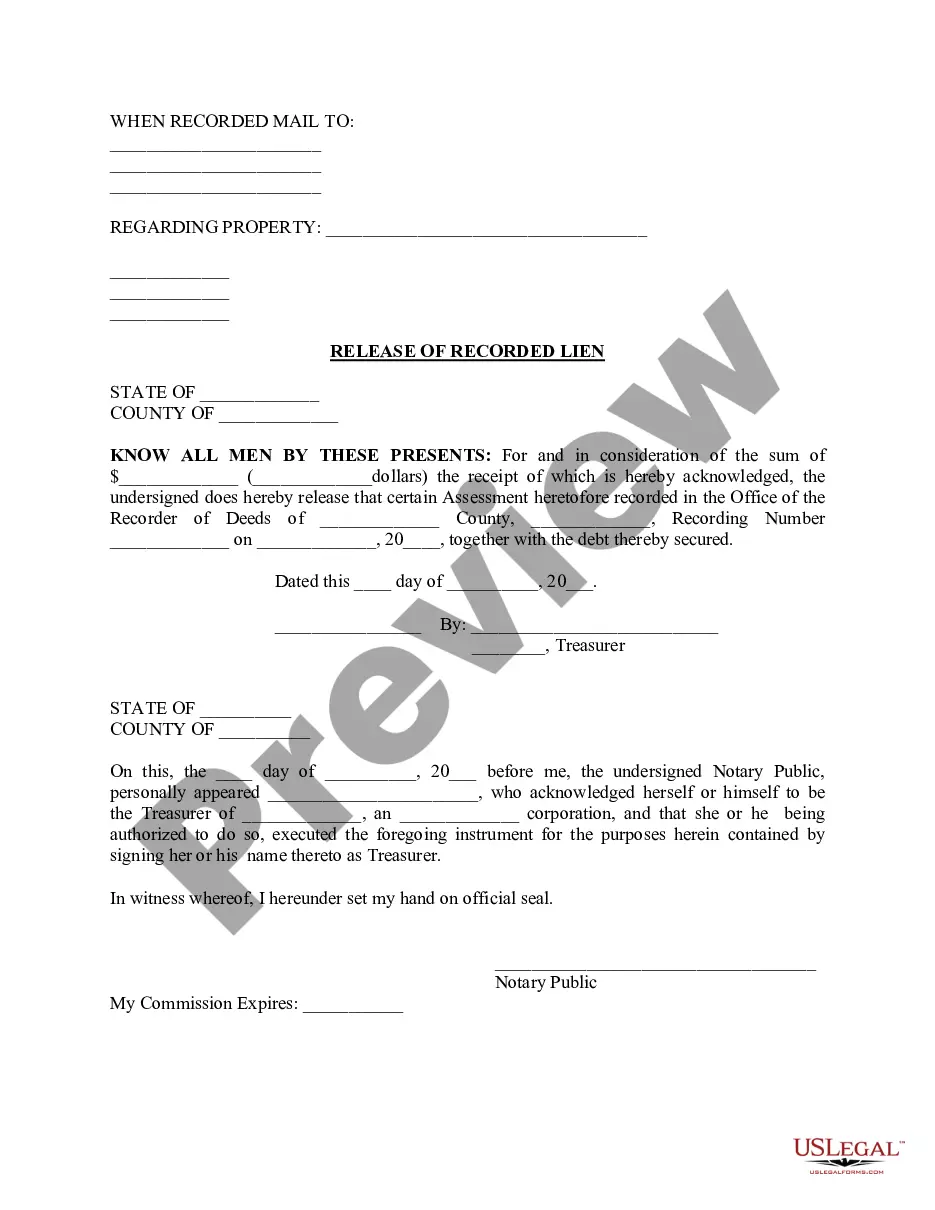

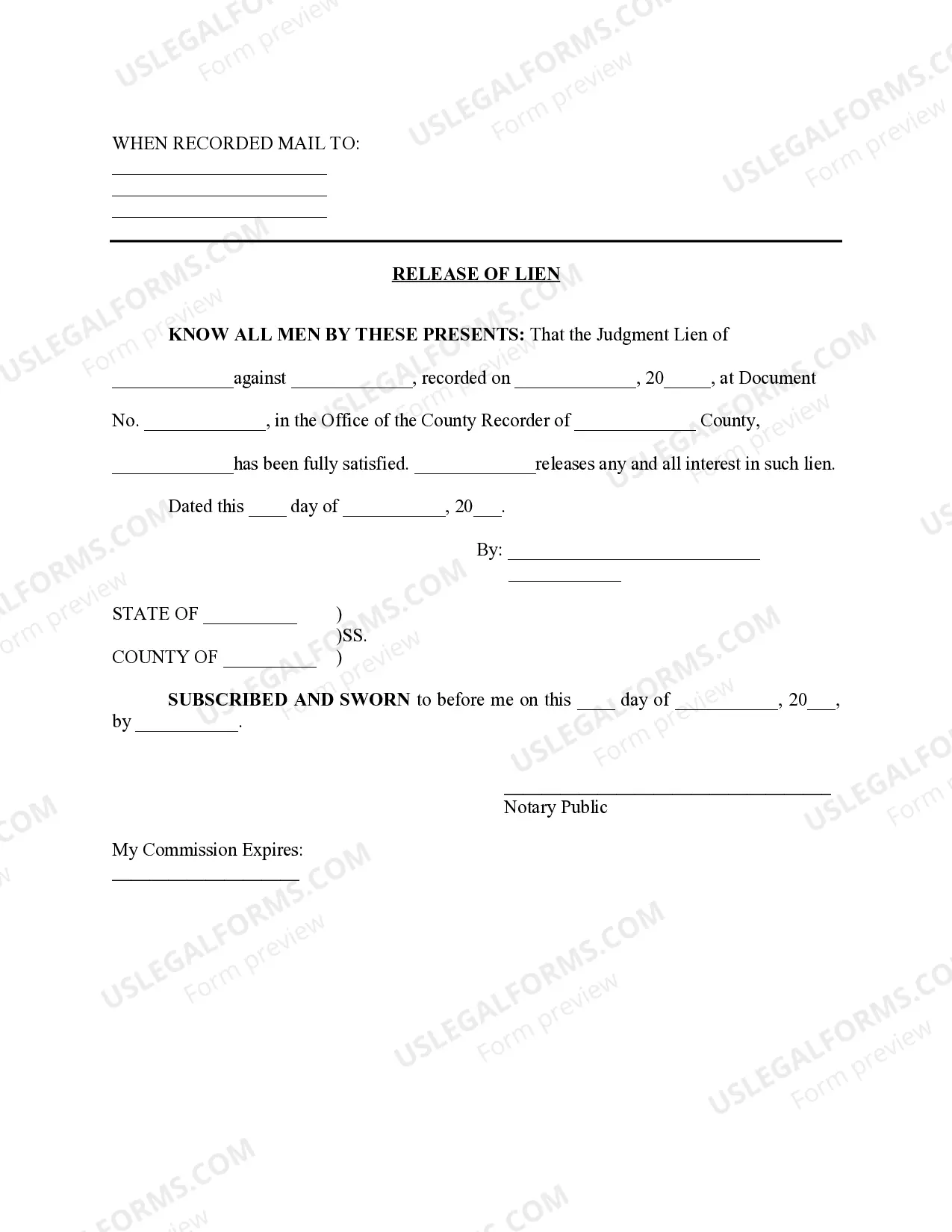

In Lima, Arizona, a Release of Recorded Lien refers to a legal document that serves to officially release a previously recorded lien on a property or asset. This document plays a crucial role in clearing the title or ownership of the property, ensuring smooth real estate transactions, and resolving financial obligations. When a lien is released, it essentially indicates that the debt or claim against the property has been paid off, satisfied, or resolved. The Lima Arizona Release of Recorded Lien can be categorized into several types, depending on the nature of the lien being released. Some key types of liens that may require a release in Lima, Arizona, include: 1. Mechanic's Lien Release: A mechanic's lien is typically filed by contractors, subcontractors, or suppliers to secure payment for unpaid bills or debts related to construction work or renovations. Once the debt is cleared, a Mechanic's Lien Release is necessary to release the lien from the property. 2. Mortgage Lien Release: A mortgage lien is placed on a property by a lender as collateral for a loan. Upon full repayment of the mortgage, the lender issues a Mortgage Lien Release to remove the lien, allowing the property owner to freely transfer or sell it. 3. Judgment Lien Release: A judgment lien is a result of a court order issued against a debtor for unpaid debts or legal judgments. When the required payment is made, a Judgment Lien Release is filed to release the lien and relieve the debtor from any further obligations. 4. Tax Lien Release: A tax lien is imposed by government authorities, such as the Internal Revenue Service or the Arizona Department of Revenue, when an individual or business fails to pay their taxes. Once the delinquent taxes are paid, a Tax Lien Release is issued to release the lien and restore the property owner's rights. 5. HOA Lien Release: Homeowners' Association (HOA) liens are recorded against a property when an owner fails to meet their financial obligations, such as unpaid dues or fines. Once the outstanding balance is paid, an HOA Lien Release is filed, removing the lien and restoring the homeowner's privileges. It is important to note that each type of lien release may have specific requirements, deadlines, and forms that need to be followed in accordance with Lima, Arizona regulations. Therefore, individuals and legal professionals involved in real estate transactions should carefully review the requirements for the specific type of lien being released to ensure compliance and a seamless transfer of property ownership.

