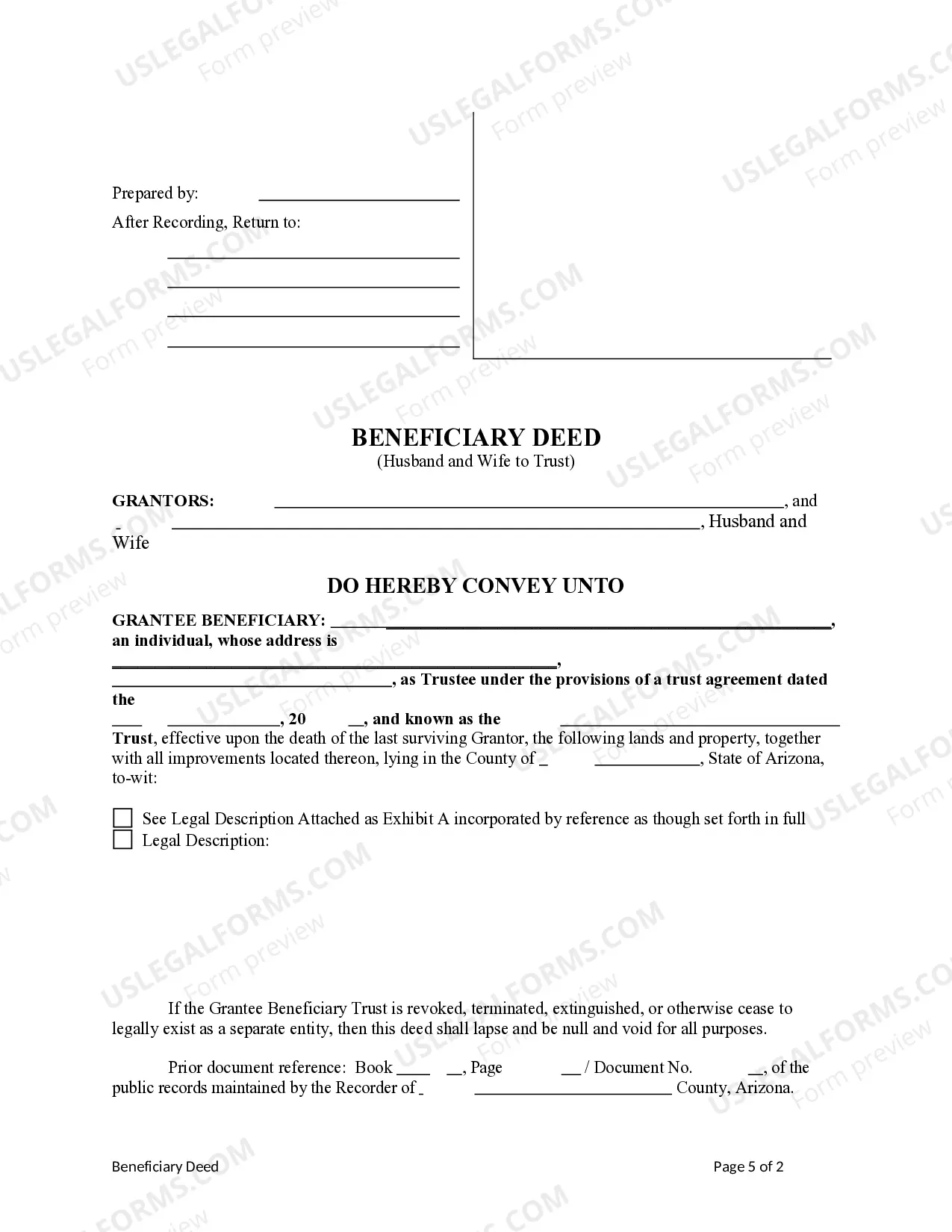

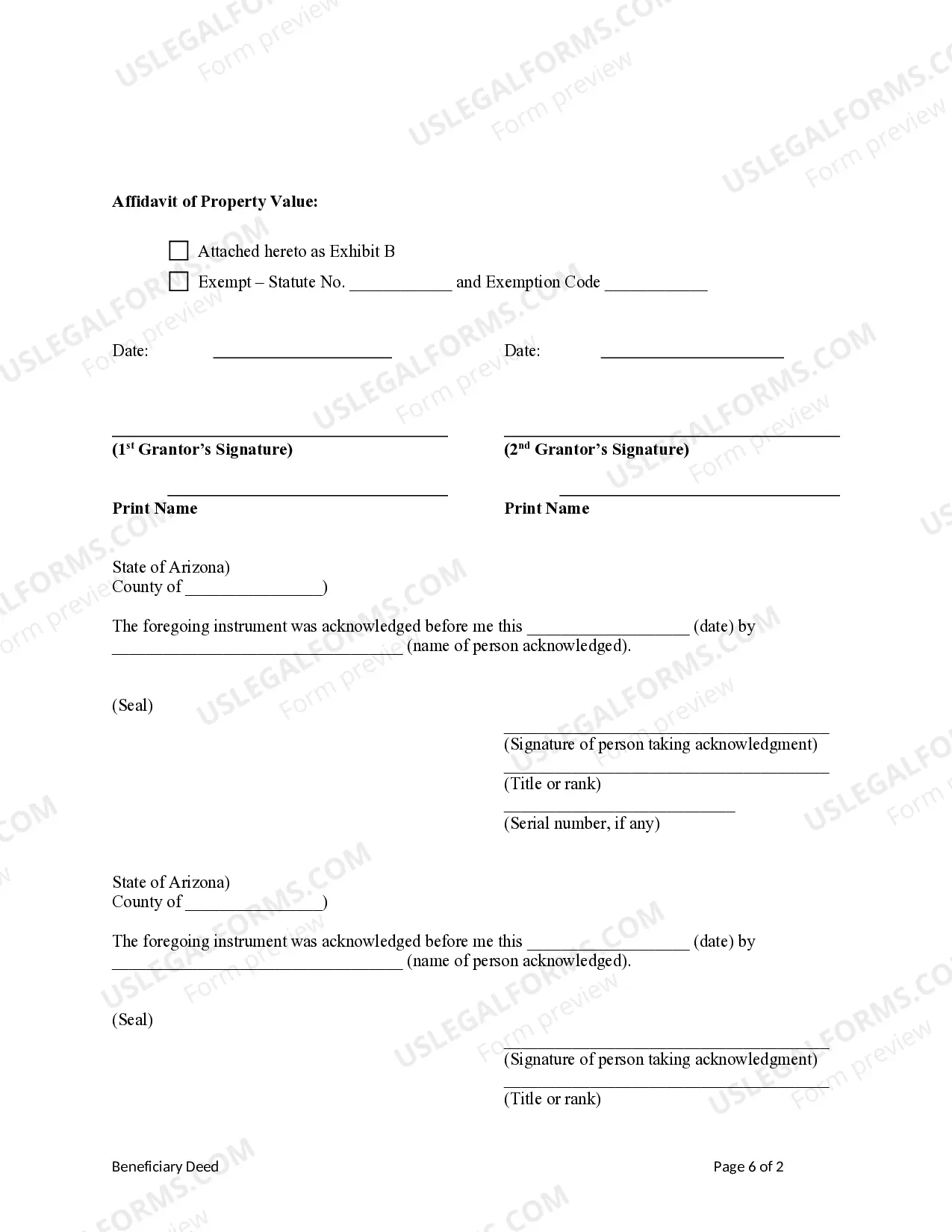

This form is a Beneficiary or Transfer on Death Deed where the Grantors are husband and wife and the Grantee Beneficiary is a Trust. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving Grantor. The deed is not effective unless recorded before the death of the last surviving Grantor. This deed complies with all state statutory laws.

