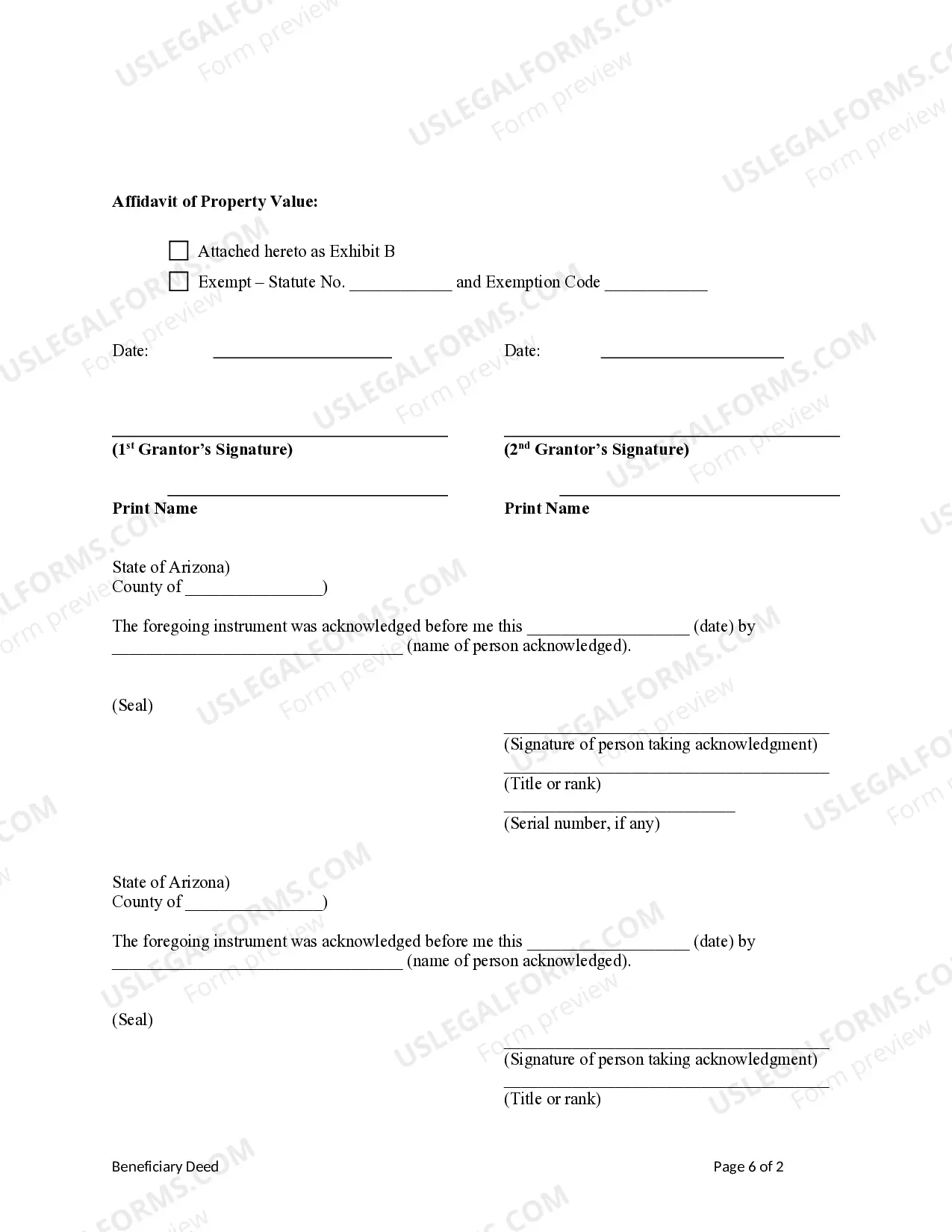

This form is a Beneficiary or Transfer on Death Deed where the Grantors are husband and wife and the Grantee Beneficiary is a Trust. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving Grantor. The deed is not effective unless recorded before the death of the last surviving Grantor. This deed complies with all state statutory laws.

