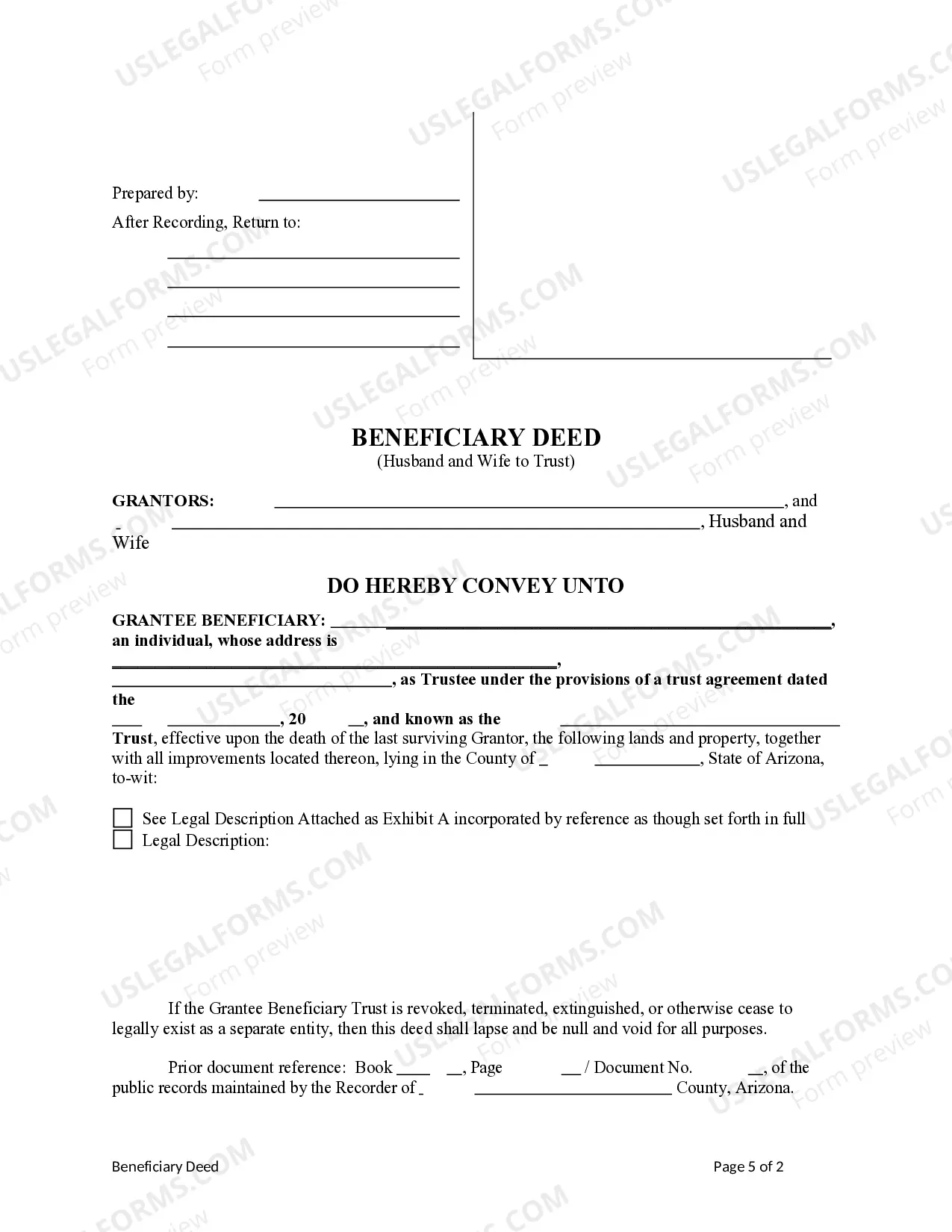

This form is a Beneficiary or Transfer on Death Deed where the Grantors are husband and wife and the Grantee Beneficiary is a Trust. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving Grantor. The deed is not effective unless recorded before the death of the last surviving Grantor. This deed complies with all state statutory laws.

Surprise Arizona Beneficiary Deed from Husband and Wife to Trust

Description

How to fill out Arizona Beneficiary Deed From Husband And Wife To Trust?

We consistently endeavor to minimize or evade legal repercussions when navigating intricate legal or financial matters.

