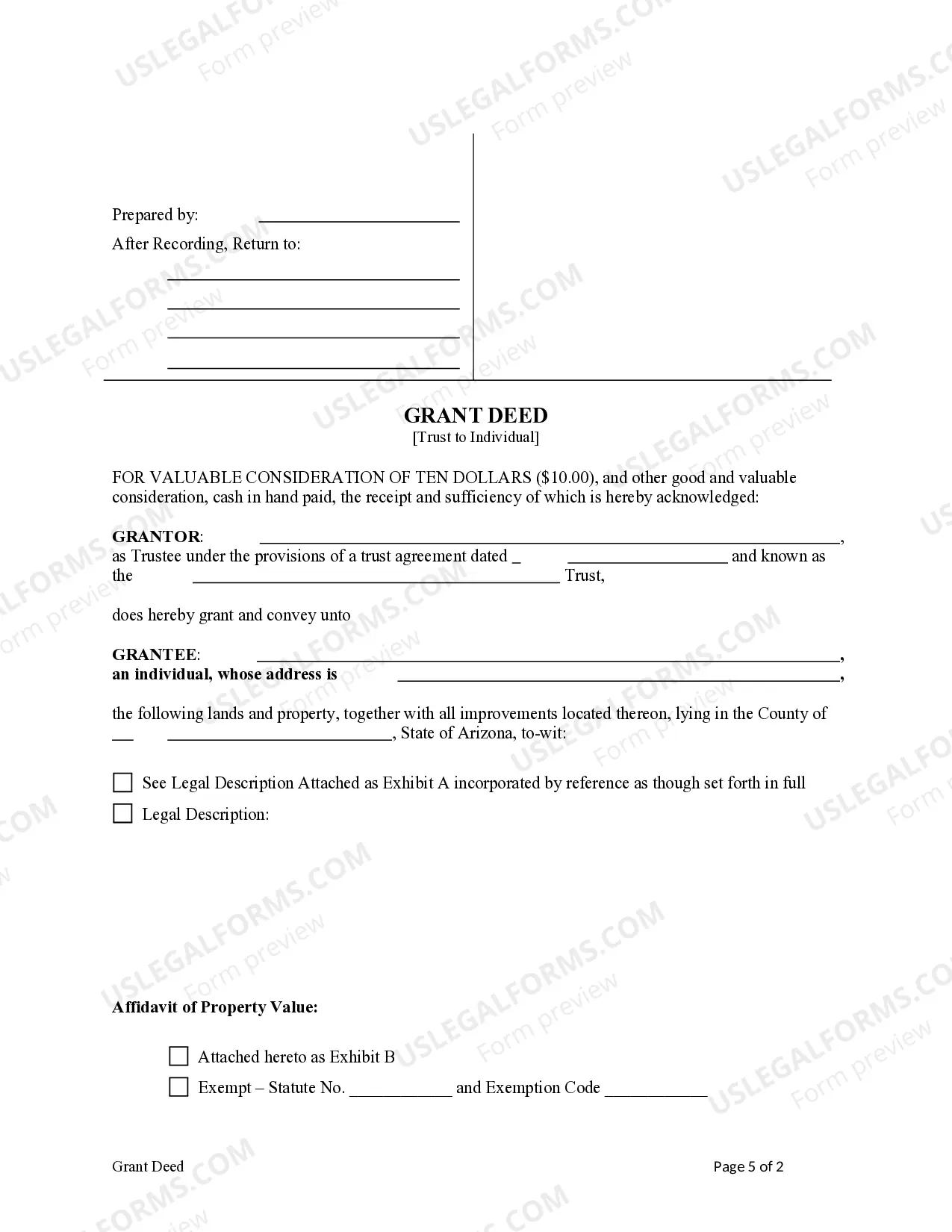

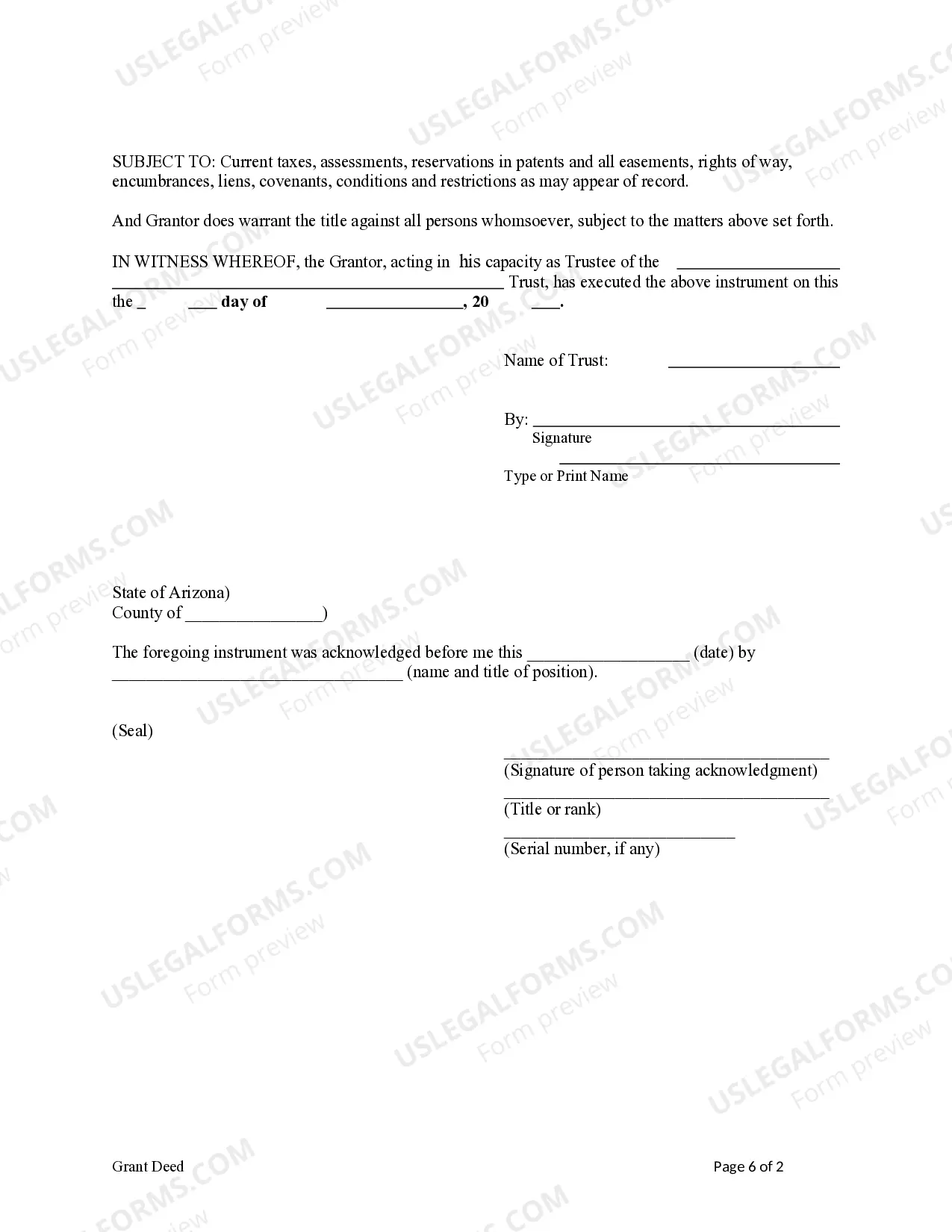

This form is a Grant or Warranty Deed where the Grantor is a trust and the Grantee is an Individual. The Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

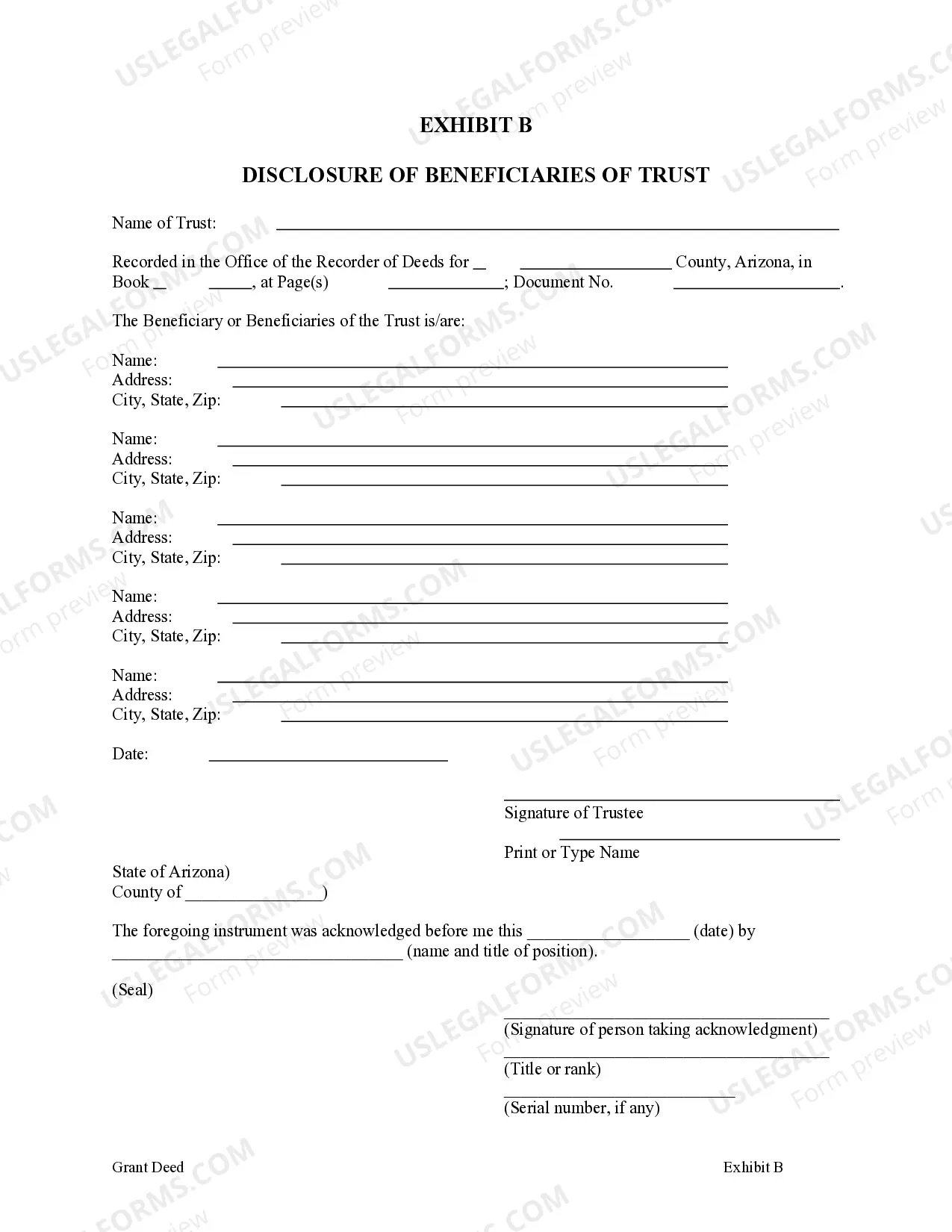

A Surprise Arizona grant deed — trust to an individual is a legal document that transfers real estate ownership from a trust to an individual in Surprise, Arizona. This type of deed is commonly used in trust estate planning to ensure a seamless transfer of property to an individual beneficiary. The grant deed — trust to an individual is a crucial instrument in the estate planning process. It guarantees the transfer of ownership rights, protecting the rights of the trust beneficiaries and ensuring a smooth transition of the property. This legal document helps to avoid probate and facilitates the efficient transfer of property to the intended individual recipient. There are various types of Surprise Arizona grant deed — trust to an individual, including: 1. Revocable Living Trust Grant Deed: This is the most common type of grant deed- trust to an individual used in estate planning. A revocable living trust is created during the granter's lifetime, and upon their passing, the property is transferred to an individual beneficiary mentioned in the trust. 2. Irrevocable Trust Grant Deed: In this type of grant deed- trust, the property is transferred from an irrevocable trust to an individual beneficiary. Unlike the revocable living trust, this type of trust cannot be altered or revoked by the granter, providing stricter protection and control over the property. 