Title: Understanding Surprise Arizona Notice of Levy for Delinquent Taxes: Types and Details Introduction: Are you an Arizona resident striving to comprehend the intricacies of Surprise Arizona Notice of Levy for Delinquent Taxes? This comprehensive guide aims to provide a detailed explanation of what this notice entails, discuss its purpose, and shed light on different types of levy notices in Surprise, Arizona. 1. What is a Surprise Arizona Notice of Levy for Delinquent Taxes? The Surprise Arizona Notice of Levy for Delinquent Taxes is a formal communication issued by the Surprise Tax Collector's office to individuals or businesses with outstanding tax liabilities. It serves as a legal notification informing the recipient about their delinquent tax debt and the initiation of the levy process. 2. Purpose of the Surprise Arizona Notice of Levy for Delinquent Taxes: The primary objective of the Surprise Arizona Notice of Levy for Delinquent Taxes is to alert taxpayers about their overdue tax obligations and the subsequent actions that may follow. This notice serves as a mandatory step before the tax authorities can seize a taxpayer's assets to satisfy the outstanding tax debt. 3. Types of Surprise Arizona Notice of Levy for Delinquent Taxes: a. Personal Property Levy (Wage Levy): This type of levy notice targets an individual's paycheck or wages. The Surprise Tax Collector's office collaborates with the taxpayer's employer, directing them to withhold a portion of the individual's earnings to cover their unpaid tax liability until the debt is resolved. b. Bank Account Levy: Under a Bank Account Levy, the Surprise Tax Collector's office can seize funds directly from a taxpayer's bank accounts to settle the delinquent tax debt. This levy allows the tax authorities to freeze and withdraw funds, including savings, personal, or business accounts. c. Property Levy: A Property Levy involves the seizure and sale of a taxpayer's assets, such as real estate properties, vehicles, or other valuables, to recover the delinquent tax debt. Notice of the impending property auction may be sent to the taxpayer, giving them an opportunity to resolve the debt before the auction takes place. d. Federal Payment Levy Program (FLP): In cases where the taxpayer is also a recipient of federal payments such as Social Security benefits or federal retirement pension, the Surprise Arizona Notice of Levy for Delinquent Taxes can be used to intercept a portion of those payments to satisfy the tax debt. 4. Responding to a Surprise Arizona Notice of Levy for Delinquent Taxes: Upon receiving the notice, it is crucial for the taxpayer to take immediate action. Exploring options such as reaching out to the Surprise Tax Collector's office, seeking professional assistance, or establishing a payment plan can help resolve the delinquent tax debt and potentially prevent further levy actions. Conclusion: Surprise Arizona Notice of Levy for Delinquent Taxes is a legal notice sent by the Surprise Tax Collector's office to taxpayers with outstanding tax liabilities. Understanding the different types and implications of levy notices can assist taxpayers in adopting appropriate measures to address their delinquent tax obligations and avoid potential asset seizures. Seeking assistance from tax professionals is highly recommended navigating through this process successfully.

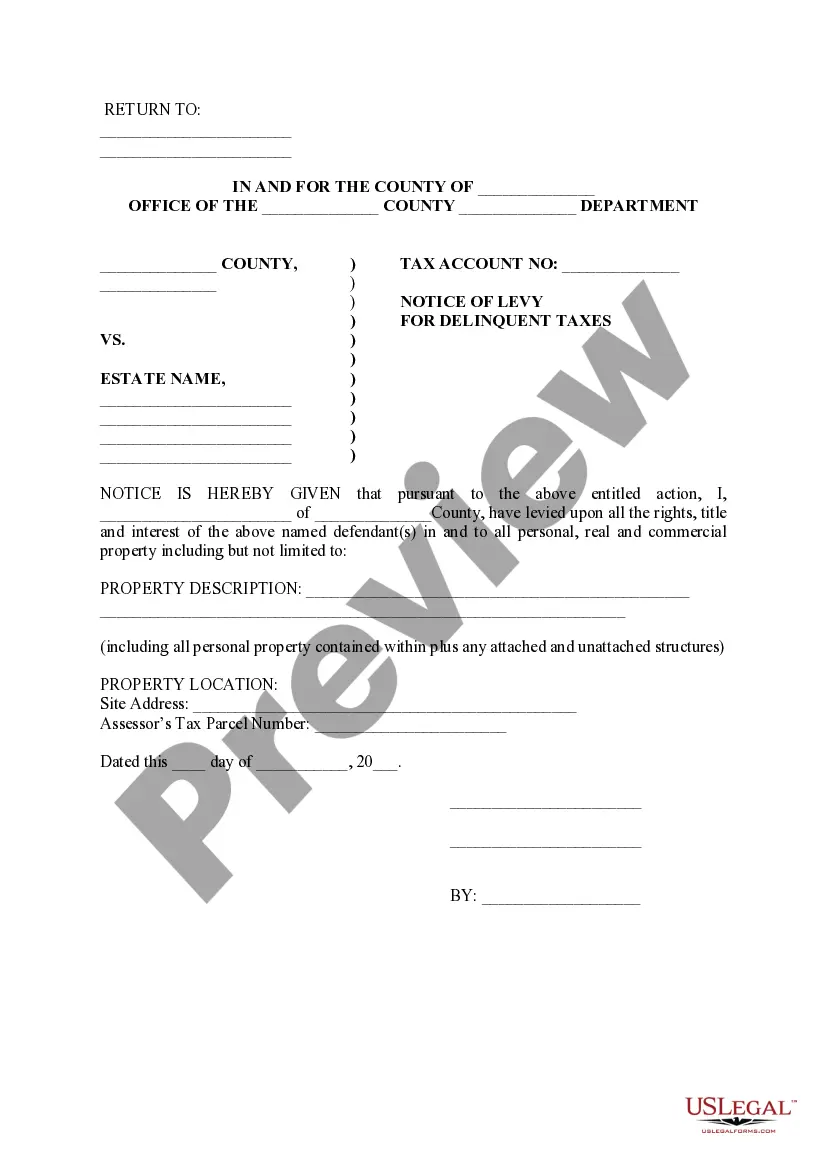

Surprise Arizona Notice of Levy for Delinquent Taxes

Description

How to fill out Surprise Arizona Notice Of Levy For Delinquent Taxes?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for someone with no law education to create such paperwork cfrom the ground up, mainly because of the convoluted jargon and legal subtleties they entail. This is where US Legal Forms can save the day. Our service provides a massive collection with over 85,000 ready-to-use state-specific forms that work for practically any legal situation. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you want the Surprise Arizona Notice of Levy for Delinquent Taxes or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Surprise Arizona Notice of Levy for Delinquent Taxes quickly employing our reliable service. If you are presently an existing customer, you can proceed to log in to your account to download the needed form.

Nevertheless, in case you are unfamiliar with our library, ensure that you follow these steps before downloading the Surprise Arizona Notice of Levy for Delinquent Taxes:

- Ensure the template you have found is good for your location since the regulations of one state or county do not work for another state or county.

- Preview the document and go through a brief description (if available) of scenarios the document can be used for.

- In case the one you picked doesn’t suit your needs, you can start again and search for the suitable form.

- Click Buy now and choose the subscription option that suits you the best.

- with your credentials or create one from scratch.

- Select the payment method and proceed to download the Surprise Arizona Notice of Levy for Delinquent Taxes once the payment is done.

You’re all set! Now you can proceed to print out the document or complete it online. Should you have any problems getting your purchased forms, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.