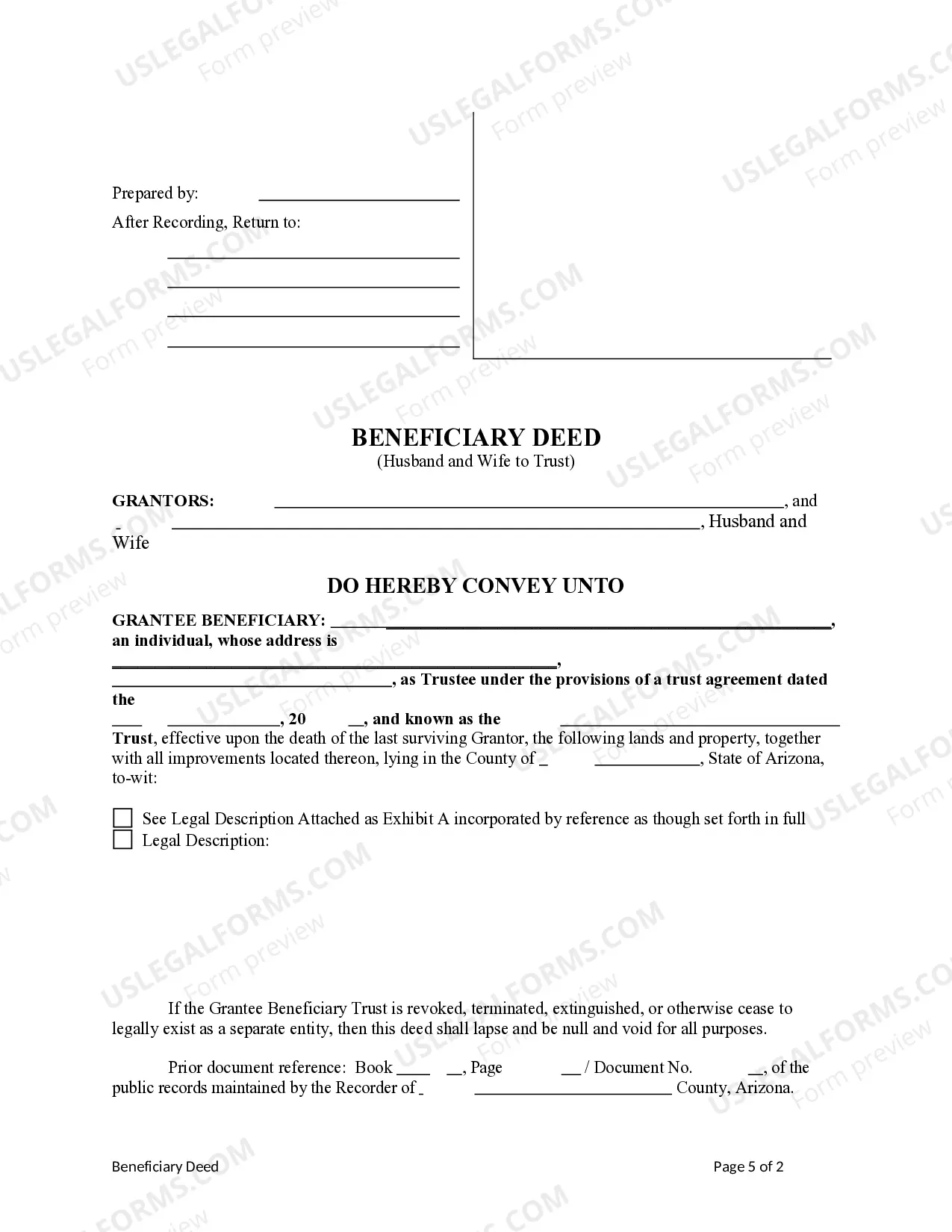

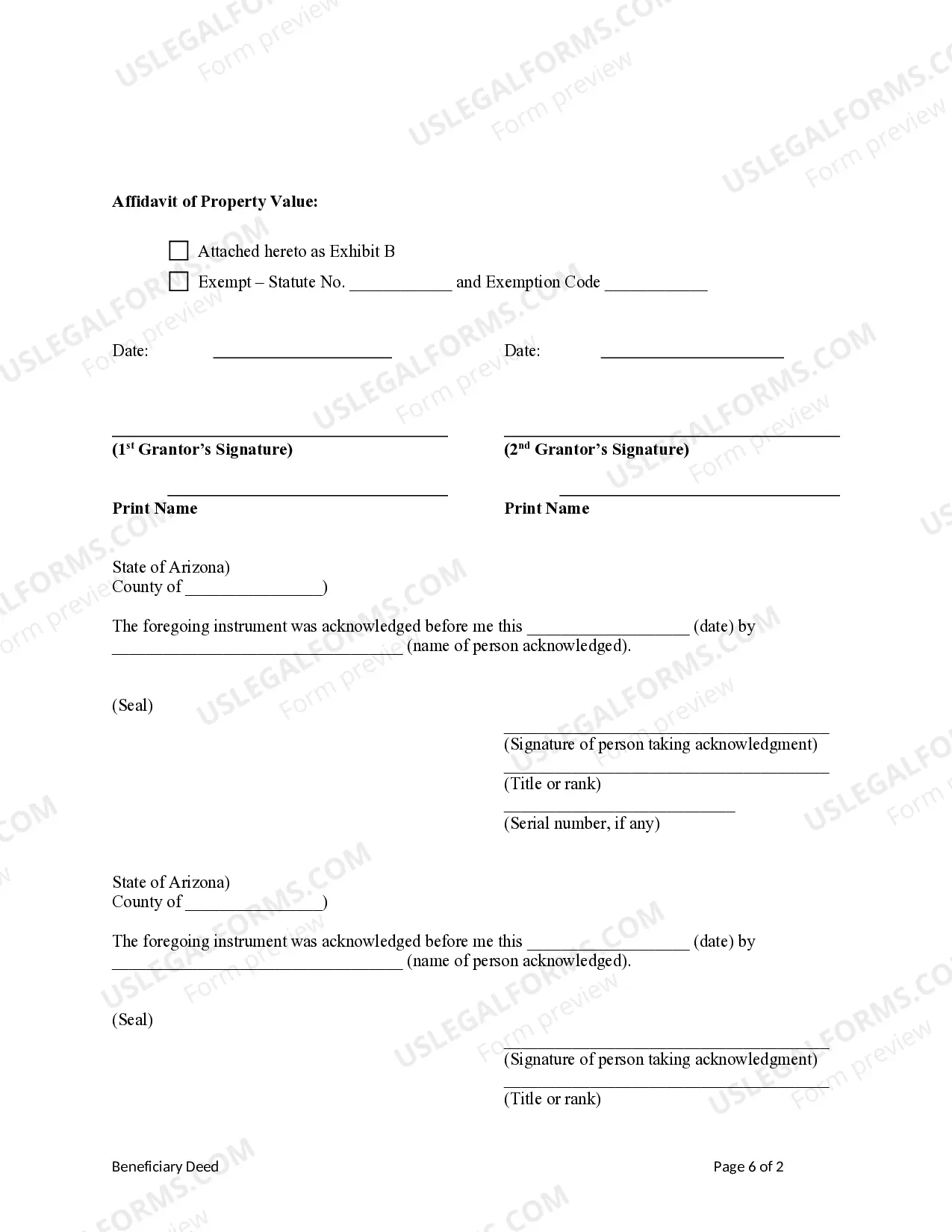

This form is a Beneficiary or Transfer on Death Deed where the Grantors are husband and wife and the Grantee Beneficiary is a Trust. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving Grantor. The deed is not effective unless recorded before the death of the last surviving Grantor. This deed complies with all state statutory laws.

