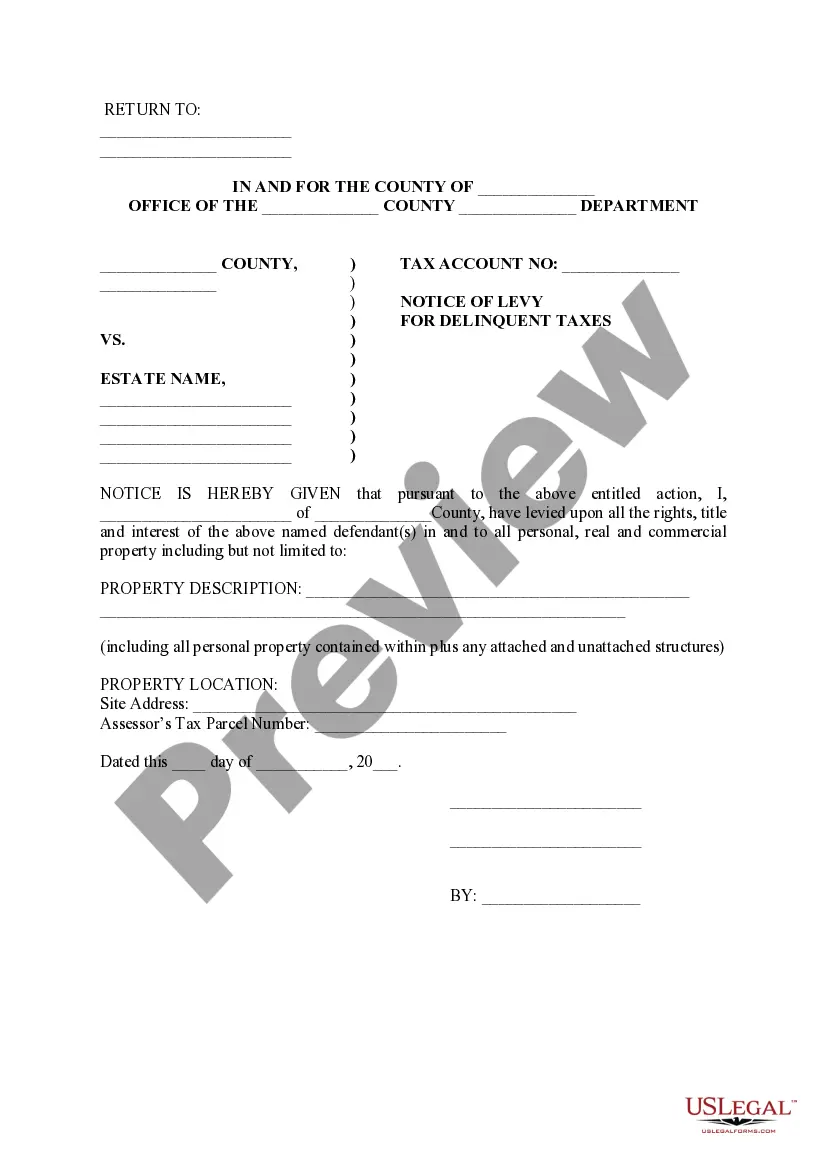

The Tempe Arizona Notice of Levy for Delinquent Taxes is an official legal document issued by the City of Tempe's tax department to enforce the collection of unpaid taxes from individuals or businesses within the city limits. This notice serves as a warning to the delinquent taxpayer that their assets may be seized or legal actions may be taken to satisfy the debt owed to the city. This notice is typically sent after multiple attempts to collect the outstanding taxes have failed, including notices, warnings, and demand letters. It is an important step in the collection process and carries significant consequences for those who ignore or fail to respond appropriately. The Tempe Arizona Notice of Levy for Delinquent Taxes initiates a series of actions that can lead to the seizure of assets or the imposition of wage garnishments, bank levies, or property liens. The purpose of this notice is to communicate the seriousness of the situation to the delinquent taxpayer and provide them with an opportunity to address their tax obligations before more aggressive measures are taken. There are different types of Tempe Arizona Notice of Levy for Delinquent Taxes, depending on the nature of the delinquent taxes owed. Some common variations of this notice include: 1. Personal Income Tax Levy: This notice is issued to individuals who have failed to pay their personal income taxes owed to the City of Tempe. It warns the taxpayer that their wages or other sources of income may be garnished to satisfy the outstanding debt. 2. Business Tax Levy: This notice is sent to businesses that have failed to pay their business taxes owed to the City of Tempe. It informs the business owner that their business assets, bank accounts, or other property may be seized to settle the delinquent tax liability. 3. Property Tax Levy: This notice applies to property owners who have not paid their property taxes owed to the City of Tempe. It serves as a warning that the city may place a lien on the property, potentially leading to a foreclosure if the taxes remain unpaid. In summary, the Tempe Arizona Notice of Levy for Delinquent Taxes is a crucial step in the tax collection process within the city. It warns delinquent taxpayers of the potential consequences they may face if they fail to resolve their outstanding tax obligations. Different versions of this notice are issued, depending on the specific type of taxes that remain unpaid. It is important for individuals and businesses to take this notice seriously and take immediate action to address their tax liabilities.

Tempe Arizona Notice of Levy for Delinquent Taxes

Description

How to fill out Tempe Arizona Notice Of Levy For Delinquent Taxes?

If you are searching for a relevant form template, it’s impossible to find a more convenient platform than the US Legal Forms site – one of the most comprehensive libraries on the internet. With this library, you can get thousands of document samples for company and personal purposes by types and regions, or key phrases. With our advanced search feature, finding the most recent Tempe Arizona Notice of Levy for Delinquent Taxes is as elementary as 1-2-3. Furthermore, the relevance of each document is verified by a group of professional attorneys that on a regular basis check the templates on our platform and update them in accordance with the newest state and county regulations.

If you already know about our system and have an account, all you should do to receive the Tempe Arizona Notice of Levy for Delinquent Taxes is to log in to your account and click the Download option.

If you make use of US Legal Forms the very first time, just follow the instructions below:

- Make sure you have opened the sample you want. Check its description and use the Preview feature (if available) to explore its content. If it doesn’t suit your needs, utilize the Search field at the top of the screen to find the appropriate file.

- Confirm your selection. Click the Buy now option. Following that, pick the preferred pricing plan and provide credentials to sign up for an account.

- Make the purchase. Use your credit card or PayPal account to complete the registration procedure.

- Receive the form. Indicate the format and save it on your device.

- Make changes. Fill out, modify, print, and sign the acquired Tempe Arizona Notice of Levy for Delinquent Taxes.

Each form you save in your account does not have an expiry date and is yours forever. You can easily gain access to them using the My Forms menu, so if you need to receive an additional duplicate for modifying or creating a hard copy, you may come back and export it again at any time.

Take advantage of the US Legal Forms professional catalogue to gain access to the Tempe Arizona Notice of Levy for Delinquent Taxes you were seeking and thousands of other professional and state-specific samples in one place!