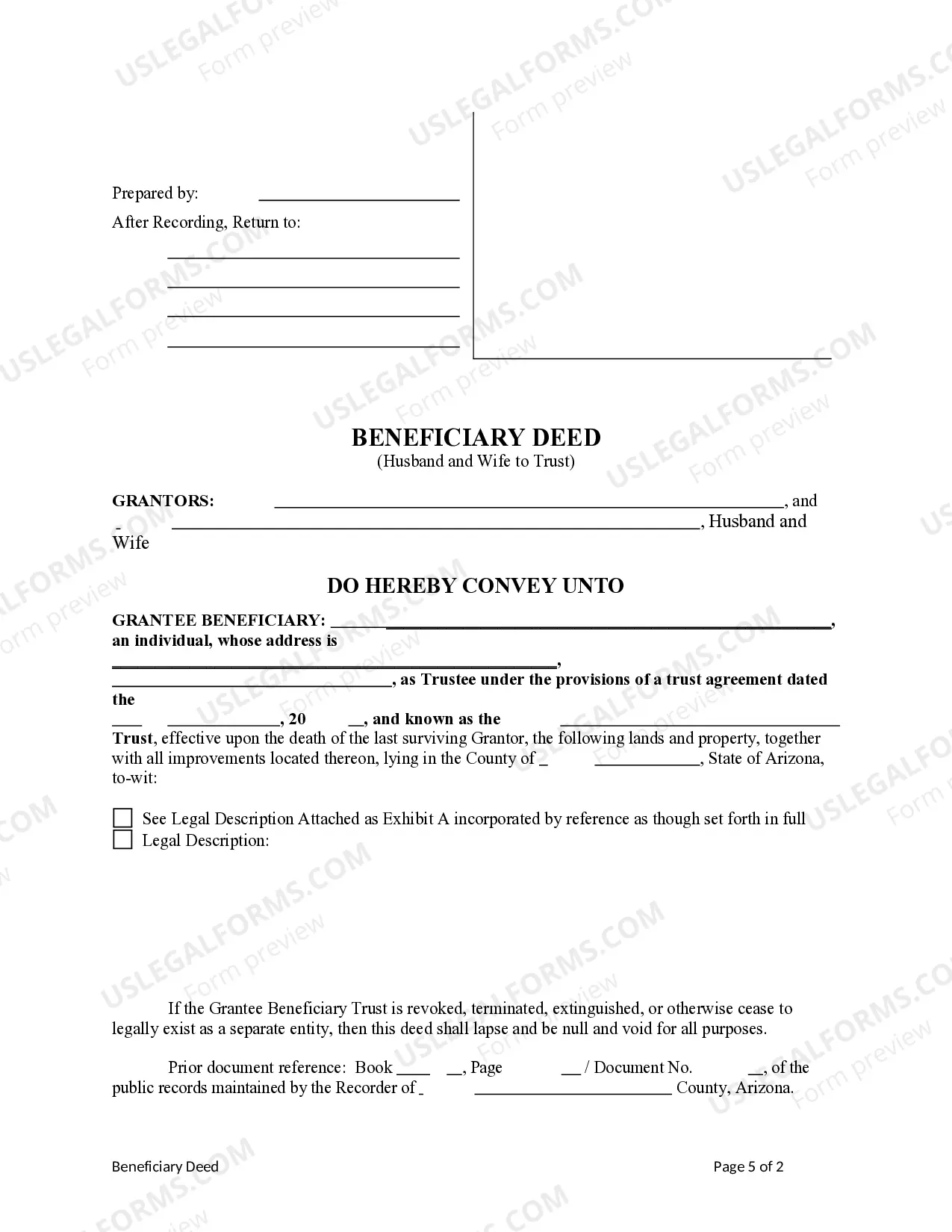

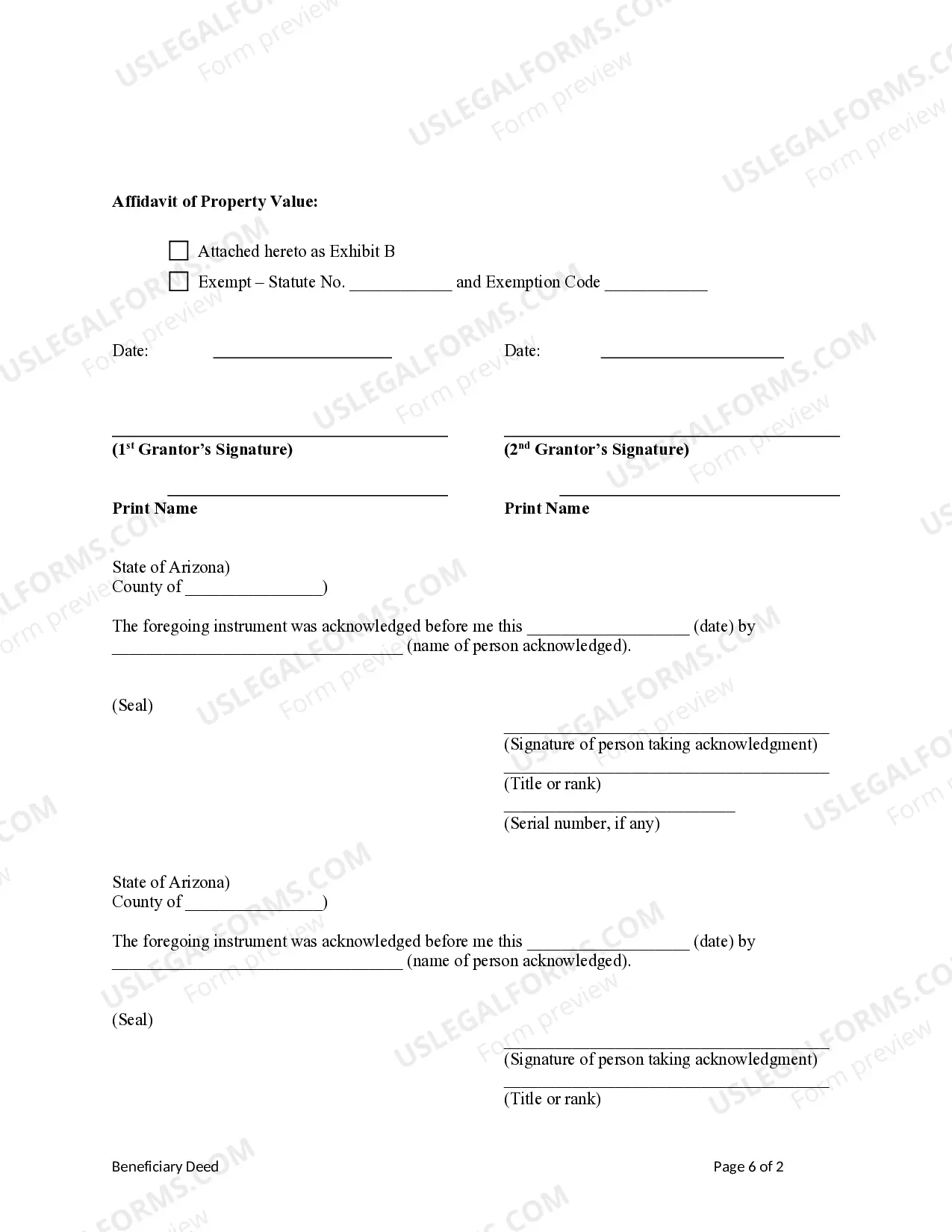

This form is a Beneficiary or Transfer on Death Deed where the Grantors are husband and wife and the Grantee Beneficiary is a Trust. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving Grantor. The deed is not effective unless recorded before the death of the last surviving Grantor. This deed complies with all state statutory laws.