3. Testamentary Trust Grant Deed: A testamentary trust grant deed is created under the terms of a will. It takes effect upon the granter's death and transfers the property from the trust to an individual beneficiary outlined in the will. 4. Family Trust Grant Deed: A family trust grant deed is established by a family to hold and manage the family's assets. The property is transferred from the family trust to an individual beneficiary, who may be a family member, according to the trust's provisions. It is essential to consult with an experienced estate planning attorney or legal professional in Surprise, Arizona, to navigate the specific requirements and laws related to the grant deed- trust to an individual. This ensures that the process complies with all legal regulations and safeguards the interests of both the trust and individual beneficiary.A Surprise Arizona grant deed — trust to an individual is a legal document that transfers real estate ownership from a trust to an individual in Surprise, Arizona. This type of deed is commonly used in trust estate planning to ensure a seamless transfer of property to an individual beneficiary. The grant deed — trust to an individual is a crucial instrument in the estate planning process. It guarantees the transfer of ownership rights, protecting the rights of the trust beneficiaries and ensuring a smooth transition of the property. This legal document helps to avoid probate and facilitates the efficient transfer of property to the intended individual recipient. There are various types of Surprise Arizona grant deed — trust to an individual, including: 1. Revocable Living Trust Grant Deed: This is the most common type of grant deed- trust to an individual used in estate planning. A revocable living trust is created during the granter's lifetime, and upon their passing, the property is transferred to an individual beneficiary mentioned in the trust. 2. Irrevocable Trust Grant Deed: In this type of grant deed- trust, the property is transferred from an irrevocable trust to an individual beneficiary. Unlike the revocable living trust, this type of trust cannot be altered or revoked by the granter, providing stricter protection and control over the property. 3. Testamentary Trust Grant Deed: A testamentary trust grant deed is created under the terms of a will. It takes effect upon the granter's death and transfers the property from the trust to an individual beneficiary outlined in the will. 4. Family Trust Grant Deed: A family trust grant deed is established by a family to hold and manage the family's assets. The property is transferred from the family trust to an individual beneficiary, who may be a family member, according to the trust's provisions. It is essential to consult with an experienced estate planning attorney or legal professional in Surprise, Arizona, to navigate the specific requirements and laws related to the grant deed- trust to an individual. This ensures that the process complies with all legal regulations and safeguards the interests of both the trust and individual beneficiary.