To achieve this, we request attorney services that are typically very expensive. However, not every legal challenge is similarly complicated. Most can be managed by us independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and dissolution petitions. Our collection enables you to handle your matters independently without resorting to a lawyer.

We provide access to legal document templates that aren't always publicly accessible. Our templates are specific to states and regions, which greatly simplifies the search process.

Ensure that the Surprise Arizona Beneficiary Deed from Husband and Wife to Trust adheres to the laws and regulations of your state and region. Furthermore, it's crucial that you review the form's description (if provided), and if you find any inconsistencies with your original search, look for an alternative form. Once you've confirmed that the Surprise Arizona Beneficiary Deed from Husband and Wife to Trust is appropriate for your situation, you may choose the subscription option and proceed to payment. Afterward, you can download the form in any available format. With over 24 years of service, we've assisted millions of individuals by providing readily customizable and up-to-date legal documents. Take advantage of US Legal Forms today to conserve effort and resources!

- Utilize US Legal Forms whenever you need to locate and download the Surprise Arizona Beneficiary Deed from Husband and Wife to Trust or any other document quickly and securely.

- Simply Log In to your account and click the Get button next to it.

- If you've misplaced the form, you can always re-download it from within the My documents tab.

- The process is equally simple if you're new to the platform! You can set up your account in just a few minutes.

Form popularity

FAQ

Absolutely, a non-attorney can prepare a deed, including a Surprise Arizona Beneficiary Deed from Husband and Wife to Trust. Many individuals choose to manage their own deeds using online resources, such as USLegalForms. These platforms provide user-friendly templates that simplify the process. However, be mindful of state-specific regulations to ensure the deed complies with legal standards.

Yes, you can transfer a deed without an attorney, including a Surprise Arizona Beneficiary Deed from Husband and Wife to Trust, as long as you follow the proper procedures. You can find templates and instructions on platforms like USLegalForms, which can guide you through the process. However, if you're unsure or have complex circumstances, consulting with a legal professional may save you time and prevent issues later. It’s essential to ensure all legal requirements are met to avoid complications.

