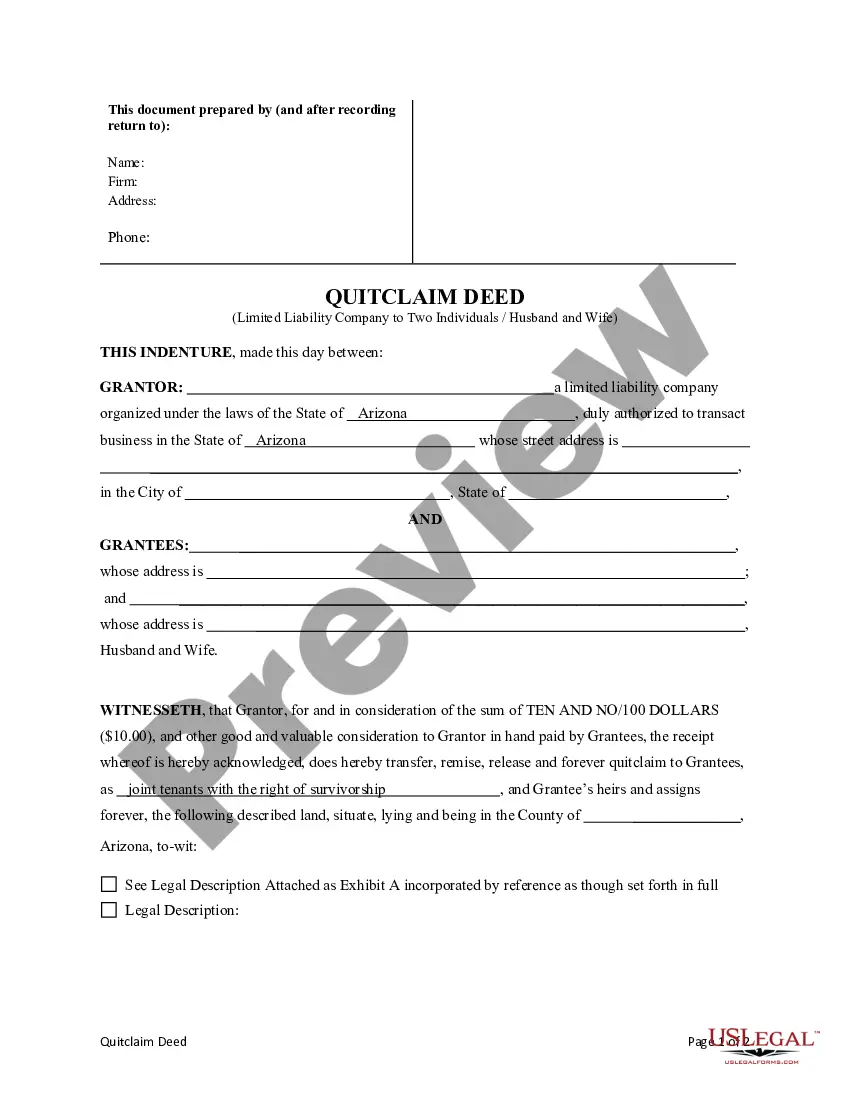

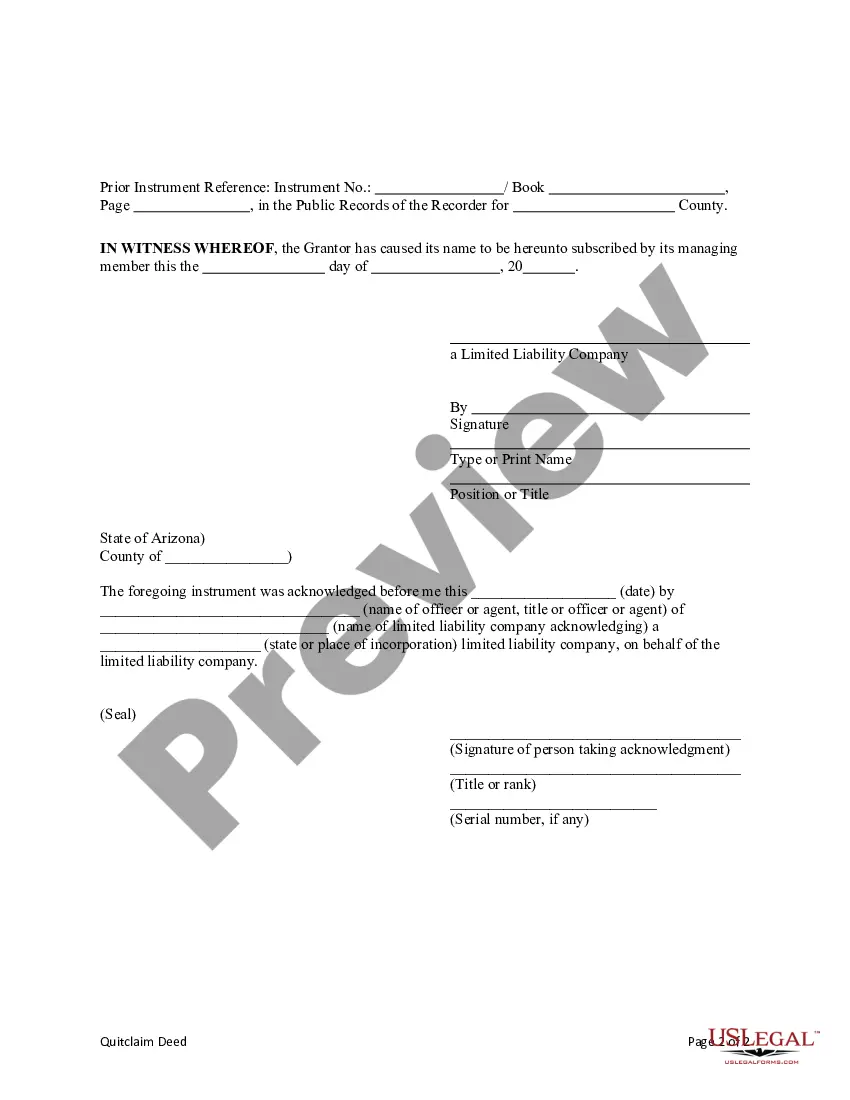

This form is a Quitclaim Deed where the Grantor is a limited liability company and the Grantees are Husband and Wife or two individuals. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

A Surprise Arizona Quitclaim Deed from a Limited Liability Company to Two Individuals/Husband and Wife is a legally binding document used to transfer the ownership of a property from an LLC to a married couple in Surprise, Arizona. This type of deed is commonly associated with real estate transactions and specifically caters to situations where the LLC wishes to transfer the property to two individuals who are legally married. In this particular scenario, the limited liability company is legally relinquishing all its rights and interests in the property to the husband and wife. It is important to note that a quitclaim deed only transfers the ownership interest the LLC has, without offering any guarantee or warranty regarding the property's title. There are various types of Surprise Arizona Quitclaim Deeds from Limited Liability Company to Two Individuals/Husband and Wife, depending on specific circumstances. Some examples include: 1. Joint Tenancy Quitclaim Deed: This type of deed is used when the couple intends to hold the property as joint tenants, meaning that if one spouse passes away, the other will automatically inherit the deceased spouse's share of the property. 2. Tenancy in Common Quitclaim Deed: In contrast to joint tenancy, this deed allows the married couple to hold the property as tenants in common, wherein they have individual shares and can designate beneficiaries for their respective portions. This means that if one spouse dies, their share can be passed onto someone other than the surviving spouse. 3. Community Property Quitclaim Deed: In states that follow community property laws, such as Arizona, this type of deed may be used. Community property laws stipulate that any property acquired during the marriage is owned equally by both spouses. Therefore, the transfer of property through a community property quitclaim deed ensures that both spouses have an equal ownership interest. It is crucial for the involved parties to understand the legal