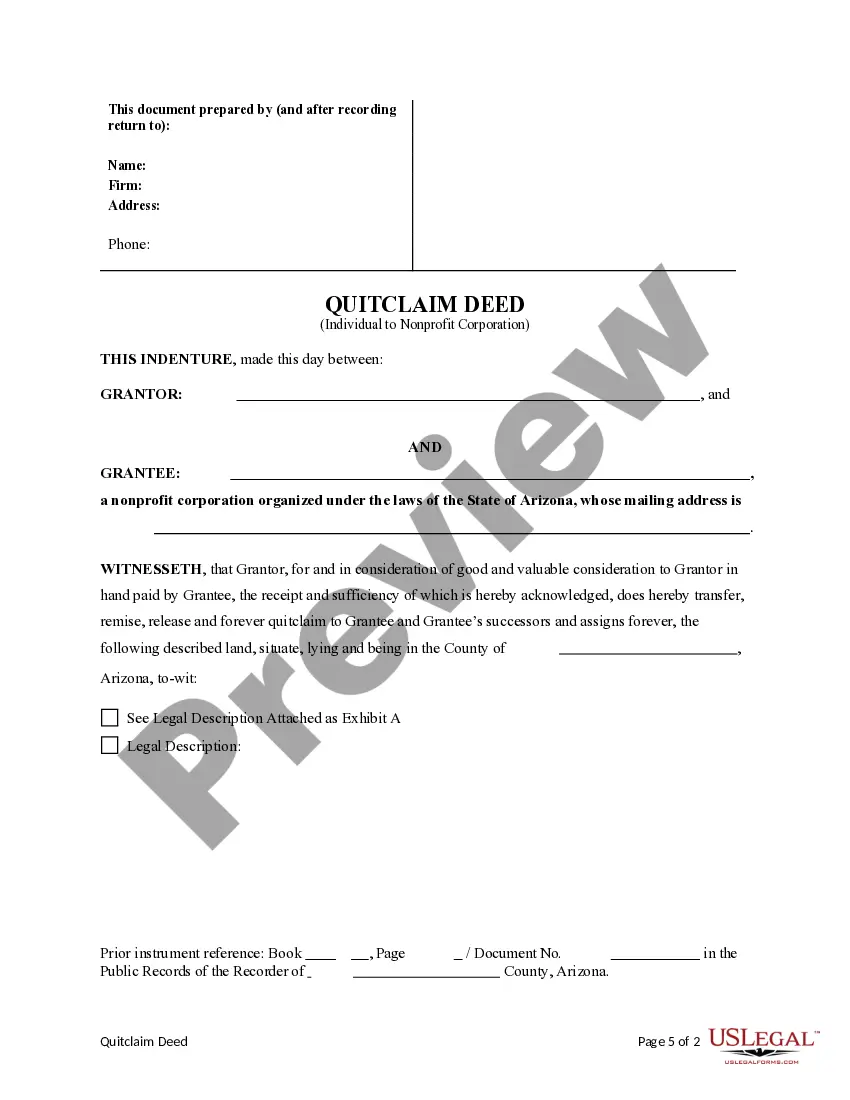

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is a Nonprofit Corporation. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Description: A Surprise Arizona Quitclaim Deed from an individual to a nonprofit corporation is a legal document that transfers ownership of a property from an individual to a nonprofit organization without providing any warranties or guarantees about the property's title or any potential claims against it. This type of deed is commonly used when the property is being donated or sold at a reduced price to a nonprofit organization. Keywords: 1. Quitclaim Deed: A legal document used to transfer ownership of a property without any warranties or guarantees. 2. Surprise, Arizona: A city located in Maricopa County, Arizona, known for its rapid growth and vibrant community. 3. Nonprofit Corporation: An organization that operates for the benefit of the public and is exempt from taxation by the Internal Revenue Service. 4. Property Transfer: The process of transferring ownership or title of a property from one party to another. 5. Donation: The act of giving property or assets to a nonprofit corporation without any monetary compensation. Types of Surprise Arizona Quitclaim Deed from an Individual to a Nonprofit Corporation: 1. Regular Quitclaim Deed: This is the standard type of quitclaim deed used to transfer ownership of a property from an individual to a nonprofit corporation. It includes all the necessary provisions and legal requirements for the transfer. 2. Tax-Exempt Quitclaim Deed: This type of quitclaim deed is specifically designed for properties that are being donated to a nonprofit organization. It may include additional tax-related provisions or requirements to ensure compliance with applicable tax laws and regulations. 3. Reduced Price Quitclaim Deed: This variant of the quitclaim deed is used when the property is being sold to a nonprofit corporation at a significantly reduced price. It may include provisions related to the discounted purchase amount or any conditions associated with the reduced price. 4. Conditional Quitclaim Deed: This type of quitclaim deed includes specific conditions or restrictions on the transfer of ownership. It may require the nonprofit corporation to meet certain criteria or fulfill obligations before the transfer is considered complete. It is important to consult with legal professionals or real estate experts when preparing or dealing with a Surprise Arizona Quitclaim Deed from an individual to a nonprofit corporation, as the specific requirements and regulations may vary depending on the circumstances and objectives of the transfer.Description: A Surprise Arizona Quitclaim Deed from an individual to a nonprofit corporation is a legal document that transfers ownership of a property from an individual to a nonprofit organization without providing any warranties or guarantees about the property's title or any potential claims against it. This type of deed is commonly used when the property is being donated or sold at a reduced price to a nonprofit organization. Keywords: 1. Quitclaim Deed: A legal document used to transfer ownership of a property without any warranties or guarantees. 2. Surprise, Arizona: A city located in Maricopa County, Arizona, known for its rapid growth and vibrant community. 3. Nonprofit Corporation: An organization that operates for the benefit of the public and is exempt from taxation by the Internal Revenue Service. 4. Property Transfer: The process of transferring ownership or title of a property from one party to another. 5. Donation: The act of giving property or assets to a nonprofit corporation without any monetary compensation. Types of Surprise Arizona Quitclaim Deed from an Individual to a Nonprofit Corporation: 1. Regular Quitclaim Deed: This is the standard type of quitclaim deed used to transfer ownership of a property from an individual to a nonprofit corporation. It includes all the necessary provisions and legal requirements for the transfer. 2. Tax-Exempt Quitclaim Deed: This type of quitclaim deed is specifically designed for properties that are being donated to a nonprofit organization. It may include additional tax-related provisions or requirements to ensure compliance with applicable tax laws and regulations. 3. Reduced Price Quitclaim Deed: This variant of the quitclaim deed is used when the property is being sold to a nonprofit corporation at a significantly reduced price. It may include provisions related to the discounted purchase amount or any conditions associated with the reduced price. 4. Conditional Quitclaim Deed: This type of quitclaim deed includes specific conditions or restrictions on the transfer of ownership. It may require the nonprofit corporation to meet certain criteria or fulfill obligations before the transfer is considered complete. It is important to consult with legal professionals or real estate experts when preparing or dealing with a Surprise Arizona Quitclaim Deed from an individual to a nonprofit corporation, as the specific requirements and regulations may vary depending on the circumstances and objectives of the transfer.