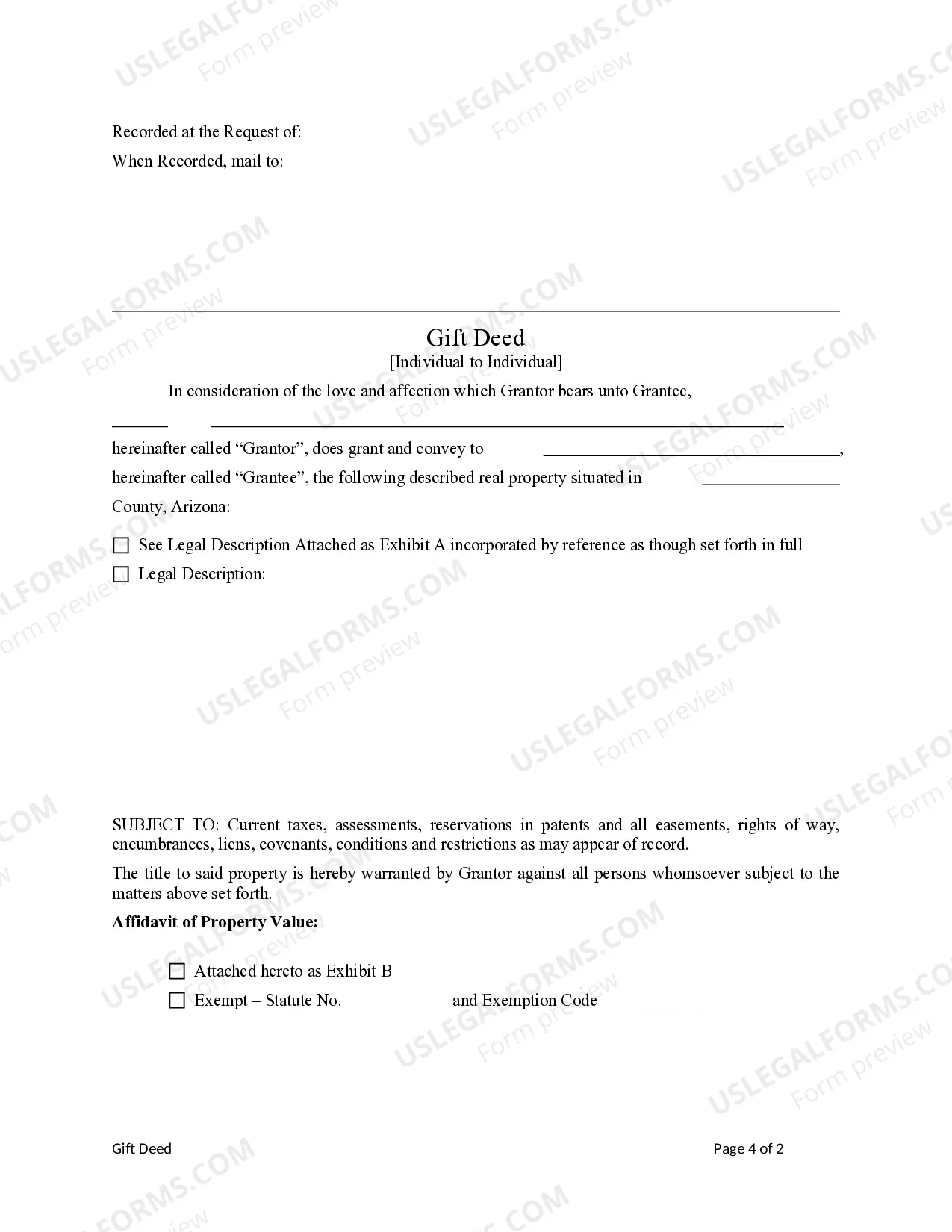

This form is a Gift Deed where the Grantor is an individual and the Grantee is an individual. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Tucson Arizona Gift Deed from an Individual to an Individual is a legally binding document that transfers ownership of a property or asset from one individual to another, without any exchange of money. This type of deed is often used when a person wants to gift a property or valuable asset to a family member, friend, or loved one. The gift deed serves as evidence of the transfer of ownership, ensuring that both parties have a clear understanding of the transaction. It outlines the details of the gift, including the description of the property or asset, the names of the giver (granter) and recipient (grantee), and any conditions or restrictions placed on the gift. There are different types of Tucson Arizona Gift Deeds from an Individual to an Individual, each serving specific purposes: 1. General Gift Deed: This is the most common type of gift deed. It transfers ownership without any conditions or restrictions. The granter simply gives the property or asset to the grantee as a gift, with no exchange of money required. 2. Gift Deed with Reservation of Life Estate: This type of gift deed allows the granter to transfer ownership of a property or asset to the grantee while retaining the right to use and enjoy the property for the rest of their life. Upon the granter's death, full ownership is transferred to the grantee. 3. Gift Deed with Conditions or Restrictions: In some cases, the granter may include specific conditions or restrictions on the gift. For example, the granter may require the grantee to maintain the property or asset in a certain condition, or they may impose limitations on the grantee's ability to sell or transfer the gift. It is important to consult a qualified attorney or real estate professional specializing in Tucson Arizona Gift Deeds from an Individual to an Individual to ensure that the document is drafted correctly and adheres to all legal requirements. This will help protect the interests of both the giver and the recipient and ensure a smooth transfer of ownership.