implications of the quitclaim deed and, if necessary, consult with an attorney to ensure a smooth and legally valid transfer of property occurs.A Surprise Arizona Quitclaim Deed from a Limited Liability Company to Two Individuals/Husband and Wife is a legally binding document used to transfer the ownership of a property from an LLC to a married couple in Surprise, Arizona. This type of deed is commonly associated with real estate transactions and specifically caters to situations where the LLC wishes to transfer the property to two individuals who are legally married. In this particular scenario, the limited liability company is legally relinquishing all its rights and interests in the property to the husband and wife. It is important to note that a quitclaim deed only transfers the ownership interest the LLC has, without offering any guarantee or warranty regarding the property's title. There are various types of Surprise Arizona Quitclaim Deeds from Limited Liability Company to Two Individuals/Husband and Wife, depending on specific circumstances. Some examples include: 1. Joint Tenancy Quitclaim Deed: This type of deed is used when the couple intends to hold the property as joint tenants, meaning that if one spouse passes away, the other will automatically inherit the deceased spouse's share of the property. 2. Tenancy in Common Quitclaim Deed: In contrast to joint tenancy, this deed allows the married couple to hold the property as tenants in common, wherein they have individual shares and can designate beneficiaries for their respective portions. This means that if one spouse dies, their share can be passed onto someone other than the surviving spouse. 3. Community Property Quitclaim Deed: In states that follow community property laws, such as Arizona, this type of deed may be used. Community property laws stipulate that any property acquired during the marriage is owned equally by both spouses. Therefore, the transfer of property through a community property quitclaim deed ensures that both spouses have an equal ownership interest. It is crucial for the involved parties to understand the legal implications of the quitclaim deed and, if necessary, consult with an attorney to ensure a smooth and legally valid transfer of property occurs.