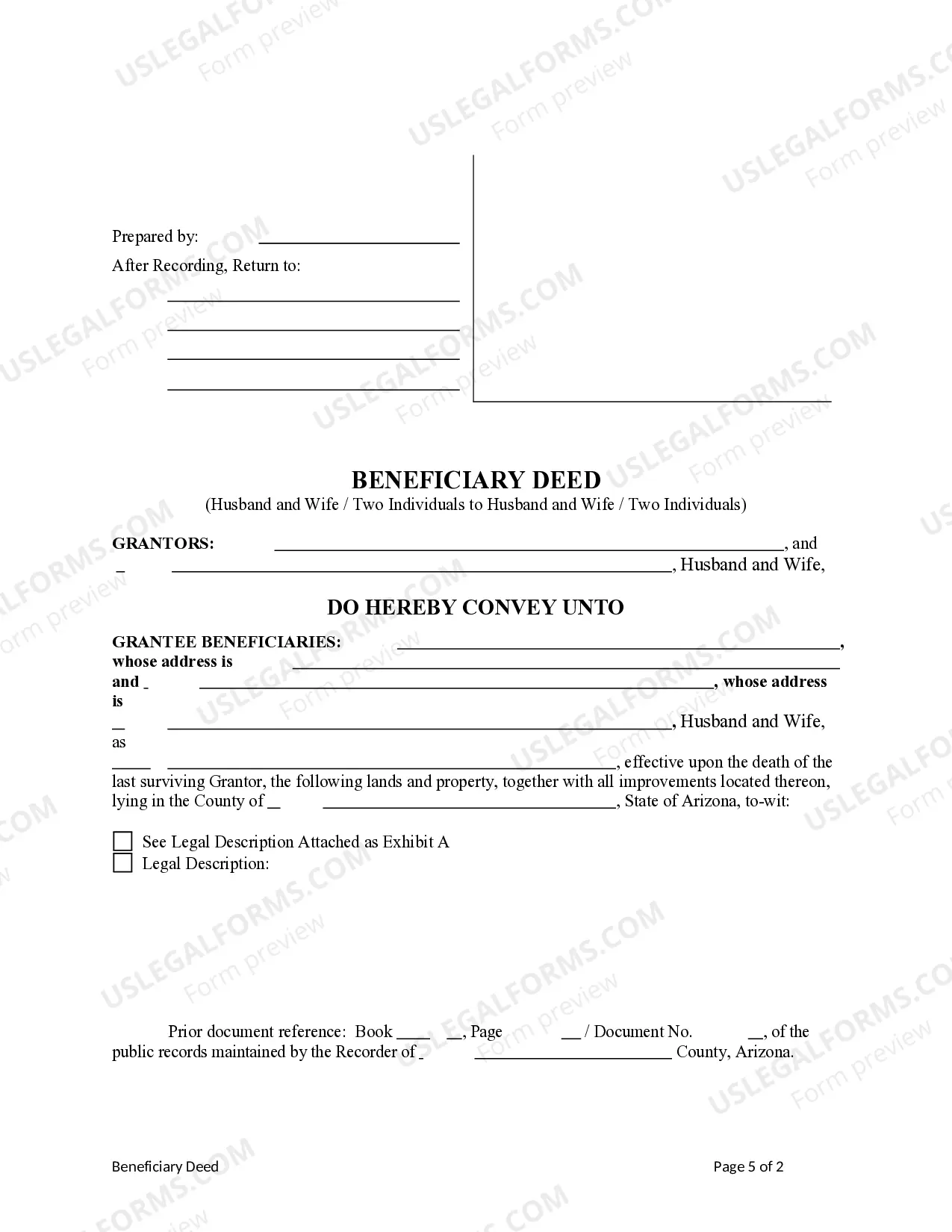

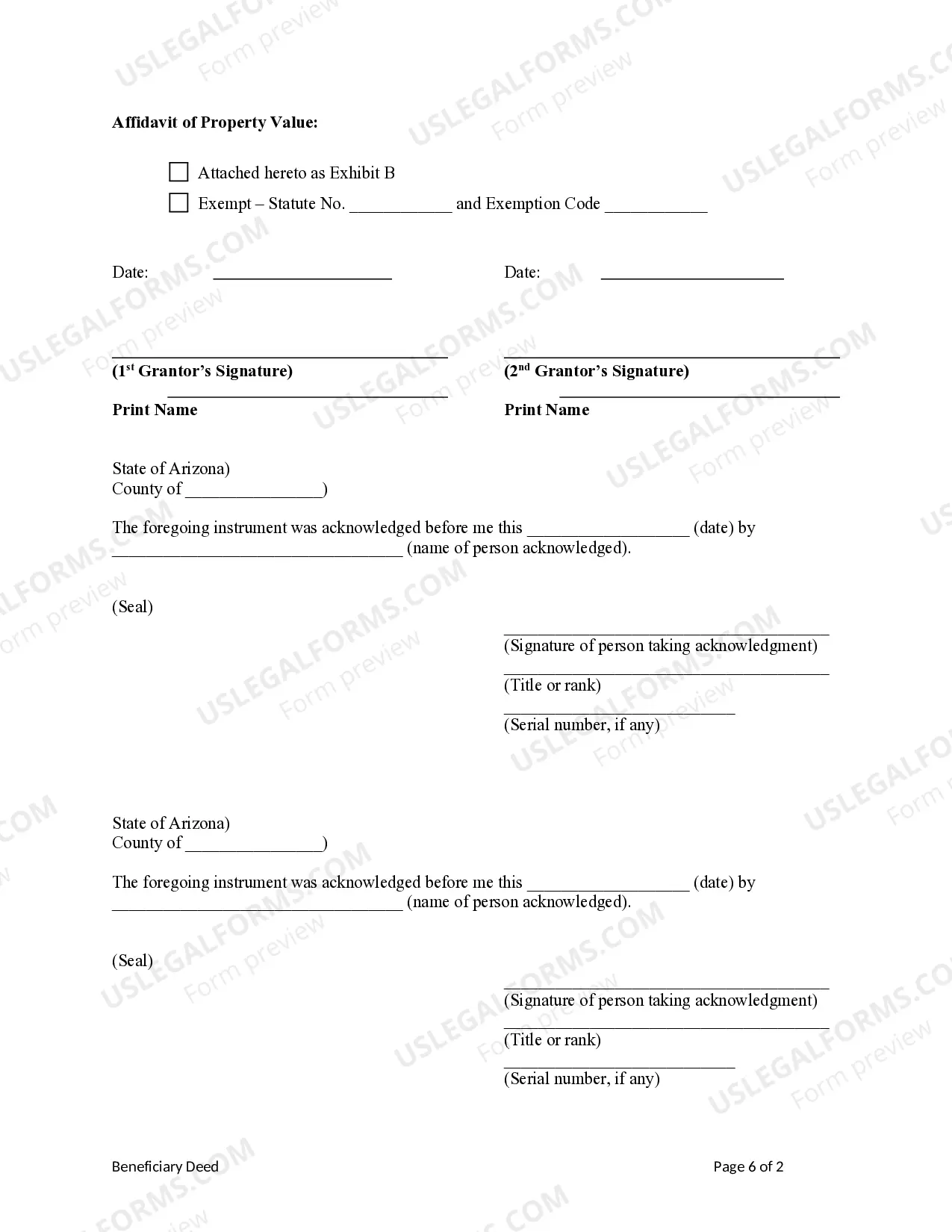

This form is a Transfer on Death Deed where the Grantors are husband and wife / two individuals and the Grantees are husband and wife / two individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving Grantor. This deed complies with all state statutory laws.