A Glendale Arizona Beneficiary Deed from Husband and Wife to Trust is a legal document used to transfer real estate property ownership from a married couple to a trust. This type of deed allows for the seamless transfer of property upon the death of the husband and wife without the need for probate. The Glendale Arizona Beneficiary Deed from Husband and Wife to Trust is specifically designed to protect the property and ensure a smooth transition of ownership upon the demise of the couple. By naming a trust as the beneficiary, they can designate how the property will be managed and distributed to their chosen beneficiaries. This type of deed is beneficial for estate planning purposes as it allows the couple to have control over the destiny of their assets, even after their passing. It can simplify and expedite the transfer process, saving time and costs associated with probate proceedings. Types of Glendale Arizona Beneficiary Deed from Husband and Wife to Trust: 1. Revocable Beneficiary Deed: This type of deed allows the husband and wife to retain control over the property during their lifetime. They have the flexibility to modify or revoke the beneficiary designation or transfer the property to another trust if desired. 2. Irrevocable Beneficiary Deed: By using an irrevocable beneficiary deed, the couple relinquishes all control and ownership rights over the property. Once the deed is executed, it cannot be modified or revoked without the consent of all trust beneficiaries. This type of deed is typically used for long-term asset protection and estate tax planning purposes. 3. Joint Tenancy with Right of Survivorship Beneficiary Deed: In this scenario, the property ownership is held jointly by the husband and wife, and upon the death of one spouse, the surviving spouse automatically becomes the sole owner. This type of deed is a common choice for couples who desire a simple transfer of ownership upon the death of one spouse without the need for probate or trust administration. In summary, a Glendale Arizona Beneficiary Deed from Husband and Wife to Trust is a powerful estate planning tool. It allows a married couple to transfer their property to a trust, ensuring the efficient and orderly distribution of assets after their passing. With different types of Glendale Arizona Beneficiary Deeds available, couples can tailor their estate planning needs to specific situations and goals.A Glendale Arizona Beneficiary Deed from Husband and Wife to Trust is a legal document used to transfer real estate property ownership from a married couple to a trust. This type of deed allows for the seamless transfer of property upon the death of the husband and wife without the need for probate. The Glendale Arizona Beneficiary Deed from Husband and Wife to Trust is specifically designed to protect the property and ensure a smooth transition of ownership upon the demise of the couple. By naming a trust as the beneficiary, they can designate how the property will be managed and distributed to their chosen beneficiaries. This type of deed is beneficial for estate planning purposes as it allows the couple to have control over the destiny of their assets, even after their passing. It can simplify and expedite the transfer process, saving time and costs associated with probate proceedings. Types of Glendale Arizona Beneficiary Deed from Husband and Wife to Trust: 1. Revocable Beneficiary Deed: This type of deed allows the husband and wife to retain control over the property during their lifetime. They have the flexibility to modify or revoke the beneficiary designation or transfer the property to another trust if desired. 2. Irrevocable Beneficiary Deed: By using an irrevocable beneficiary deed, the couple relinquishes all control and ownership rights over the property. Once the deed is executed, it cannot be modified or revoked without the consent of all trust beneficiaries. This type of deed is typically used for long-term asset protection and estate tax planning purposes. 3. Joint Tenancy with Right of Survivorship Beneficiary Deed: In this scenario, the property ownership is held jointly by the husband and wife, and upon the death of one spouse, the surviving spouse automatically becomes the sole owner. This type of deed is a common choice for couples who desire a simple transfer of ownership upon the death of one spouse without the need for probate or trust administration. In summary, a Glendale Arizona Beneficiary Deed from Husband and Wife to Trust is a powerful estate planning tool. It allows a married couple to transfer their property to a trust, ensuring the efficient and orderly distribution of assets after their passing. With different types of Glendale Arizona Beneficiary Deeds available, couples can tailor their estate planning needs to specific situations and goals.