A Gilbert Arizona Beneficiary Deed from Husband and Wife to Trust is a legal document that allows married couples in Gilbert, Arizona, to transfer the ownership of their property into a trust upon their death. This type of deed is commonly used as an estate planning tool to ensure a seamless transfer of assets and avoid probate. The Gilbert Arizona Beneficiary Deed from Husband and Wife to Trust operates similarly to a regular beneficiary deed but is specifically designed for couples who wish to transfer their property into a trust. By doing so, the property is protected and managed by the trust, providing numerous benefits to the beneficiaries. Key features and benefits of a Gilbert Arizona Beneficiary Deed from Husband and Wife to Trust include: 1. Avoidance of Probate: One of the main advantages of using a beneficiary deed is the avoidance of probate. When the property is transferred directly to the trust, it bypasses the probate process, saving time and potentially reducing costs. 2. Property Management: The trust established by the beneficiary deed ensures effective management of the property after the couple's passing. This can be particularly advantageous if there are minor or incapacitated beneficiaries who need ongoing support and guidance in managing the asset. 3. Flexibility: Gilbert Arizona Beneficiary Deed from Husband and Wife to Trust allows couples to maintain control over their property during their lifetime. They retain the ability to sell, lease, or mortgage the property as they see fit. The trust only comes into effect upon their death. 4. Privacy: Unlike the probate process, which is a matter of public record, using this type of beneficiary deed provides a level of privacy. The details of the trust and the distribution of assets can remain confidential. Different types of Gilbert Arizona Beneficiary Deed from Husband and Wife to Trust may include: 1. Revocable Beneficiary Deed: This type of deed allows the couple to retain control and make changes to the trust during their lifetime, including the ability to revoke it if they choose to do so. 2. Irrevocable Beneficiary Deed: In contrast to the revocable beneficiary deed, this type of deed cannot be altered or revoked once it is executed. It provides a more secure and permanent transfer of the property into the trust. 3. Joint Beneficiary Deed: This deed allows both spouses to designate the same trust as the beneficiary, ensuring that the property passes directly into the trust upon the death of either spouse. It simplifies the transfer process and helps avoid potential complications. In conclusion, a Gilbert Arizona Beneficiary Deed from Husband and Wife to Trust provides a secure and efficient way for married couples to transfer their property into a trust, ensuring a smooth transition upon their passing. It offers benefits such as avoidance of probate, property management, flexibility, and privacy. Different types of deeds include revocable, irrevocable, and joint beneficiary deeds.A Gilbert Arizona Beneficiary Deed from Husband and Wife to Trust is a legal document that allows married couples in Gilbert, Arizona, to transfer the ownership of their property into a trust upon their death. This type of deed is commonly used as an estate planning tool to ensure a seamless transfer of assets and avoid probate. The Gilbert Arizona Beneficiary Deed from Husband and Wife to Trust operates similarly to a regular beneficiary deed but is specifically designed for couples who wish to transfer their property into a trust. By doing so, the property is protected and managed by the trust, providing numerous benefits to the beneficiaries. Key features and benefits of a Gilbert Arizona Beneficiary Deed from Husband and Wife to Trust include: 1. Avoidance of Probate: One of the main advantages of using a beneficiary deed is the avoidance of probate. When the property is transferred directly to the trust, it bypasses the probate process, saving time and potentially reducing costs. 2. Property Management: The trust established by the beneficiary deed ensures effective management of the property after the couple's passing. This can be particularly advantageous if there are minor or incapacitated beneficiaries who need ongoing support and guidance in managing the asset. 3. Flexibility: Gilbert Arizona Beneficiary Deed from Husband and Wife to Trust allows couples to maintain control over their property during their lifetime. They retain the ability to sell, lease, or mortgage the property as they see fit. The trust only comes into effect upon their death. 4. Privacy: Unlike the probate process, which is a matter of public record, using this type of beneficiary deed provides a level of privacy. The details of the trust and the distribution of assets can remain confidential. Different types of Gilbert Arizona Beneficiary Deed from Husband and Wife to Trust may include: 1. Revocable Beneficiary Deed: This type of deed allows the couple to retain control and make changes to the trust during their lifetime, including the ability to revoke it if they choose to do so. 2. Irrevocable Beneficiary Deed: In contrast to the revocable beneficiary deed, this type of deed cannot be altered or revoked once it is executed. It provides a more secure and permanent transfer of the property into the trust. 3. Joint Beneficiary Deed: This deed allows both spouses to designate the same trust as the beneficiary, ensuring that the property passes directly into the trust upon the death of either spouse. It simplifies the transfer process and helps avoid potential complications. In conclusion, a Gilbert Arizona Beneficiary Deed from Husband and Wife to Trust provides a secure and efficient way for married couples to transfer their property into a trust, ensuring a smooth transition upon their passing. It offers benefits such as avoidance of probate, property management, flexibility, and privacy. Different types of deeds include revocable, irrevocable, and joint beneficiary deeds.