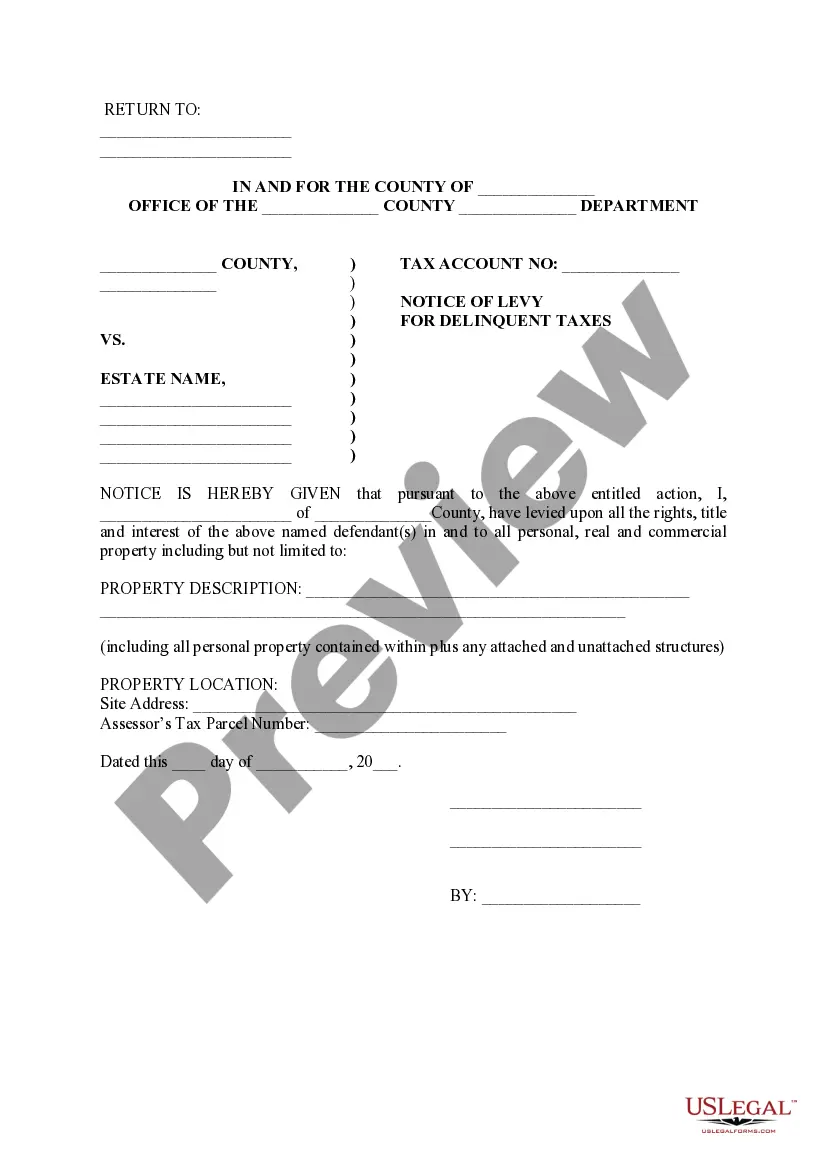

A Scottsdale Arizona Notice of Levy for Delinquent Taxes is a legal document issued by the tax authorities in Scottsdale, Arizona to individuals or businesses who owe outstanding taxes. This notice serves as a warning to the taxpayer that their assets may be seized or their wages garnished if they fail to settle their tax debt promptly. The Scottsdale Arizona Notice of Levy for Delinquent Taxes is specifically designed to notify taxpayers of their legal obligation to pay their outstanding taxes. It includes detailed information about the amount owed, the tax years in question, and the specific tax laws that the taxpayer has violated. The notice also outlines the consequences of non-compliance, such as the seizure of bank accounts, real estate, vehicles, or other valuable assets to satisfy the tax debt. There are different types of Scottsdale Arizona Notice of Levy for Delinquent Taxes, depending on the taxpayer's circumstances and the severity of their delinquency. Some common types include: 1. Wage Levy: This type of levy allows the tax authorities to garnish a portion of the taxpayer's wages or salary until the tax debt is fully paid off. The employer is legally obligated to comply with the levy and deduct the specified amount from the taxpayer's paycheck. 2. Bank Levy: A bank levy authorizes the tax authorities to freeze the taxpayer's bank account(s) and withdraw funds to cover the outstanding tax debt. Once the funds are seized, they are applied towards the tax liability, thereby reducing or eliminating the debt. 3. Property Levy: In more severe cases of delinquency, the tax authorities may issue a property levy, where they seize and sell the taxpayer's real estate, vehicles, or other valuable assets to satisfy the tax debt. The proceeds from the sale are used to repay the delinquent taxes, and any remaining amounts are returned to the taxpayer. It is important for individuals and businesses in Scottsdale, Arizona to take the Scottsdale Arizona Notice of Levy for Delinquent Taxes seriously. Ignoring or avoiding payment of tax debts can lead to significant financial consequences, as the tax authorities have the power to enforce collection through various forms of levies. It is advisable for affected taxpayers to seek professional assistance from tax attorneys or consultants, who can provide guidance, negotiate with the tax authorities, and explore potential solutions to resolve the delinquency.

Scottsdale Arizona Notice of Levy for Delinquent Taxes

Category:

State:

Arizona

City:

Scottsdale

Control #:

AZ-046LRS

Format:

Word;

Rich Text

Instant download

Description

This Notice of Levy permits the legal seizure of title and interest to all personal, real, and commercial property to satisfy a tax debt.