Chandler, Arizona Beneficiary Deed from Husband and Wife to Trust: A Comprehensive Guide In Chandler, Arizona, a Beneficiary Deed from Husband and Wife to Trust is a legal document that allows property owners to transfer their real estate assets to a trust. This type of deed is commonly used as part of estate planning to ensure a smooth transfer of property after the owners' death, while avoiding the need for probate. The Husband and Wife To Trust Beneficiary Deed provides a means for spouses to designate their joint ownership rights in a property to a revocable living trust. By doing so, the property will be effectively transferred to the trust upon the death of the last surviving spouse. This helps to streamline the distribution of assets and minimizes complications associated with probate. One significant advantage of using a Beneficiary Deed from Husband and Wife to Trust in Chandler, Arizona is that it allows the property to be transferred without the need for court involvement or approval. This saves time, reduces costs, and maintains privacy as the transfer happens outside the probate process. Chandler, Arizona offers several types of Beneficiary Deeds from Husband and Wife to Trust, allowing property owners to select the specific deed that suits their needs. Some common options include: 1. Joint Tenancy with Right of Survivorship: With this type of deed, both spouses own equal shares of the property. Upon the death of one spouse, the property automatically transfers to the surviving spouse without the need for probate. 2. Community Property with Right of Survivorship: This option is available to married couples in Arizona and treats both spouses' assets as community property. Upon the death of one spouse, the property automatically transfers to the surviving spouse. 3. Tenancy in Common: This type of deed allows spouses to hold unequal shares in a property. Unlike joint tenancy, each spouse's ownership interest can be transferred to beneficiaries of their choosing upon their death. It is important to consult with an experienced attorney or a licensed professional when considering a Chandler, Arizona Beneficiary Deed from Husband and Wife to Trust. They can provide guidance on the specific provisions, legal requirements, and tax implications associated with this type of deed. In conclusion, a Beneficiary Deed from Husband and Wife to Trust in Chandler, Arizona is a powerful estate planning tool. It allows spouses to transfer their property to a living trust, avoiding probate and ensuring a seamless transfer of assets. With different types of beneficiary deeds available, property owners can choose the option that best fits their unique circumstances and goals.Chandler, Arizona Beneficiary Deed from Husband and Wife to Trust: A Comprehensive Guide In Chandler, Arizona, a Beneficiary Deed from Husband and Wife to Trust is a legal document that allows property owners to transfer their real estate assets to a trust. This type of deed is commonly used as part of estate planning to ensure a smooth transfer of property after the owners' death, while avoiding the need for probate. The Husband and Wife To Trust Beneficiary Deed provides a means for spouses to designate their joint ownership rights in a property to a revocable living trust. By doing so, the property will be effectively transferred to the trust upon the death of the last surviving spouse. This helps to streamline the distribution of assets and minimizes complications associated with probate. One significant advantage of using a Beneficiary Deed from Husband and Wife to Trust in Chandler, Arizona is that it allows the property to be transferred without the need for court involvement or approval. This saves time, reduces costs, and maintains privacy as the transfer happens outside the probate process. Chandler, Arizona offers several types of Beneficiary Deeds from Husband and Wife to Trust, allowing property owners to select the specific deed that suits their needs. Some common options include: 1. Joint Tenancy with Right of Survivorship: With this type of deed, both spouses own equal shares of the property. Upon the death of one spouse, the property automatically transfers to the surviving spouse without the need for probate. 2. Community Property with Right of Survivorship: This option is available to married couples in Arizona and treats both spouses' assets as community property. Upon the death of one spouse, the property automatically transfers to the surviving spouse. 3. Tenancy in Common: This type of deed allows spouses to hold unequal shares in a property. Unlike joint tenancy, each spouse's ownership interest can be transferred to beneficiaries of their choosing upon their death. It is important to consult with an experienced attorney or a licensed professional when considering a Chandler, Arizona Beneficiary Deed from Husband and Wife to Trust. They can provide guidance on the specific provisions, legal requirements, and tax implications associated with this type of deed. In conclusion, a Beneficiary Deed from Husband and Wife to Trust in Chandler, Arizona is a powerful estate planning tool. It allows spouses to transfer their property to a living trust, avoiding probate and ensuring a seamless transfer of assets. With different types of beneficiary deeds available, property owners can choose the option that best fits their unique circumstances and goals.