Pima Arizona Release of Recorded Lien

Description

How to fill out Pima Arizona Release Of Recorded Lien?

Make use of the US Legal Forms and obtain immediate access to any form sample you want. Our helpful website with a huge number of document templates makes it easy to find and obtain almost any document sample you require. It is possible to download, fill, and certify the Pima Arizona Release of Recorded Lien in just a matter of minutes instead of browsing the web for hours trying to find a proper template.

Using our collection is a wonderful strategy to raise the safety of your record submissions. Our experienced lawyers on a regular basis review all the documents to make sure that the forms are appropriate for a particular state and compliant with new acts and polices.

How can you obtain the Pima Arizona Release of Recorded Lien? If you already have a subscription, just log in to the account. The Download button will appear on all the samples you view. Moreover, you can get all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, follow the instructions listed below:

- Open the page with the form you require. Make sure that it is the template you were hoping to find: check its headline and description, and take take advantage of the Preview option when it is available. Otherwise, use the Search field to find the needed one.

- Start the downloading process. Click Buy Now and choose the pricing plan you like. Then, create an account and pay for your order with a credit card or PayPal.

- Download the file. Choose the format to get the Pima Arizona Release of Recorded Lien and change and fill, or sign it according to your requirements.

US Legal Forms is one of the most considerable and trustworthy document libraries on the internet. We are always ready to assist you in any legal case, even if it is just downloading the Pima Arizona Release of Recorded Lien.

Feel free to make the most of our service and make your document experience as efficient as possible!