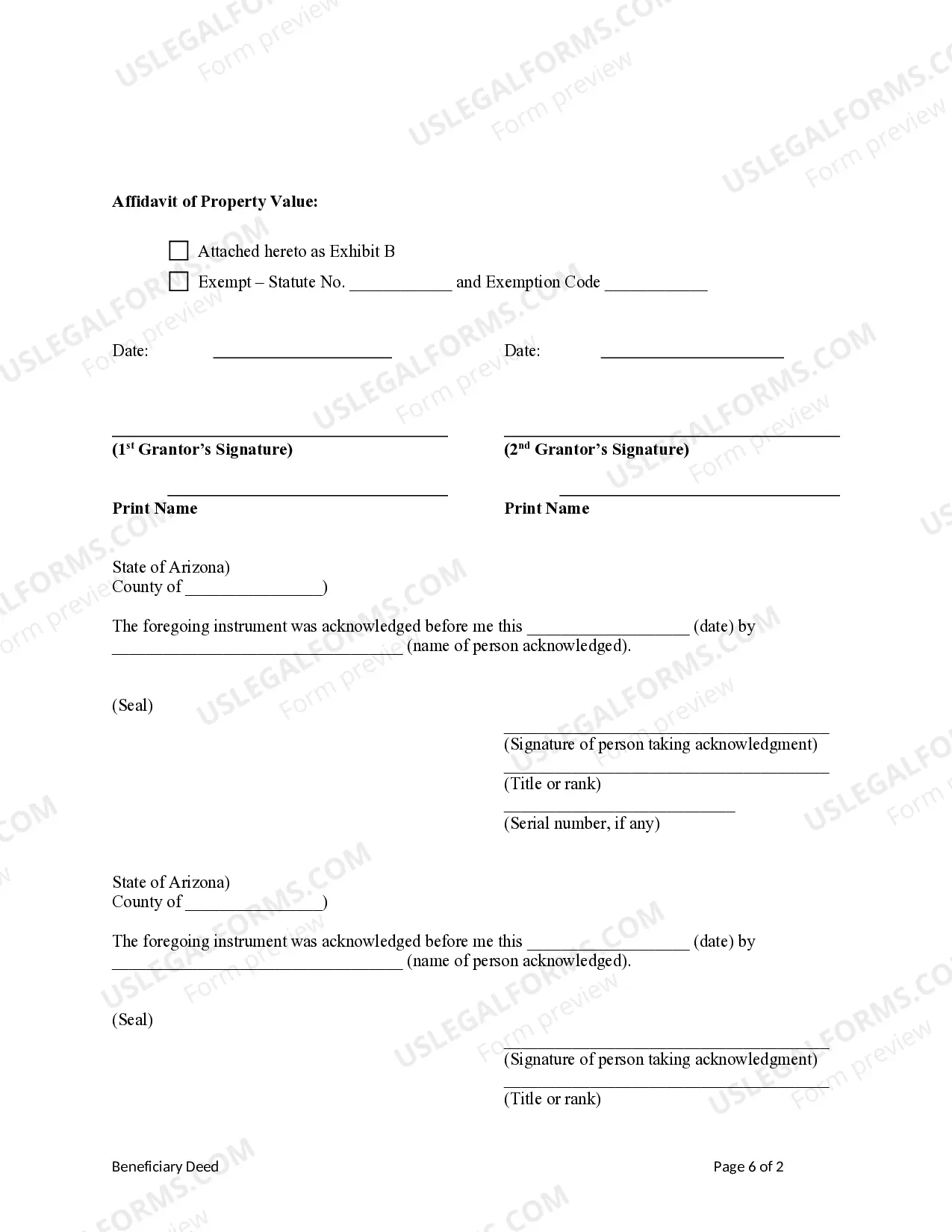

To file a Surprise Arizona Beneficiary Deed from Husband and Wife to Trust, you need to submit the deed to the county recorder's office in the county where the property is located. Ensure that to include all required information, such as the names of the grantors and grantees, and the legal description of the property. Filing fees may vary by county, so it’s wise to check with your local office. Once recorded, the deed becomes part of the public record.

To transfer property to a trust in Arizona, you should start by executing a Surprise Arizona Beneficiary Deed from Husband and Wife to Trust. This deed allows both spouses to designate the trust as the recipient of the property upon their passing, ensuring a smooth transfer without probate. After drafting the deed, you must record it with the county recorder's office to make it legally binding. Utilizing platforms like US Legal Forms can help you access the necessary templates and ensure compliance with Arizona laws.

Writing a beneficiary deed requires attention to specific terms such as the names of all parties involved, the property description, and signature lines for the grantors. You might also need to include notarization for it to be legally binding. To accurately draft the Surprise Arizona Beneficiary Deed from Husband and Wife to Trust, consider using templates provided by uslegalforms to ensure compliance with state requirements.

While a beneficiary deed has many advantages, it also has disadvantages. One limitation is that it only transfers the property upon death, which means the owners cannot change their minds once it's filed without executing a new deed. Understanding the complexities of the Surprise Arizona Beneficiary Deed from Husband and Wife to Trust can help you navigate potential pitfalls, and consulting uslegalforms is recommended.

To record a beneficiary deed in Arizona, you must file the completed deed with the county recorder's office where the property is located. Ensure you include necessary information such as the names of the grantors, the designated beneficiary, and an accurate property description. Proper recording is crucial to make the Surprise Arizona Beneficiary Deed from Husband and Wife to Trust legally effective.

Transferring a deed to a trust in Arizona involves creating a new deed that names the trust as the new owner. You will need to ensure that the trust is properly established and signed by the trustors. Utilizing uslegalforms can simplify the process, ensuring all details align with Arizona laws, especially when considering the Surprise Arizona Beneficiary Deed from Husband and Wife to Trust.

A beneficiary deed directly transfers property to a beneficiary upon the owner's death, which bypasses probate. In contrast, a trust holds property for beneficiaries and can manage it during the owner's lifetime. When considering the Surprise Arizona Beneficiary Deed from Husband and Wife to Trust, understand that although both tools serve to transfer property, they function differently in estate planning.

To write a beneficiary deed, you must include essential details like the names of the current property owners, the designated beneficiary, and a clear description of the property. If you are a husband and wife planning to transfer property using the Surprise Arizona Beneficiary Deed from Husband and Wife to Trust, it's crucial to have the right legal format. You may consider using resources from uslegalforms for guidance on accurate deed creation.