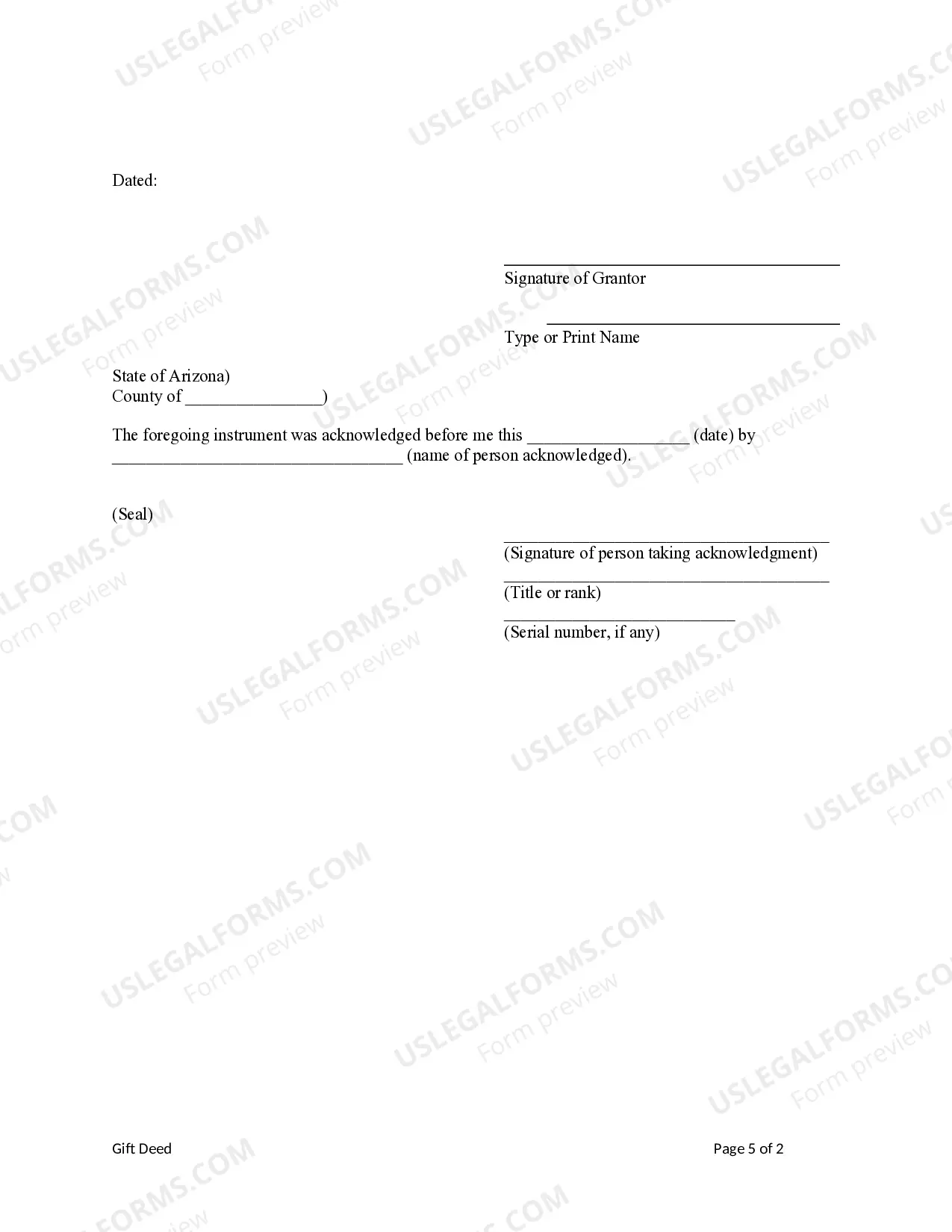

This form is a Gift Deed where the Grantor is an individual and the Grantee is an individual. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Tempe Arizona Gift Deed from an Individual to an Individual is a legal document that transfers ownership of a property or asset from one individual to another as a gift, without any exchange of monetary compensation. This type of deed is commonly used when an individual wishes to transfer their property to a family member, friend, or loved one without involving a sale transaction. The Tempe Arizona Gift Deed must satisfy certain legal requirements to be considered valid. It should include the names and addresses of both the donor (the person giving the gift) and the done (the recipient). The property or asset being gifted should be clearly described, including its legal description, such as the lot of number, block number, and subdivision name. Additionally, the deed should explicitly state that the transfer is a gift and that no consideration or payment is being exchanged. There are a few different types of Tempe Arizona Gift Deeds from an Individual to an Individual, each serving a specific purpose: 1. General Gift Deed: A general gift deed is the most common type, transferring full ownership and rights of the property to the done. This type of deed is often used when an individual wants to transfer a property to a family member or loved one without any restrictions or conditions. 2. Conditional Gift Deed: A conditional gift deed imposes certain conditions or restrictions on the done regarding the use or ownership of the property. For example, the donor may specify certain conditions that the done must fulfill, such as maintaining the property or using it for a specific purpose. 3. Life Estate Gift Deed: A life estate gift deed grants the done ownership and usage rights of the property only for the duration of the donor's lifetime. After the donor's death, the property passes to another designated beneficiary, as mentioned in the deed. 4. Remainder Gift Deed: A remainder gift deed grants the done ownership of the property for a certain period or until a specified condition occurs. However, after the specified period or condition is met, ownership of the property passes to another designated beneficiary, as stated in the deed. It is crucial to consult with a qualified attorney or real estate professional when creating a Tempe Arizona Gift Deed from an Individual to an Individual to ensure all legal requirements are met and to understand the implications of the transfer. This will help ensure a smooth and legally sound transaction, while also protecting the interests of both the donor and the done.A Tempe Arizona Gift Deed from an Individual to an Individual is a legal document that transfers ownership of a property or asset from one individual to another as a gift, without any exchange of monetary compensation. This type of deed is commonly used when an individual wishes to transfer their property to a family member, friend, or loved one without involving a sale transaction. The Tempe Arizona Gift Deed must satisfy certain legal requirements to be considered valid. It should include the names and addresses of both the donor (the person giving the gift) and the done (the recipient). The property or asset being gifted should be clearly described, including its legal description, such as the lot of number, block number, and subdivision name. Additionally, the deed should explicitly state that the transfer is a gift and that no consideration or payment is being exchanged. There are a few different types of Tempe Arizona Gift Deeds from an Individual to an Individual, each serving a specific purpose: 1. General Gift Deed: A general gift deed is the most common type, transferring full ownership and rights of the property to the done. This type of deed is often used when an individual wants to transfer a property to a family member or loved one without any restrictions or conditions. 2. Conditional Gift Deed: A conditional gift deed imposes certain conditions or restrictions on the done regarding the use or ownership of the property. For example, the donor may specify certain conditions that the done must fulfill, such as maintaining the property or using it for a specific purpose. 3. Life Estate Gift Deed: A life estate gift deed grants the done ownership and usage rights of the property only for the duration of the donor's lifetime. After the donor's death, the property passes to another designated beneficiary, as mentioned in the deed. 4. Remainder Gift Deed: A remainder gift deed grants the done ownership of the property for a certain period or until a specified condition occurs. However, after the specified period or condition is met, ownership of the property passes to another designated beneficiary, as stated in the deed. It is crucial to consult with a qualified attorney or real estate professional when creating a Tempe Arizona Gift Deed from an Individual to an Individual to ensure all legal requirements are met and to understand the implications of the transfer. This will help ensure a smooth and legally sound transaction, while also protecting the interests of both the donor and the done.