A Tempe Arizona Beneficiary Deed from Husband and Wife to Trust is a legal document that allows married couples to transfer their property ownership to a trust, thereby ensuring a smooth transfer of assets upon their passing. This estate planning tool provides various benefits, such as avoiding probate, maintaining privacy, and allowing for efficient asset distribution. One notable type of Tempe Arizona Beneficiary Deed from Husband and Wife to Trust is the Joint Tenancy with Right of Survivorship (TWOS). This type of deed stipulates that both spouses own the property equally, and upon the death of one spouse, the surviving spouse automatically becomes the sole owner of the property. Another type of Beneficiary Deed from Husband and Wife to Trust is the Tenancy in Common (TIC). In this case, each spouse owns a specific percentage of the property, which they can then allocate to their respective trusts. Upon the death of one spouse, their share is passed on according to the terms outlined in their trust. Creating a Tempe Arizona Beneficiary Deed from Husband and Wife to Trust involves specific steps. First, consult with an experienced estate planning attorney to ensure compliance with local laws and requirements. Next, determine the type of joint ownership (TWOS or TIC) that suits your needs. Then, draft the beneficiary deed, including the names of the granter (husband and wife), the trustee (the trust), and the beneficiaries (usually the couple's children). It is crucial to accurately identify the property being transferred, including its legal description and any associated documents, such as mortgage information. Additionally, the granter(s) must sign the beneficiary deed in the presence of a notary public to make it legally binding. To record the beneficiary deed, it needs to be filed with the County Recorder's Office in the county where the property is located. This step ensures that the transfer of ownership is properly documented, protecting the interests of the trust and the beneficiaries. In conclusion, a Tempe Arizona Beneficiary Deed from Husband and Wife to Trust is a valuable estate planning tool for married couples wishing to transfer their property to a trust. By understanding the different types of beneficiary deeds available, couples can choose the best option to suit their specific circumstances and objectives. Seeking guidance from an attorney is crucial to ensure a smooth and legally sound transfer of assets.A Tempe Arizona Beneficiary Deed from Husband and Wife to Trust is a legal document that allows married couples to transfer their property ownership to a trust, thereby ensuring a smooth transfer of assets upon their passing. This estate planning tool provides various benefits, such as avoiding probate, maintaining privacy, and allowing for efficient asset distribution. One notable type of Tempe Arizona Beneficiary Deed from Husband and Wife to Trust is the Joint Tenancy with Right of Survivorship (TWOS). This type of deed stipulates that both spouses own the property equally, and upon the death of one spouse, the surviving spouse automatically becomes the sole owner of the property. Another type of Beneficiary Deed from Husband and Wife to Trust is the Tenancy in Common (TIC). In this case, each spouse owns a specific percentage of the property, which they can then allocate to their respective trusts. Upon the death of one spouse, their share is passed on according to the terms outlined in their trust. Creating a Tempe Arizona Beneficiary Deed from Husband and Wife to Trust involves specific steps. First, consult with an experienced estate planning attorney to ensure compliance with local laws and requirements. Next, determine the type of joint ownership (TWOS or TIC) that suits your needs. Then, draft the beneficiary deed, including the names of the granter (husband and wife), the trustee (the trust), and the beneficiaries (usually the couple's children). It is crucial to accurately identify the property being transferred, including its legal description and any associated documents, such as mortgage information. Additionally, the granter(s) must sign the beneficiary deed in the presence of a notary public to make it legally binding. To record the beneficiary deed, it needs to be filed with the County Recorder's Office in the county where the property is located. This step ensures that the transfer of ownership is properly documented, protecting the interests of the trust and the beneficiaries. In conclusion, a Tempe Arizona Beneficiary Deed from Husband and Wife to Trust is a valuable estate planning tool for married couples wishing to transfer their property to a trust. By understanding the different types of beneficiary deeds available, couples can choose the best option to suit their specific circumstances and objectives. Seeking guidance from an attorney is crucial to ensure a smooth and legally sound transfer of assets.