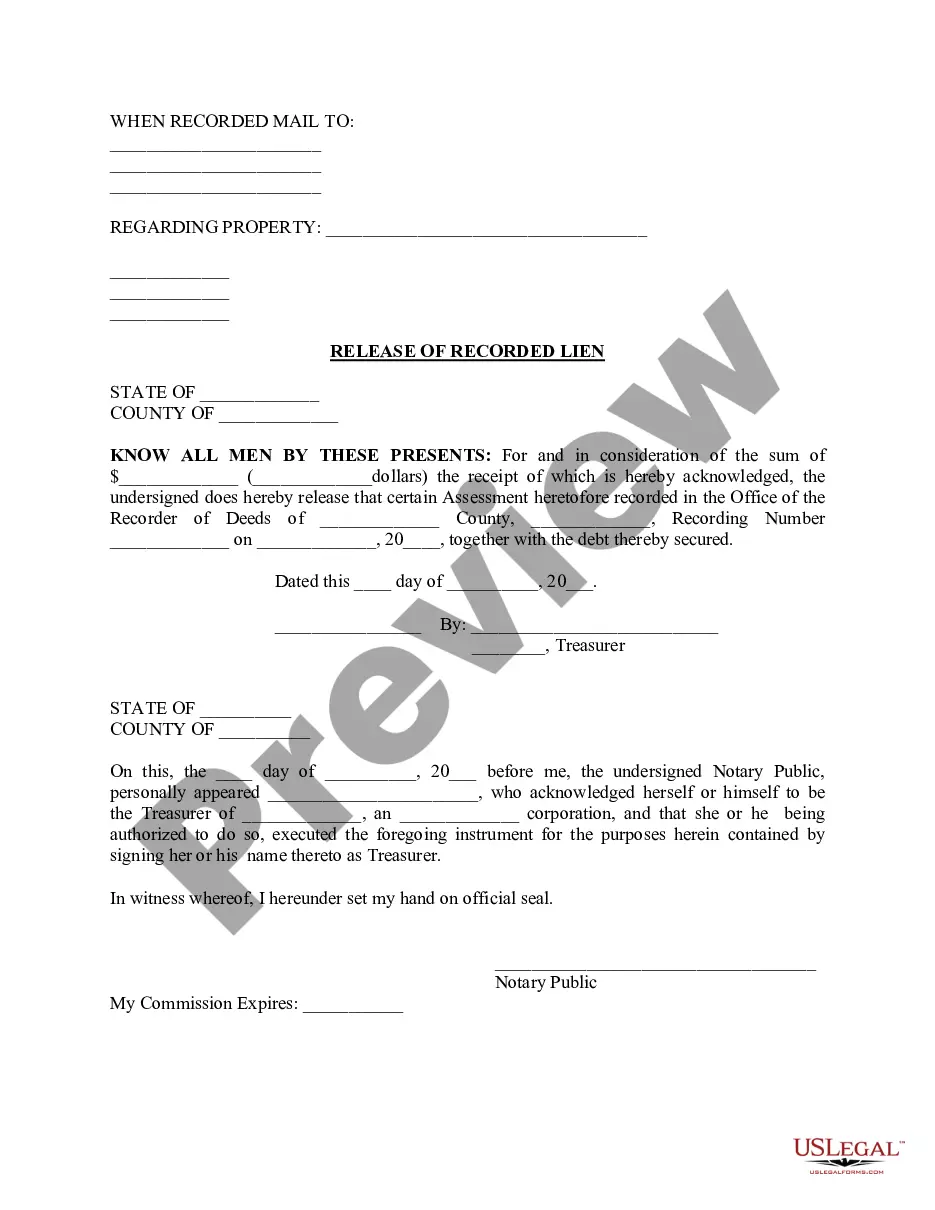

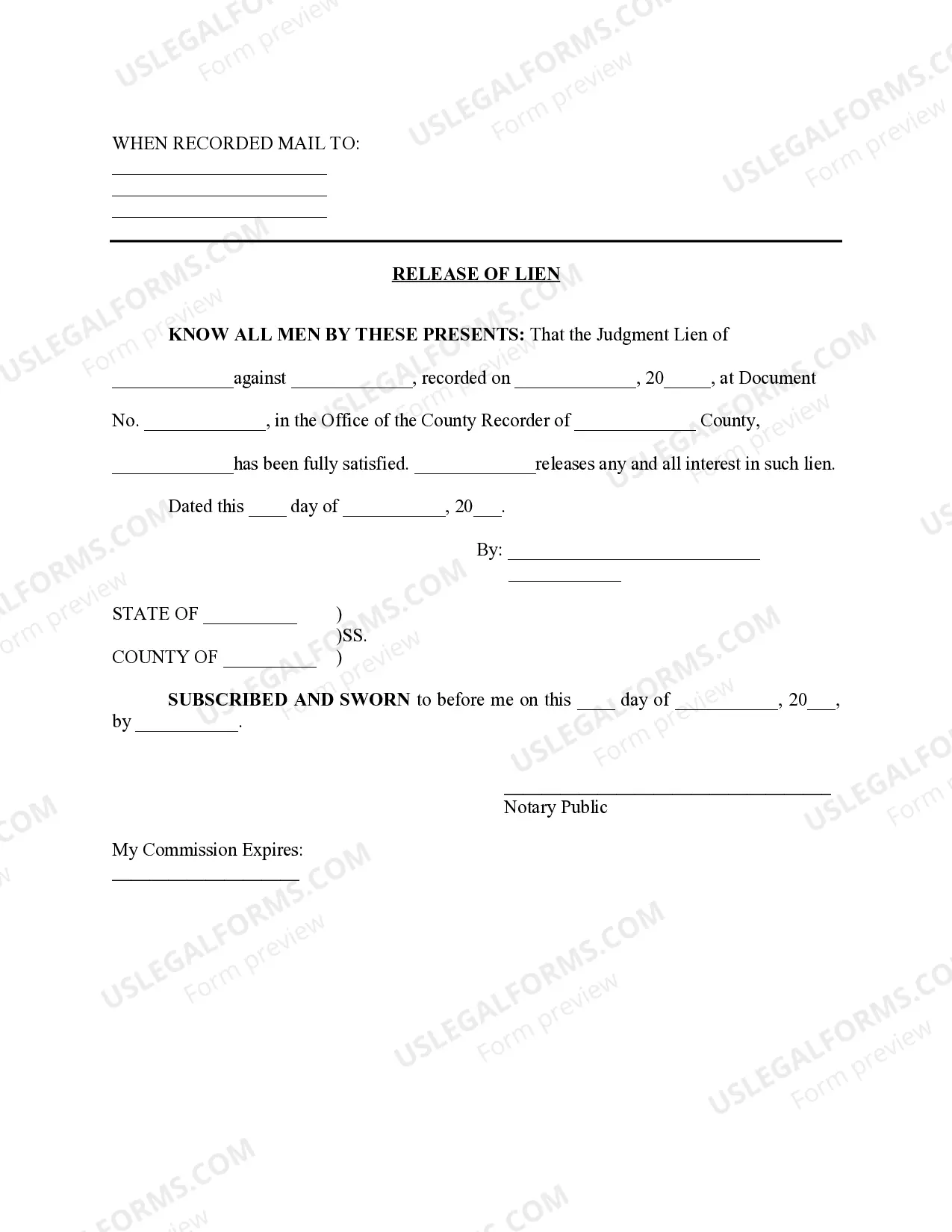

Surprise Arizona Release of Recorded Lien: A Comprehensive Overview In Surprise, Arizona, the Release of Recorded Lien is a legal document that serves as an official acknowledgment of the satisfaction or discharge of a previously recorded lien on a property. This important legal procedure is crucial for property owners and lenders to have a clear title and ensure that any outstanding debt or encumbrances are properly addressed. The Release of Recorded Lien essentially declares that the lien holder no longer holds a claim against the property and releases their legal right to execute the lien in the future. This document acts as proof that the property is no longer encumbered and can be freely transferred or sold without any legal obstacles. There are various types of Surprise Arizona Release of Recorded Liens, depending on the nature and purpose of the lien being released. Some of these types include: 1. Mortgage Lien Release: This type of release is commonly associated with mortgages and occurs when a property owner pays off their mortgage loan in full. Once the lender receives the final payment, they issue a Release of Recorded Lien to officially release the mortgage lien from the property title. 2. Mechanic's Lien Release: Mechanic's liens are typically filed by contractors, subcontractors, or suppliers who haven't been fully paid for their services or materials provided for property improvements. In Surprise, Arizona, the Release of Recorded Lien for mechanic's liens is issued when the debts owed to these parties are settled, either through payment or negotiation. 3. HOA Lien Release: Homeowners Association (HOA) liens are placed on properties when owners fail to pay their HOA fees or violate certain rules and regulations. Upon resolving the outstanding fees, fines, or violations, the HOA issues a Release of Recorded Lien, releasing their claim on the property. 4. Tax Lien Release: This type of lien is filed by local or federal tax authorities when property owners fail to pay their property taxes. A Release of Recorded Lien for tax liens is issued once the owner pays the outstanding taxes, penalties, and any accrued interest, releasing the lien from the property. 