A Surprise Arizona Beneficiary or Transfer on Death (TOD) Deed — Husband and Wife / Two Individuals to Husband and Wife / Two Individuals is a legal document that allows joint property owners to transfer their ownership rights to their spouse or another individual upon their death. This type of deed ensures a smooth transfer of assets outside of probate and can offer various forms depending on the specific circumstances. One type of Surprise Arizona Beneficiary or TOD Deed is the "Husband and Wife to Husband and Wife" deed, which enables couples who jointly own property in Surprise, Arizona, to pass their ownership interest directly to the surviving spouse upon one's death. This type of deed is ideal for married couples who wish to avoid probate and want to ensure that their property passes seamlessly to the surviving spouse. Another form of Surprise Arizona Beneficiary or TOD Deed is the "Two Individuals to Husband and Wife" deed. This document is suitable for unmarried couples or co-owners who wish to transfer their property to their partner upon their death. It allows the surviving partner to inherit the deceased partner's ownership interest without going through the probate process. The primary purpose of using a Surprise Arizona Beneficiary or TOD Deed — Husband and Wife / Two Individuals to Husband and Wife / Two Individuals is to simplify and expedite the transfer of property ownership after death, minimizing the time, cost, and legal complexities associated with probate. By designating a beneficiary or TOD recipient in the deed, individuals can ensure that their property passes directly to the intended recipients without any delays. This type of deed offers numerous advantages, including the ability to retain full control of the property during the owner's lifetime, the flexibility to change or revoke the designation of beneficiaries or recipients, and protection from potential creditors or liens against the co-owner's interests. Additionally, TOD deeds can also accommodate multiple beneficiaries or co-owners if desired. To create a Surprise Arizona Beneficiary or TOD Deed — Husband and Wife / Two Individuals to Husband and Wife / Two Individuals, it is essential to engage a qualified real estate attorney who has knowledge and experience with Arizona state laws. They can guide you through the legal process, ensure compliance with local regulations, and customize the deed to meet your specific needs and circumstances. In conclusion, a Surprise Arizona Beneficiary or TOD Deed — Husband and Wife / Two Individuals to Husband and Wife / Two Individuals offers a convenient and efficient way to transfer property ownership in Surprise, Arizona, while avoiding probate. By understanding the different types of deeds available and seeking professional legal assistance, individuals can protect their assets and ensure a smooth transfer of ownership to their desired beneficiaries or recipients.A Surprise Arizona Beneficiary or Transfer on Death (TOD) Deed — Husband and Wife / Two Individuals to Husband and Wife / Two Individuals is a legal document that allows joint property owners to transfer their ownership rights to their spouse or another individual upon their death. This type of deed ensures a smooth transfer of assets outside of probate and can offer various forms depending on the specific circumstances. One type of Surprise Arizona Beneficiary or TOD Deed is the "Husband and Wife to Husband and Wife" deed, which enables couples who jointly own property in Surprise, Arizona, to pass their ownership interest directly to the surviving spouse upon one's death. This type of deed is ideal for married couples who wish to avoid probate and want to ensure that their property passes seamlessly to the surviving spouse. Another form of Surprise Arizona Beneficiary or TOD Deed is the "Two Individuals to Husband and Wife" deed. This document is suitable for unmarried couples or co-owners who wish to transfer their property to their partner upon their death. It allows the surviving partner to inherit the deceased partner's ownership interest without going through the probate process. The primary purpose of using a Surprise Arizona Beneficiary or TOD Deed — Husband and Wife / Two Individuals to Husband and Wife / Two Individuals is to simplify and expedite the transfer of property ownership after death, minimizing the time, cost, and legal complexities associated with probate. By designating a beneficiary or TOD recipient in the deed, individuals can ensure that their property passes directly to the intended recipients without any delays. This type of deed offers numerous advantages, including the ability to retain full control of the property during the owner's lifetime, the flexibility to change or revoke the designation of beneficiaries or recipients, and protection from potential creditors or liens against the co-owner's interests. Additionally, TOD deeds can also accommodate multiple beneficiaries or co-owners if desired. To create a Surprise Arizona Beneficiary or TOD Deed — Husband and Wife / Two Individuals to Husband and Wife / Two Individuals, it is essential to engage a qualified real estate attorney who has knowledge and experience with Arizona state laws. They can guide you through the legal process, ensure compliance with local regulations, and customize the deed to meet your specific needs and circumstances. In conclusion, a Surprise Arizona Beneficiary or TOD Deed — Husband and Wife / Two Individuals to Husband and Wife / Two Individuals offers a convenient and efficient way to transfer property ownership in Surprise, Arizona, while avoiding probate. By understanding the different types of deeds available and seeking professional legal assistance, individuals can protect their assets and ensure a smooth transfer of ownership to their desired beneficiaries or recipients.