A Scottsdale Arizona Notice of Levy for Delinquent Taxes is a legal document issued by the tax authorities in Scottsdale, Arizona to individuals or businesses who owe outstanding taxes. This notice serves as a warning to the taxpayer that their assets may be seized or their wages garnished if they fail to settle their tax debt promptly. The Scottsdale Arizona Notice of Levy for Delinquent Taxes is specifically designed to notify taxpayers of their legal obligation to pay their outstanding taxes. It includes detailed information about the amount owed, the tax years in question, and the specific tax laws that the taxpayer has violated. The notice also outlines the consequences of non-compliance, such as the seizure of bank accounts, real estate, vehicles, or other valuable assets to satisfy the tax debt. There are different types of Scottsdale Arizona Notice of Levy for Delinquent Taxes, depending on the taxpayer's circumstances and the severity of their delinquency. Some common types include: 1. Wage Levy: This type of levy allows the tax authorities to garnish a portion of the taxpayer's wages or salary until the tax debt is fully paid off. The employer is legally obligated to comply with the levy and deduct the specified amount from the taxpayer's paycheck. 2. Bank Levy: A bank levy authorizes the tax authorities to freeze the taxpayer's bank account(s) and withdraw funds to cover the outstanding tax debt. Once the funds are seized, they are applied towards the tax liability, thereby reducing or eliminating the debt. 3. Property Levy: In more severe cases of delinquency, the tax authorities may issue a property levy, where they seize and sell the taxpayer's real estate, vehicles, or other valuable assets to satisfy the tax debt. The proceeds from the sale are used to repay the delinquent taxes, and any remaining amounts are returned to the taxpayer. It is important for individuals and businesses in Scottsdale, Arizona to take the Scottsdale Arizona Notice of Levy for Delinquent Taxes seriously. Ignoring or avoiding payment of tax debts can lead to significant financial consequences, as the tax authorities have the power to enforce collection through various forms of levies. It is advisable for affected taxpayers to seek professional assistance from tax attorneys or consultants, who can provide guidance, negotiate with the tax authorities, and explore potential solutions to resolve the delinquency.

How to fill out Scottsdale Arizona Notice Of Levy For Delinquent Taxes?

If you’ve already used our service before, log in to your account and save the Scottsdale Arizona Notice of Levy for Delinquent Taxes on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Make certain you’ve located the right document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Scottsdale Arizona Notice of Levy for Delinquent Taxes. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!