5. Judgment Lien Release: Judgment liens are the result of court judgments awarded to creditors or plaintiffs for unpaid debts or damages. The Release of Recorded Lien for judgment liens is issued once the judgment is satisfied or settled, ensuring the lien is removed from the property title. In conclusion, the Surprise Arizona Release of Recorded Lien plays a vital role in maintaining clear and unencumbered property titles. Whether it's a mortgage lien, mechanic's lien, HOA lien, tax lien, or judgment lien, the release document signifies the satisfactory conclusion of any outstanding debt or obligation associated with the property, granting property owners the freedom to manage their assets without legal restrictions.

Surprise Arizona Release of Recorded Lien

Description

How to fill out Surprise Arizona Release Of Recorded Lien?

Take advantage of the US Legal Forms and have immediate access to any form you need. Our helpful platform with a huge number of documents makes it easy to find and get virtually any document sample you need. You are able to export, fill, and certify the Surprise Arizona Release of Recorded Lien in just a couple of minutes instead of browsing the web for many hours looking for a proper template.

Utilizing our library is a great way to raise the safety of your form submissions. Our experienced attorneys regularly check all the documents to ensure that the forms are relevant for a particular region and compliant with new acts and polices.

How do you get the Surprise Arizona Release of Recorded Lien? If you have a subscription, just log in to the account. The Download button will appear on all the documents you view. Furthermore, you can find all the earlier saved files in the My Forms menu.

If you don’t have a profile yet, stick to the tips below:

- Find the template you need. Make certain that it is the template you were looking for: examine its title and description, and use the Preview function when it is available. Otherwise, make use of the Search field to look for the needed one.

- Start the downloading procedure. Select Buy Now and choose the pricing plan you prefer. Then, create an account and pay for your order using a credit card or PayPal.

- Export the document. Indicate the format to obtain the Surprise Arizona Release of Recorded Lien and revise and fill, or sign it for your needs.

US Legal Forms is probably the most extensive and trustworthy form libraries on the internet. Our company is always happy to help you in virtually any legal procedure, even if it is just downloading the Surprise Arizona Release of Recorded Lien.

Feel free to take advantage of our platform and make your document experience as straightforward as possible!